Josh Black is Executive Vice President and Editor-in-chief at Insightia. This post is based on an article from The Activist Investing Annual Review 2021.Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

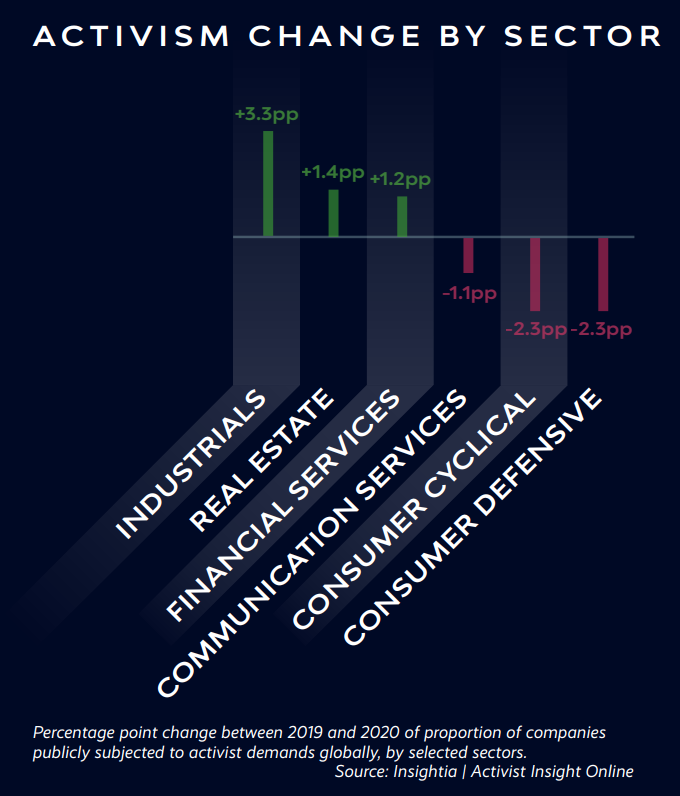

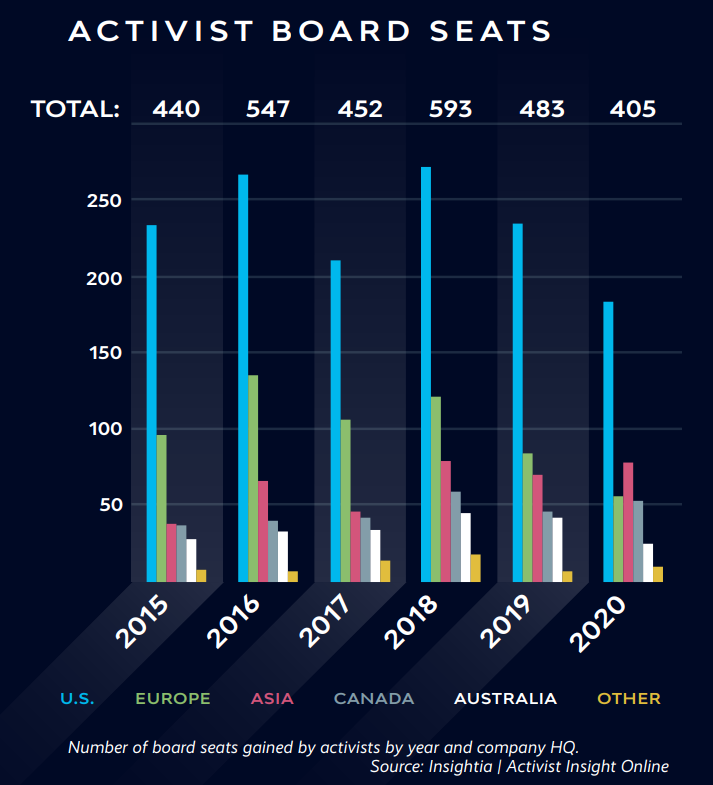

At the peak of proxy season 2020, many activists halted or dialed back campaigns where they feared a sudden change of shareholder perspectives or of irrecoverable value destruction. That led to a sluggish year—a 10% decline in companies publicly subjected to activist demands, a median Total Follower Return of 2%, and about a 16% decline in board seats won worldwide thanks mainly to fewer settlements.

Since then, however, activists have acted ruthlessly to shake up both their own operations and the management of portfolio companies. If 2019 was the year that ended the secular expansion of activist investing, 2020 was a reminder to focus on first principles—subpar valuations due to fixable problems with a quick path to change. All would agree; leadership matters in a pandemic.

Hindsight 2020

Chiding activists for their lack of optimism is easy after the fact. Central bank support leading to a broad market recovery helped put a shine on activist portfolios. The market’s response to stocks in a process of transition has since become exuberant and funds that doubled down on their convictions were rewarded handsomely.

Also unexpected, control slate victories for Starboard Value and Bow Street Capital helped the number of board seats won at contested meetings in the U.S. to the highest level for at least six years. There were shareholder meetings in Europe and Japan that were so unexpectedly close that rematches against weakened incumbents are inevitable. By the fourth quarter, activists had started to think big about ways of demonstrating underperformance and about whole industries that need to adapt, including media, energy, and active fund management.

Impatience could set the stage for a busy proxy season. COVID-19 has created new laggards and left some CEOs that might have been the right choice a year ago ill-suited to their roles. Experienced activists have started to identify those discrepancies and, if they are not distracted by innovations such as special purpose acquisition companies (SPACs), their example will inspire others to join the fray. Opportunistic M&A could also heighten confidence in activist investing, by giving investors more ways to win.

Reasons to Be Cautious

Each year we ask whether activism will continue to make inroads into relatively new markets, most recently with a focus on Europe and Asia. Activity was down sharply in 2020, particularly in the U.K. But the relatively strong showing of France and Japan indicated that there is life in these markets yet. Even if persistent restrictions on travel hinder activism’s rebound outside of the U.S. in 2021, the long-term trend does not appear to have changed.

A bigger structural challenge is ESG. A wide swathe of activists has now demonstrated the ability to incorporate environmental and social issues into their campaigns. Fewer have scaled the practice into a working business model and Jeff Ubben’s Inclusive Capital Partners and Chris James’ Engine No. 1 will be scrutinized in 2021 on precisely this objective. Given the pace of change in the stewardship community, which not long ago lagged active managers but is now setting the agenda and priorities of public companies, activists will have to be smart not to look like relics.

Activists could choose to take their time exploring new markets and sectors before investing, in case the recovery starts to falter. Fundraising for single-purpose vehicles and time-consuming takeover attempts could limit the number of campaigns some funds can undertake.

More likely, companies themselves will warn their investors that the recovery is too fragile and the situation too grave, while playing hardball by keeping activists off ballots through invalidated nominations or more restrictive poison pills. Proxy season 2021 may be attritional, especially for newcomers or inexperienced activists. Choosing the right targets, advancing credible solutions, and displaying tactical nous will be more important than ever for dissidents.

Print

Print