Avi Sheldon is a consultant at Semler Brossy Consulting Group LLC. This post is based on a Semler Brossy memorandum by Mr. Sheldon, Blair Jones, Andrew Friedlander, and Matthew Mazzoni.

Given growing stakeholder focus on Human Capital Management (HCM), we sought to understand how companies would approach the HCM disclosure within proxy statements this year. Our study of a sample of proxies filed in December 2020 and January 2021 offers an early proxy season preview of HCM disclosure practices.

Background

In 2020 the Securities and Exchange Commission (SEC) amended certain Regulation S-K rules as part of its ongoing initiative to modernize non-financial disclosure. The rules include a new principles-based requirement that companies address HCM details within the 10-K’s description of the business, to the extent such details are material to understanding the business. The new 10-K disclosure has pushed companies to develop and refine their strategy for communicating HCM actions, processes, and metrics. The requirement arrives when companies are engaging with stakeholders on social topics like HCM more than ever before, with Covid-19 accelerating the trend. Such engagement typically relies on a range of communications channels to deliver a holistic and harmonic narrative, especially given the conservative approach to disclosure that is appropriate for the 10-K. We speculate that 2021 will be an inflection point for the communication of HCM details, including in filings beyond the 10-K such as the proxy statement.

Key Findings

Given the tailwinds behind HCM disclosure, we were not surprised to find that recent proxy statements reflect a surge in the degree and prevalence of HCM details relative to prior years. Specifically, we found:

- 62% of recent proxy statements we analyzed included specific HCM-related details that extend beyond “boilerplate” claims; more than 2x the rate of prior-year proxies

- The companies that provided HCM details in prior proxies materially expanded such disclosures this year

- HCM disclosures covered a range of topics and degrees of detail, and appeared in a variety of locations within the proxy; no one-size-fits-all approach

Overview of Study and Sample

N = 53 Companies Above $3B Market Capitalization (January 2021)

Study Approach

- We analyzed 53 proxy statements filed in Dec. 2020 or Jan. 2021, each from companies with (i) a market cap greater than $3 billion, and (ii) a 10-K filed after Nov. 9th when the new S-K disclosure rule took effect

- Analyzed the same companies’ proxies from prior years to understand how the disclosures evolved this year

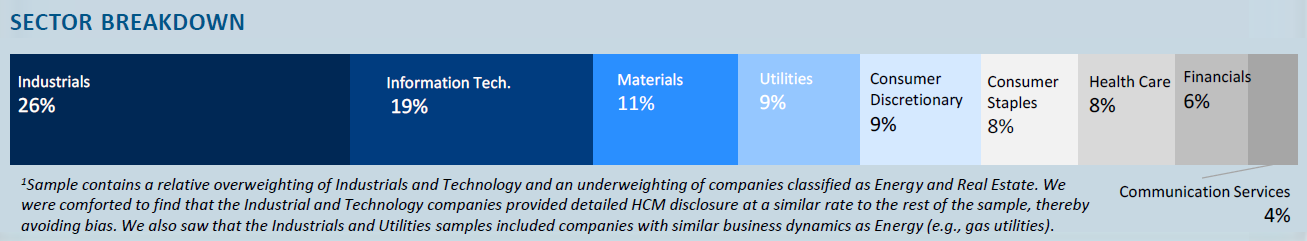

- Determined that the sector breakdown of our sample has not unduly biased our findings

- In each proxy we searched for disclosed details across a range of HCM topics described on the next page

- Captured only the cases where relevant disclosure described specific data, actions, policies, processes and/or programs (e.g., description of D&I initiatives or workforce demographics)

- Disregarded broad, commonplace statements (e.g., “we strive for a diverse workforce and inclusive culture, guided by the Board and senior management who are responsible for our D&I strategy”)

- Where detailed HCM disclosure was identified, captured the length of the disclosure and which proxy section the disclosure appeared

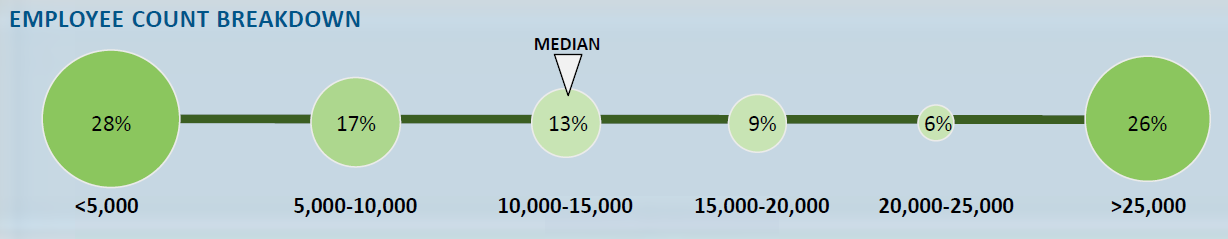

- We identified two predictors of HCM disclosure. Companies were more likely to disclose HCM details if they (i) consider HCM-related performance in pay decisions or (ii) employ a larger number of employees

Occurrence of Detailed HCM Disclosure Breakdown

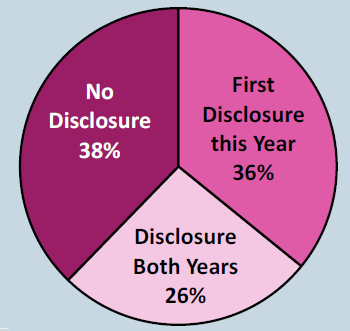

- 62% of the proxies filed this December and January contained detailed HCM disclosure

- Over half of these represent the company’s first disclosure of HCM details in the proxy

- Only 26% (14 of 53) provided HCM details in last year’s proxy

- 15 of 53 (28%) disclosed the consideration of human capital-related performance within executive pay. Nearly all these companies disclosed HCM details

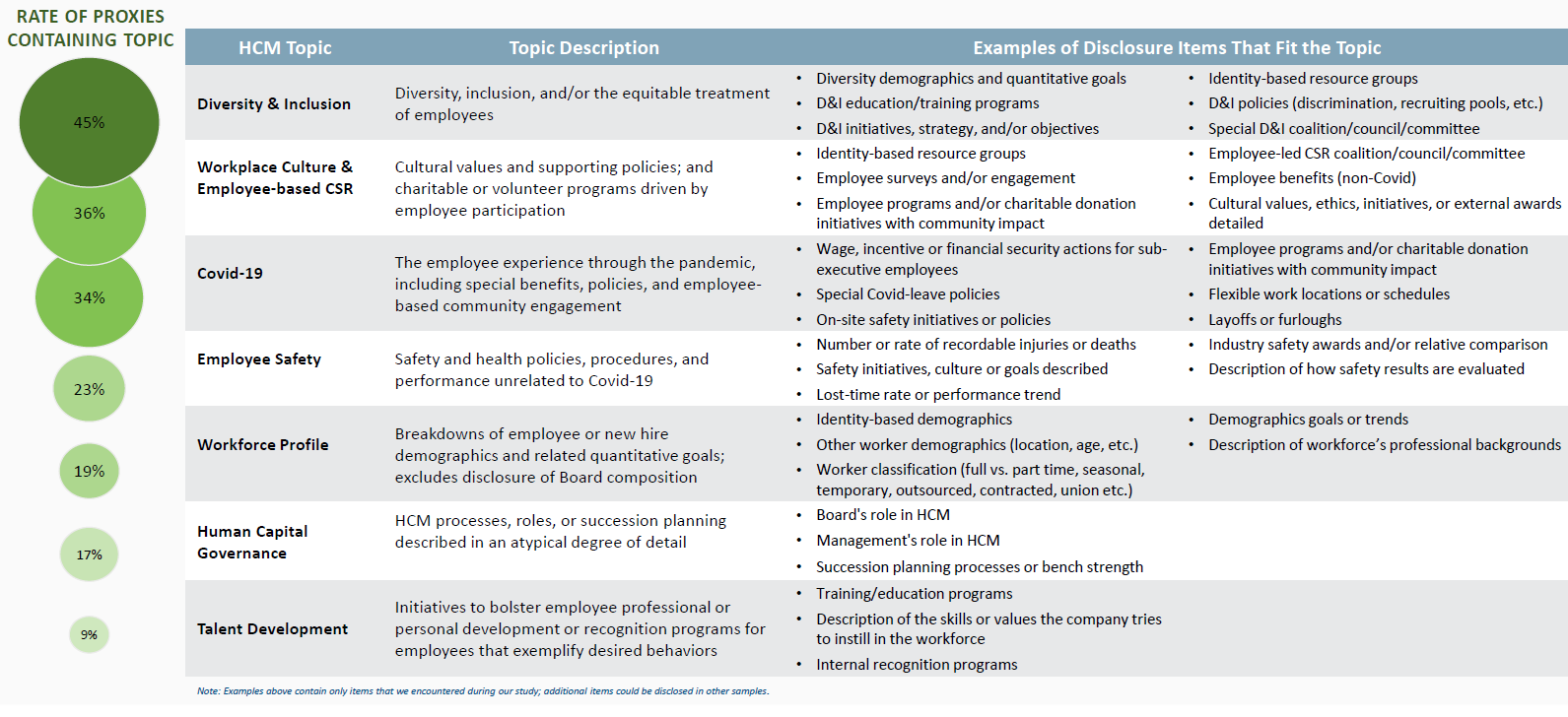

Description and Prevalence of HCM Topics Across Seven Topics

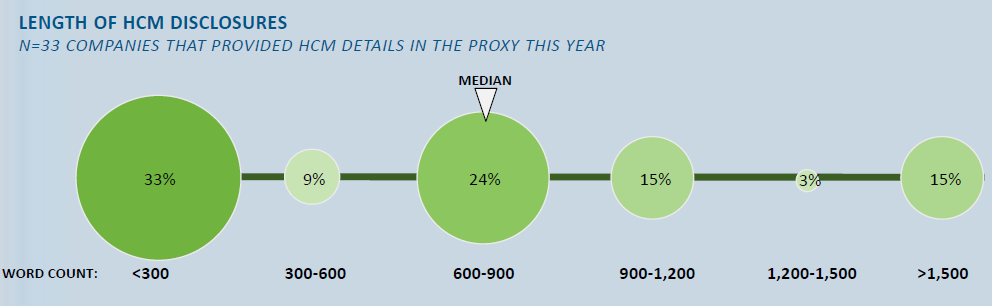

Findings: Length of HCM Disclosure

As measured by the summed word counts of paragraphs relating to HCM within each proxy statement

Findings

- The proxies that contained any HCM items disclosed varying degrees of detail

- One -third of the disclosures totaled fewer than 300 words in length, typically representing just a single HCM item or two

- 600-1,200 words was also common (39% of disclosures), typically in the form of three to six paragraphs and bulleted lists

- A handful of companies (e.g., Starbucks and Hologic) provided thousands of words of detail that consumed multiple pages of the proxy

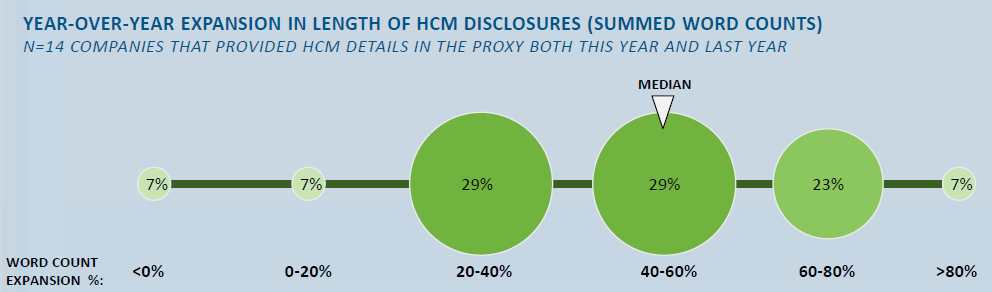

- 12 of the 14 companies that provided HCM disclosure last year expanded that disclosure by at least 20% this year

- Median expansion: 47%

- These companies (e.g., Visa) were more likely to provide particularly lengthy disclosures this year, with the median length reaching ~1,100 words

Findings: Location and Scope of Disclosure

Approaches to Where HCM Details Were Disclosed and How Many Topics They Covered Varied

Findings

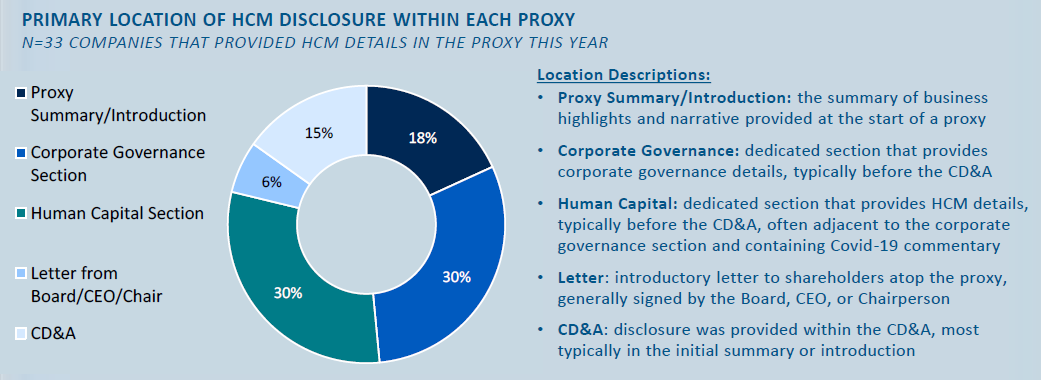

- We found no predominant approach for where companies are providing their HCM narrative within the proxy. We did identify the following themes, however:

- Most commonly, proxies contained dedicated sections for corporate governance and HCM matters. These typically appear after the director election section and before the CD&A

- Otherwise, HCM highlights were provided within summaries or letters from board members, at the start of either the proxy or the CD&A

- The number of HCM disclosure topics covered within a proxy varied widely and companies covering more topics had longer disclosures

- Some topics paired naturally with others and were often provided together, such as D&I with Workforce Profile or Covid-19 actions with

Culture & CSR

- Some topics paired naturally with others and were often provided together, such as D&I with Workforce Profile or Covid-19 actions with

The complete publication, including footnotes, is available here.

Print

Print