Todd Sirras is managing director, Austin Vanbastelaer is senior consultant, and Justin Beck is a consultant at Semler Brossy Consulting Group LLC. This post is based on a Semler Brossy memorandum by Mr. Sirras, Mr. Vanbastelaer, Mr. Beck, Basil Williams, and Sarah Hartman.

Our first Say on Pay and Proxy Results report of the 2020 proxy season included four predictions for voting trends. At that time, it was difficult to estimate the impact that COVID-19 would have on 2020 corporate performance and compensation programs (and significant uncertainty still exists). Compensation-related actions in response to COVID-19 will be a major discussion point in CD&As and proxy advisor reviews that are released in early 2021. Below are the trends we observed through the 2020 proxy season.

- We did not observe any change in the average Say on Pay vote support for Russell 3000 companies from 2019 to 2020, despite a significant number of companies disclosing mid-year pay We expect the 2021 average vote support and failure rate to reflect more of COVID-19’s impact as shareholders learn the full breadth of actions (such as discretionary bonus adjustments, modifications to outstanding equity, and other design changes) taken by companies through proxy filings covering FY20 executive compensation

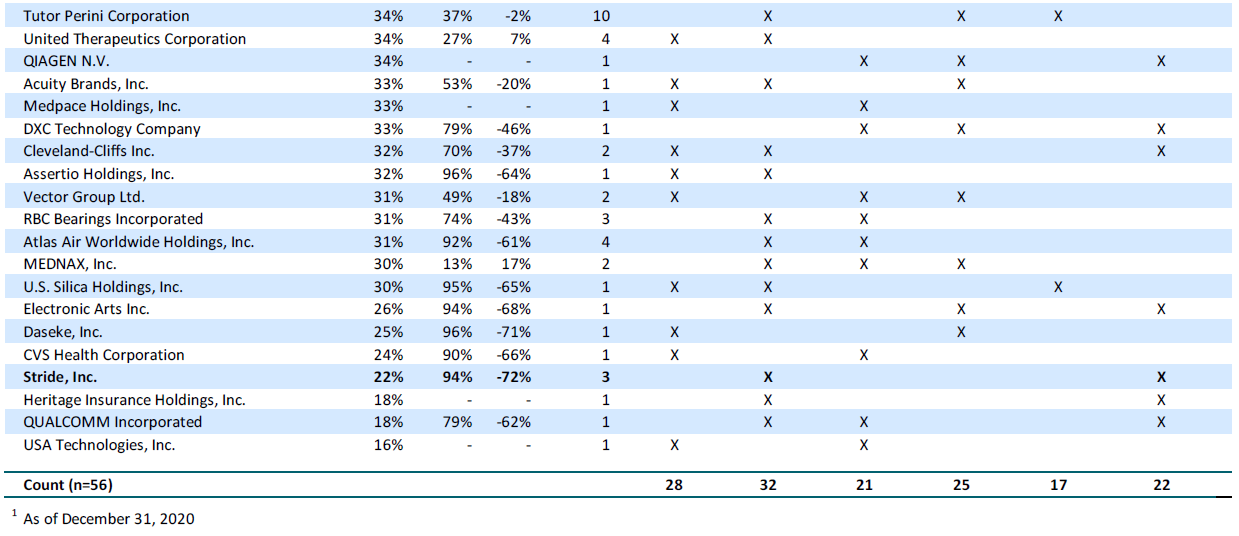

- Based on the Say on Pay failure rate’s cyclical trend since 2011, we predicted the Say on Pay failure rate for Russell 3000 companies would fall below 2% after two consecutive years above 5%. The failure rate decreased to 2.3% in 2020

- We expected the standard deviation of Say on Pay voting to increase above the 13% standard deviation observed in 2019 due to differing approaches from investors measuring company’s pay-and-performance relationship; however, this shift was not as impactful as expected and the standard deviation decreased from 13% to 12.3% in 2020

- We anticipated average Director vote support would fall below 94.5% as shareholders continue to increase expectations for Average vote support in 2020 (94.9%) did not drop as drastically as predicted; however, we expect this trend will continue at the current pace in 2021 as pay-related decisions in the COVID-19 environment are assessed in next year’s proxies

- We predicted the median vote support for Environmental and Shareholder proposals would reach 30%. Overall, vote support did not increase in 2020, but the number of proposals receiving above 50% support increased significantly. Investors are tightening their expectations around ESG-related actions and are holding companies accountable to these expectations through other avenues beyond shareholder proposals

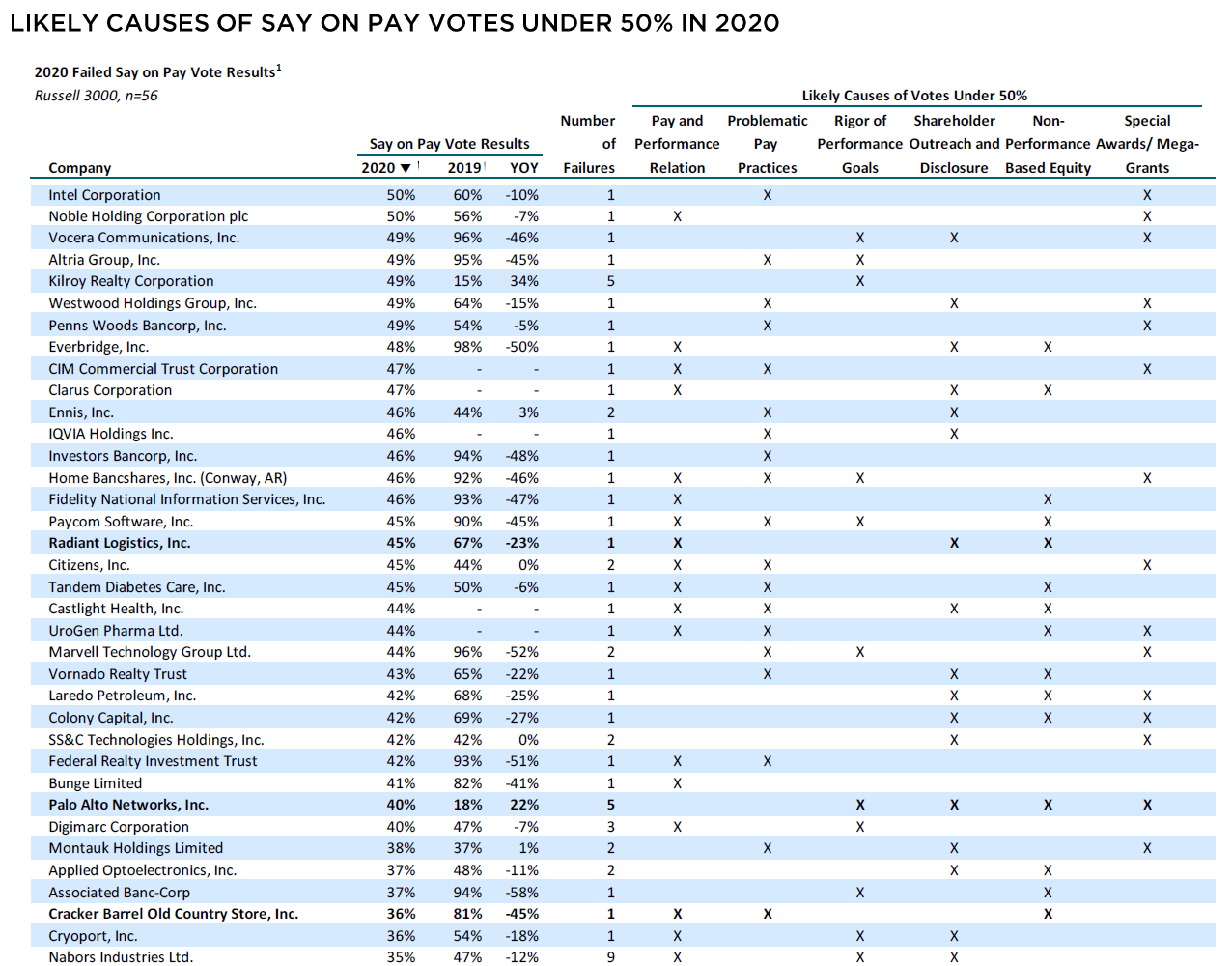

Breakdown of Say on Pay Vote Results

56 Russell 3000 companies (2.3%) failed Say on Pay in 2020. Four companies failed since our last report in September – these companies are highlighted in bold below.

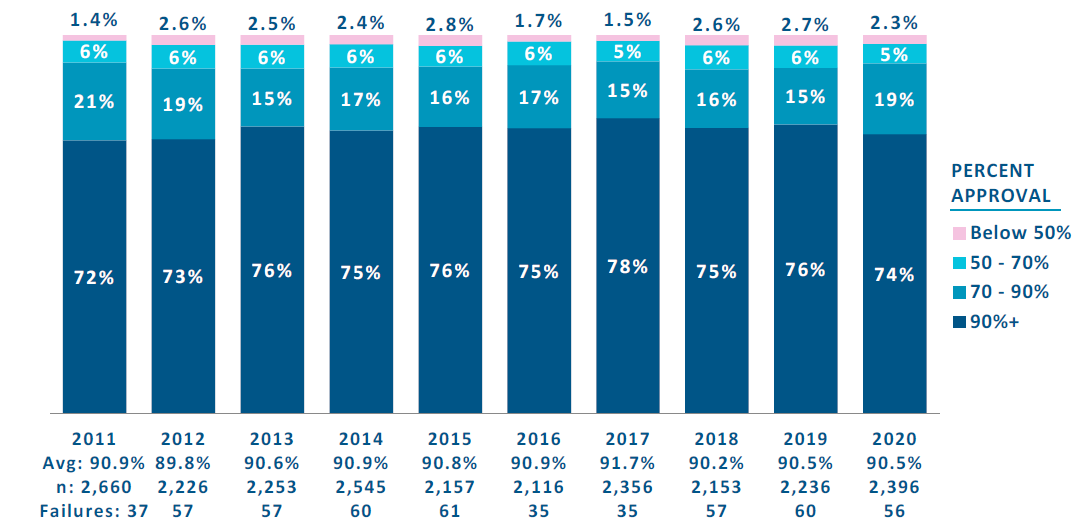

Say on Pay Observations

- The number of failures (56) and failure rate (2.3%) were both lower than last year, and were the lowest observed since 2017

- The 90.5% average vote result in 2020 was the same as the average vote result in 2019

- One-third of the S&P 500 has received vote support below 70% at least once since 2011

- The percentage of companies that received support between 70% and 90% was the highest observed since 2011

- 10% of the Russell 3000 and 8% of the S&P 500 constituents have failed Say on Pay at least once over the same period

Source: Data provided by ESGAUGE and Semler Brossy; analysis by Semler Brossy; ISS Voting Analytics. Russell 3000 sample effective as of July 1, 2019.

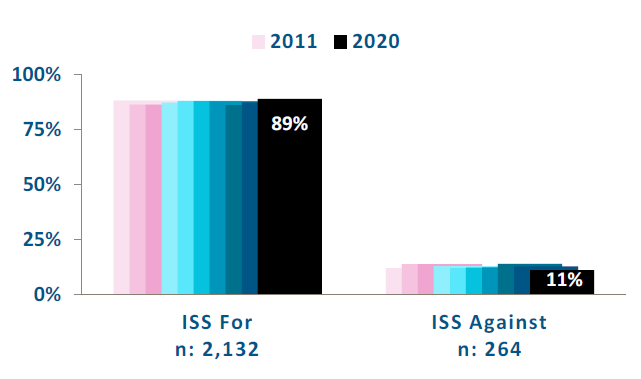

ISS Recommendation Rate

- 89% of companies received a “For” recommendation from ISS in 2020. This is the highest rate observed since 2011

- We expect that COVID-19’s impact and ISS’ changes to its pay and performance tests are the primary reasons that the 2020 “For” rate is the highest observed over the last ten years

- We will continue to monitor this number in 2021 as we expect that companies taking actions in contrast to ISS’ COVID-19 guidance will lead ISS to recommend “Against” for a higher percentage of companies in 2021

Source: Data provided by ESGAUGE, Semler Brossy and ISS Voting Analytics; analysis by Semler Brossy. Russell 3000 sample effective as of July 1, 2019

- During the 2020 proxy season, shareholders voted on 148 social proposals and 38 environmental proposals – median support for environmental proposals (22%) was 400 basis points lower than last year, while median support for social proposals (29%) was equal to the median support observed last year

- Thirteen social proposals (9%) and six environmental proposals (16%) received greater than 50% support in 2020

- By comparison, 6.2% of social proposals and 0% of environmental proposals received greater than 50% support in 2019 See additional analysis and insights on ESG in executive incentives at www.semlerbrossy.com/corporate-purpose-guidance/

Spotlight: Procter & Gamble

Shareholders submitted a proposal requesting that Proctor & Gamble publish a report on the company’s efforts to eliminate deforestation from its supply chain. The proposal passed with 68% vote support

- The proponents of the proposal cited the company’s use of palm oil and forest pulp (commodities considered leading drivers of forest degradation) as well as the company’s connections with palm oil suppliers linked to illegal deforestation as the basis for the initiative

- The proponents of the proposal specifically noted that potential remedies could include no-deforestation policies for all relevant commodities and disclosure of quantitative progress reports/ time-bound action plans

- The Board’s response opposing the resolution stated that the company is already committed to responsible sourcing in its supply chain and already reports on its progress toward its goals in its Annual Citizenship report

- ISS recommended “For” the proposal, citing that environmentalists question the deforestation standards of some third-party certification partners that the company references in its Citizenship Report and that the company lags its peers in terms of deforestation commitments and policies to monitor its suppliers

Director Election Observations

- Average vote support for Director nominees (94.9%) was 20 basis points lower than the average support observed in 2019; this continues a trend of declining average vote support for director nominees over the last five years

- The percentage of Director nominees that receive vote support over 95% has declined from 79% of nominees in 2016 to 73% of nominees in 2020

- Over the past five years, average Director election vote support at companies that received a Say on Pay vote below 50% in the prior year is six percentage points lower than at companies that received above 70% vote support

- Average vote support for female Director nominees was 180 basis points higher than average support for male nominees in a second consecutive year

- Average vote support for equity proposals (89.4%) was 110 basis points higher than the average vote support observed last year

- The number of equity proposals (697) increased in 2020 after the number of proposals in 2019 (565) and 2018 (558) were the two lowest since 2011; we expect the number of proposals in future years will remain below the levels observed prior to 2018 due to the elimination of the 162(m) provision that required shareholder approval of performance goals in incentive plans every five years

- Companies that received Say on Pay support below 70% received ten percentage points lower support on equity proposals than companies that received Say on Pay support above 90%

Print

Print