Benjamin Colton and Robert Walker are Global Co-Heads of Asset Stewardship at State Street Global Advisors. This post is based on their SSgA memorandum.

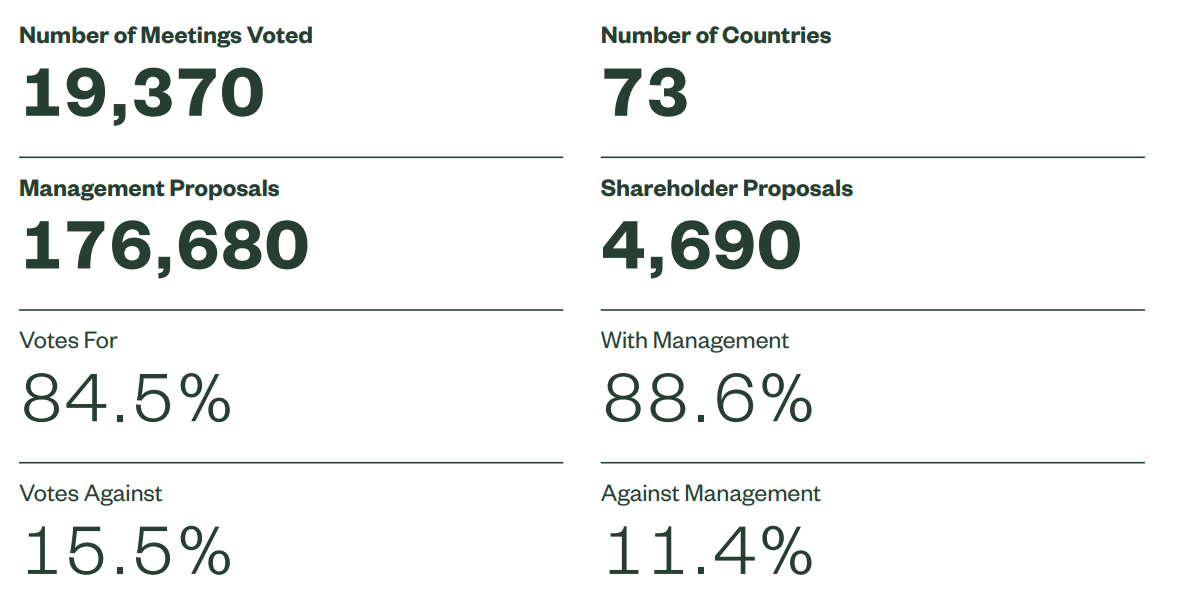

In 2020, we voted in over 19,000 meetings and engaged with over 2,400 companies. In all, our engagement activities encompassed companies representing 78% of our 2020 equity AUM.

In this post, we provide highlighted insights from our voting and engagement activities, as well as core campaign, sector and thematic takeaways.

Our 2020 voting record is publicly available here.

Engagement Statistics

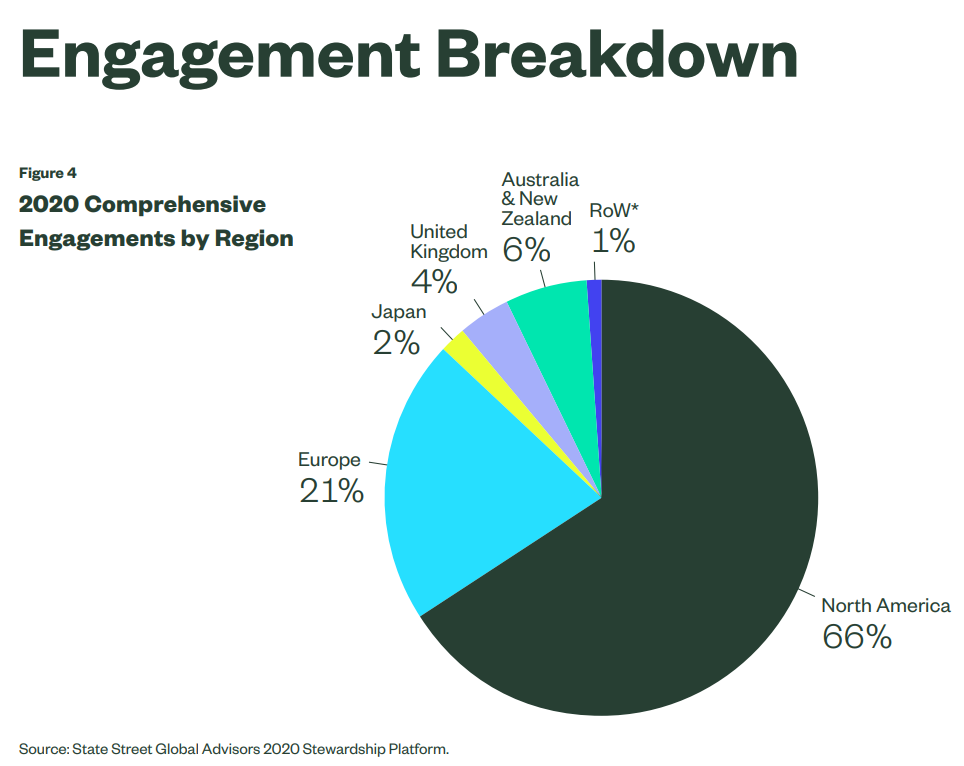

We engaged with 1,721 companies during 2020, of which 672 were comprehensive engagements based on in-person meetings or via conference calls and 1,740 were through letter-writing campaigns. We identify target companies for engagement through multiple methods, including proprietary ESG screens and the sector and thematic priorities identified in our annual stewardship objectives.

We sent letters to 80 companies on the thematic issue of gender diversity across three markets and 1,125 companies our 2020 CEO letter. We also sent letters to all S&P 500 companies on Racial Diversity Guidance. In addition we sent a collaborative letter with other investors to all DAX 30 companies on the thematic issue of board accountability calling on them to voluntarily adopt a three-year election cycle for shareholder-elected supervisory board members.

In 2020, we also conducted 851 engagements with companies on their R-Factor scores. Details on these campaigns can be found in the Fearless Girl (page 30) and Integrating R-Factor Into Vote Decisions (page 40) and Our Collaborative Initiatives (page 60) sections of the complete publication (available here).

Companies Engaged by Topic

For a comprehensive list of companies engaged with during 2020 and the topics of engagement, please see here.

Engagement & Voting Highlights

Compensation

Executive compensation is a perennial engagement and voting topic for the Asset Stewardship team. We believe that executive compensation presents risks, such as creating perverse incentives, as well as opportunities, such as demonstrating a commitment to ESG priorities.

When structured appropriately, executive compensation can be well aligned with operational goals and shareholder results. However, this topic is receiving elevated attention because the Covid-19 pandemic has rendered many compensation-linked performance targets unattainable.

During our engagements with our portfolio companies, most report that they plan to update their executive compensation programs but acknowledge that they have not yet acted.

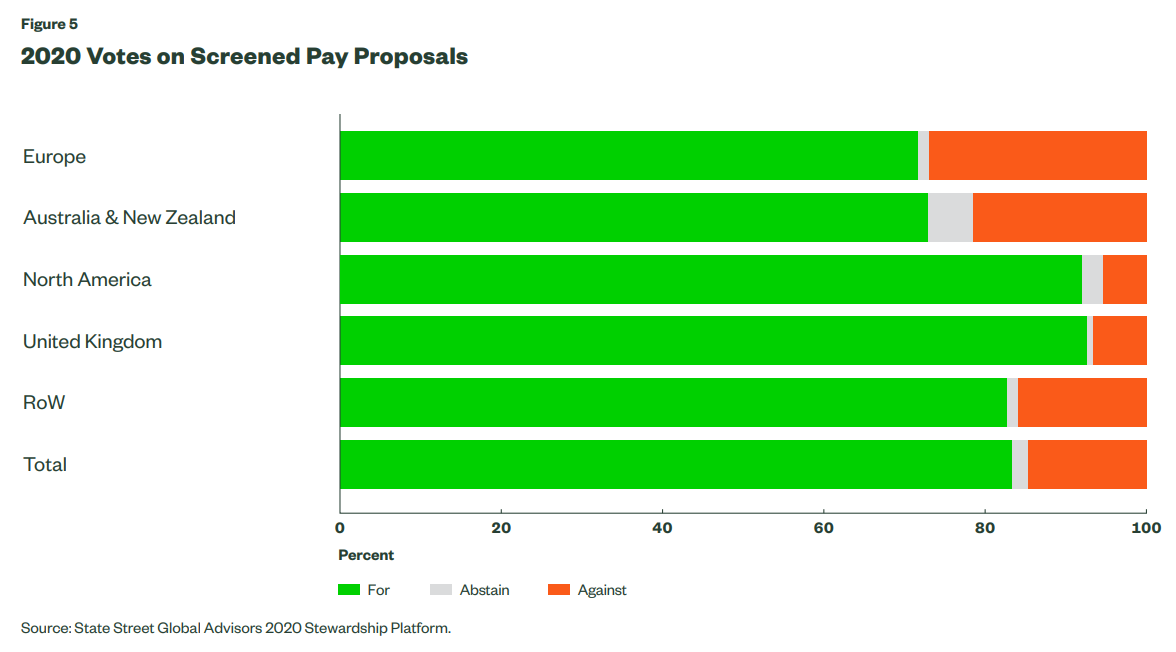

In 2020, there were 7,416 proposals on compensation practices or policies across our global investment portfolios. We supported approximately 84% of pay-related proposals, an increase from 82% support in 2019.

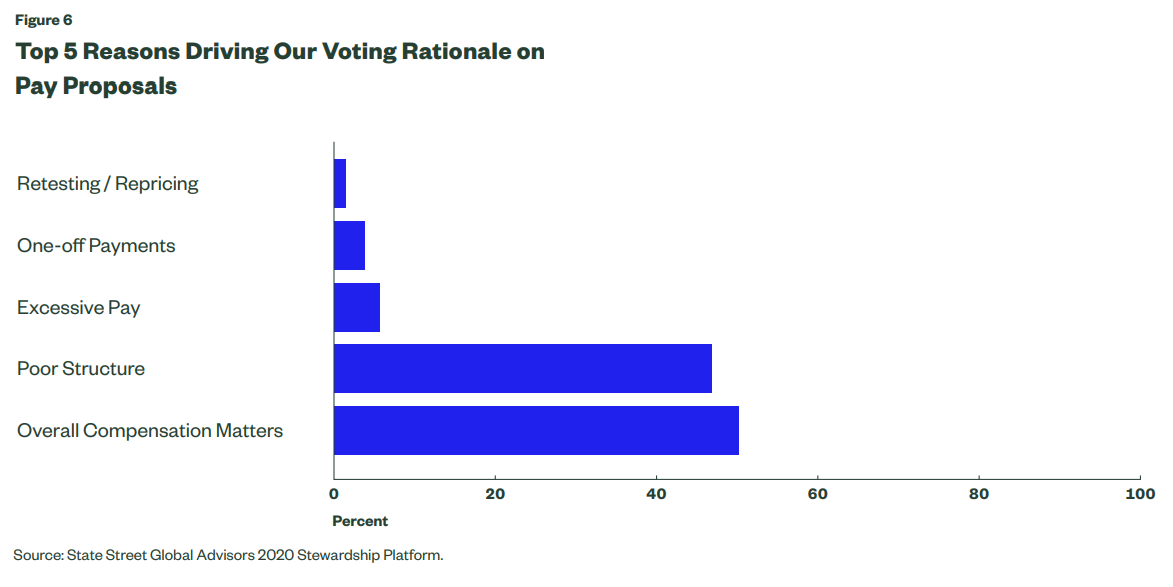

During the year, our votes against compensation proposals were mainly due to growing concerns about pay-for-performance misalignment, poor disclosure of pay structures, and increasing pay quantum in the prior year.

In contrast, our rationale for abstaining on pay-related proposals was the result of situations where we could not provide unqualified support or where companies had responded to some, but not all, of our concerns on pay.

As was the case in 2019, we continue to find that poor structure (43%) remains a key factor driving our voting rationale on pay proposals, as presented in Figure 4 above. We have found that, in terms of structure, incentive design is still in need of improvement and that there is not always a strong link between pay and business strategy.

Examining Regional Differences in Our Voting on Pay Proposals

United States and United Kingdom

The higher level of ‘for’ votes in compensation proposals in the US and UK markets is rooted in the fact that companies within both markets have provided detailed disclosure of their compensation structures for many years.

Further, the consistency of reporting on pay in the US and UK markets has made it easier for investors to analyze and compare pay levels, and drive change in specific areas such as holding periods for long-term awards. Consequently, companies in the US and UK are much more aware of the specific pay practices that may concern investors and lead to a negative vote.

Europe

The high level of ‘against’ votes is a consequence of the lack of consistency and transparency in reporting on pay structures across European markets, and market variations in the ability of investors to approve remuneration structures/policy through an annual advisory or binding shareholder vote.

We expect companies to improve the level of disclosure and structure of their remuneration plans going forward because of the implementation of the European Union’s Shareholder Rights Directive (SRD II), which came into effect for European member states in June 2019 and aims to create a consistent framework for remuneration disclosure by issuers. We also saw an increase by over 948 votes in Europe due to a significant increase in the number of proposals in all markets

Australia

We voted against proposals that had poor remuneration structures, inadequate disclosure, or a misalignment between pay and performance. We find that Australian remuneration plans are shifting more toward short-term priorities and away from long-term targets. While Australian companies have improved disclosure on the metrics used within their short-term incentive plans, we expect them to disclose their performance against such targets when making remuneration decisions.

Further, the benchmarking of total remuneration against much larger US companies without sufficient justification resulted in a ratcheting up of pay to senior executives in some companies. We have increased our engagement with Australian companies with a focus on ensuring compensation plans are linked to long-term performance and do not include aspirational peers.

Board Refreshment

Board refreshment is the mechanism through which companies can update board skills and seek director candidates with diverse backgrounds and skills to complement the expertise of serving directors. Since 2014, we have voted against 1,366 companies for board refreshment or tenure concerns.

Of the 313 companies we voted against in 2019, 96 fell off our screen in 2020, meaning that 31% of the companies we voted against in 2019 improved their board refreshment practices.

Incorporating R-Factor

Beginning in the 2020 proxy season, we started taking action against board members at companies in the S&P 500, FTSE 350, ASX 100, TOPIX 100, DAX 30 and CAC 40 indices that are laggards based on their R-Factor scores and that cannot articulate how they plan to improve their score. In the event that we feel a company is not committed to engaging with us or improving their disclosure or performance related to financially material ESG matters, we may not support the re-election of the board’s independent leader. Ultimately, we took voting action against 14 companies in 2020. For further information, please see the R-Factor section (page 40 of the complete publication).

Gender Diversity (Australia, Canada, Europe, Japan, United Kingdom, and United States)

Ultimately, we took voting action against 313 companies in 2020 for failing to demonstrate sufficient progress on board diversity. For further information, please see the Fearless Girl Campaign section (page 30 of the complete publication).

Key Takeaways from 2020

Through voting and engagement with our investee companies we have found:

Covid-19’s Impact on Pay

Executives are taking temporary pay cuts in light of Covid-19. Many CEOs and senior executives in the companies hardest hit by the pandemic have announced that they will voluntarily reduce their pay until Covid-19 has subsided. However, most companies refrained from fundamentally restructuring schemes as they are still actively trying to assess the impact of the pandemic.

Discretion will be a key consideration going forward. In light of the pandemic’s impact on executives’ annual and long-term incentives, many companies are considering using discretion to determine any awards to be earned for 2020.

In our view, compensation committees should be clear about the discretionary powers available to them. We expect committees using discretion to adjust payouts to ensure the outcomes will reflect company and executive performance and align with shareholders.

Increasing Complexity

We have observed annual plans becoming overly complex, using numerous metrics with differentiated weighting. Complex plans make it difficult for us to determine what the executive is being incentivized for, or how business results translate into awards. We encourage companies to simplify bonus plans and to ensure they have clear linkage to strategy.

Overreliance on Relative TSR

We have also observed relative total shareholder return (TSR) increasingly becoming the metric of choice for performance-based equity awards.

While relative TSR shows a company’s commitment to creating long-term value for shareholders relative to competitors, it should not be used as the sole performance metric. Rather, we encourage companies to take a more holistic approach using a blend of relative TSR and long-term operational metrics that aligns with the company’s strategy.

Performance-Based Equity Plans Continue to Increase in the US

There has been a further shift away from time-vested awards without performance conditions attached to performance-based equity in long-term incentive plans.

We view this as a positive trend that creates stronger alignment among executive rewards, company performance and shareholder value.

The complete publication is available here.

Print

Print