Peter Reali is Managing Director and Head of Engagement, Responsible Investing, Jennifer Grzech and Anthony Garcia are Directors, Responsible Investing, at Nuveen. This post is based on their Nuveen memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here).

The global pandemic motivated investors to increase their focus on the strategic impacts of environmental and social responsibility on long-term shareholder value. Now, more than ever, investors are using proxy votes to express their views on company behavior, rather than relying on company disclosure. And after an unprecedented year, the blurred lines between what constitutes E, S or G are highlighting the challenges of a one-size-fits-all approach to proxy voting.

Volume of E&S Shareholder Proposals is On the Rise

Proxy voting is the primary means for shareholders to communicate their views about a company’s environmental, social and governance (ESG) practices. Shareholder proposals tend to focus on a single, concrete call to action and provide investors with a more solid basis for any further action.

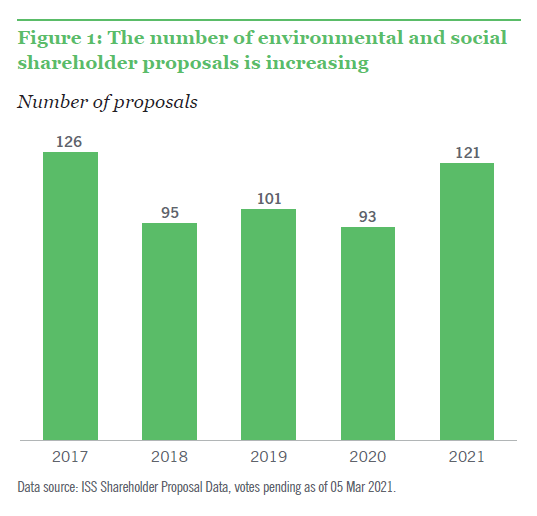

At the end of the 2020 proxy season, 90% of S&P 500 companies had published some kind of ESG report, up from 86% the prior year and 20% a decade ago. Despite this increase in transparency, the number of shareholder proposals requesting additional environmental and social information remains elevated. What’s behind this trend?

ESG reporting still lacks standardization

The Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) have developed standards to enable businesses to identify and communicate financially material sustainability information to their investors.

Many investors and industry groups have endorsed these standards for their materiality, consistency and robustness. However, in 2020, less than 25% of S&P 500 companies’ ESG reports were aligned with the SASB reporting framework, only 16% of reports referenced TCFD and only 5% of companies published complete TCFD-aligned reports.

However, as investors continue to push companies on environmental and social issues, improved transparency and standardization, companies are seeking SEC approval to omit shareholder proposals from ballots through no-action requests. If a shareholder proposal is too narrow, a company can allege “micromanagement,” but overly broad proposals leave room for a company to claim that its current ESG reporting constitutes “substantial implementation.” More than 90% of company requests to omit a proposal from the ballot cite these issues, whereas less than 10% cite the request as economically irrelevant to the company.

The SEC process allowed 63 resolutions related to environmental and social issues to be omitted in 2020, up from 41 in 2016. The recent precedent on no-action requests has limited shareholders’ ability to bring certain proposals to a vote. This could also account for the increase in shareholder proposals, particularly the large number that are climate related. Greater volumes and diverse approaches increase the probability that proposals will make it to company ballots.

Climate-Related Proposals Seek Accountability and Outcomes

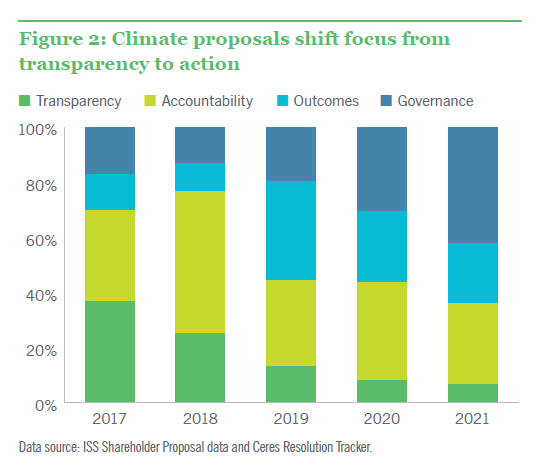

While shareholder proposals have increased in volume, they have also evolved beyond general requests for additional transparency. Similarly, the objectives often go beyond a better understanding of ESG risk and opportunity for inclusion in the investment process. It is now common to see proposals that, for example, request information on the governance of environmental issues or the business strategy to promote the outcome of racial equity or the low-carbon transition.

Aside from driving a greater number of shareholder proposals, the SEC’s recent record on no-action requests may also explain why the scope of climate-related proposals has expanded. With the SEC omitting more than a dozen proposals related to the alignment of company carbon reduction goals with the Paris Agreement, shareholders have turned to requests for disclosure of lobbying activities or enhanced board oversight of climate risk as alternatives to direct requests for target setting.

This points to another notable shift in climate-related proposals. Some proponents, viewing disclosure as insufficient, are using shareholder proposals to push companies on performance toward a low-carbon transition. In these cases, the requests can often be seen as a commentary on a company’s lack of commitment to decarbonization and alignment with recognized science-based transition targets. In fact, many key 2021 proposals targeting the world’s largest emitters have gone to companies that already disclose information related to climate risks and/or have greenhouse gas (GHG) reduction targets.

As a result, climate-focused stakeholders have filed 126 proposals for the 2021 proxy season, however fewer than half of proposals voted on or pending (36%) focus on traditional transparency requests. Requests on GHG reduction targets and strategy are the most popular topics (26%), followed by lobbying disclosure requests (15%) and board oversight of climate and sustainability strategies (11%). Only one proposal requests a broad-based sustainability report where the company currently lacks any environmental disclosure.

This year, 2021, could become a watershed year for environmental proposals receiving majority support, based on recent trends in investor ownership concentration and the stewardship activities of the largest global investors. On the other hand, it remains uncertain how far most investors are willing to push entire industries toward specific business models that align with the outcome of a net-zero economy.

Votes on the management-sponsored “say on climate” proposals may serve as a better litmus test for investors’ points of view on a particular company’s climate strategy. While only a small number of companies have included such a vote on the ballot for 2021, more than 10 shareholder proposals request the company adopt the shareholder right to add a “say on climate” proposal at future annual meetings.

Diversity and Inclusion Proposals Take a Broader View

Investors strengthened the call for board diversity

Investors continue to coalesce around calls for board diversity. Companies have generally responded, often acting unilaterally to add diverse directors or commit to enhancing their nominating policy.

As a result, fewer shareholder proposals on board diversity are making it to a vote. Given the sporadic nature of these proposals, investors’ convictions can be more clearly understood through the votes against directors where the board lacks diversity. In 2020, 9 of 42 directors that failed to receive majority support for election were on boards where lack of gender diversity was the only notable issue, and more than 25% of nominating committee members on boards that lacked gender diversity received less than 70% support for election.

However, in 2021, we are seeing an increased focus on race/ethnicity in the boardroom. Whereas less than 10% of boards in the Russell 3000—and none in the S&P 500—lack gender diversity, nearly 40% of Russell 3000 boards lack racial and/or ethnic diversity.

Many mainstream investors have now put companies on notice regarding diversifying their boards beyond gender. However, most investors are calling more for transparency on board race/ethnicity composition than action on board refreshment. Boards that take a wait-and-see approach to enhancing diversity are taking on risk, as they are working against investor advocacy for increased transparency, data providers improving data collection services, NASDAQ’s proposed board disclosure regulations and the legislation enacted by states, such as California.

A focus on diversity extends to the workforce

Beyond the boardroom, investors have increased their interest regarding diversity and inclusion within a company’s workforce. We’ve seen a dramatic increase in shareholder proposals requesting disclosure of EEO-1 reports. Investors with public campaigns on workforce transparency have stated an intention to file more than 40 shareholder resolutions requesting disclosure of EEO-1 data. In 2020, only 22 total shareholder proposals requesting EEO-1 data were filed, and only eight went to a vote.

Most companies disclose nonstandard diversity and inclusion metrics in ESG reporting, such as percent of “diverse managers,” without absolute numbers or specific definitions. Companies must acknowledge that adding one or two female directors can create meaningful diversity and inclusion in the boardroom, but it will require adding hundreds of female managers to achieve a similar increase in gender diversity in company leadership.

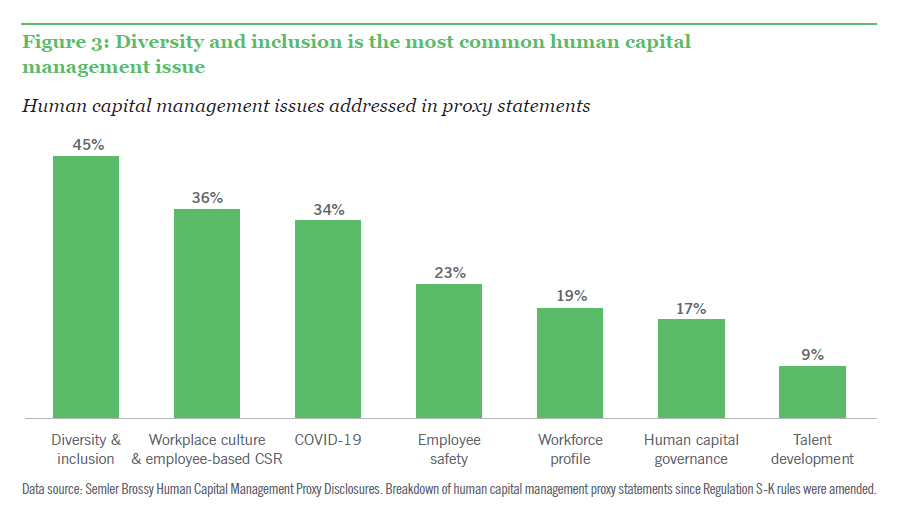

Diversity and inclusion is now the most common human capital management issue addressed in proxy statements. As companies begin to expand human capital management disclosures in line with the amended Regulation S-K requirements, shareholder proposals may find new ways of viewing diversity and inclusion within human capital management.

Rather than focusing on demographic disclosure, some past shareholder proposals focused on how human capital management policies were affecting diversity and inclusion outcomes. The “unadjusted pay gap” proposals from 2018 and 2019 reflect this type of advocacy. While the market narrative on the unadjusted pay gap centered on the existence/size of the gap, the proposals’ overall request was for reporting on the policy; reputational, competitive and operational risks; and the risks related to recruiting and retaining diverse talent.

Company practices on racial equity come under scrutiny

Multiple shareholder proposal proponents also focus on racial equity from a supplier, customer and community perspective. Some proponents identify industries with historically discriminatory business practices, such as consumer finance, and others target companies based on how the companies communicated their values and how companies responded to the 2020 protests for racial justice.

The proposals typically request that the company demonstrate accountability to racial equity in its business practices, whether through a tangible action or a third-party assessment and validation of the value of the company’s policies and practices.

Corporations are Held Accountable of Their Responses to Current Events

Corporate accountability also appears in other shareholder proposals, such as those tied to the coronavirus pandemic, as well as the 2020 presidential election and subsequent insurrection at the Capitol.

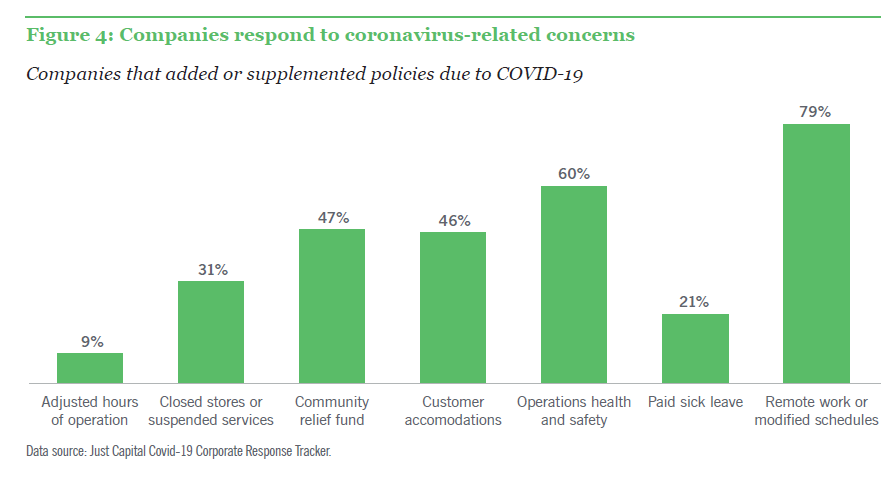

Coronavirus

Proposals resulting from the global pandemic emphasize ESG best practices not often addressed in the proxy voting process. These proposals include requests for paid sick leave and other employee health and safety policies.

A focus on how the board oversees the employee workforce may also connect to the small but increased advocacy to add employee representatives to the board. The companies targeted with these proposals generally have a significant portion of “essential workers” in their workforces.

Political activity

Shareholder proposals on political activities have been the most-voted proposals of the past two years. These proposals continue to gain investor support as company behavior is successfully influenced by such efforts.

Furthermore, recent political unrest may add a new perspective for how shareholders analyze and vote on these proposals. Many companies have already announced policy changes on direct political contributions. It remains uncertain whether and how companies will reconsider other political activities and whether that assessment will extend to addressing other societal issues.

Executive compensation

Shareholder proponents are requesting that executive compensation create management accountability for executing on ESG strategies and commitments. The requests range from a broad look at integrating SASB metrics to more company-specific issues.

While many companies proactively incorporated ESG factors into the compensation design, the ESG factors typically get included as part of a holistic assessment of a variety of strategic factors. The metrics evaluated and the bonuses awarded specific to ESG performance are often less transparent than the financial component of compensation. Early examples have faced stakeholder criticism and have not clearly demonstrated an improvement in terms of accountability.

Improved Data Quality and Availability Drive Attention to Outcomes

The increased attention on ESG from shareholders, stakeholders and regulators sets up 2021 as likely another year of record support for shareholder proposals, and perhaps increased votes against boards that are not keeping pace with ESG transparency and accountability.

It is yet to be seen how companies will respond to majority support for these proposals, and whether transparency and accountability will ultimately lead companies toward desired ESG outcomes.

As the market coalesces around the need for standardized and material ESG disclosures, investors will be able to further assess company performance and translate their assessment into proxy votes. We believe the connection between company engagement and integrating ESG data into the investment process will increase market focus on positive ESG outcomes in the future.

The complete publication, including footnotes, is available here.

Print

Print