Sophie Calder-Wang is Assistant Professor of Real Estate at The Wharton School of the University of Pennsylvania; Paul A. Gompers is Eugene Holman Professor of Business Administration at Harvard Business School; and Patrick Sweeney is a Research Associate at Harvard Business School. This post is based on their recent paper.

Over the last seventy years, female labor market participation has increased significantly. Women’s representation in highly compensated occupations such as law, medicine, consulting, and investment banking has steadily improved. Yet, the gender diversity in venture capital has lagged significantly behind: On average, only about 8% of venture capital investors hired are women over the past three decades.

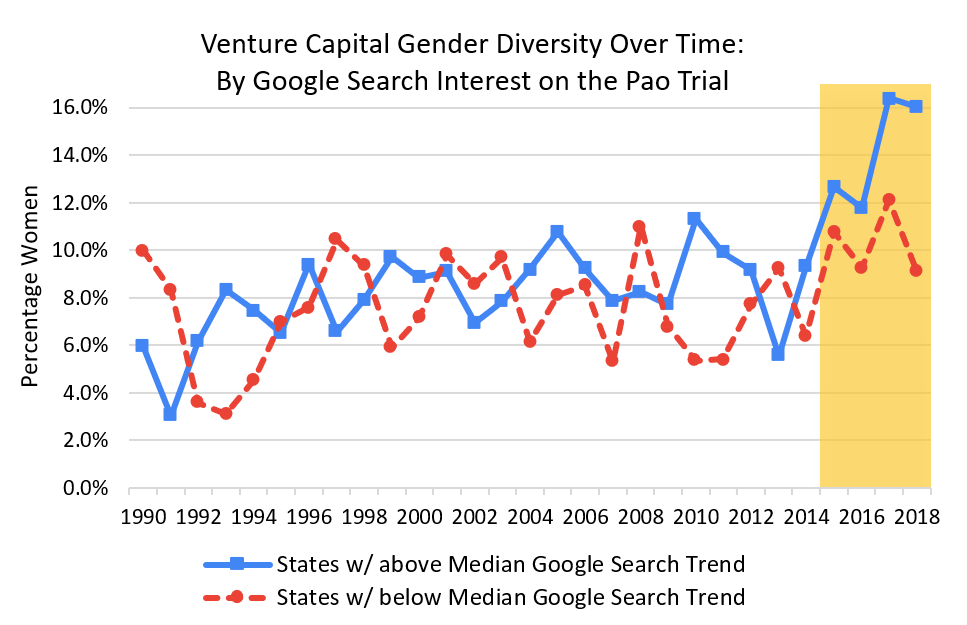

In this study, we examine the impact of the gender discrimination lawsuit Pao v. Kleiner Perkins on gender issues in the venture capital industry. We have two main findings: First, we show that the Pao trial causes a significant increase in the hiring of women investors in venture capital from 2015 to 2019. We find significantly stronger effects in states with greater awareness of the trial, as measured by Google search trends. Second, we find that the increased hiring of women investors in venture capital is an important driver leading to more funding allocated to companies started by women founders.

Ellen Pao, a junior venture capital partner, filed a discrimination lawsuit in 2012 against Kleiner Perkins Caufield & Bayers, one of the oldest venture capital firms in the Silicon Valley. It went to trial in February 2015, and a jury in San Francisco rejected her gender discrimination claim on March 27, 2015. The Pao trial was closely followed by many major media outlets such as the New York Times, the Wall Street Journal, Financial Times, and Forbes. It also drew significant attention from many US-based venture capital firms.

To examine whether the lawsuit causes any changes in the subsequent hiring and investing behaviors in venture capital, we collect extensive data from various sources. We obtain detailed deal level information from VentureSource, covering 1990 through mid-2019. For each portfolio company, besides their location and industry, we collect information about the individuals involved with the firm, including founders, venture capital investors, angel investors, board members, and early hires. We hand-collected their biographical information such as gender, ethnicity, education, and prior job experience from various sources such as online resume websites, web searches, SEC filings, and news articles.

We begin our empirical analysis by examining the impact that the Pao trial had on the hiring of women investors in venture capital using a heterogenous difference-in-difference framework. We use the Google search trends of “Ellen Pao” in 2015 across different states to measure the differential awareness of the Pao trial. We interact Google search trends with a post-Pao dummy variable. We find that states with higher Google search trends for Ellen Pao experience a larger increase in the hiring for women after the trial. A one standard deviation increase in Google search trends is associated with a 1.2% increase in the fraction of women hired, or a 14% increase compared to the prior-year baselines.

Fig 1: VC gender diversity over time. The shaded area designates the period after the Pao trial.

Next, we use an instrumental variable (IV) framework to address the potential measurement problems of Google search trends. A good instrument should be correlated with the awareness of the trial as it pertains to gender issues but uncorrelated with search intensity driven by other factors such as general interest in legal or celebrity matters. We use state-level maternity benefits as an instrumental variable for Google search trends. We obtain maternity benefit scores from the National Partnership for Women and Families, which grades each state’s laws on paid job protection, family and maternity leave, and flexible use of sick leave. We find that one standard deviation increase in the state-level maternity score implies a 2.2% increase in the hiring of women investors in venture capital, a 26% increase from the prior year baselines. Given that our IV framework produces a larger coefficient than the OLS specification, it suggests that the instrumental variable is effective in addressing the measurement problem. Overall, our results lead us to believe that there is a causal link between the awareness of the Pao trial and an increase in hiring women in venture capital.

Lastly, we examine how the awareness of the Pao trial may affect the downstream allocation of funding flowing to founders. In general, we find that women investors are significantly more likely to invest in companies founded by women entrepreneurs than their male colleagues. Before the Pao trial, on average, 11.9% of a women investor’s portfolio is invested in companies started by women, compared to only 7.2% of their male colleagues, representing a 65% increase in the propensity. The gap persists after the Pao trial: The percentage of women founders in women investors’ portfolios is 15.0%, compared to 8.8% for men. When we use the same instrument variable framework with women founder as the outcome variable, we do not find a statistically significant coefficient. It suggests that the awareness of the Pao trial does not seem to affect the propensity to invest more in women founders differentially. In other words, our results indicate that any differential increase in women founders backed by venture capital after the Pao trial is driven by the increases in the percentage of women investors hired into the venture capital industry.

Overall, our results show that increased awareness of gender issues can help to improve a firm’s diversity. Since venture capital plays a crucial role in allocating resources towards entrepreneurship and innovation, it has an outsized impact on the overall economy. More than 60% of IPOs had venture financing, and 44% of all research and development spending among U.S. companies had previously been backed by venture capital. Our results are important for ensuring that opportunities become accessible for all aspiring investors and entrepreneurs despite their demographic backgrounds.

The full paper is available here.

Print

Print