Lindsey Stewart is Senior Manager of Investor Engagement at KPMG LLP. This post is based on his KPMG memorandum. Related research from the Program on Corporate Governance includes The Untenable Case for Perpetual Dual-Class Stock (discussed on the Forum here) and The Perils of Small-Minority Controllers by Lucian Bebchuk and Kobi Kastiel (discussed on the Forum here).

Key points

- Recent UK government consultations have the common aim of reinforcing the UK’s position as a world-class investment destination, but they approach that aim with differing priorities.

- In responding to these consultations, UK shareholders—who overall are staunch defenders of the “one share one vote” principle—are carefully weighing up the costs and benefits of giving greater control to company founders and directors.

- Proposals of BEIS” “Restoring Trust” consultation—such as those on internal controls attestations, the Audit and Assurance Policy, and the Resilience Statement—could help bridge the gap

- The ongoing consultations are a unique opportunity for all stakeholders to influence the direction of corporate governance standards in the UK.

There’s been a flood of reviews and consultations from the UK government on the future of UK PLC as it seeks to “build back better” after the pandemic—a fact that public policy and governance experts can’t fail to have noticed.

My colleagues and I, in KPMG’s UK Audit practice, have unsurprisingly focused our attention on the 230-page consultation from the Department for Business, Energy and Industrial Strategy (BEIS): “Restoring Trust in Audit and Corporate Governance’.

Around the same time as “Restoring Trust” was issued, two other reviews were published by HM Treasury—the UK Listings Review by Lord Jonathan Hill and the Review of UK Fintech by Ron Kalifa OBE.

Common aims, differing priorities

All three documents express very similar high-level sentiments—for example:

- “Restoring Trust” highlights a determination “to reinforce the UK’s position as a world-class destination for investment’;

- the Hill Review mentions a need to “encourage more of the growth companies of the future to list here in the UK’; and

- the Kalifa Review cites its aim to “cement the country’s reputation as a listing destination’.

It has been mentioned in many of our recent conversations with the UK’s largest institutional investors that the three papers” proposals appear at times to pull in very different directions.

The corporate governance proposals in BEIS” “Restoring Trust” consultation focus on:

- ensuring that shareholders in UK companies are appropriately informed and protected against negligence or wrongdoing;

- strengthening and clarifying areas of the regime governing directors” responsibilities over the company; and

- making improvements aimed at ensuring the minority of directors who run companies with insufficient care and attention are held accountable.

In contrast, HM Treasury’s proposals for amending the UK Listings regime (found in the Hill and Kalifa Reviews) prioritise:

- enabling company founders to retain greater control over the companies they list, by allowing dual-class share structures and reductions in minimum free float for Premium listed companies; and

- increasing retail shareholder engagement and their participation in capital raisings and other corporate actions.

These differing priorities raise a few important questions that stakeholders—shareholders, directors, regulators, auditors and legislators—will all need to consider carefully if the key goal of making UK capital markets even more attractive is to be achieved.

Investors consider the costs and benefits of greater founder control

The ability to retain company founders with unique knowledge and skills is frequently cited as a driving factor behind proposals to allow dual-class share structures and reductions in minimum free float requirements.

The Hill Review proposes that companies be permitted to issue a separate share class held by company founders with up to 20 votes per share, with all other shareholders having only one vote per share. The second class of shares would have a time limit of three years, at which point all issued share capital would revert to “one share, one vote’.

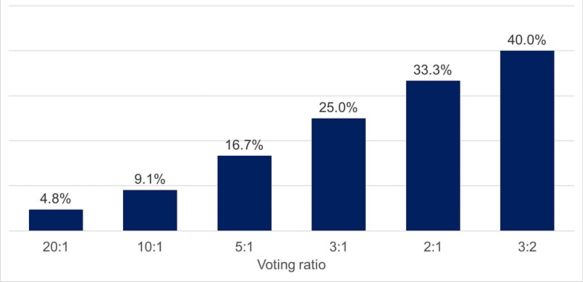

A 20:1 voting ratio permits holders of “Class B” shares to control more than 50% of the votes at a company’s general meeting with less than 5% of the issued share capital. However, as the chart below shows, Class B shareholders can retain a significant amount of control over a company even with a voting ratio considerably smaller than 20:1.

Percentage shareholding required to control 50 percent of votes in a dual-class share structure

Additionally, a proposed reduction in minimum free floats for Premium listed companies (from 25% to 15%) would mean a reduction in the level of influence institutional public shareholders have over such companies—again handing more control to founders and pre-IPO shareholders.

Retention of key skills and personnel are important priorities for all companies and attracting more growth companies to the UK is certainly a desirable aim. Asset managers who support the Hill Review proposals mention that there is a balance to be struck between ensuring the highest standard of governance and supporting the growth of companies and the UK economy.

However, it’s fair to say that many of the UK’s leading institutional investors are not enthusiastic about the prospect of abandoning the “one share, one vote” principle that they consider a bedrock of UK corporate governance principles so that company founders can sell equity stakes in their businesses to the public without ceding control.

These investors” key area of concern is not so much that companies with dual-class share structures or low free floats are permitted to come to market—many such companies have successfully listed in London in the Standard (rather than Premium) market segment. It’s more that such companies would be permitted to enter the FTSE UK indices if they are included in the Premium segment, effectively becoming a mandatory shareholding for many institutional investors due to the way their portfolios are constructed.

In short, investors want safeguards to remain in place in cases where they are, in practice, forced buyers of a company’s shares.

Additionally, if the objectively desirable aim of increasing retail shareholder participation in UK companies is to be achieved, then many argue that shareholder protections should be given more emphasis.

What might help?

Some commentators in the investment stewardship community contemplate a role for the UK’s regulators in ensuring that greater control for founders doesn’t develop into a broader weakening of the UK’s corporate governance standards over the long-term.

Government policy appears—sensibly—to be tilted to reducing regulatory reach and overlap following the EU Exit; yet it’s important to remember that a robust regulatory framework underpinned by high corporate governance standards is a core part of what makes the UK’s capital markets attractive.

In this regard, the proposals found in the BEIS “Restoring Trust” consultation could help pave a way forward.

For example, it proposes—as a baseline—for company directors to review and report annually on whether and why the company’s internal controls are effective, with options for the auditor to comment on or provide assurance over the directors” attestation. Opinions vary over what combination of these options strikes the right balance; but for companies with dual class share structures or lower free floats that could potentially be included in the Premium segment, it’s possible that greater auditor involvement could give shareholders a higher level of comfort.

The proposed new Resilience Statement, setting out how directors are assessing the company’s prospects and challenges over varying time horizons would also help provide greater transparency.

Additionally, the Audit and Assurance Policy proposed in “Restoring Trust” gives shareholders an opportunity to assess the areas of corporate reporting that they believe are fundamental to the investment case (such as alternative performance metrics and ESG disclosures) and request additional assurance where needed.

Next steps

The issues highlighted above represent a narrow area in a much broader discussion on what the future of UK PLC should look like.

One key aspect of the discussion is how to provide companies with access to capital for growth to support economic recovery and job creation, while also providing shareholders with attractive opportunities to invest in that growth. Another key consideration is how to maintain a necessary level of investor protection, upholding the UK’s reputation for high corporate governance standards.

Striking the right balance will be crucial. However, in order to get that balance right, it’s important that all stakeholders submit their views for consideration.

The BEIS “Restoring Trust” consultation is open for comment until 8 July 2021. Subsequent consultations on the Hill and Kalifa Reviews are currently in the pipeline. Don’t miss this opportunity to have your say.

Print

Print