Mary Ann Deignan is a Managing Director, Jim Rossman is Managing Director and Co-Head of Capital Markets Advisory, and Christopher Couvelier is a Managing Director at Lazard. This post is based on a Lazard memorandum by Ms. Deignan, Mr. Rossman, Mr. Couvelier, Rich Thomas, Lauren Ortner, and Michael Hinz. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Observations on the Global Activism Environment in H1 2021

1. U.S. Activity Leads Global Market in H1 2021

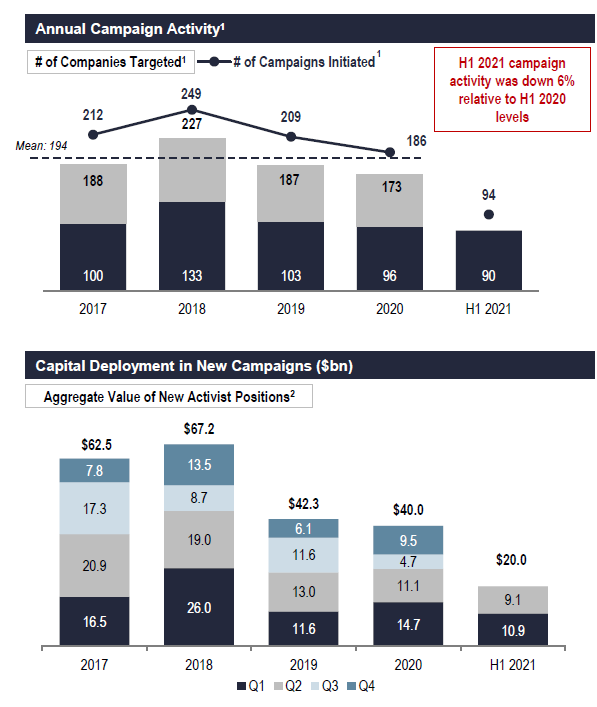

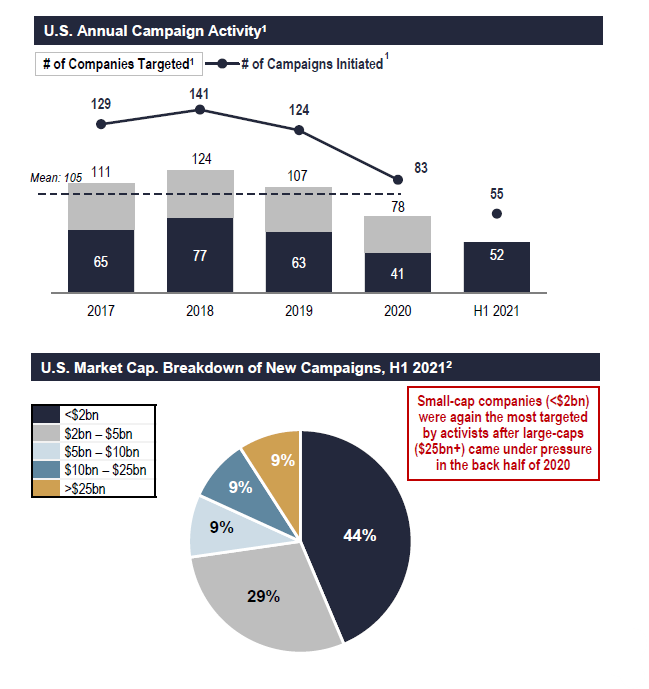

- 94 new campaigns were initiated globally in H1 2021, in line with H1 2020 levels

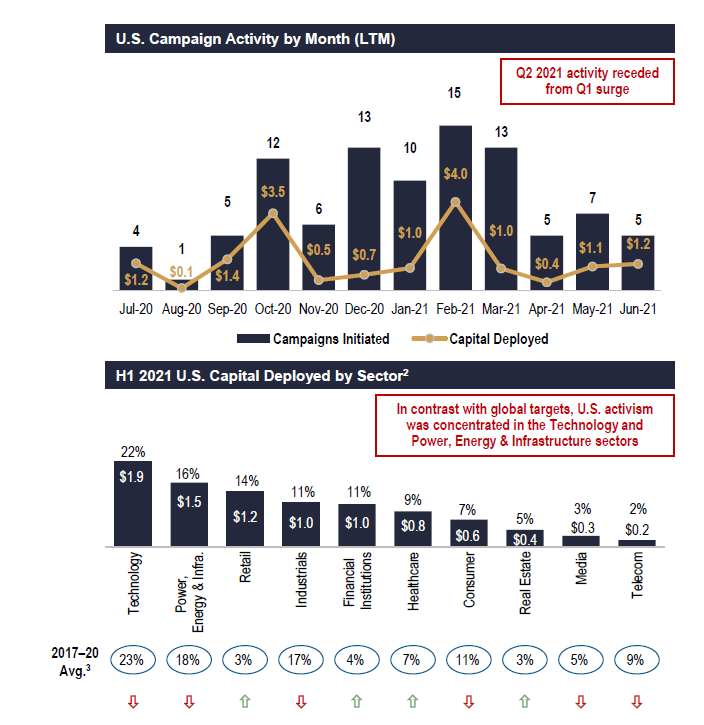

- Year-over-year stability buoyed by a strong Q1, with Q2’s new campaigns launched (39) and capital deployed ($9.1bn) below multi -year averages

- H1 was distinguished by several high-profile activist successes at global mega-cap companies, including ExxonMobil (Engine No. 1), Danone (Bluebell and Artisan Partners) and Toshiba (Effissimo, Farallon, et al.)

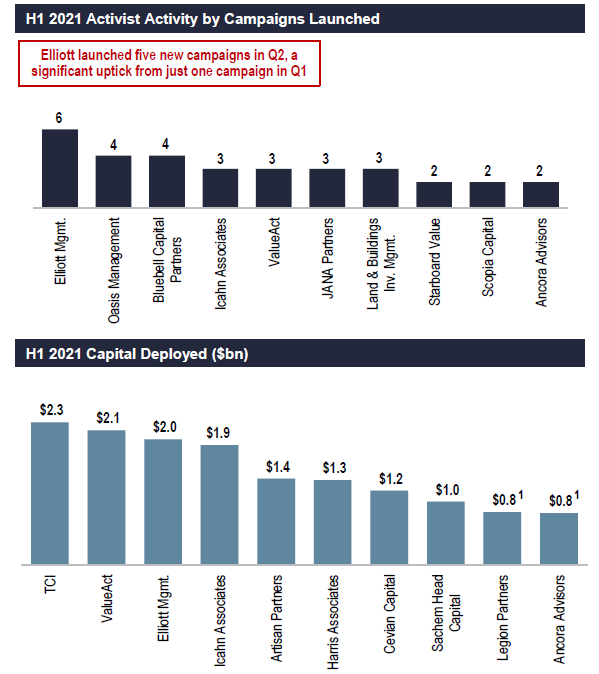

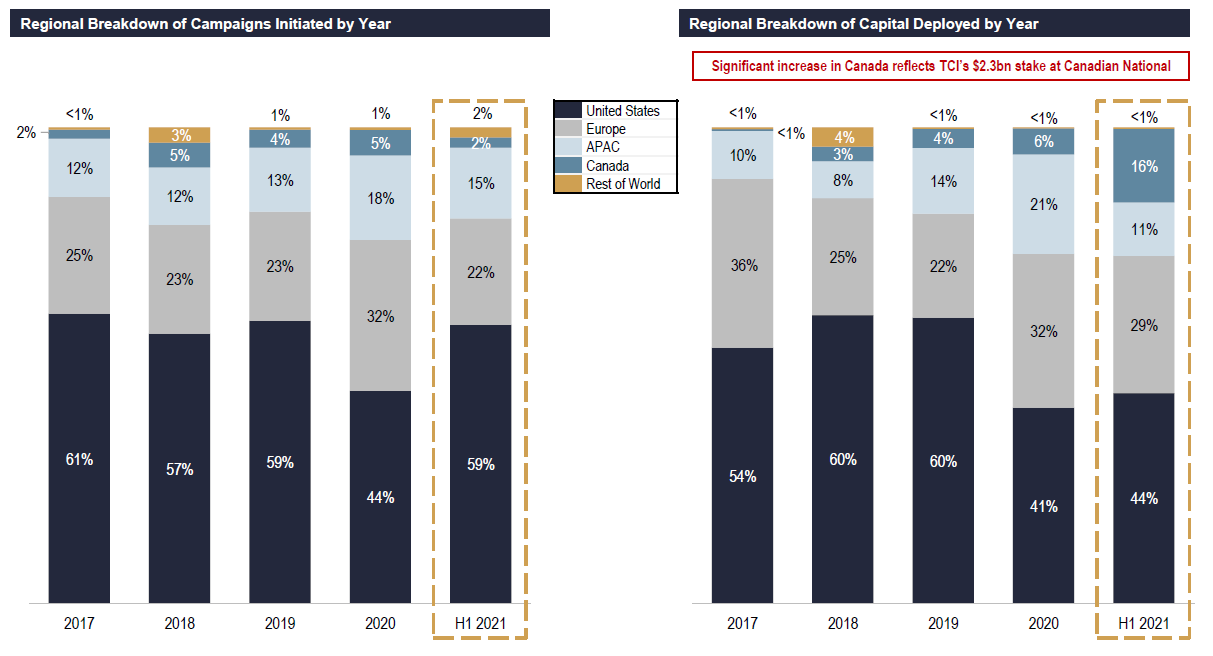

- U.S. share of H1 global activity (59% of all campaigns) remains elevated relative to 2020 levels (44% of all campaigns) and in line with historical levels

- The 55 U.S. campaigns initiated in H1 2021 represent a 31% increase over the prior-year period

- After only initiating one new campaign in Q1 2021, Elliott launched five campaigns in Q2 2021 and returned to being the period’s most prolific activist

- H1 2021 activity in Europe slowed following a record-setting end to 2020; the region’s 21 new campaigns included Elliott’s agitation at GlaxoSmithKline and Bluebell’s campaigns at Danone and Vivendi

- 10 campaigns were launched at Japanese targets in H1, and the share of non-U.S. activity represented by Japanese targets (26%) reached the highest level in recent years

- The activist success at Toshiba is viewed as a watershed moment in Japanese activism that may catalyze further scrutiny of Japan’s corporate governance system

2. Successful Attack on ExxonMobil Dominates Proxy Season

- Engine No. 1’s proxy fight at ExxonMobil—which saw the Company replace two incumbents in the lead-up to the AGM and an additional three seats won in the final vote—made Exxon the largest issuer ever to lose a proxy fight

- Engine No. 1’s campaign—which coupled “traditional” criticisms of performance and strategy with ESG attack vectors—was also noteworthy due to the wide margin of victory and broad shareholder support across the “Big 3” U.S. passive managers, pensions funds and active managers

- The ousting of Toshiba’s Chairman and one other Director at its 2021 AGM that followed an investigation into allegations of collusion to influence shareholder votes further showcased investors taking a more active stance to hold leaders accountable for perceived governance failures

- A number of highly contentious proxy fights remain unresolved heading into H2 2021, including Starboard’s ongoing agitation at Box for three Board seats and open criticism of KKR’s recent “white squire” investment

3. M&A-Related Activism Persists, with Opposition to Deals on the Rise

- 44% of all activist campaigns in H1 2021 featured an M&A-related thesis, in line with the multi-year average of 40%

- Among all global M&A-focused campaigns in H1 2021, 56% centered on scuttling or sweetening an announced transaction; among European M&A-focused campaigns, this figure was 100%

- Prominent examples of scuttle/sweeten campaigns included Canadian National (TCI) and Hilton Grand Vacations (Land & Buildings)

- By contrast, campaigns pushing for an outright sale of the company occurred relatively less frequently, accounting for only 12% of M&A-related campaigns in H1 2021, below the multi-year average of 34%

- Among all global M&A-focused campaigns in H1 2021, 56% centered on scuttling or sweetening an announced transaction; among European M&A-focused campaigns, this figure was 100%

4. ESG Remains in the Spotlight

- Investor support for E&S-related shareholder proposals reached new highs: 14% of all proposals passed in H1 2021, up from a three-year average of ~6%, as proposals at companies such as Chevron and DuPont secured broad-based backing

- ESG equity inflows moderated in April and May (average monthly inflows of $2.2bn versus $3.7bn in Q1) but remain on pace to surpass 2020’s record

- Environmental issues dominated the regulatory conversation as the SEC aims to propose rules on mandatory climate disclosures as early as October

5. Significant Dry Powder for SPAC M&A

- Record-breaking SPAC activity continued into H1 2021, with 163 SPACs completing deals and $129bn of dry powder still searching for targets

- Short activism targeting de-SPACed companies has emerged as an increased threat in H1 2021, with prominent short sellers, such as Hindenburg Research, attacking high-profile de-SPACs such as DraftKings, Lordstown Motors and Clover Health

Source: FactSet, press reports and public filings as of 6/30/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

Global Activism Activity

Global Campaign Activity and Capital Deployed ($ in billions)

Source: FactSet, press reports and public filings as of 6/30/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1Companies spun off as part of campaign process counted separately.

2Calculated as of campaign announcement date. Does not include campaigns in which the size of the activist stake is not publicly disclosed.

34-year average based on aggregate value of activist positions.

Global Activist Activity in H1 2021 ($ in billions)

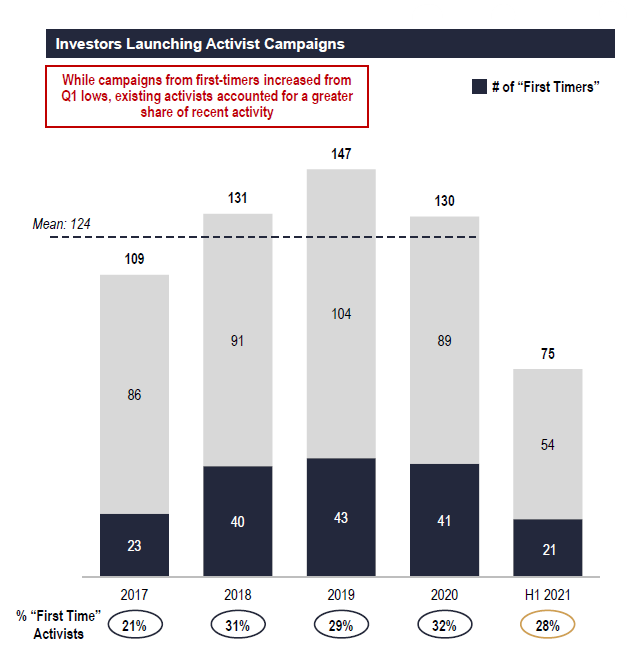

Following a muted Q1, Elliott initiated five new campaigns in Q2, regaining its rank as the most prolific activist globally; initiations by first-time activists were in-line with historic levels, with Engine No. 1 capturing meaningful attention

Source: FactSet, press reports and public filings as of 6/30/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1Includes the value of the entire ~9.5% stake taken in Kohl’s by the consortium of Ancora Advisors, Legion Partners, Macellum Advisors and 4010 Capital announced on 2/21/2021.

U.S. Rebound Driving H1 Global Activity ($ in billions)

H1 2021 U.S. activity remained elevated relative to 2020 levels, representing 59% of global campaigns; capital deployed in the U.S. increased Y-o-Y, representing 44% of capital deployed, but was below multi-year averages (54%) and its Q1 2021 level (56%)

Source: FactSet, press reports and public filings as of 6/30/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn. APAC includes all of Asia, Australia and New Zealand.

U.S.: Campaign Activity and Capital Deployed ($ in billions)

Source: FactSet, press reports and public filings as of 6/30/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1Companies spun off as part of campaign process counted separately.

2Calculated as of campaign announcement date.

34-year average based on aggregate value of activist positions.

The complete publication, including footnotes, is available here.

Print

Print