Shirley Westcott is a Senior Vice President at Alliance Advisors LLC. This post is based on her Alliance Advisors memorandum.

Overview

The year-long pandemic and economic lock-downs that denoted 2020 gave way to a dynamic 2021 annual meeting season as investors wielded their proxy votes to express their views on an array of environmental, social and governance proposals issues, executive compensation plans and corporate board quality and effectiveness.

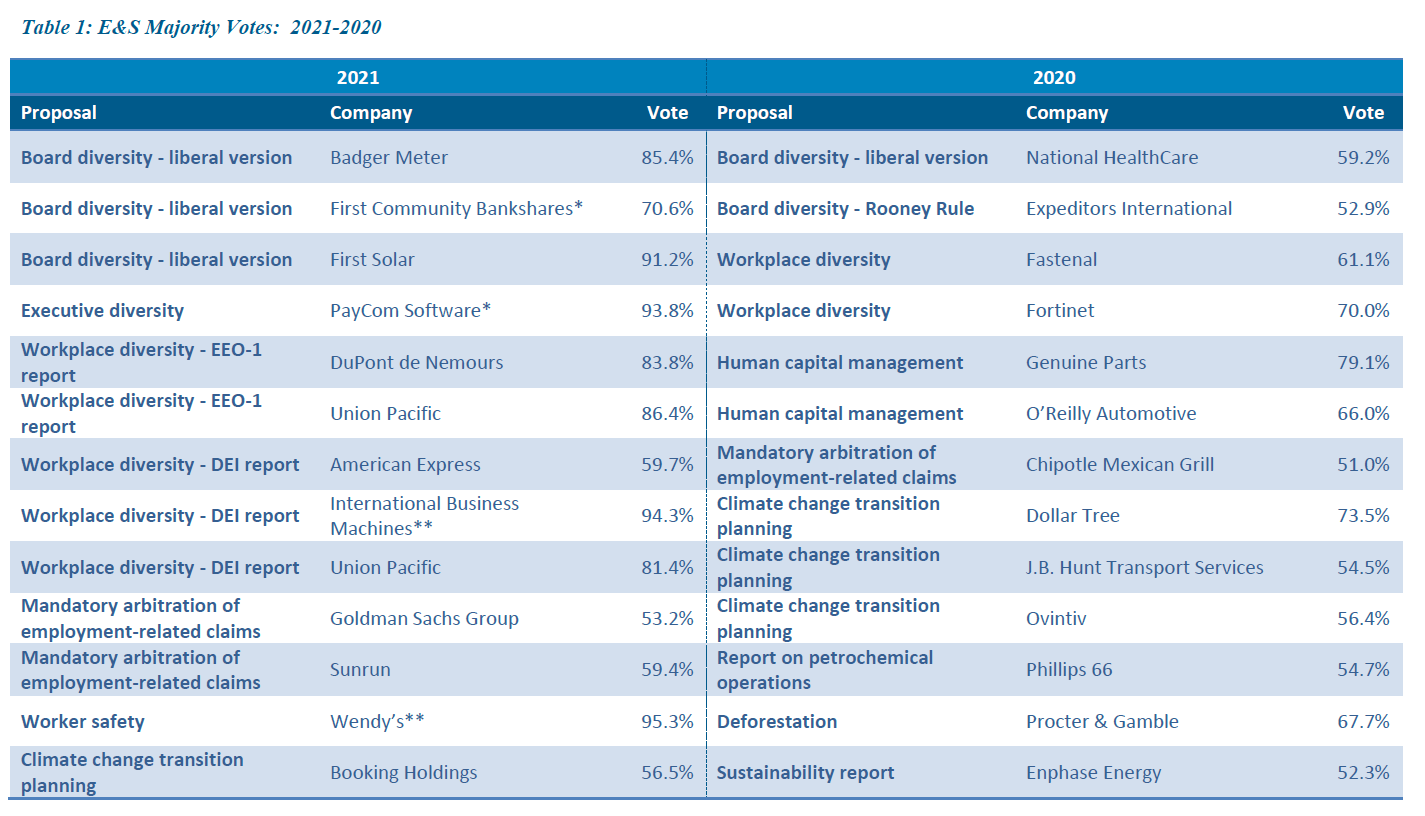

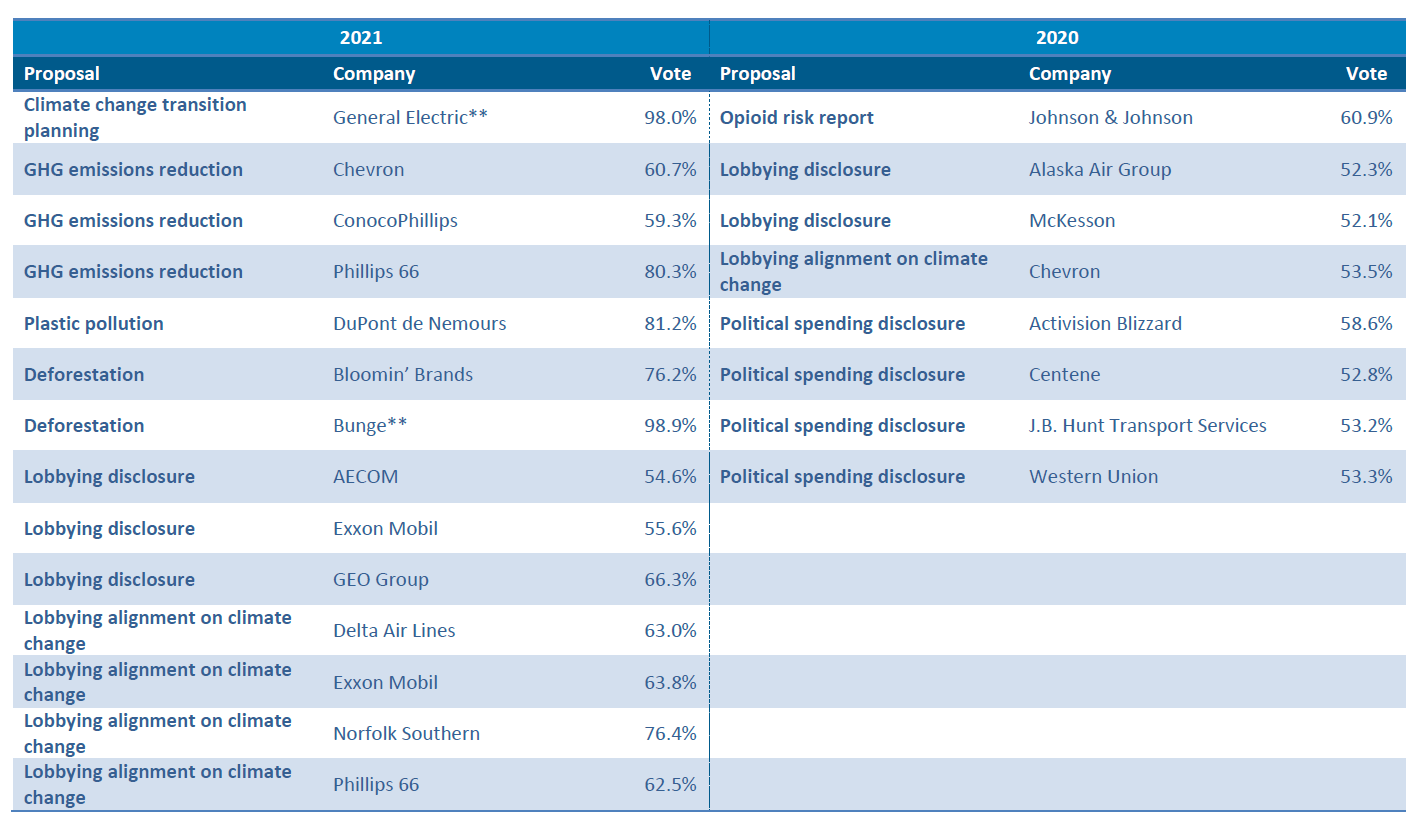

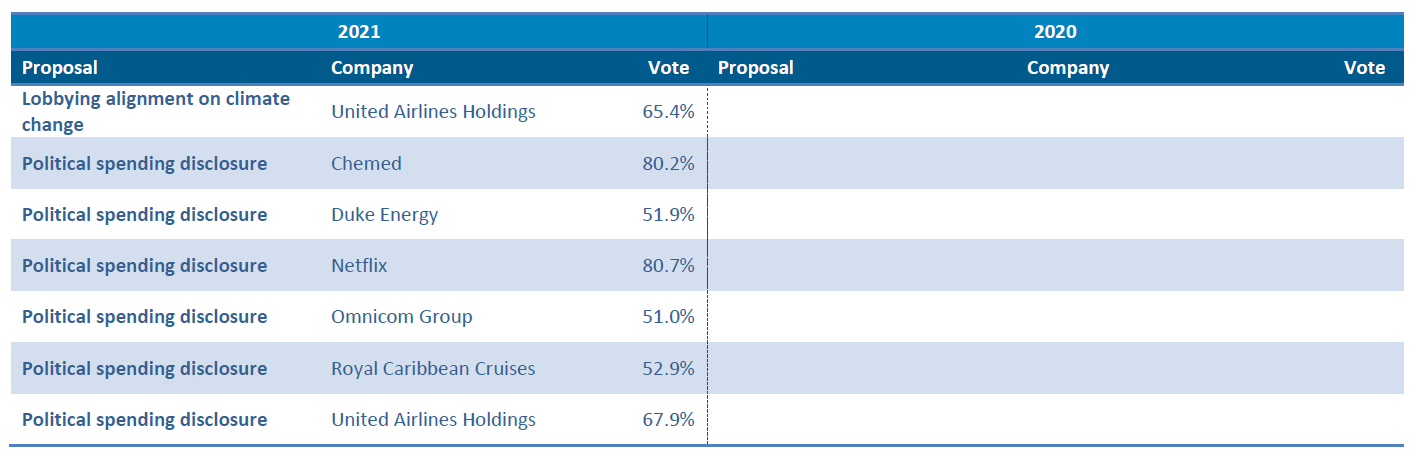

Environmental and social (E&S) resolutions drew some eye-popping support levels, including over a dozen on diversity, climate change and political spending that scored over 80% (see Table 1). A total of 34 E&S proposals have received majority support to date— surpassing last year’s record 21—and included six that were unopposed by the boards. Some newly emergent resolutions on racial audits, access to COVID-19 medicines and say-on-climate (SOC) advisory votes also did remarkably well for their first year, reaching vote averages in the 30% range.

Albeit groundbreaking, the results are not entirely unexpected. Major investors, including BlackRock and Vanguard, had signaled a greater willingness to support E&S resolutions this year as well as hold board members accountable for inadequate attention to material E&S risks. This culminated in the blowout of the season when shareholders unseated three Exxon Mobil directors in a landmark proxy fight launched by newcomer activist Engine No. 1—the first contest of its kind tied to the global energy transition. [1]

Shareholders also made their voices heard in the executive compensation arena by slamming companies for pay-for-performance (PFP) misalignment, in some cases inflamed by COVID-19-related pay adjustments. Through June, 60 companies had failed their say-on-pay (SOP) votes, an 11% increase over the first half of 2020. Large caps in particular faced record protest votes with 16 failures among S&P 500 constituents.

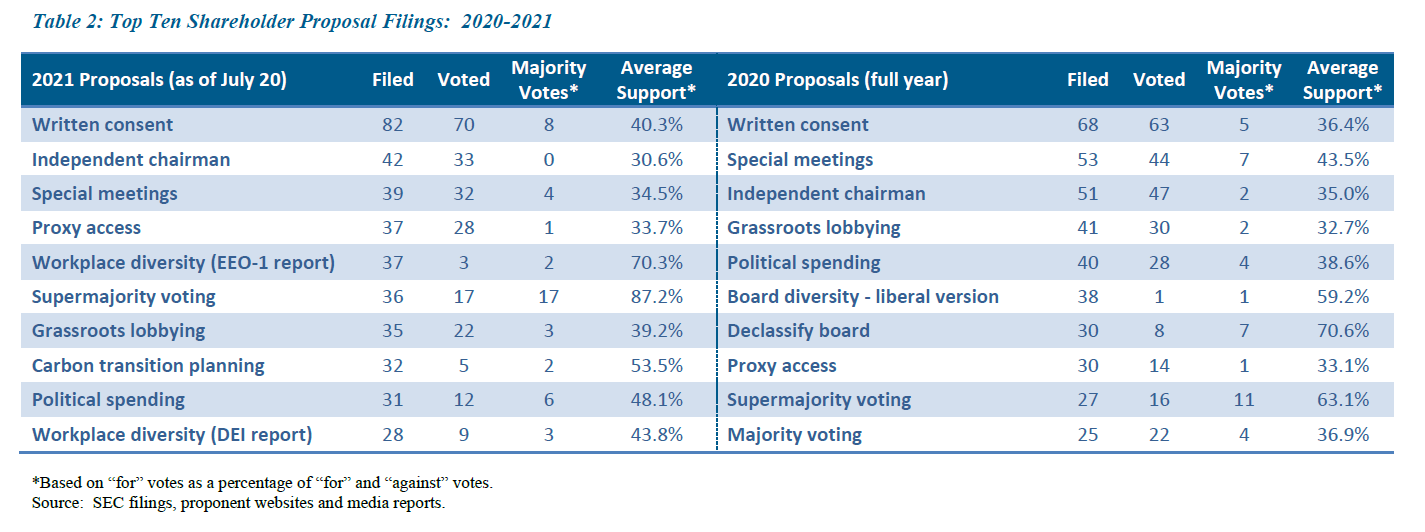

On the governance front, corporate gadflies John Chevedden, Kenneth Steiner, James McRitchie and Myra Young deluged proxy ballots with written consent resolutions (see Table 2) while setting their sights on broader stakeholder concerns such as organizing as a public benefit corporation (PBC) or allowing employee participation on boards. Overall, governance proposals delivered 41 majority votes—one less than in 2020— with universally accepted measures such as board declassification and the repeal of supermajority voting posting the highest margins.

Highlights of the 2021 proxy season, including key votes and emerging trends, are discussed in more detail below.

Board and Executive Diversity

Last year’s social justice protests following the death of George Floyd elevated diversity, equity and inclusion (DEI) as a key investor priority for 2021. With women now holding 24.3% of Russell 3000 directorships, this year’s resolutions to improve board diversity took aim at boards with no apparent racial or ethnic diversity. [2] Of the four proposals voted, three received sizable (over 70%) support, while the fourth occurred at a controlled company. A separate proposal at PayCom Software on executive diversity, which was unopposed by the board, won 93.8% support.

| Board Diversity | 2021 Vote |

|---|---|

| Badger Meter | 85.4% |

| First Community Bankshares* | 70.6% |

| First Solar | 91.2% |

| Where Food Comes From** | 3.1% |

*The board made no recommendation on the proposal.

** The directors and officers own 53.9% of the stock.

Per its Boardroom Accountability Project 3.0, the New York City Comptroller continued to promote diverse director candidate searches (Rooney Rule policies), but all of its 2021 resolutions were withdrawn due to company compliance. One remains pending at Constellation Brands’ July 20 annual meeting.

Newly adopted investor and proxy advisor policies are galvanizing corporate disclosure and action on board diversity. Beginning this year or next, various investors—including Vanguard, State Street Global Advisors (SSGA), JPMorgan Asset Management and Alliance Bernstein—will hold nominating committee chairs accountable if their boards fail to disclose or lack racial/ethnic diversity. Institutional Shareholder Services (ISS) also plans to oppose nominating committee chairs in 2022 at S&P 1500 and Russell 3000 firms that have no racially or ethnically diverse directors.

As a result, there was a marked improvement in disclosure this year. Of the S&P 500 firms that have filed 2021 proxy statements to date, 71% disclosed the racial/ethnic composition of their boards. [3] Of these, two-thirds presented the data in an aggregate (board-level) form rather than by individual director. In contrast, Glass Lewis reported that in 2020 only 30% of S&P 500 boards divulged their racial/ethnic diversity. [4]

Investor policy shifts also appear to be impacting director votes. Through June, some 95 nominating/governance committee chairs received negative votes in excess of 30%, a sizable increase from 55 in the first half of 2020. While this may be attributable to a variety of factors, 85% of these companies did not disclose any board racial/ethnic diversity.

Workplace Diversity (EEO-1 Report)

Longstanding calls for the disclosure of workforce diversity data gained considerable momentum this year due to multiple shareholder campaigns and a quadrupling of resolutions filed. In addition, SSGA announced that in 2022 it will begin voting against compensation committee chairs at S&P 500 firms that do not disclose their EEO-1 reports which provide a standardized breakdown of workforce demographics across 10 employment categories.

The New York City Retirement Systems (NYCRS) reported in late April that 62 S&P 100 firms now disclose or have committed to disclosing their EEO-1 data as a result of its letter-writing campaign begun last July. Prior to the launch of this initiative, only 14 S&P 100 firms publicized their Consolidated EEO-1 Report. [5] Similarly, Calvert Research & Management reported that 32 of the 82 companies it engaged agreed to publish their EEO-1 survey responses. [6]

As a result, only three EEO-1 resolutions went to a vote and in two cases received over 80% support. New resolutions primarily sponsored by the AFL-CIO advocating Rooney Rules for all employee hires were withdrawn or omitted as micromanagement.

| Workplace Diversity (EEO-1 Report) | 2021 Vote |

|---|---|

| Charter Communications* | 40.7% |

| DuPont de Nemours | 83.8% |

| Union Pacific | 86.4% |

*Liberty Broadband owns 27.6% of the stock.

DEI report

In addition to EEO-1 disclosures, shareholders also requested more comprehensive reporting on companies’ DEI efforts, including the effectiveness of programs and goals related to the promotion, recruitment and retention of protected classes of people. The number of submissions tripled from last year and of the six voted—all backed by ISS and Glass Lewis—three received majority support.

| Workplace Diversity (DEI Report) | 2021 Vote |

|---|---|

| American Express | 59.7% |

| Berkshire Hathaway* | 27.1% |

| Charter Communications** | 41.4% |

| International Business Machines*** | 94.3% |

| Union Pacific | 81.4% |

| United Parcel Service | 33.7% |

*Directors and officers hold 35.3% of the voting power.

**Liberty Broadband owns 27.6% of the stock.

***The board recommended in favor of the proposal.

In contrast, requests to assess inclusion in the workplace—specifically policies or unwritten norms that reinforce racism—fared poorly. Both ISS and Glass Lewis opposed the resolutions, which received 11.1% at Intel and 11.9% at PayPal Holdings.

Racial Equity Audits

Companies that made public statements in support of racial justice following last year’s social unrest found themselves on the hot seat this season to match their words with actions. A new request asked for an independent racial equity audit to assess whether a company’s policies, products and services contribute to discrimination. The eight voted averaged 31.1% support with ISS and Glass Lewis reaching differing opinions. Glass Lewis generally backed the requests with a view that racial audits can aid companies in reducing the risk of high-profile controversies. ISS contended that audits were unnecessary because of other meaningful actions the companies had taken to address racial inequities.

| Racial Audits | 2021 Vote |

|---|---|

| Amazon.com | 44.2% |

| Bank of America | 26.5% |

| Citigroup | 38.6% |

| Goldman Sachs Group | 31.3% |

| Johnson & Johnson | 33.9% |

| JPMorgan Chase | 40.5% |

| State Street | 36.8% |

| Wells Fargo* | 13.1% |

*Wells Fargo plans to conduct a third-party human rights impact assessment that will include a special focus on racial equity.

A related proposal seeking a report on plans to promote racial justice in the workplace and operations received 38.9% at Abbott Laboratories. In this case, ISS endorsed the resolution while Glass Lewis opposed it.

Climate Change

Climate change was the dominant theme among environmental resolutions this year with nearly a third directed at oil and natural gas companies, electric utilities and the transportation sector. Big oil recorded some of the highest votes, including three seeking a substantial reduction of Scope 3 emissions—namely, those arising from energy products. Requests for reports on the financial impacts of the International Energy Agency’s Net Zero 2050 Scenario also received substantial support at Chevron (47.8%) and Exxon Mobil (48.9%).

| Greenhouse Gas (GHG) Emissions Reduction | 2021 Vote |

|---|---|

| Chevron | 60.7% |

| ConocoPhillips | 59.3% |

| Phillips 66 | 80.3% |

Other types of environmental resolutions generated some formidable support levels and, in the case of repeat targets, revealed some dramatic shifts in investor voting patterns. Notably, a proposal on plastic pellet spills scored 80.2% at DuPont de Nemours, compared to a mere 6.7% in 2019, while a deforestation resolution garnered 76.2% at Bloomin’ Brands, up from 26.5% in The other deforestation proposal voted won 98.9% approval at Bunge with the board’s backing.

Say on Climate

The Children’s Investment Fund mobilized a new initiative—which it plans to roll out to 100 S&P 500 firms by the end of 2022—asking companies to hold an annual shareholder advisory vote on their climate action plans. Four proposals went to a vote, averaging 28.8% support. Two companies—Moody’s and S&P Global—complied with the shareholder request by holding their first SOC votes. Both received overwhelming (over 90%) support from investors. [7]

| Say on Climate | 2021 Vote |

|---|---|

| Booking Holdings | 37.5% |

| Charter Communications | 39.0% |

| Monster Beverage* | 7.0% |

| Union Pacific | 31.6% |

*The Monster Beverage proposal was framed as a binding bylaw amendment.

So far, investors and proxy advisors have been split on the SOC concept. ISS backed both of the management resolutions and the shareholder proposals at Charter Communications and Booking Holdings. [8] Glass Lewis, which only supported one resolution (Booking Holdings), expressed concern that SOC votes could result in a rubber stamping of weak climate strategies. [9] In an April memo, Glass Lewis indicated that it would generally recommend against both management- and shareholder-sponsored proposals in 2021, but plans to refine its approach for the 2022 proxy season following investor and company engagements.

BlackRock and Vanguard similarly expressed diverging views on the shareholder resolution at Union Pacific. BlackRock endorsed it, as well as the one at Charter Communications, arguing that it would accelerate the companies’ progress on climate risk management—a rationale BlackRock used to support other types of climate resolutions (e.g., at Berkshire Hathaway and General Electric). [10] Vanguard rejected the proposal in the belief that SOC placed a short-term focus on long-term goals and could inappropriately delegate strategy oversight responsibilities to shareholders. [11] Other investors have voiced similar concerns and are opposing this year’s shareholder resolutions (Norges Bank Investment Management) or are abstaining on them (Calvert, Neuberger Berman and the New York State Common Retirement Fund (NYSCRF)). [12]

Political Activities

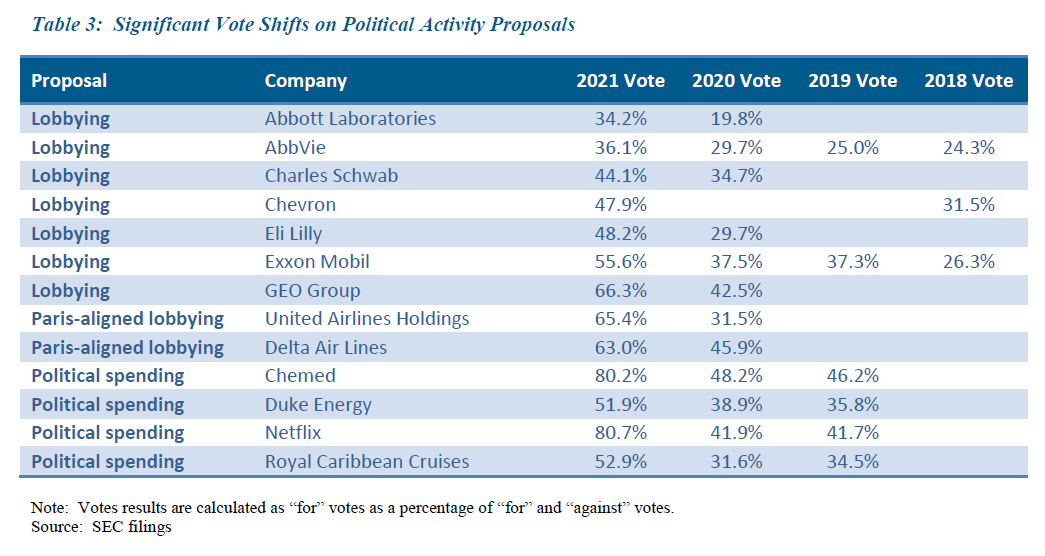

As with climate change, there has been a marked shift in investor views regarding corporate election spending and lobbying activities, evidenced by the surge in votes at companies that had been targeted in the past (see Table 3). Average support on political contribution proposals escalated to 48.1% from 38.6% in 2020 and included six majority votes, while average support on lobbying proposals rose to 39.2% from 32.7% in 2020 and included three majority votes.

Historically, BlackRock and Vanguard have generally opposed these resolutions. [13] However in a December bulletin, BlackRock indicated that it may support shareholder requests for additional disclosure if it identifies material inconsistencies between a company’s political activities and its publicly stated priorities and affiliated trade association views on major policy positions. Similarly, Vanguard stated in March that it may vote in favor of proposals calling for greater disclosure and oversight of corporate political activities when a company’s disclosure significantly lags that of its peers or its political activities appear to be misaligned with its long-term strategy. [14]

Vote swings were particularly pronounced on proposals that specifically addressed the cohesion of companies’ political contributions or affiliations and their publicly stated values and policies. Three requests for a congruency analysis of political and electioneering expenditures against corporate values averaged 38.4% in 2021. When these were last seen on ballots in 2016 and 2015, albeit at different targets, votes averaged 6.5% and 6%, respectively. Glass Lewis has consistently rejected these proposals, while ISS began endorsing them this year.

| Political and Electioneering Congruency Report | 2021 Vote |

|---|---|

| Home Depot | 38.0% |

| JPMorgan Chase | 30.0% |

| Pfizer | 47.2% |

Investors also questioned the extent that companies’ lobbying activities conformed to their public pledges to cut GHG emissions in line with the Paris Agreement goal of limiting global warming to 2° Celsius. After last year’s inaugural resolution received majority support at Chevron, over half of this year’s targets— including American International Group, CSX, Duke Energy, Entergy, FirstEnergy, General Motors and Valero Energy—agreed to the reporting. Investors were strongly in favor of the proposals that were voted with five receiving over 60% support.

| Paris-Aligned Lobbying | 2021 Vote |

|---|---|

| Delta Airlines | 63.0% |

| Exxon Mobil | 63.8% |

| Norfolk Southern | 76.4% |

| Phillips 66 | 62.5% |

| Sempra Energy | 37.5% |

| United Airlines Holdings | 65.4% |

| Delta Airlines | 63.0% |

COVID-19-Oriented

One of the few pandemic-specific proposals to reach proxy ballots asked pharmaceutical companies to report on the pricing and access of their COVID-19 vaccines and therapeutics. Backed by ISS, the resolutions averaged a respectable 31.2% support. Glass Lewis and BlackRock opposed the measure, arguing that the companies already provided sufficient transparency on their COVID-19 products.

| COVID-19 Drug Pricing | 2021 Vote |

|---|---|

| Johnson & Johnson | 31.8% |

| Merck | 33.6% |

| Pfizer | 28.3% |

A proposal to protect essential food workers’ rights during the pandemic received 95.3% support at Wendy’s and was backed by the board. Other resolutions dealing with worker health and safety were largely omitted as ordinary business, including over a half dozen wanting paid sick leave to be provided as a standard employee benefit.

Corporate Governance

As in 2020, calls to adopt or ease various governance measures—specifically written consent, special meetings, proxy access and independent board chairs— ranked as the top four types of shareholder proposal filings (see Table 2). Almost 90% of these proposals were sponsored by Chevedden, Steiner, McRitchie and Young, and 60% of them were directed at repeat targets.

Despite the vigorous activity around these topics, vote outcomes did not improve in most cases. Average support for special meeting proposals fell to 34.5%— the lowest level in the past 10 years—likely because over 80% of the resolutions sought a reduction in current ownership thresholds (typically 25%) to a low 10%. Shareholders also continued to reject requests to amend proxy access bylaws, typically to enable unlimited group aggregations, as well as calls for independent board chairs due to the prevalence of robust lead director positions. Average support for independent board chair resolutions saw a marked decline in 2021 to 30.6% from 35% in 2020.

Proposals to adopt written consent were one exception where the passage rate rose to 11.4% from 7.9% in 2020, though still well below the percentage approved in each of the past three years (15%-20%). Consistent with past years, the highest votes occurred at companies that also lacked special meeting rights: New York Community Bancorp (79.1%), Texas Instruments (78%) and Xerox Holdings (79.2%).

Stakeholder Governance

Various proponents, including McRitchie and Young, stepped up their campaign on stakeholder governance by asking companies that signed the Business Roundtable’s 2019 Statement on the Purpose of a Corporation to convert to a PBC. This extreme measure backfired with all of the resolutions receiving less than 4% support except at Yelp where it received 11.8%.

McRitchie also joined the advocacy for worker participation in company governance by promoting Rooney Rules requiring that the initial list of director

candidates include non-management employees. Resolutions encouraging employee representation on boards continued to flounder with largely single-digit support. However, two were backed by ISS including a Rooney Rule proposal at Amazon.com (17.5%) and a proposal to form a pandemic workforce advisory council at Walmart (11.5%).

Compensation

During last year’s COVID-19 pandemic and economic shutdowns, investors and proxy advisors promised to carefully evaluate 2020 executive compensation packages, particularly where companies used discretion or adjusted pay arrangements. However, the numbers suggest that pandemic-related decisions had a limited impact on this year’s pay votes compared to other overarching concerns.

Through June, average say-on-pay (SOP) support across all companies was 90.9%, up from 90.5% during the same period last year, while ISS’s opposition rate fell to 11.2%, compared to 11.7% in the first half of 2020. Significantly fewer firms received less than 70% support—6.5% versus 7.4% last year—but the failure rate rose to 2.4% from 2.1%. Particularly pronounced was the number of failed SOP votes among S&P 500 companies, including some that had reduced CEO pay: 16 compared to 12 during the entirety of 2020. [15] In nearly all cases these were first-time failures. Ten other S&P 500 firms eked out narrow wins. [16]

According to compensation consultants, this year’s failures were largely driven by a significant amount of pay disconnected from company performance. In a June 24 report, Semler Brossy indicated that only one-third of failed SOP votes among Russell 3000 firms were likely due to COVID-19-related actions. Seventy-five percent were attributable to PFP misalignment, problematic pay practices and/or special awards and mega grants. [17] Equilar posited that the pandemic likely exacerbated shareholder criticism of CEO pay that was already viewed as unnecessarily high. [18]

Looking Ahead

2021 has been a breakthrough year for shareholder advocacy around E&S matters, but regulatory developments could reshape the landscape going forward.

Still on the horizon are Rule 14a-8 amendments enacted last fall, which are scheduled to take effect for 2022 annual meetings. Unless revisited by the SEC or overturned through legal challenges, the changes could reduce shareholder proposal activity due to stricter requirements for submitting and resubmitting resolutions. This could compel investors to rely more on engagement or resort to alternative actions to effect change, such as voting against directors, mounting proxy fights or invoking proxy access provisions.

Longer term, the now Democrat-led SEC may produce other game changers. New disclosure mandates under consideration would supplant the need for much of investors’ private ordering efforts. The Spring 2021 Reg-Flex Agenda includes proposed rulemaking on disclosures related to climate risk, corporate board diversity and human capital, including workforce diversity, all with October target dates. [19] Meanwhile, the SEC has delayed its decision on Nasdaq’s board diversity listing proposal until Aug. 8.

The SEC is also moving towards finalizing a rule on universal proxy cards—first proposed in 2016—which would allow shareholders who vote by proxy to “split the ticket” in contested elections and choose their preferred combination of management and dissident nominees. Business groups have long cautioned that a universal ballot could increase the number and frequency of proxy fights and enhance the influence of activist investors with short-term or special interest agendas.

Table 1: E&S Majority Votes: 2021-2020

Note: Vote results are calculated as “for” votes as a percentage of “for” and “against” votes.

*The board made no recommendation on the proposal.

**The board supported the proposal.

Source: SEC filings

Table 2: Top Ten Shareholder Proposal Filings: 2020-2021

*Based on “for” votes as a percentage of “for” and “against” votes. Source: SEC filings, proponent websites and media reports.

Table 3: Significant Vote Shifts on Political Activity Proposals

Note: Votes results are calculated as “for” votes as a percentage of “for” and “against” votes. Source: SEC filings

Endnotes

1 See Alliance Advisors’ post on the Exxon Mobil proxy fight at https://corpgov.law.harvard.edu/2021/07/24/was-the-exxon-fight-a-bellwether/.(go back)

2 See Equilar’s Q1 2021 Gender Diversity Index at https://www.equilar.com/reports/81-q1-2021-equilar-gender-diversity-index. The end goal cited by the Alliance for Board Diversity (ABD) is board representation that reflects the demographics of the U.S. population: 50% women, 13% black, 18% Hispanic and 6% Asian/Pacific Islander. See ABD’s “Missing Pieces Report,” 6th edition at https://www2.deloitte.com/us/en/pages/center-for-board-effectiveness/articles/missing-pieces-board-diversity-census-fortune-500-sixth-edition.html.(go back)

3 The figure excludes companies that reported “diverse” directors without separating out gender diversity from racial/ethnic diversity.(go back)

4 See Glass Lewis’s report on board racial/ethnic diversity in 2020 at https://www.glasslewis.com/racial-ethnic-diversity-in-the-boardroom-glass-lewis-special-report/.(go back)

5 See NYCRS’ April 2021 press release at https://comptroller.nyc.gov/newsroom/comptroller-stringer-and-nyc-funds-to-urge-vote-yes-on-race-gender-and-ethnicity-workforce-demographic-disclosures-at-dupont-and-union-pacific/.(go back)

6 See Calvert’s 2021 engagement report at https://www.calvert.com/media/public/38031.pdf.(go back)

7 SquareWell Partners reported that 23 companies globally have committed to holding either a one-time or recurring SOC vote. See https://www.irmagazine.com/reporting/say-climate-proposals-used-some-simply-appear-progressive-warns-squarewell.(go back)

8 ISS plans to continue developing its approach to SOC proposals after soliciting investor feedback post-season. See https://www.issgovernance.com/file/policy/active/americas/US-Procedures-and-Policies-FAQ.pdf.(go back)

9 See Glass Lewis’s approach to SOC proposals at https://www.glasslewis.com/say-on-climate-votes-glass-lewis-overview/.(go back)

10 See BlackRock’s 2021 vote bulletins on Charter Communications and Moody’s at https://www.blackrock.com/corporate/literature/press-release/blk-vote-bulletin-charter-communications-may-2021.pdf and https://www.blackrock.com/corporate/literature/press-release/blk-vote-bulletin-moodys-apr-2021.pdf.(go back)

11 See Vanguard’s 2021 vote bulletin on Union Pacific at https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/UnionPacific_1660080_062021.pdf and its general approach to SOC proposals at https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/INSSAYC_052021.pdf.(go back)

12 NYSCRF is abstaining on all SOC votes and proposals this year. However, it has voted against a record 387 directors at 72 companies that have failed to address climate risks. See https://www.responsible-investor.com/articles/us-pension-giants-abstain-from-vinci-say-on-climate-vote-after-criticising-campaign and https://www.osc.state.ny.us/press/releases/2021/07/dinapoli-announces-unprecedented-support-climate-actions-during-2021-proxy-season.(go back)

13 See the Center for Political Accountability’s review of 2018-2020 mutual fund voting at https://politicalaccountability.net/hifi/files/2020-Proxy-Vote-Analysis-Report-CPA.pdf.(go back)

14 See BlackRock’s and Vanguard’s perspectives on corporate political activities at https://www.blackrock.com/corporate/literature/publication/blk-commentary-perspective-on-corporate-political-activities.pdf and https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/INVSPOLS_032021.pdf.(go back)

15 These included AT&T, General Electric, Halliburton, Howmet Aerospace, Intel, International Business Machines, Marathon Petroleum, Norwegian Cruise Line Holdings, Paycom Software, Phillips 66, Prologis, PTC, Skyworks Solutions, Starbucks, TransDigm and Walgreens Boots Alliance.(go back)

16 These included Activision Blizzard (55.6%), Aptiv (57.5%), Biogen (51.4%), Chipotle Mexican Grill (51.4%), Hilton Worldwide Holdings (56.9%), Johnson & Johnson (56.7%), Kansas City Southern (57.8%), Netflix (50.7%), Sealed Air (55.1%) and Wells Fargo (57.8%).(go back)

17 See Semler Brossy’s report at https://semlerbrossy.com/wp-content/uploads/2021/06/SBCG-2021-SOP-Report-2021-06-23.pdf.(go back)

18 See Equilar’s findings at https://www.equilar.com/blogs/514-say-on-pay-slides-as-ceo-pay-rises.(go back)

19 See the SEC’s press release on its annual regulatory agenda at https://www.sec.gov/news/press-release/2021-99(go back)

Print

Print