Brian Sant is Senior Director of Digital Communications and Marketing at Ceres. This post is based on his Ceres memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here).

Despite the challenges, Ceres continued to expand our networks of powerful investors and companies, adding 44 new members in 2020. Just before the year began, we released the new Ceres Roadmap 2030, a 10-year action plan to help companies navigate and succeed in the accelerated transition to a just, inclusive, net zero emissions future. And our initiatives made critical advances.

Climate Action 100+ Grows in Size and Influence

The global investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change added a powerful voice to its roster just as 2020 began. BlackRock, the world’s largest asset manager with more than $6.8 trillion in assets and a member of Ceres Investor Network since 2008, joined Climate Action 100+ on January 9, 2020. Less than a week later, BlackRock’s CEO Larry Fink announced in his annual letter that sustainability is at the center of BlackRock’s investment practices and called on every government, company and shareholder to confront climate change as a unique material financial and investment risk. Blackrock’s size and influence would bring even more heft to the initiative once the U.S. proxy season began.

Proposals filed by Climate Action 100+ investor signatories calling on major oil and electric power companies to disclose lobbying activities and improve governance on climate change garnered record levels of support in 2020.

In a big win, a 53% majority of shareholders at Chevron Corp. voted for a resolution seeking a commitment from the oil giant to align its lobbying activities on climate policy with the goal of the Paris Agreement. Filed by Climate Action 100+ investor signatory BNP Paribas Asset Management, this was the first climate-related proposal ever to win a majority of Chevron shareholder votes and it was the only proposal on Chevron’s 2020 proxy ballot that won a majority.

And we’ve seen even more record-setting progress already in 2021. In a dramatic shake up signaling an accelerating transition away from a fossil fuel economy, a majority of ExxonMobil shareholders voted to replace three of the oil major’s board of directors with an alternative slate of candidates experienced in clean energy and energy transitions. In addition, shareholders won majority votes on climate-related proposals they put forth at Chevron, ExxonMobil, Phillips66, ConocoPhillips, General Electric, Delta and United Airlines.

Climate Action 100+ now has more than 575 investor signatories responsible for more than $54 trillion in assets under management. Ceres is a founding member of the initiative, working with investors signatories in North America.

Read more in the latest Climate Action 100+ Progress Report.

Watch our Ceres 2020 digital conference session below.

Record Number of Investors and Companies LEAD on Climate Policy

As 2020 began, the setting for climate action looked dismal. The U.S. had taken steps to officially withdraw from the Paris Agreement, the last round of global climate talks failed to address the speed and scale needed to address the climate crisis, and a novel virus outbreak was threatening to, and would soon become, a worldwide pandemic, upending the global economy and impacting the lives of millions of people.

In May, the murder of George Floyd by police cast a spotlight on the systemic racial inequities in the U.S. In addition to the systemic racism in our policing and legal system, this tragic event also sparked a conversation about the persistent inequities in our climate and energy work. As a result, Ceres has begun to reexamine the policies and solutions we advocate for to ensure that these actions prioritize the communities most vulnerable to the climate crisis. We are working with more climate and environmental justice groups to advance more equitable climate and energy policies going forward.

Despite these added crises, Ceres was able to make substantial progress on climate and energy policy in the U.S. In May 2020, we organized the largest ever call to action from the business community to the U.S. Congress on the ongoing climate crisis. CEOs and representatives from more than 330 businesses, including Adobe, Capital One, CommonSpirit Health, DSM North America, Dow, Eileen Fisher, General Mills, Mars, Inc., Microsoft, NIKE, Salesforce, and VISA virtually called on a bipartisan group of lawmakers to build back a better economy by infusing resilient, long-term climate solutions into upcoming Covid-19 economic recovery plans. We also engaged federal regulators on how to address the systemic financial risks of climate change through the Ceres Accelerator for Sustainable Capital Markets.

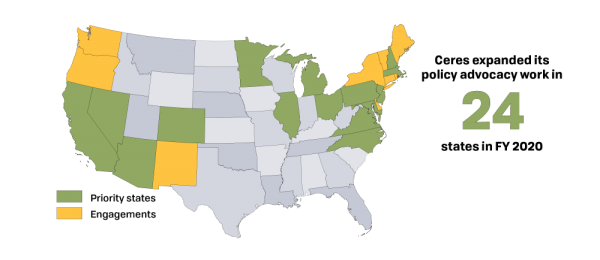

In addition to federal calls to action, Ceres mobilized investors and companies to advocate for innovative climate and energy policies in states throughout the nation.

In New Jersey, major investors and companies urged lawmakers to advance policies that will accelerate the state’s transition to a clean, modern transportation system and increase the number of electric vehicles on the road.

More than 100 investors and companies in the Northeast and Mid-Atlantic showed their support for the Transportation and Climate Initiative (TCI), a market-based policy to create a clean, equitable, and efficient transportation system for the region. Calling TCI a “once-in-a-generation opportunity to modernize and decarbonize our region’s transportation system,” the signatories emphasized how TCI will help to achieve several of their shared business goals.

Ceres helped build support for the passage of Virginia’s Clean Energy Act which will build an electricity grid that would run on 100% carbon-free energy and completely eliminate carbon pollution from the state’s utilities by 2050.

Adobe, Autodesk, Microsoft, Providence St. Joseph Health, Uber, and other major companies, healthcare systems, and large energy consumers on the Pacific Coast publicly supported expanding cap-and-invest programs in California, Oregon, and Washington to scale up efforts to reduce greenhouse gas emissions across the region.

After several years of advocacy from Ceres and our state and business partners, we welcomed the passage of Massachusetts’ 2050 Roadmap Bill (H.4912), which codifies net zero goals for the state, raising the 2050 emissions reduction target from 80% below 1990 levels to 85% and requiring that all remaining emissions be offset. The bill was passed in 2021.

Ceres and nearly 40 companies publicly supported an agreement by the governors of California, Connecticut, Colorado, Hawaii, Maine, Maryland, Massachusetts, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, and Washington, as well as the District of Columbia to work collectively to decarbonize commercial vehicles. Ceres organized a statement of business support ahead of the announcement, highlighting the long-term cost savings and benefits that can be captured by decarbonizing commercial vehicles and underscoring policy innovation as a necessary element to expedite the market transition.

In Pennsylvania, Ceres and the Interfaith Center on Corporate Responsibility (ICCR) organized a statement of support for a strong final regulation to reduce air pollution and methane emissions proposed by the Pennsylvania Department of Environmental Protection (DEP). Fifty investors representing $4 trillion in assets signed the statement and called on the Pennsylvania oil and gas companies they own to also support the proposed rule, which would cut volatile organic compounds (VOCs) by more than 4,400 tons per year and methane emissions by more than 75,000 tons per year.

Also in Pennsylvania, Ceres mobilized a dozen major businesses to call for the state to join the Regional Greenhouse Gas Initiative (RGGI). Ten states in the Northeast and Mid-Atlantic, including Maryland, New York, and New Jersey, already participate in RGGI, and Virginia finalized plans to participate beginning in January. The initiative is designed to reduce power sector carbon dioxide emissions by capping them under a gradual, market-based program. Pennsylvania’s power sector is the fifth-largest emitter of carbon dioxide in the United States, making it a key state to participate in this program.

Our persistence on moving climate and energy policies in states across the country, as well as our continued mobilization of investor and company efforts to support climate action and the Paris Agreement through the We Are Still In (which led to the launch of America Is All In as the U.S. formally re-entered the landmark agreement) movement paid off. With the election of the Biden-Harris administration at the end of last year, there is now a renewed focus on tackling the climate crisis at the highest levels of government. The U.S. is now back in the Paris Agreement, and Ceres is working with the new administration to ensure that climate action is at the core of everything we do.

Watch the session about state climate policy from our Ceres 2020 annual conference below.

Investors Focus on Food

In addition to the oil and gas industry, investors also focused their efforts on reducing the climate impacts of the food and agriculture industry, specifically fast food companies.

Ceres and the global investor network FAIRR has been working with investors to get the world’s largest fast food companies to take faster and deeper action to manage climate and water risks in their supply chains. In 2020, the investor coalition nearly doubled in size from $6.5 trillion to more than $11.4 trillion in managed assets.

The investors have been engaging with Chipotle Mexican Grill, Domino’s Pizza, McDonald’s, Restaurant Brands International (owners of Burger King), Wendy’s Co., and Yum! Brands (owners of KFC and Pizza Hut), calling on the fast food giants to set aggressive targets to reduce their greenhouse gas emissions and the water usage and water quality impacts of their meat and dairy supply chains. Of the six engaged companies:

- McDonald’s and Yum Brands! have set or publicly committed to set science-based emission reduction targets.

- Restaurant Brands International has stated its intention to set an emissions reduction target for its restaurants in the U.S. and Canada.

- McDonald’s has conducted a water risk assessment specifically for meat and dairy suppliers.

- Restaurant Brands International plans to conduct a life-cycle assessment that will consider its water footprint, among other impacts.

And already in 2021 we’re seeing more results. Now, five out of the six fast food brands engaged in this effort have publicly stated they will set, or have already set, science-based targets to reduce their emissions.

You can learn more about our work on water issues with these food companies in our Annual Report update about the water crisis.

Increasing Electric Vehicle (EV) Fleets

The transportation sector is currently the largest and fastest growing GHG-emitting sector in the U.S. economy. This means that transportation decarbonization is critical to addressing climate change in the U.S. and globally. EVs present significant benefits to companies and the environment, including reduced greenhouse gas emissions, cost savings on fuel and maintenance, freedom from reliance on volatile oil and gas prices, improved passenger safety, and more.

To demonstrate both the need and the demand for more EVs and EV infrastructure, Ceres launched the Corporate Electric Vehicle Alliance in 2020. The Ceres-led Alliance will help member companies make and achieve bold commitments to fleet electrification and boost the electric vehicle market by signaling the breadth and scale of corporate demand for electric vehicles. It will also provide a platform to coordinate support for policies that enable fleet electrification.

The Corporate Electric Vehicle Alliance’s founding members are Amazon, AT&T, Clif Bar, Consumers Energy, DHL, Centrica Business Solutions (previously Direct Energy), Genentech, IKEA North America, LeasePlan, Lime, and Siemens. These members operate some of the largest fleets in the U.S. and some have already made significant commitments to electric vehicles.

Print

Print