Jim Rossman is Managing Director and Head of Shareholder Advisory; Mary Ann Deignan is Managing Director; and Christopher Couvelier is Director at Lazard. This post is based on their Lazard memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Executive Summary

- Rule 13F-1 of the Securities Exchange Act of 1934 requires institutional investors with discretionary authority over more than $100 million of public equity securities to make quarterly filings on Schedule 13F

- Schedule 13F filings disclose an investor’s holdings as of the end of the quarter, but generally do not disclose short positions or holdings of certain debt, derivative and foreign listed securities

- Filing deadline is 45 days after the end of each quarter; filings for the quarter ended June 30, 2021 were due on August 16, 2021

- Lazard’s Capital Markets Advisory Group has identified 12 core activists, 30 additional activists and 20 other notable investors (listed below) and analyzed the holdings they disclosed in their most recent 13F filings and subsequent 13D and 13G filings, other regulatory filings and press reports

- For all 62 investors, the focus of Lazard’s analysis was on holdings in companies (excluding SPACs) with market capitalizations in excess of $500 million

- Lazard’s analysis, broken down by sector and by company, is enclosed. The nine sector categories are:

- Consumer

- FIG

- Healthcare

- Industrials

- Media/Telecom

- PEI

- Real Estate

- Retail

- Technology

- Within each of these sectors, Lazard’s analysis is comprised of:

- A one-page summary of notable new, exited, increased and decreased positions in the sector

- A list of companies in the sector with activist holders and other notable investors

- Companies are listed in descending order of market capitalization

- Lazard will continue to conduct this analysis and produce these summaries for future 13F filings

- The 13F filing deadline for the quarter ending September 30, 2021 will be November 15, 2021

List of Activist and Other Notable Investors―2Q 2021

Source: Edgar.

Note: 13F filings typically disclose positions in U.S. listed securities only. Total market values as of August 16, 2021. Certain investors may be excluded due to data availability or missing the filing deadline.

1Reflects only holdings included in investors’ 13F filings (i.e., excludes offshore holdings that may be reflected in the analysis on the following pages).

2For non-core activists with over 100 positions disclosed, the analysis on the following pages presents only holdings greater than 1.0% of shares outstanding.

3Availed itself of confidential treatment to withhold disclosure of certain positions as of June 30, 2021.

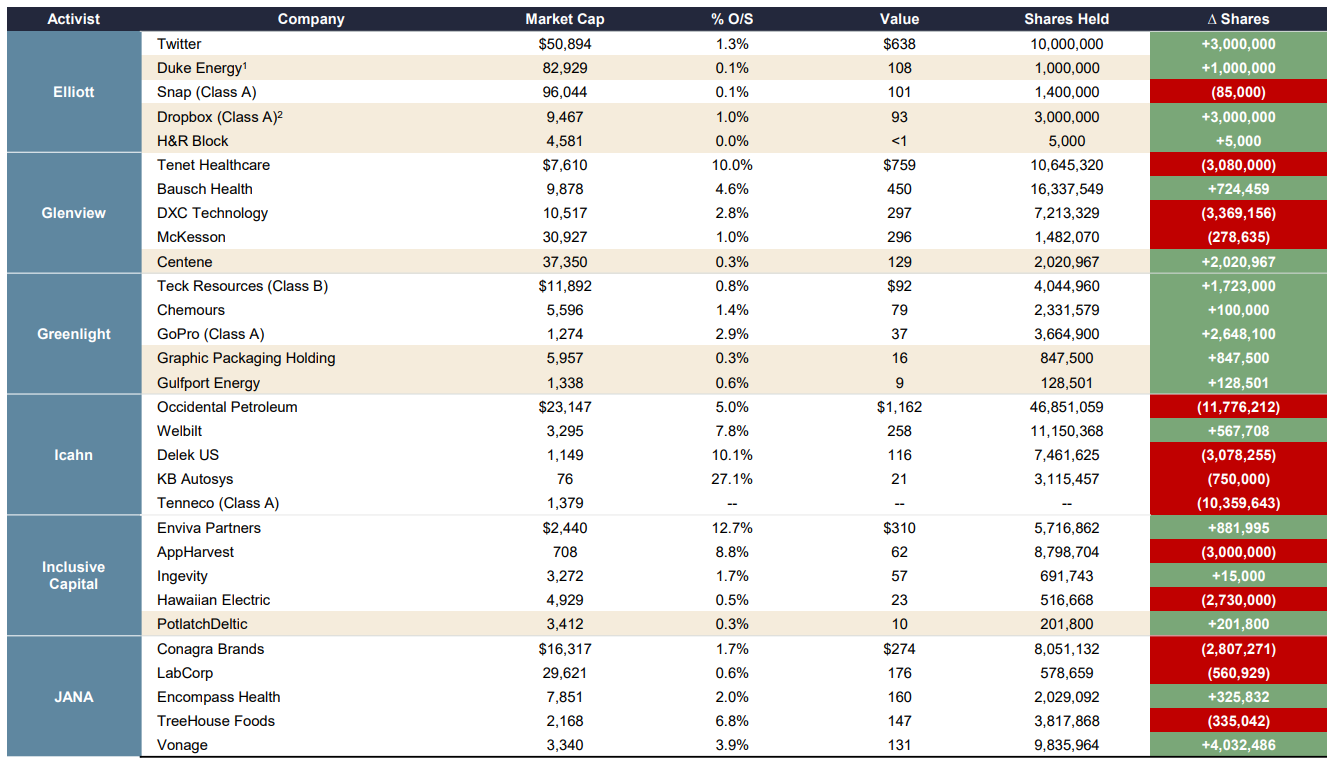

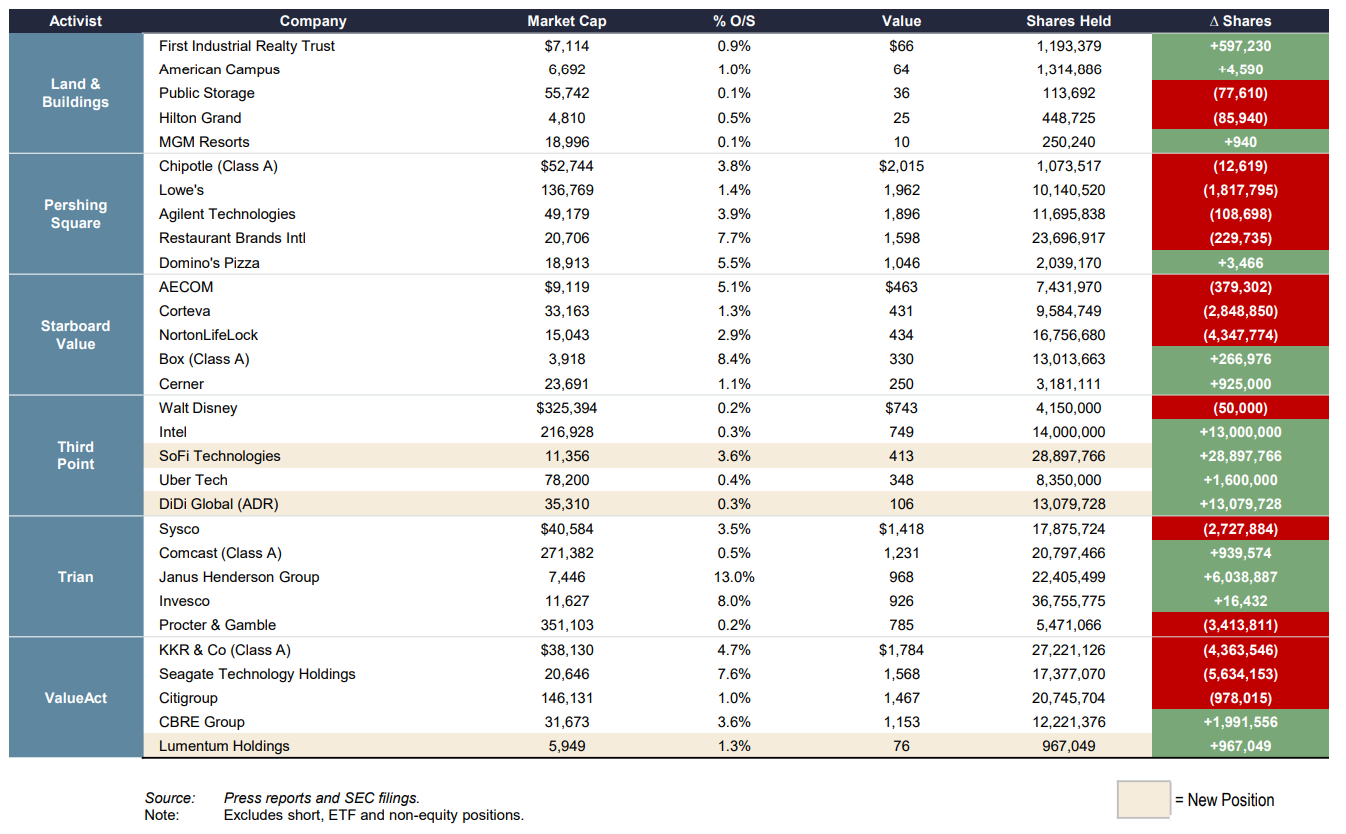

Selected Notable Holdings of Core Activists ($ in millions)

Source: Press reports and SEC filings.

Note: Excludes short, ETF and non-equity positions.

1Elliott’s investment with Duke Energy was first reported in May 2021.

2Elliott’s investment with Dropbox was first reported in June 2021.

The complete publication, including footnotes, is available here.

Print

Print