Michael J. Callahan is Professor of the Practice of Law at Stanford Law School; David Larcker is Professor of Accounting at Stanford Graduate School of Business; and Brian Tayan is a researcher with the Corporate Governance Research Initiative at Stanford Graduate School of Business. This post is based on their recent paper. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

We recently published a paper on SSRN, The General Counsel View of ESG Risk, that examines the view that general counsel and senior in-house counsel have of ESG.

ESG—Environmental, Social, and Governance matters—have become a central focus of governance practitioners in recent years. This trend, however, has not come without controversy and confusion, including the definition and scope of ESG and the impact of ESG on corporate performance, investment, and disclosure.

Proponents of ESG argue that increased investment in environmental and social activity contributes to long-term success of an organization through the mitigation of social ills that pose long-term risk. They contend that investment in social objectives reduces the risk profile of the company by addressing externalities before they manifest themselves, thereby lowering long-term costs to both shareholders and stakeholders. By aligning corporate practices with desirable social objectives, the company will create profits that are larger, more sustainable, and more equitably distributed among all stakeholders—shareholders, employees, and the community alike. Through increased disclosure, shareholders can monitor corporate progress and hold management accountable for outcomes.

Critics of ESG argue that the introduction of broad environmental and social objectives into the corporate purpose distracts management and the board from its central profit-making objective. They contend that efforts to maximize long-term value are already incorporated into strategic plans, investment decisions, and risk management programs and that many of the objectives of ESG are political in nature and should be addressed in the public sphere through elected officials rather than in the private sphere through corporate managers. Requiring ESG disclosure would not only compel companies to pursue these objectives, but it would also create a burdensome reporting obligation because of the scope, breadth, and imprecision of potential measures.

Rigorous research provides no clear-cut resolution to the controversy. Margolis, Elfenbein, and Walsh (2009) conduct a meta-analysis of 35 years of research on corporate social responsibility and find a positive but economically insignificant association with performance. Kitzmueller and Shimshack (2012) conduct a literature review of the topic and similarly conclude there is little support for corporate social responsibility having a positive impact on performance. Christensen, Hail, and Luez (2021) examine corporate social responsibility from a disclosure perspective. They find that increased reporting can benefit markets through greater liquidity and lower cost of capital but also can harm companies through public release of proprietary information and exposure to litigation. Also unknown are questions of how a broadening of the corporate mandate to incorporate ESG impacts managerial accountability, employee productivity, and customer purchase behavior.

General Counsel View of ESG

To provide insight into these issues, we surveyed General Counsel and senior legal officers (referred to collectively here as “General Counsel”) in large and mid-sized companies. General Counsel offer an interesting perspective on ESG because their job includes them in executive-level and boardroom decisions and requires them to balance operating and risk-mitigating considerations. They have deep knowledge of the corporate objectives for ESG but also oversee the weighing of harm that might arise from corporate actions or inactions. As such, they are charged with advising boards and companies on operating “between the guardrails” of risk-informed and responsible decision making.

We find that General Counsel, on average, support ESG-related activities and at the same time harbor significant concern for the legal and regulatory risk of these activities. Their companies have faced internal and external pressure to pursue environmental and social initiatives and have responded in many cases by increasing investment in these initiatives. At the same time, General Counsel express notable concern about the potential liability from disclosure of ESG-related activities and reputational and productivity costs caused by CEO and employee-driven activism.

ESG Pressure

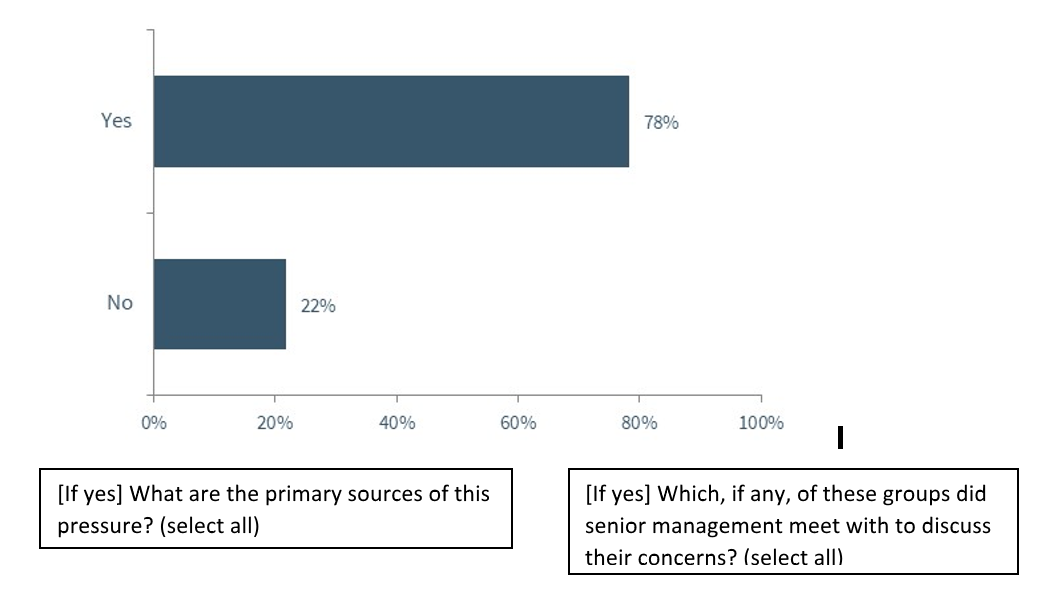

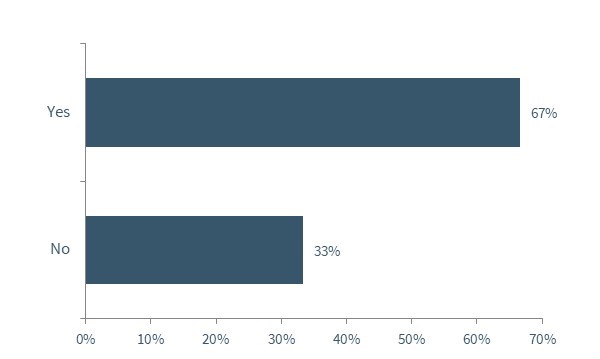

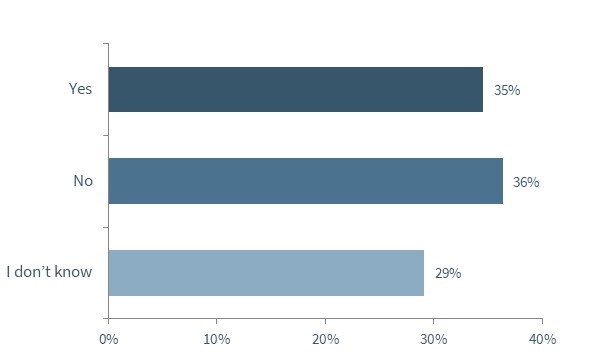

General Counsel report significant internal and external pressure from constituents to increase their organization’s commitment to ESG. Over three-quarters (78 percent) have faced such pressure in the past three years, while 22 percent have not. The largest sources of pressure are the company’s own employee base (48 percent of those reporting internal or external pressure), the company’s large institutional investors (44 percent), customers (41 percent), third-party advocacy groups (33 percent), and ESG ratings firms (24 percent). To a lesser extent, companies face pressure from the community (19 percent), local media (15 percent), and suppliers (7 percent). Small retail investors (2 percent) and creditors (2 percent) are unlikely to pressure companies regarding ESG.

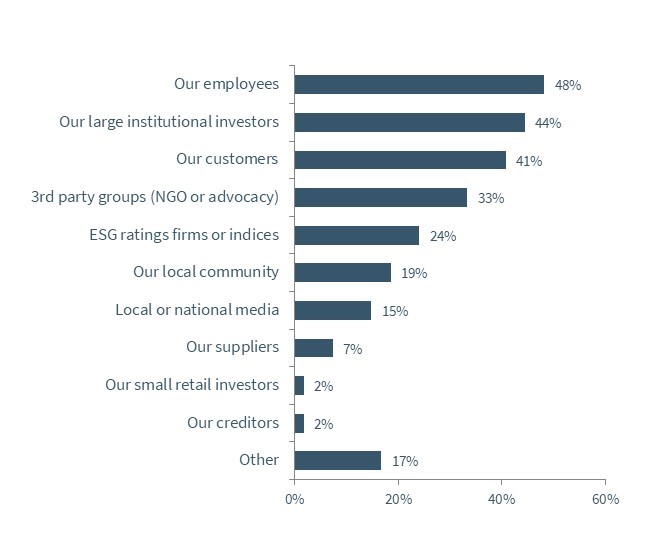

General Counsel say their senior management team is very willing to meet with these groups to discuss their concerns. Senior management met with ESG ratings firms 85 percent of the time, large institutional investors 83 percent of the time, employees 62 percent, customers 59 percent of the time, and third-party advocacy groups 39 percent (see Exhibit 1). We find this level of engagement surprising, and it demonstrates eagerness on the part of companies to understand the viewpoints of their constituents. It is perhaps not surprising that companies are most receptive to meeting with ESG ratings firms and large institutional investors who potentially have a direct impact on the company’s share price and perceived governance quality in the marketplace. The high level of engagement with employees on ESG matters is also notable and reflects the competitive talent market in certain sectors and the tight labor supply many businesses are facing as large economies emerge from government enforced COVID-19 lockdowns.

ESG Pressure by Issue

According to General Counsel, companies are most frequently pressured to increase their financial commitments to diversity, equity, and inclusion (80 percent). They also face considerable pressure to address environmental or sustainability matters (67 percent). They are less likely to be pressured to improve the social impact of their company (47 percent) or increase wages to lower-level employees (35 percent).

Companies claim to be highly responsive to these pressures. 96 percent of companies increased their financial or organizational commitment to diversity, equity, and inclusion when pressured to do so. Similarly, 97 percent claim to increase their commitment to the environment in response to stakeholder pressure, and 92 percent to improve the social impact of their company. Companies are less likely to respond to pressure to increase wages to low-level employees, although 76 percent still profess to doing so (see Exhibit 2).

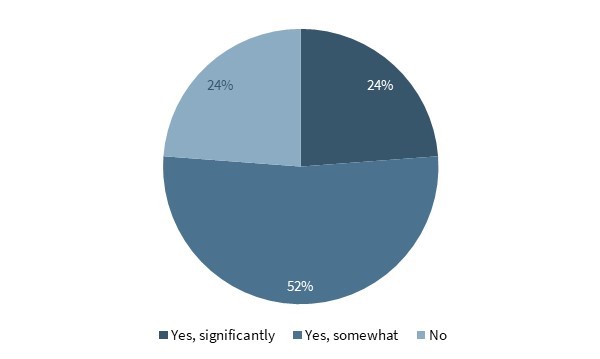

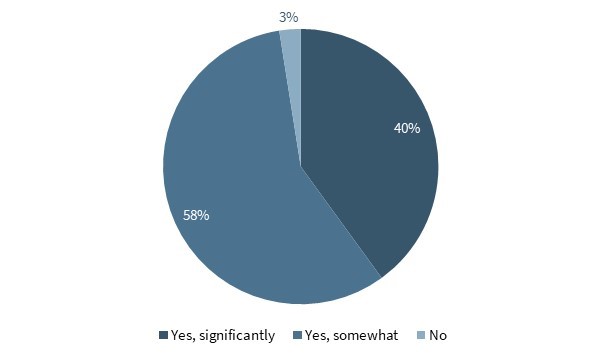

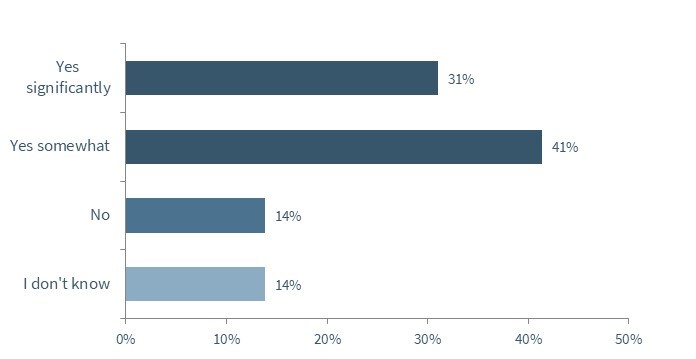

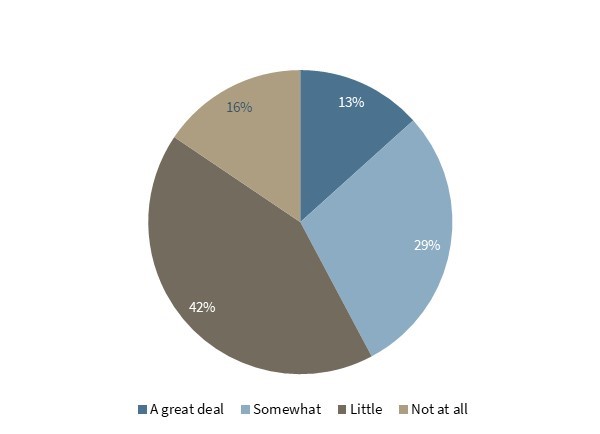

General Counsel believe that investments such as these improve the long-term financial performance of their company. A third (31 percent) believe organizational investments in ESG significantly improve long-term performance and 41 percent believe it somewhat improves performance, while only 14 percent say it does not improve performance. This of course invites the question of why, if ESG investments are performance enhancing, the companies did not make these investments independent of pressure from constituents to do so (see Exhibit 3).

ESG Metrics and Disclosure

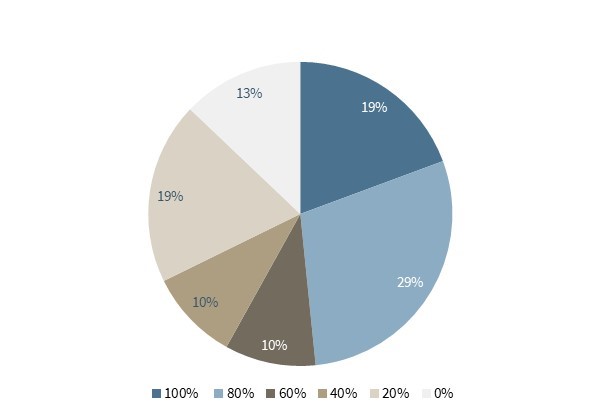

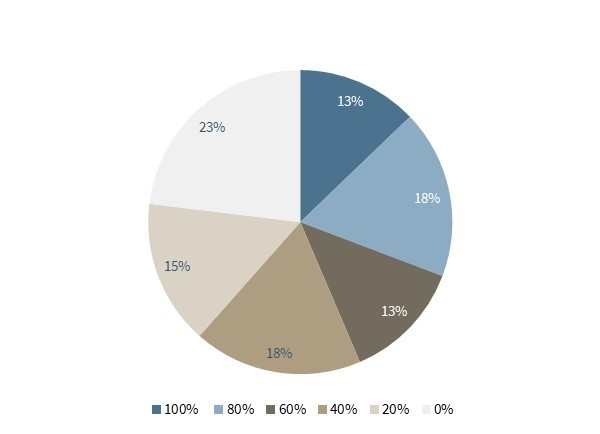

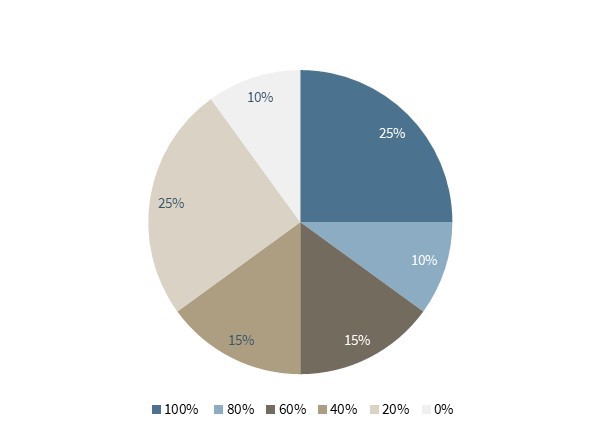

Companies disclose only a portion of the information they track relating to ESG initiatives. Companies that track environmental-related factors release only a third of that information to the public. Those that track diversity-related metrics disclose approximately 60 percent of that data. Companies that track societal impact data disclose half.

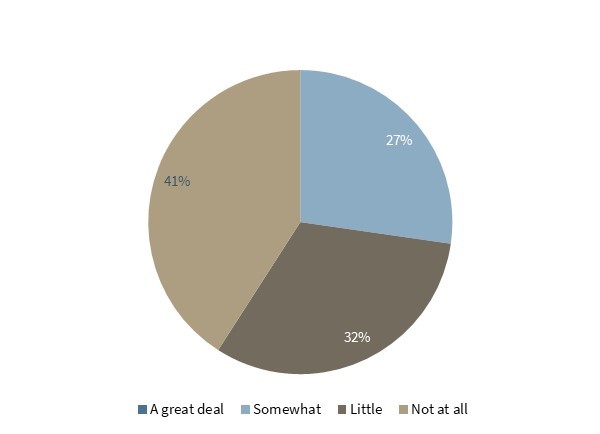

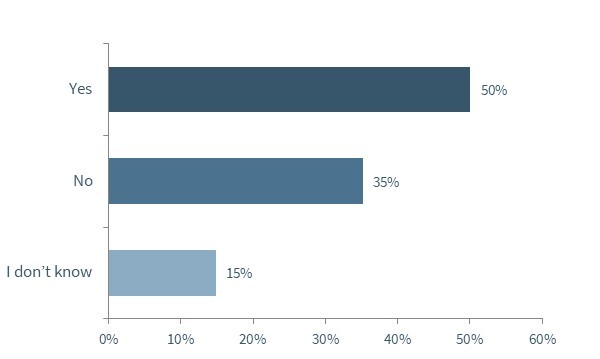

While General Counsel support ESG-related initiatives, they express notable concern about the impacts of disclosing this data to the public. Half (50 percent) worry that environmental disclosure increases their legal or regulatory exposure, and 42 percent worry that diversity disclosure does so. 27 percent are concerned that social impact disclosure increases legal and regulatory risk (see Exhibit 4). These are considerable levels given the potential for mandatory ESG disclosure across all public market participants.

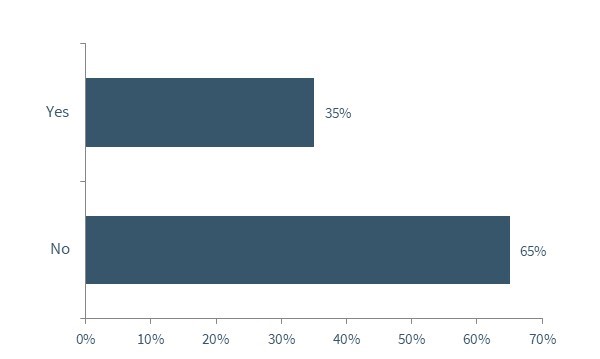

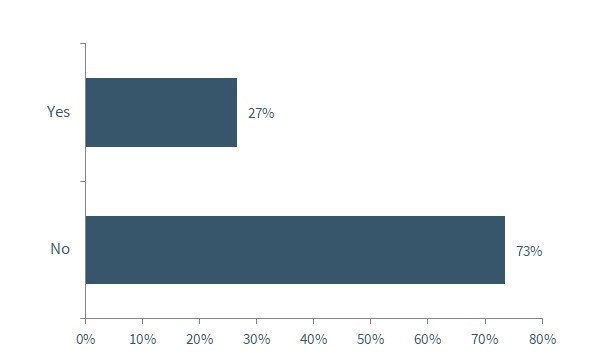

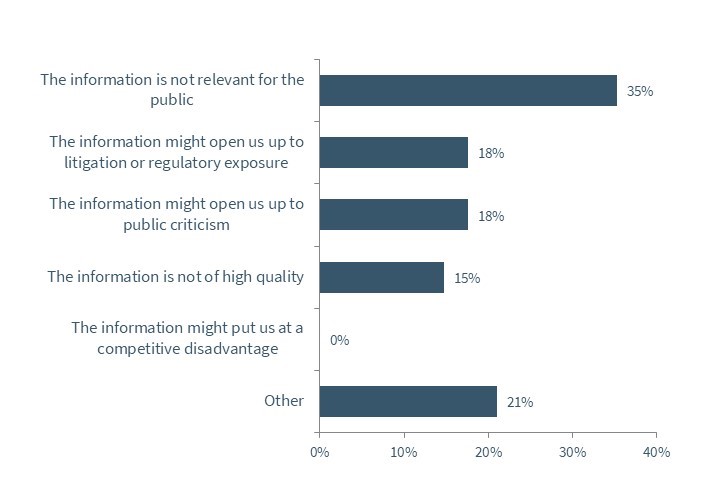

Next, we explored why companies do not disclose the Equal Employment Opportunity (EEO) data that they are required to report to the U.S. Department of Labor. In our sample, 27 percent purport to make their EEO-1 Report publicly available on their website. Among those that do not, 35 percent say the information is not relevant to the public, 18 percent worry it would expose the company to liability, 18 percent that it might open the company to public criticism, and 15 percent say EEO-1 information is not high-quality. Interestingly, no respondent believes disclosure of diversity data might harm the competitive positioning of their company (see Exhibit 5).

CEO and Employee Activism

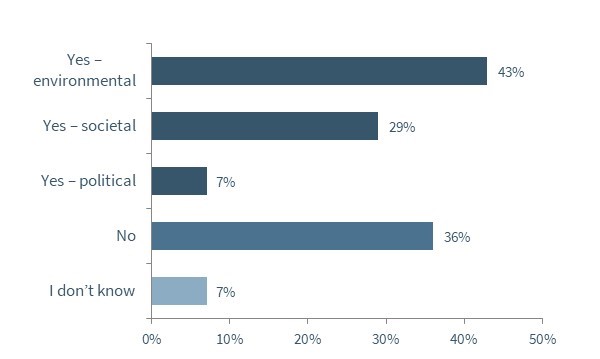

Next we explored General Counsel viewpoints on CEO and employee activism. In our sample, 43 percent of General Counsel say that the CEO of their company has taken a vocal stance on environmental issues not directly related to the core business, 29 percent on social issues, and 7 percent on political issues. (A third, 36 percent, have not taken an activist stance on these issues.) While half believe CEO activism can produce reputational benefits for the organization, 35 percent believe CEO activism exposes the company to reputational, legal, or regulatory harm—a significant level of concern.

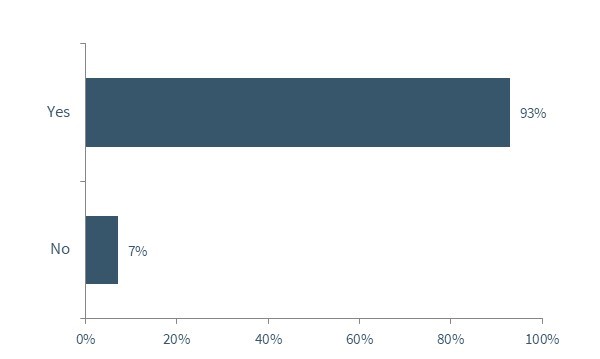

General Counsel strongly advise CEOs to discuss with them or with the board a decision to take an activist stance on social, environmental, or political issues prior to doing so. 89 percent believe the CEO should discuss the consequences of this decision in advance with the board and 93 percent with the General Counsel (see Exhibit 6). The General Counsel view of how involved the board should be in these matters may surprise some who view the CEO as having full authority to engage on social and political topics and inform boards who have not had the conversation with their leadership teams about scope of authority to make it a point to do so.

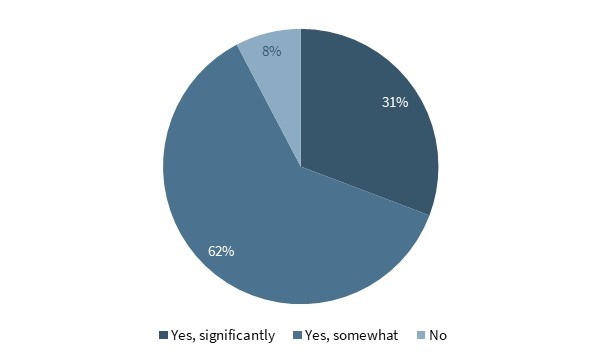

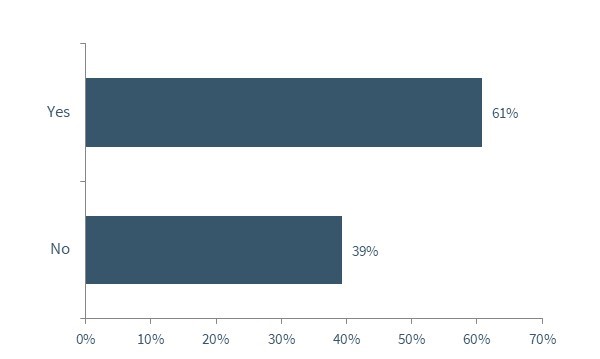

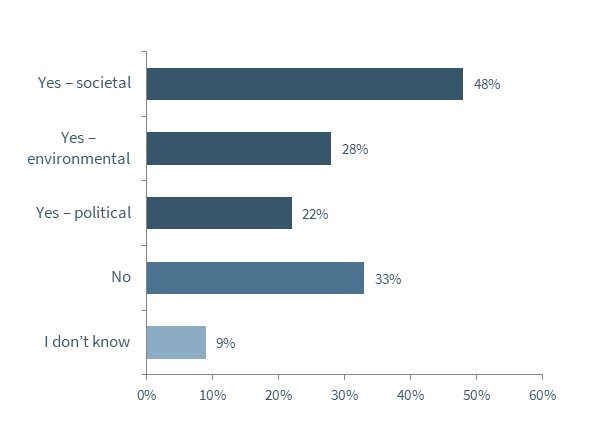

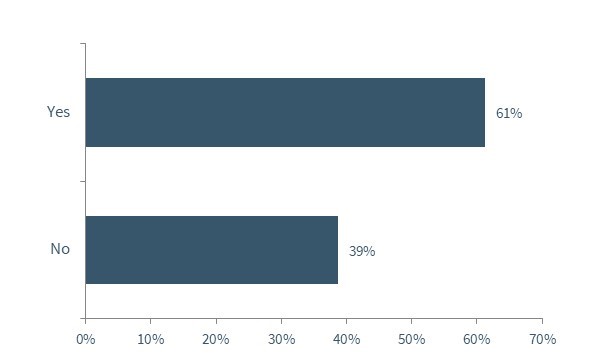

Employee pressure has also been widespread for companies to take a stance on social issues not related to the company’s main business. Approximately half (48 percent) of companies faced calls by their employee base to take a stance on a social issue, 28 percent on an environmental issue, and 22 percent on political issues. (A third, 33 percent, have not faced employee activism.) Companies are fairly responsive to these pressures. Among those facing employee activism, 61 percent agreed to take a stance on the issue while 39 percent did not.

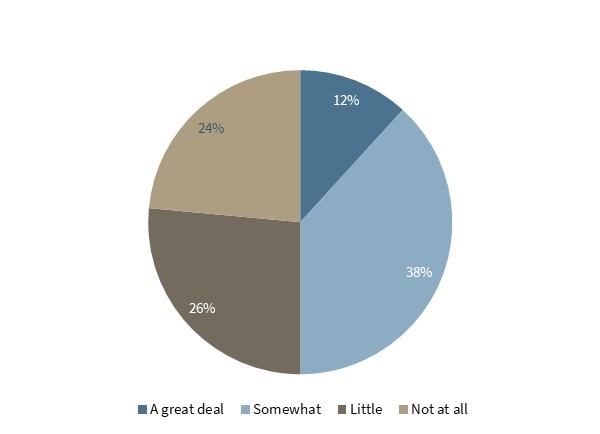

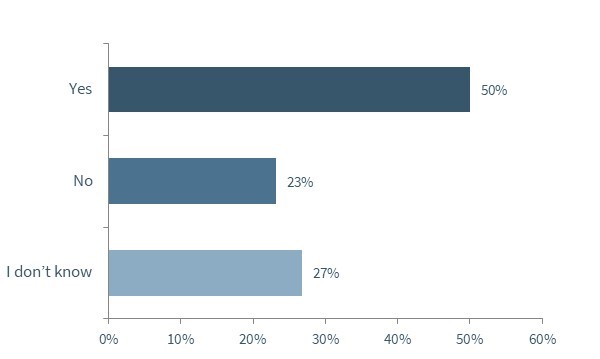

General Counsel are divided on how to handle employee activism and warn about the impact it has on a productivity. Half (50 percent) of respondents believe employee activism is a workplace-related matter that employers should engage on with employees, while 35 percent do not. 49 percent believe the discussion of social or political issues during work hours decreases employee productivity, only while 21 percent believe it increases productivity; 30 percent believe it has no impact (see Exhibit 7).

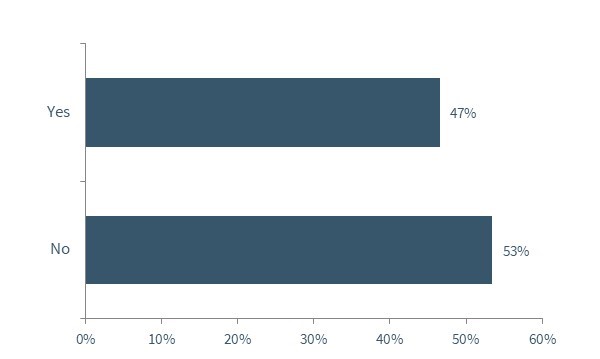

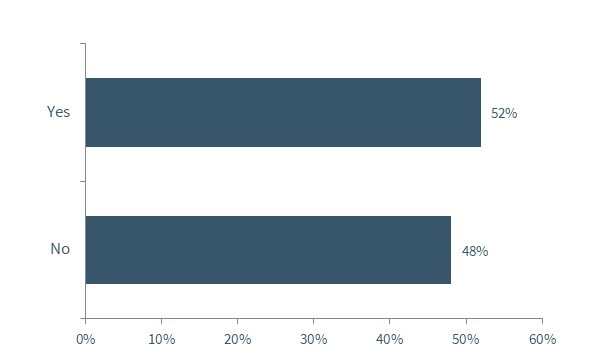

The Stick-to-Business Company

Finally, it is noteworthy that many General Counsel would recommend a policy of restricting their company from engaging in causes not directly related to the company’s strategic and financial mission. We summarized for respondents the policy adopted in 2020 by Coinbase, in which the company committed to not engage in causes apart from its core business, including public policy issues, societal issues, and political causes. When asked whether they would recommend a similar policy to the CEO and board of their company, over half (52 percent) said they would, while only 48 percent would not (see Exhibit 7).

This is a very significant percentage, and one that indicates that, despite the general trend toward ESG, stakeholder capitalism, and corporate activism, General Counsel are wary of the uncertain long-term impact. It is notable that over half of the people who are responsible for balancing the risk and reward of corporate actions advocate dialing back some of these efforts and recommitting to the central strategic and profit-making purpose.

Why This Matters

- Companies face considerable pressure from internal and external constituents to increase their investment in environmental and social initiatives, many of which are outside of the traditional scope of the company’s central mission. Survey data shows that companies are responsive to this pressure and in many cases invest in and commit resources toward meeting the concerns of these constituents. What long-term impact will these investments have on companies? Will they improve performance, or hinder it? Will they decrease risk, or expose the company to new ones?

- This Closer Look highlights the views of general and senior in-house counsel on ESG. This viewpoint is critical because of the role General Counsel play in thinking through the risk implications of corporate policy. We find considerable tension between a willingness, on one hand, to invest in and support ESG-related activities and worry, on the other hand, about liability and potential regulatory harm. Can companies find a balance between “doing good” and not creating unexpected damage? This is an important issue for boards to understand, and a discussion which the General Counsel would lead.

- Just over half of General Counsel would recommend a corporate policy of not engaging in social, political, and environmental activities not central to the company’s central mission. Such a stance would materially curtail many ESG-related activities and investment. How effective are companies at defining the boundaries of their ESG initiatives? Have they developed a clear-cut list of the activities they will and will not engage in? Do they fully understand the consequences of their activities, or have they pigeon-holed themselves by reacting to pressure from a wide number of constituents? Have boards clearly outlined their expectations to the CEO and leadership team?

- How much information should companies disclose about their ESG initiatives? While some governance experts argue for expanded disclosure to facilitate the monitoring of these projects by stakeholders and shareholders, others argue that disclosure is costly to implement and exposes the corporation to litigation. Can a company clearly, concisely, and meaningfully disclose relevant data about its efforts and outcomes in human capital management and societal and environmental impact?

The complete paper is available for download here.

Exhibit 1: Sources of ESG Pressure

ESG stands for Environmental, Social, and Governance and broadly refers to a company’s efforts to address stakeholder interests that involve your company, its workforce, its products, or its impact on society

In the last 3 years, has your company faced pressure from internal or external groups to increase its financial or organizational commitment to ESG?

Exhibit 2: ESG Pressure by Issue

In the last 3 years, has your company faced pressure to increase its financial or organizational commitment to diversity, equity and inclusion? (select all)

[If yes] Did your company subsequently increase its commitment in this area?

In the last 3 years, has your company faced pressure to increase the wages it pays to entry-level or lower-level employees?

[If yes] Did your company subsequently increase wages for these employees in response to this pressure?

In the last 3 years, has your company faced pressure to increase its financial or organizational commitment to environmental or sustainability matters (such as emissions, pollution, waste, or environmental stewardship)?

[If yes] Did your company subsequently increase its commitment in this area?

In the last 3 years, has your company faced pressure to improve the social impact of your company (such as affordability of your product, access to your product, community impact, or community engagement with your company)?

[If yes] Did your company subsequently increase its efforts in this area?

Exhibit 3: Impact of ESG Investment on Performance

Do you believe that a financial or organizational investment in ESG improves the long-term financial performance of your company?

Exhibit 4: ESG Metrics and Disclosure

Does your company internally track performance metrics related to environmental issues?

[If yes] Approximately how much of this information does your company disclose to the public?

[If yes] In general, how much do you worry that disclosure of environmental metrics would increase your company’s legal or regulatory exposure?

Does your company internally track performance metrics related to diversity, equity and inclusion?

[If yes] Approximately how much of this information does your company disclose to the public?

[If yes] In general, how much do you worry that disclosure of diversity, equity and inclusion metrics would increase your company’s legal or regulatory exposure?

Does your company internally track performance metrics related to the societal impact of your products or services (such as affordability of your product, access to your product, or community impact)?

[If yes] Approximately how much of this information does your company disclose to the public?

[If yes] In general, how much do you worry that disclosure of these metrics would increase your company’s legal or regulatory exposure?

Exhibit 5: EEO-1 Reporting and Disclosure

An EEO-1 Report is a compliance survey mandated by federal statute and regulations. The survey requires company employment data to be categorized by race/ethnicity, gender and job category.

Does your company make publicly available on its website the EEO-1 Report it files with the Department of Labor?

[If no] Why not? (select all)

Exhibit 6: CEO Activism

In the last 3 years, has the CEO of your company taken a vocal public stance on an environmental, societal, or political issue that is not directly related to your company’s business? (select all)

In general, do you believe that a CEO who takes a public stance on environmental, societal, or political issues produces reputational, legal, or regulatory benefits for the company?

In general, do you believe that a CEO who takes a public stance on environmental, societal, or political issues exposes the company to reputational, legal, or regulatory harm?

In general, do you believe a CEO should discuss with the board the possible positive and negative consequences of taking a public stance on matters such as these, prior to doing so?

In general, do you believe a CEO should discuss with the General Counsel the possible positive and negative consequences of taking a public stance on matters such as these, prior to doing so?

Exhibit 7: Employee Activism

In recent years, employees at some companies have debated stances on environmental, social, or political issues while in the workplace.

In the last 3 years, have employees of your company encouraged your management to take a vocal public stance on an environmental, societal, or political issue that is not directly related to your company’s business? (select all)

[if yes] Did your company take as stance on this issue?

In general, do you believe that employee activism is a workplace matter that employers should engage with employees on?

In general, do you believe that employee debate on social or political issues during work hours impacts employee productivity?

Recently, a company made a public statement that it would not engage in causes not directly related to its strategic and financial mission, including public policy issues, societal issues, and political causes. It would instead focus exclusively on its strategic and financial mission and only engage in policy issues directly related to that mission.

In general, would you recommend a similar policy to the CEO and board of your company?

Print

Print