Amy Rojik is Director and Founder of the BDO Center for Corporate Governance. This post is based on her BDO memorandum.

Introduction

As an uncertain business environment persists, board directors face expanding roles and responsibilities in applying the lessons learned over the past 18 months while continuing to navigate new obstacles. In our last Board Pulse Survey, directors indicated they were challenged by an array of financial, operational and regulatory pressures as the wide range of stakeholders expanded their expectations of the board’s role. In addition to those issues, board members face new regulatory changes, issues related to globalization and digital acceleration, and the rise of environmental, social and governance (ESG) factors being linked to company performance. All of these elements will play a pivotal role as boards look to thrive in today’s shifting corporate climate.

While keeping these challenges top of mind, boards are optimistic and taking active steps toward growth. Our 2021 BDO Fall Board Pulse Survey explores the evolving corporate strategies for public company boards of directors, including how they plan to pursue growth and increase transparency around strategic shifts.

Key Findings

- Coming out of the 2021 proxy season, engagement of shareholders and investors is priority #1.

- M&A is the top-ranked corporate strategy.

- Cybersecurity and data privacy continue to be significant governance issues for all companies.

- Risk of supply chain disruption challenges boards to tackle sourcing diversification head-on.

- Labor shortages and scrutiny around board composition encourage more thoughtful talent recruitment and refreshment processes.

- ESG issues remain high on boards’ priority lists, as directors explore options on how best to comply with changing requirements and communicate their efforts publicly.

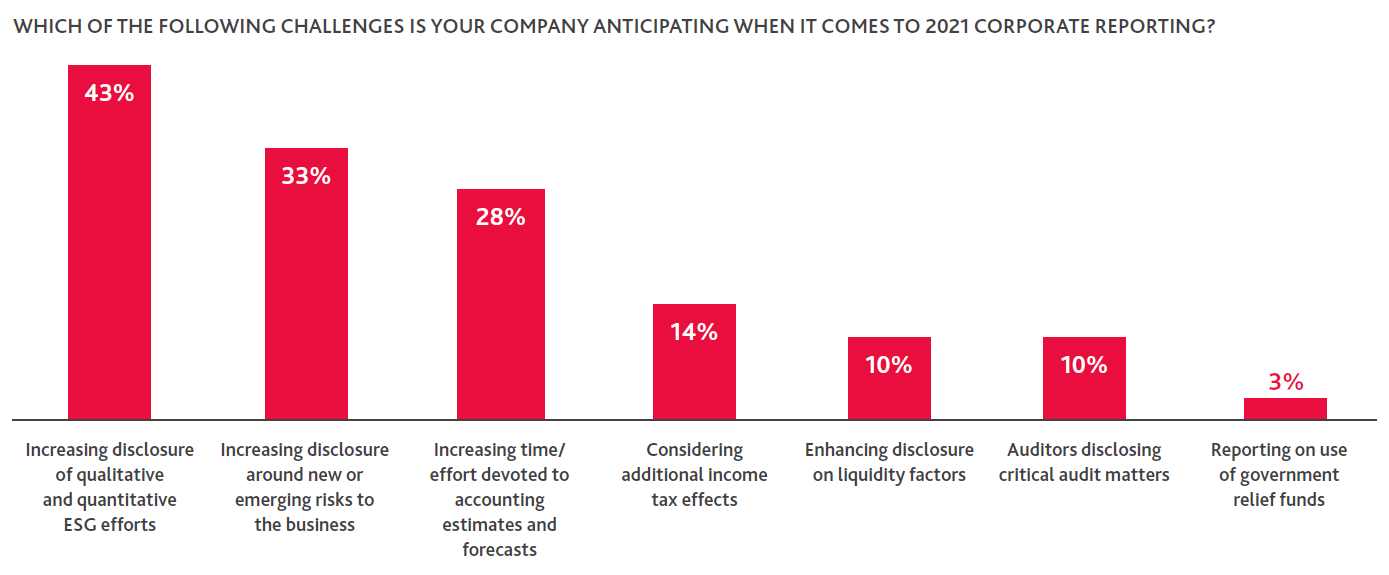

- With annual reporting approaching, boards anticipate challenges around increasing disclosures and risks.

Boards Eye Growth Strategies Despite Ongoing Economic Uncertainty

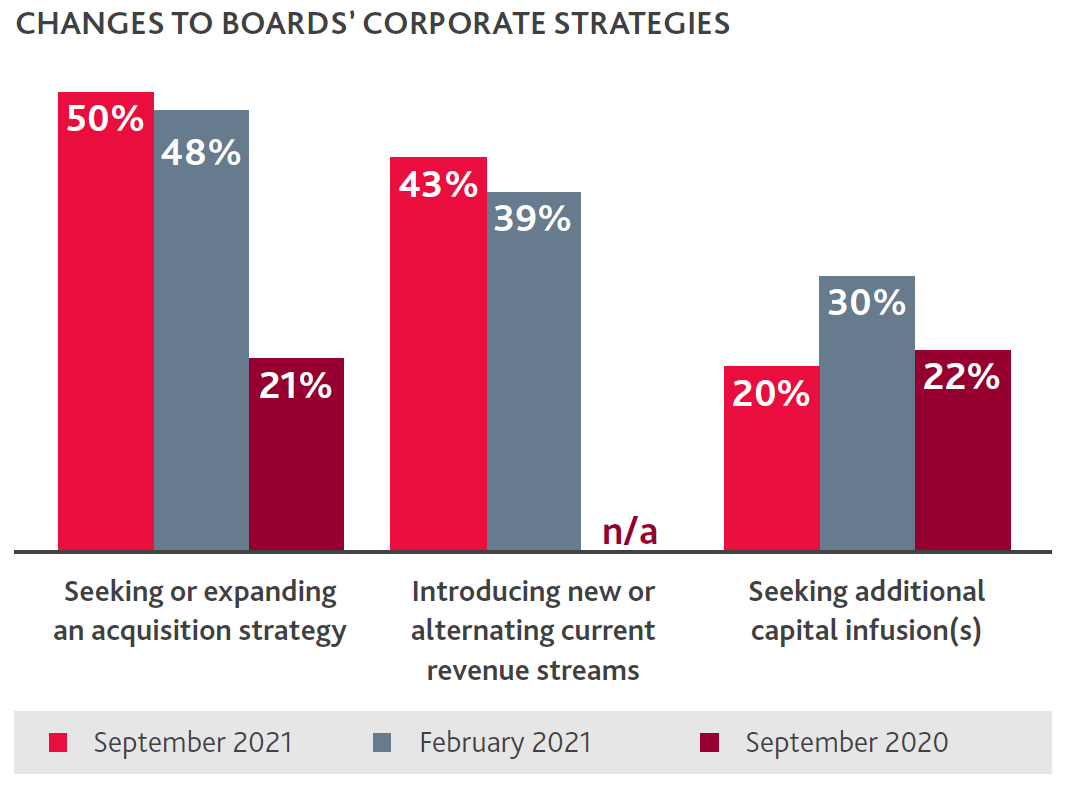

As some sectors of the economy stabilize in the wake of volatility, many unknowns remain on the horizon, such as new COVID-19 variants, looming tax policy changes, significant governmental spending and potential increases to interest rates. Despite this uncertainty, shifts in boards’ corporate strategies over the past year point to a renewed appetite for growth. Plans to explore acquisitions and new revenue streams have risen while needs for quick infusions of capital have dropped.

Growth ambitions often prompt the need for workforce expansion, and this year brings new challenges in that area. Sourcing labor is among directors’ top three impediments to economic and operational success for the rest of 2021, as cited by 16% of respondents. Corporate culture is no longer a nice-to-have—it is a key driver of business and competitive advantage that must be top-of-mind for boards.

To mitigate labor challenges, businesses are attracting and retaining talent by using the following strategies:

- 55% Re-imagining flexibility and remote work

- 51% Emphasizing diversity, equity and inclusion (DE&I)

- 46% Upskilling workforce

- 37% Enhancing employee benefits

- 32% Focusing on corporate social responsibility/philanthropy

The bulk of traditional recruitment and retention efforts continues to center on pay levels and highlighting opportunities for career advancement. However, compensation packages are composed of more than just salary. Companies poised to win the war for talent strike the right mix of salary, bonuses and equity awards in addition to offering competitive benefits along with flexible, inclusive and supportive work environments.

Integrating organizational growth and transparency requires consistent, thoughtful communication with stakeholders. Boards and executive leadership should keep relevant parties apprised of strategic shifts made in the pursuit of a more resilient and agile business model that benefits all stakeholders. As the company executes on strategy, it’s increasingly important to outline opportunities for invested parties and disclose any risks anticipated or encountered along the way. Doing so will continue to build stakeholder trust and ultimately lead to better outcomes, thereby ensuring a cohesive vision for the organization’s future.

Digital Transformation Survey Takeaways For Boards

Digital transformation plans accelerated rapidly this past year as many organizations adjusted to a majority-remote environment and invested in new or upgraded existing digital solutions.

According to BDO’s 2021 Middle Market Digital Transformation Survey, 90% of middle market organizations are maintaining or increasing their digital spend in 2021

With this broad push to enhance digital maturity, some boards are worried about falling behind. One in ten see lagging behind in digital transformation as their single biggest business risk, and another 10% of directors are concerned about allocating adequate resources to upgrade digital capabilities.

To mitigate this risk and help kickstart digital plans, many boards are focusing digital investments in a critical area: labor. With 53% of middle market organizations implementing training to upskill their workforce and focus on digital fluency, boards will need to ensure they are expanding their own digital skillsets to effectively govern in this new environment. Boards should position oversight of the strategic direction of digital plans and the development of mature digital capabilities—including automation— as an opportunity to build capacity and enhance the workforce.

Boards Address Critical Supply Chain Challenges

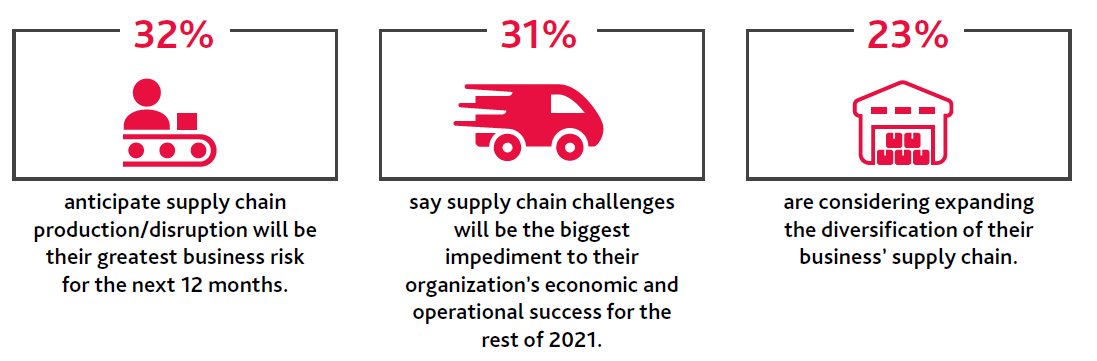

Ongoing effects from the COVID-19 pandemic continue to disrupt supply chains across industries, impacting both productivity and profitability. Material scarcity, increasing transportation costs and difficulties with demand forecasting are compounding supply chain problems. Persistent disruptions in the supply chain could hinder growth and introduce new risks.

Boards see the supply chain as a top area of concern, and many are taking steps to address these issues:

Addressing these challenges will require a combination of swift action and longer-term strategic planning. Boards should keep a close eye on the variety of management tactics put in place to overcome supply chain struggles and ensure the solutions are not implemented in a silo.

Boards Weigh in on ESG Plans, Both in the Near and Long Terms

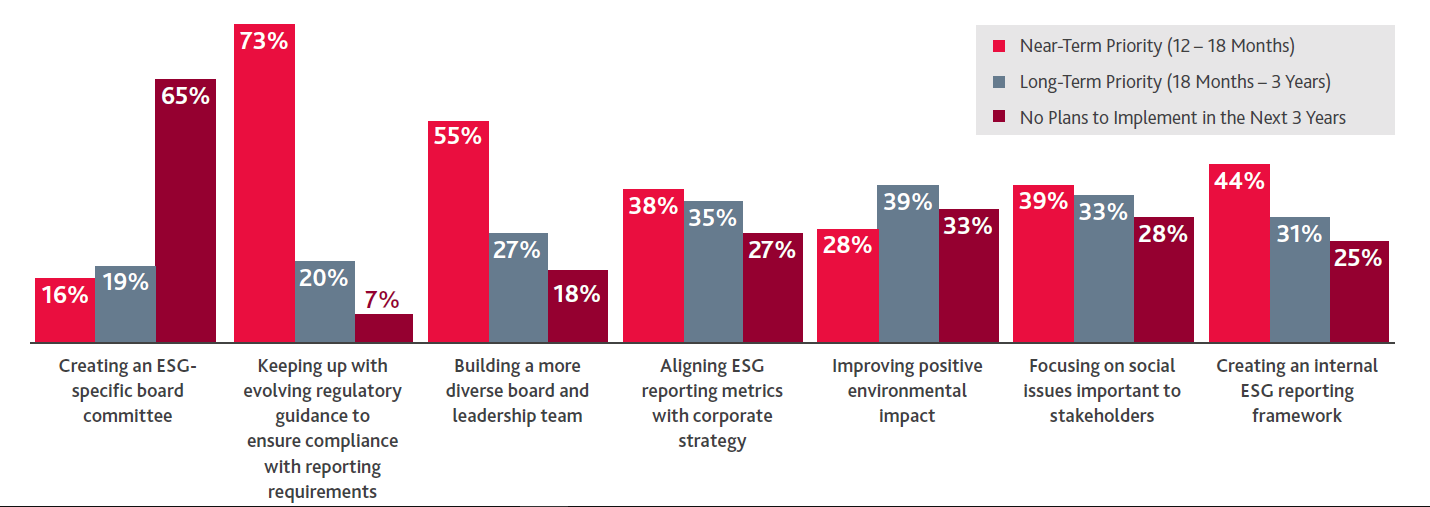

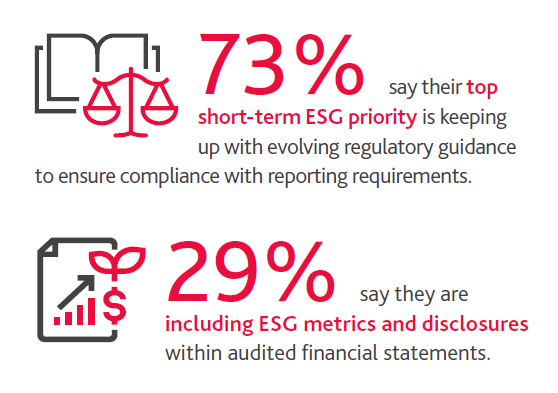

The importance of ESG initiatives continues to increase steadily for all stakeholders and has become a critical piece of the growth model for businesses. Boards have a range of plans to address ESG issues in the months and years ahead, with nearly three-quarters of directors (73%) focused on keeping up with evolving regulatory and reporting guidance for ESG in the near term.

Board members also recognize this growing need for action and transparency, as the most important priorities from shareholder meetings in the 2021 proxy season include accountability for ESG/sustainability (13%) and DE&I efforts (13%). To hold themselves accountable, more than a third of boards (35%) plan to create an ESG-specific committee during the next three years.

However, the value of ESG initiatives extends beyond satisfying stakeholders’ growing interest: Directors understand ESG efforts are good for business and will contribute to long-term stability and growth. With several ESG priorities marked by directors as near-term priorities, it is clear that boards are taking quick steps in order to ensure their organizations’ plans align with the future of business.

Examining ESG by Element

Environmental

Environmental and climate-related risks and opportunities continue to receive increasing attention globally and domestically. When the SEC closed the comment period on the proposal to expand climate risk disclosures in mid-June, the commission revealed they had received more than 550 responses. This increased interest from regulators shouldn’t come as a surprise—improving positive environmental impact was directors’ top-ranked long-term priority. The complexity of instituting this type of change could be what currently makes it a long-term priority, but shifting it to the short term could happen sooner rather than later.

Social

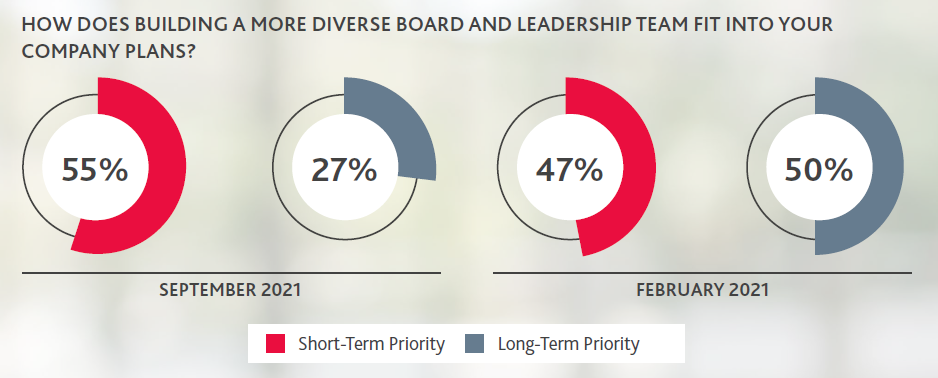

Board refreshment was another high priority coming out of 2021 shareholder meetings. Six months ago, 50% of directors said building a more diverse board leadership team was the boards’ top long-term ESG priority. As one of many factors under the “S” in ESG, we are now seeing those long-term DE&I priorities have either come to pass or become short-term areas of focus. The survey data found that 55% of board members indicate they plan to build a more diverse board and leadership team in the next 12-18 months.

With the SEC recently approving Nasdaq’s proposal to include mandatory gender and race disclosures in its listing rules, rethinking board composition is no longer optional. Under this proposal, all Nasdaq-listed companies, unless subject to certain exceptions, are required to have at least one woman and one individual from an underrepresented community on their board—or they must explain why they do not. Boards need to build this into their plans, as Nasdaq’s proposal is likely a sign of additional diversity requirements to come. This is an encouraging step forward in terms of diversifying board perspectives, which can contribute to growth.

Governance

The top-cited governance oversight challenge for the next six months is ensuring effective cybersecurity and data protection. Ransomware threats in particular are receiving considerable attention—and for good reason. Managing cybersecurity requires a layered, risk-based approach, and it’s critical for boards to take an active role in keeping their organizations prepared both proactively and reactively. In the event of a cyber-related incident, boards need to make sure they have the right skillsets on hand to respond to and remediate the threat. Ultimately, ongoing education, thorough preparation and continuous monitoring are a board’s best defenses.

Annual Reporting and What’s Next for 2022

Though there is no one-size-fits-all approach to ESG, many boards anticipate the SEC will soon release official ESG reporting requirements to provide clarity on the array of existing—and sometimes disparate—frameworks. In the meantime, directors should be working proactively to carry out their commitments and promises to their stakeholders. ESG is an area where ongoing transparency is especially crucial. Stakeholders have high expectations. Boards will be required to show not only that they have an ESG plan in place but to prove that they are taking actionable steps, supported by qualitative and quantitative disclosures and metrics, to make the plan a reality.

As we approach the final quarter of 2021, board members are working with management to ensure their financial statements and required filings are accurate, consistent, transparent and useful for decision-making. As anticipated new regulatory guidance is released—both in the U.S. and internationally—and stakeholder expectations change, boards must ensure they have accurately kept up with necessary disclosures ahead of annual reporting. Early signs from the SEC point toward a future where ESG disclosures are integrated within traditional financial reporting.

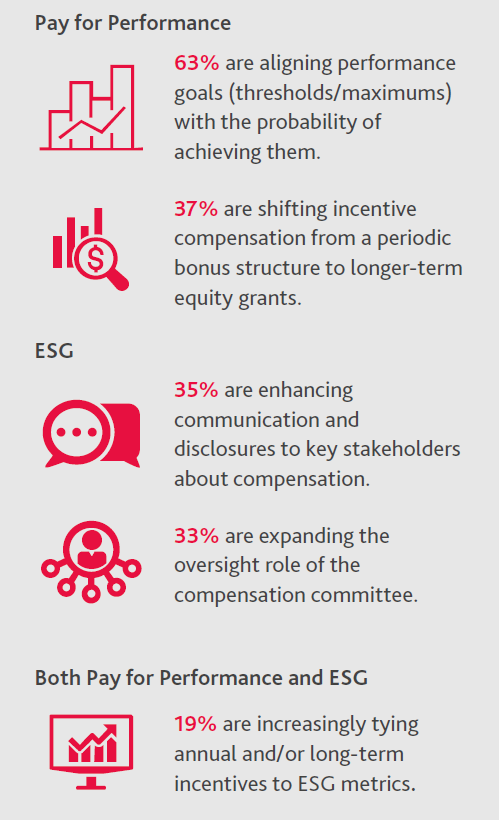

Executive compensation—an evolving conversation topic among boards and management teams—is another priority that came out of shareholder meetings in the 2021 proxy season. Boards are aiming to take specific action to align executive compensation with business objectives and evolving stakeholder expectations, particularly in the areas of pay for performance and ESG:

Looking ahead to 2022, one of the ways boards can maintain a high level of transparency is to disclose their ESG and sustainability efforts outside of just the proxy statement. When it comes to public communication around sustainability and ESG reporting, more than half of directors (51%) are already promoting these efforts on their corporate website and 30% are via social media. However, there are other opportunities to communicate these disclosures in more strategic ways. As of now, just 26% of boards are issuing standalone sustainability/ESG reports, and 20% are including this information in client or prospect discussion materials. However, another 29% indicated that they are including certain ESG metrics and disclosures within audited financial statements.

Regardless of where ESG information is reported, management—with board oversight—has an obligation to provide useful information to stakeholders and decision-makers, supported by facts and data that have integrity. The quality of data, and processes used to obtain it, should follow similar standards as other data reported in traditional financial statements. Companies are warned against including “overly aspirational” statements in their disclosures about ESG goals and objectives, or “greenwashing” by making misleading claims about environmental practices, performance or products.

Overseeing corporate reporting, inclusive of ESG and other material disclosures, is an integral part of the board’s role in governance. Amid continued uncertainty in the year ahead—regarding COVID-19, economic outlook, potential legislative changes and more—the need to accurately report on how strategic pivots toward growth are impacting financial results will be crucial. The ways that boards respond to increased transparency demands from all stakeholders, not just shareholders, will be one measure that sets the good apart from the best.

About the 2021 BDO Fall Board Pulse Survey

The 2021 BDO Fall Board Pulse Survey, conducted by Market Measurement, Inc., an independent market research consulting firm on behalf of the Corporate Governance Practice of BDO USA, examined the opinions of 230 corporate directors of public company boards in July 2021.

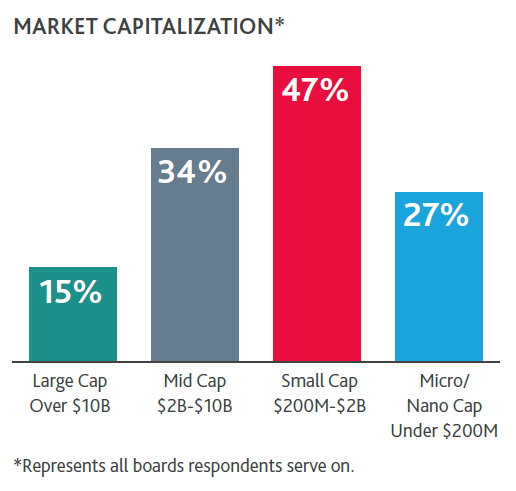

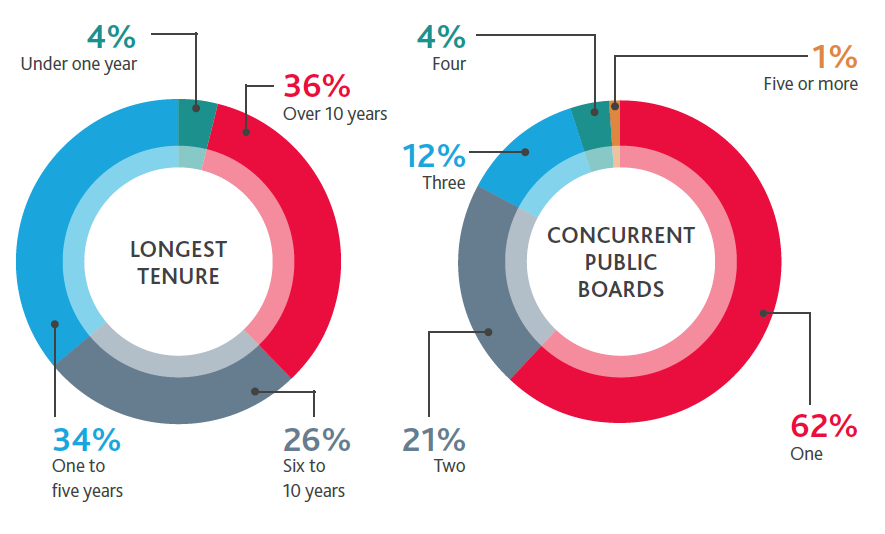

Respondents sit on boards across industries, including but not limited to technology, retail, nonprofit, manufacturing, financial services, energy, healthcare, life sciences, real estate, education and hospitality. Participants’ board experience was also noted based on the number of concurrent boards served, director tenure and size of company served:

Print

Print