Benjamin Colton is Global Co-Head of Asset Stewardship, Michael Younis is Vice President, and Devika Kaul is Asset Stewardship Analyst at State Street Global Advisors. This post is based on their SSgA memorandum.

Voting Record

Our Voting Record on Climate Related Shareholder Proposals for 2ºC Scenario Proposals

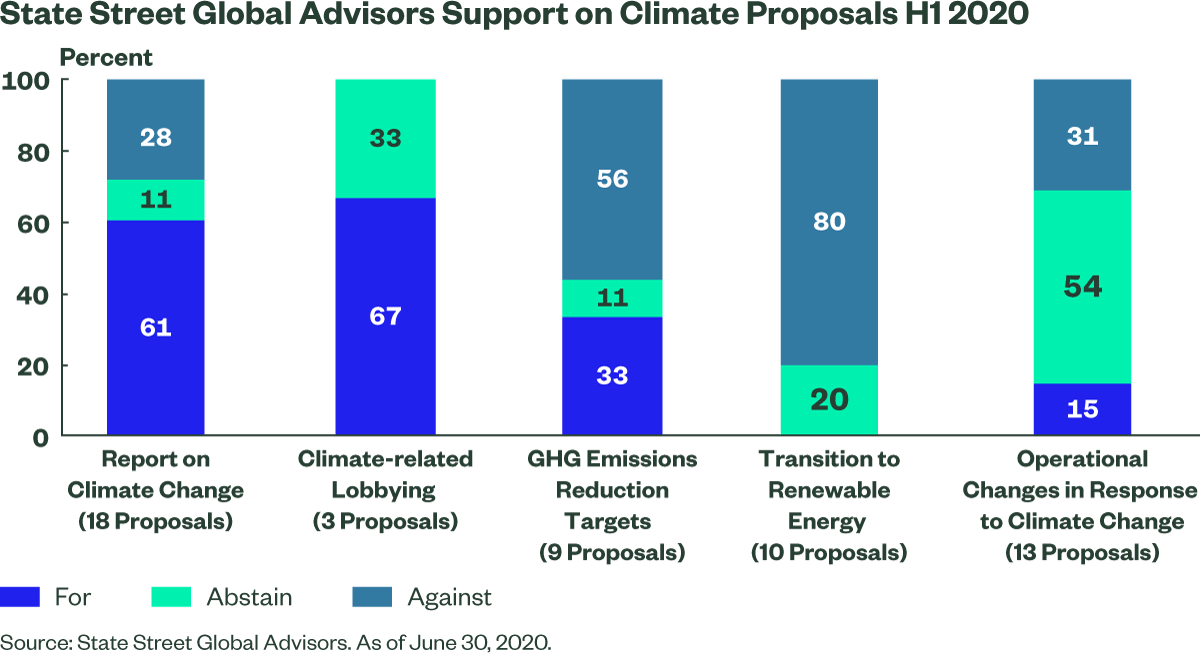

Our voting on climate change is typically prompted by shareholder proposals. However, we may also take voting action against directors even in the absence of shareholder proposals for unaddressed concerns pertaining to climate change. The number of climate-related proposals on company ballots has been steadily increasing over the past few years. Annually, we review and vote every climate-related proposal in our portfolio. We also endeavor to engage with the proponents of shareholder proposals to gain additional perspective on the issue, as well as with companies to better understand how boards are managing relevant risks.

Engagement Record

Our Engagement Record – More than 600 engagements on climate-related issues since 2014

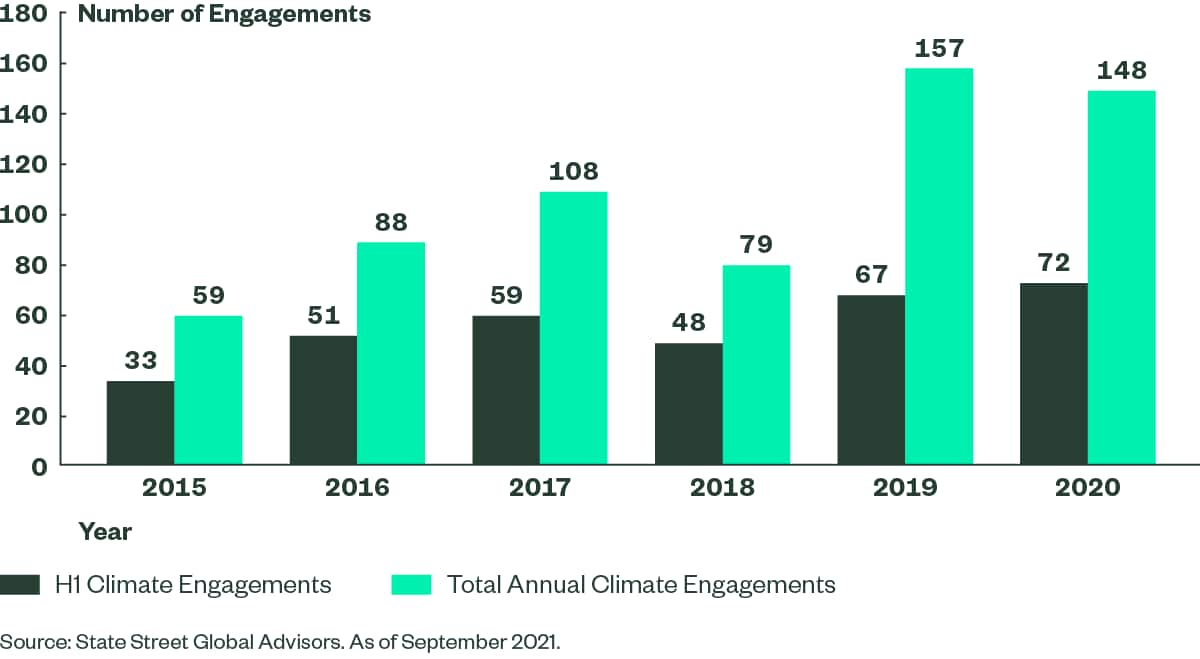

We engage with companies to understand their approaches to mitigating and managing the physical and transitional impacts of climate change. Since 2014, we have engaged with more than 600 companies across multiple industries on climate-related issues. Our engagement approach leverages the four dimensions of the Task Force on Climate-related Financial Disclosures (TCFD) framework: Governance, Strategy, Risk Management, and Metrics. We expect companies to disclose their approach to identifying climate-related risks and the management policies and practices in place to address such issues.

Our Latest Thinking

- Climate-Related Disclosures in the Technology Sector

- Climate Change Risk

- Perspectives on Effective Climate Change Disclosures

- Driving Action on Climate Change

- Climate-Related Disclosures in Oil and Gas, Mining and Utilities

- Effective Climate-Risk Disclosure in the Agricultural and Forestry Sectors through the lens of the TCFD

- Statement of Support for the Task Force on Climate-Related Financial Disclosure

- Annual Climate Stewardship Review

Advocacy

The Climate Action 100+ initiative seeks three central outcomes through engagement with companies on climate change: improving governance of climate change, reducing emissions, and strengthening climate-related disclosure. These goals are consistent with what State Street has advocated for in our company engagements, through our thought leadership, and, where needed, communicated through our voting process. The alignment between our climate stewardship approach and that of Climate Action 100+ is evident in our advocacy of the TCFD and Sustainability Accounting Standards Board (SASB) frameworks, which both are in line with the spirit of Climate Action 100+’s efforts.

Climate Investing

We believe climate change is one of the biggest risks in investment portfolios today. These risks impact almost all segments and industries—not just the obvious polluters. However, with climate risk comes tremendous investment opportunity as the economy reworks against the impact of climate change.

UN PRI 2020 Leaders’ Group

Proud to be among the 20 asset managers named to the 2020 Leaders’ group for climate reporting.

Action at State Street

Climate Related Reporting

As a signatory of the Task Force on Climate-related Financial Disclosure (TCFD) recommendations, we are engaging with companies to review the quality of their climate reporting and to understand how boards oversee climate-related risks.

We are pleased to announce that State Street is committing to reducing our carbon emissions on an absolute basis over the next 10 years in accordance with the Science-Based Targets initiative (SBTi), and we will achieve carbon neutrality for our Scope 1 (natural gas) and Scope 2 (electricity consumption) emissions this year. Carbon neutrality is achieved by calculating a company’s carbon footprint and reducing it through a combination of reduction actions plus the purchase of renewable energy credit (RECs).

Print

Print