Karen Wong is Global Head of ESG at State Street Global Advisors. This post is based on her SSgA memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here).

About this Study

In 2021, ESG investing has grown to $35+ trillion—over a third of the world’s professionally managed assets.

ESG is now well and truly mainstream across the globe. Soon ESG investing will be investing, or at the very least a fundamental component of all investing.

Our latest research uncovers the views of more than 300 institutional investors, revealing an industry poised for a surge in decarbonization target-setting over the next three years. Currently 20% of the most sophisticated have already set formal targets and momentum is clearly building for those yet to do so.

Where in the past risk mitigation and performance were the clear key drivers for investors, this time around investors told us that their climate strategies are equally about creating real change and driving the economic transition. Does this signal the start of a seismic shift to performance being measured not solely in terms of returns but also in terms of environmental and social impact?

We found that while implementation approaches vary, consensus is building that traditional benchmarks (and the implicit tracking error) won’t be sufficient and there is a growing acceptance that new benchmarks are needed. Divestment is not a preferred strategy: asset stewardship and engagement are, alongside explicit climate criteria and climate-themed management.

As investors move forward with their decarbonization targets, all major asset classes will be impacted, potentially transforming the shape and composition of investor portfolios across the world.

Methodology and Results

To gain deeper insights into how investors are implementing decarbonization strategies into their portfolios and the challenges they face, in mid-2021 State Street Global Advisors surveyed senior executives with asset allocation responsibilities at over 300 institutions. They included private and public pension funds, sovereign wealth funds, endowments, foundations, and official institutions from across the world. Respondents are directly involved in or influence asset allocation decisions.

The survey was conducted by a combination of online questions and telephone interviews. The results were analysed and collated and comprehensively supplemented by a series of in-depth interviews with senior institutional investment professionals.

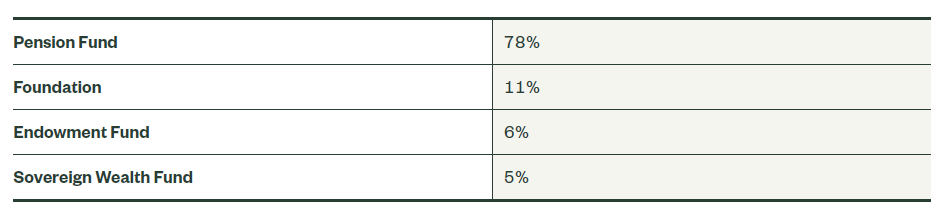

Figure 1. Institution Type

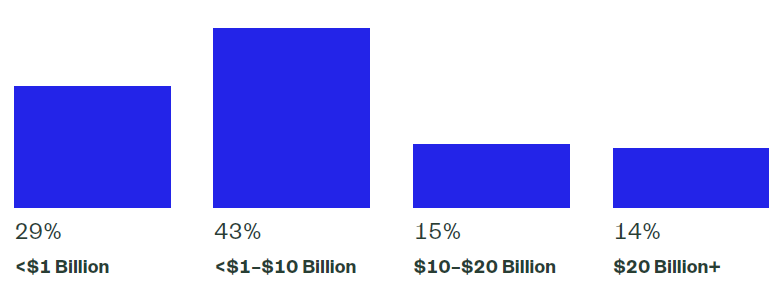

Figure 2. Assets Under Management (USD)

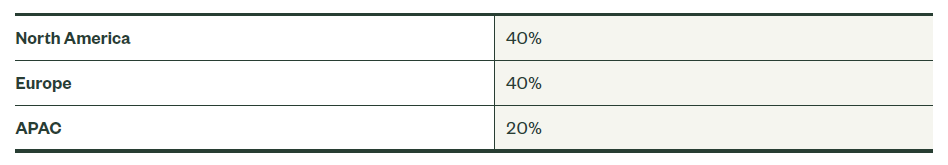

Figure 3. Region

How Investors’ Global Focus On Carbon Is Set to Alter the Game

1. Targets are Coming

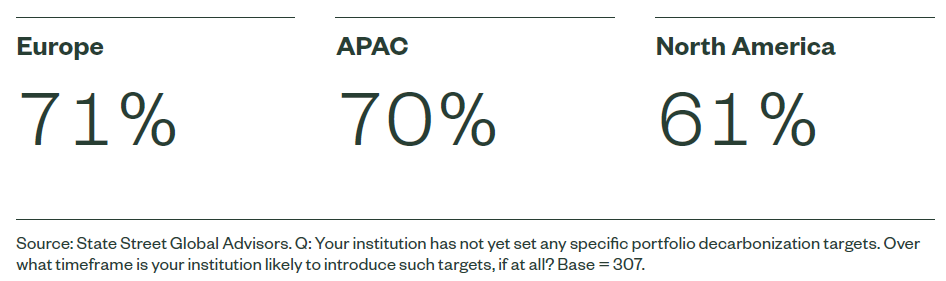

Only 20% of investors globally have committed to a specific portfolio decarbonization target, but a further 2/3 say they will introduce them within the next three years (71% in Europe; 70% in APAC; 61% in NA).

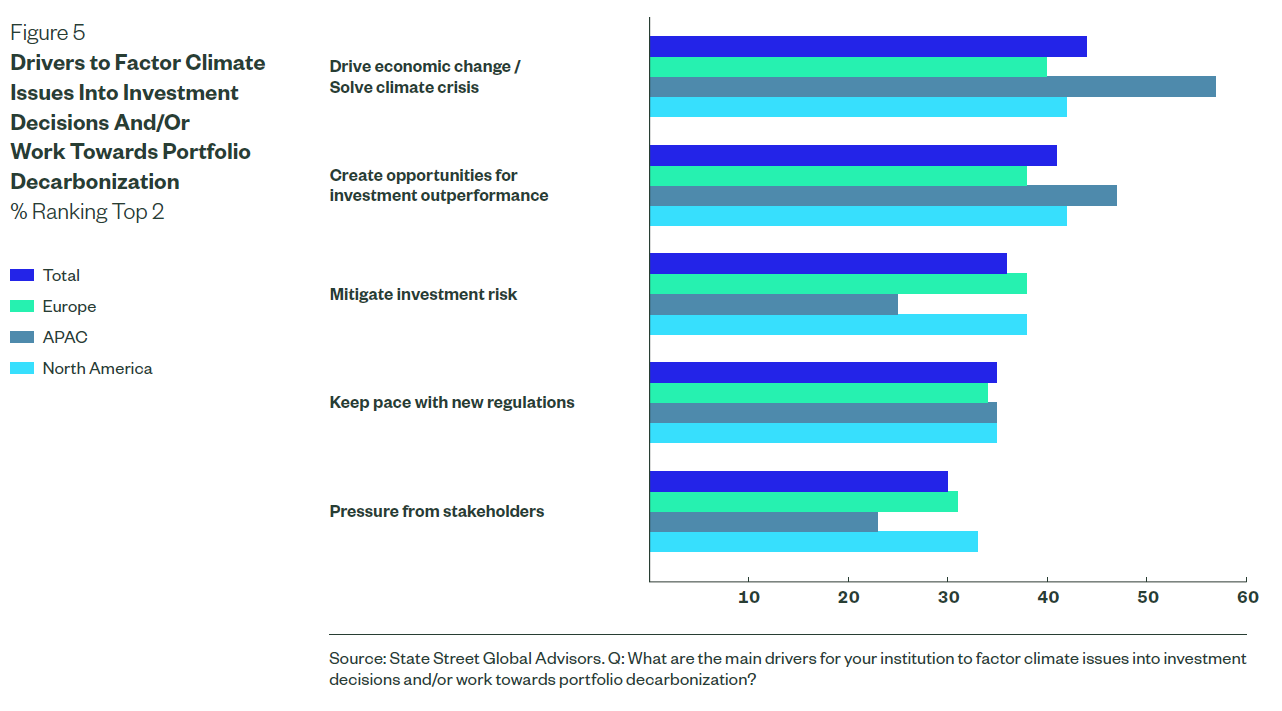

What’s driving investors? 44% cite their responsibility to drive the economic transition and help to solve the global climate crisis as their top two reasons for climate investment strategies, slightly ahead of driving outperformance (41%) and mitigating investment risk (36%).

2. Benchmarks, Barriers and Bold Leaps

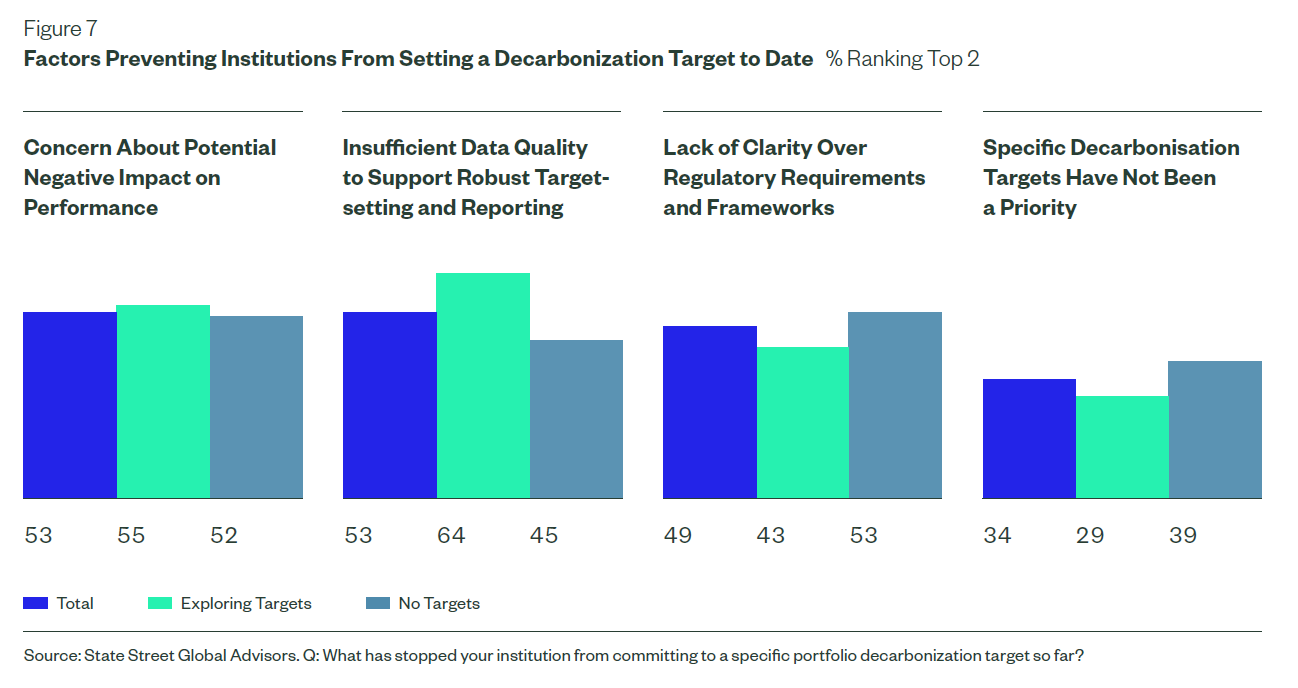

Quality ESG data is still considered a challenge and performance concerns linger for some. For those yet to set decarbonization targets, the equal-ranking top barriers to doing so were concerns about the possible negative impact on investment decision-making and performance (53%) and the quality of data from company disclosures and data providers being insufficient to support robust target-setting (53%).

Decarbonization highlights the need for bold action to either broaden tracking error allowances or move to more appropriate carbon or climate-focused benchmarks.

Three-quarters of European pension funds say their preference is to move away from standard benchmarks for their index portfolios, moving to an ESG-, climate-tilted or custom benchmark.

3. Many Pathways to Paris

All asset classes are being considered but equities, fixed income and real estate are top priorities for those who have already set targets. Over half of investors are integrating ESG or green bonds into existing fixed income strategies. Over half aim to use green bond indexes as part of their portfolio strategy.

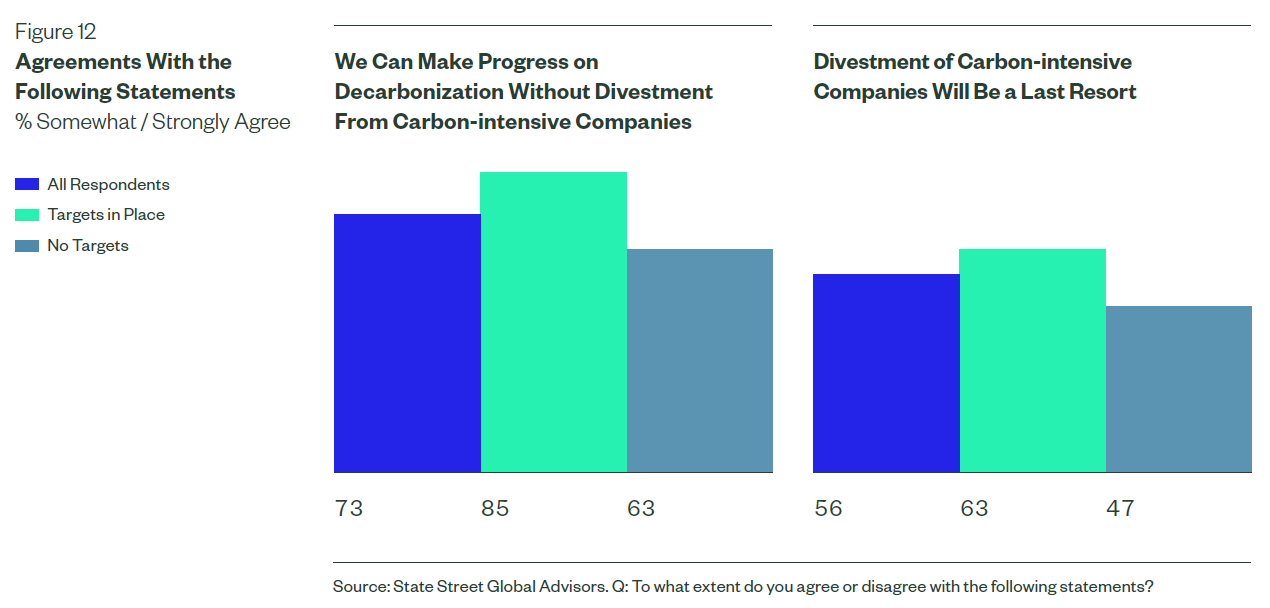

Over 80% of investors with decarbonization targets say increased allocations to climate-thematic funds will be highly important to making progress over the next three years. Just 57% say the same about divestment, and 63% say this will be considered an option of last resort. Engagement is preferred.

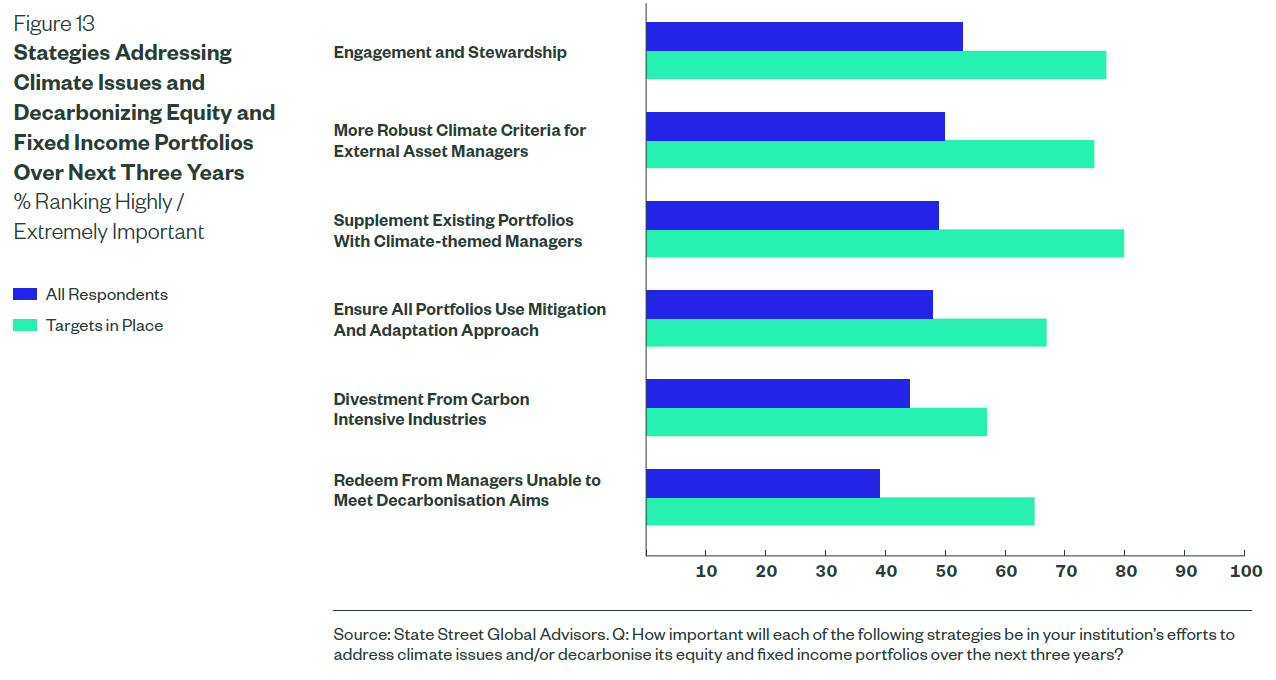

In terms of what respondents consider the most important medium-term strategy to address climate issues, asset stewardship and engagement were top, followed by employing more robust climate criteria when selecting their asset managers, then supplementing existing equity and fixed income portfolios with climate-themed managers. When considering only those respondents that have already set targets, the latter approach was most preferred.

Targets Are Coming

Decarbonization targets are set to surge across all regions over the next three years.

Already 20% have set targets. Asset owners say their responsibility to drive real change is as important as pure investment motivations. This is a major change in sentiment from previous years when such aims were minor factors in driving investing behavior.

Decarbonization Target-Setting Is Set to Ramp Up Significantly

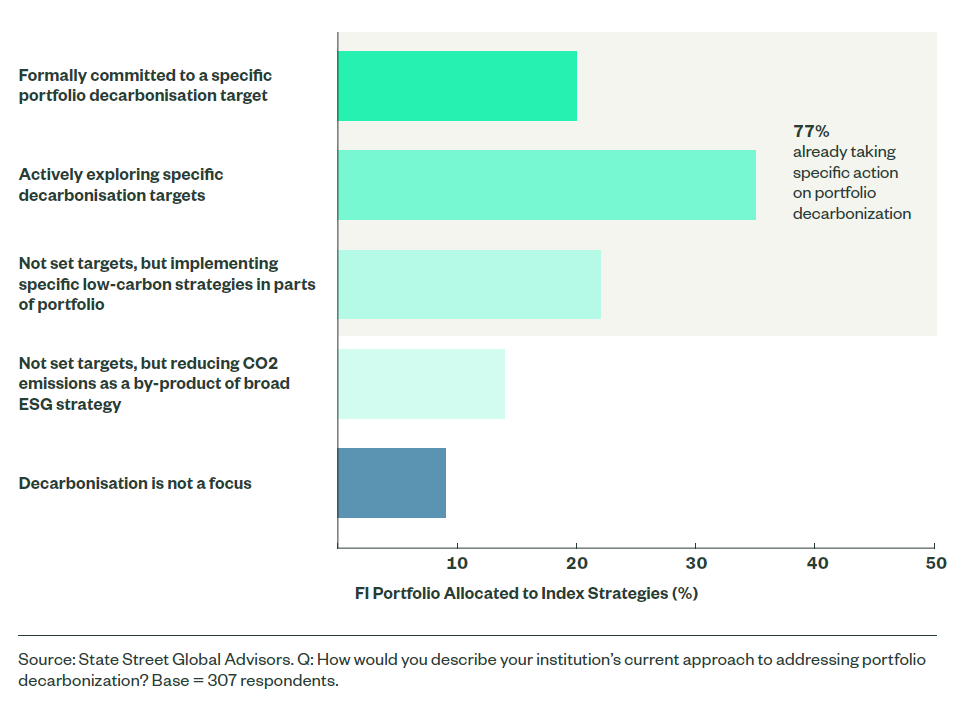

Already 20% of asset owners have committed to a specific portfolio decarbonization target and

the majority are taking deliberate action to reduce the carbon footprint of their portfolio. In total,

over three-quarters (77%) of respondents were already taking (either targeted or non-targeted)

action on decarbonization. It was not a focus for a mere 9% of respondents globally.

Figure 4. Current Approach to Addressing Portfolio Decarbonization

High Intention to Set Targets Over the Next Three Years

While only 20% of investors globally have already committed to a defined portfolio decarbonization target today, almost three-quarters of European and APAC investors say they will introduce them within the next three years, and over three-fifths of North American investors intend to do so.

The Benefits of Targets

Committing publicly to a number gives you an ambition to move towards. If you want to hit Paris alignment, that [net zero by 2050] is what it looks like. If one doesn’t have a target, you can still measure where you are, but it’s difficult to know where you’re getting to and how to plan. I think we’ve moved past the point of just having funds that are run with an ESG overlay, because that can mean, under some definitions, that you still end up with a lot of carbon-intensive industries as long as they’re valued appropriately based on analysis of the ‘E’ risk. It doesn’t force you to get to a Paris-aligned world. That’s the difference between running money in an ESG fashion and having a target/policy that drives you to remove emissions from your portfolio.”

—David Vickers, CIO, Brunel Pension Partnership

What’s Driving Investors?

Helping solve the global climate crisis is at the heart of investors’ climate investment policy. As to motivations, 44% cite their responsibility to drive the economic transition and help to solve the global climate crisis as their top motivator for climate investment strategies, slightly ahead of creating outperformance (41%) and mitigating investment risk (36%).

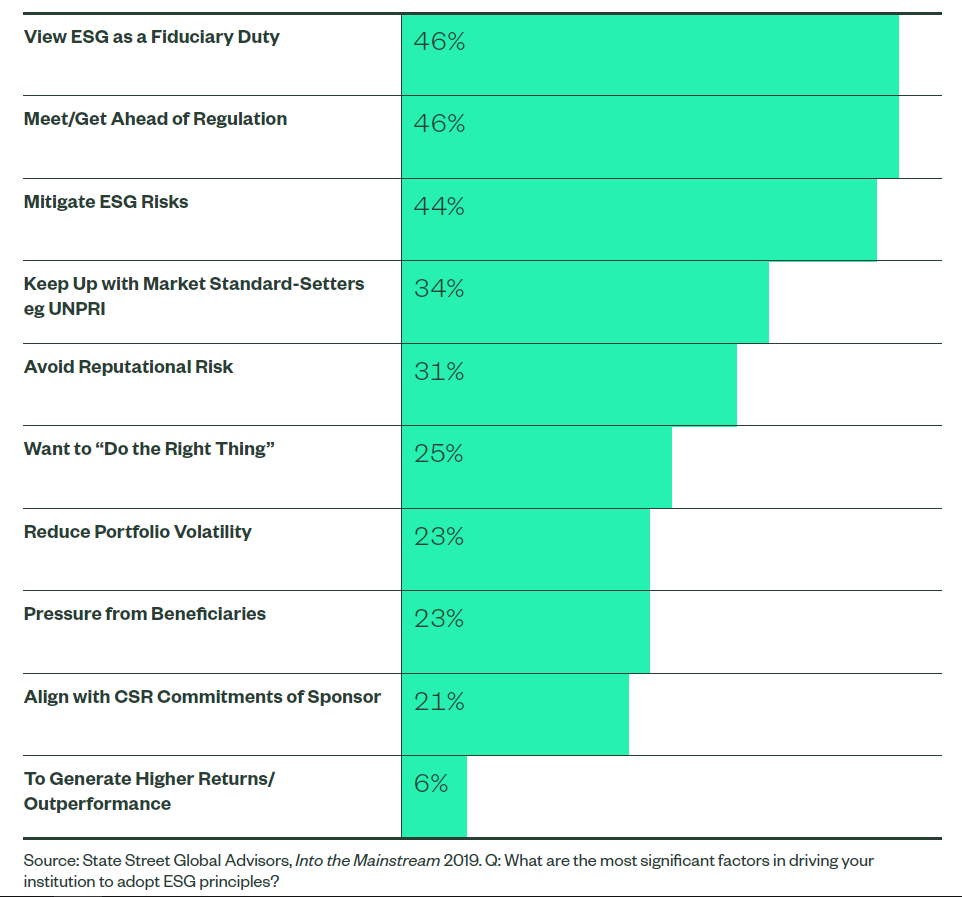

This shows a significant development from previous stated investor motivations. In our earlier ESG survey, Into the Mainstream, the top drivers were fiduciary duty, regulatory landscape, and investment risk, and ‘doing the right thing’ was much further behind in sixth place.

Thoughts on Risk

When we’re looking at these systemic risks, we have to look much broader than a smaller fund, which might be able to protect its assets by relocating them. We are too big and too long term—we have nowhere to hide. So that means we have an interest in making sure that the market and the wider system is protected. If we sold those 100 companies, our ownership of emissions would drop by 85%, but we’d still be exposed to the risks of global warming.”

—Investment Director, US Public Pension Fund

What’s Changed Since Last Time Around?

When we asked a similar global cohort of institutional investors in 2019 what factors were most significant in driving them to adopt ESG principles a very different picture emerged. Fiduciary duty and a need to meet regulation took the top spots and generating higher returns or outperformance was last at 6%.

This is very different from today with a desire to create real change taking the top slot and—perhaps enabled by the increased awareness of climate change being a systemic risk—opportunities for creating investment outperformance powering up to second place.

Figure 6. 2019’s ESG Drivers

Planning the Journey to Net Zero

The 2016 Paris Agreement makes it imperative for investors to plan their journey to net zero. A number of frameworks exist to help asset owners and managers reach net zero, providing guidelines on decarbonizing portfolios, increasing investments in climate solutions and green technologies, and improving reporting.

Asset class alignment is a key factor for aligning investments to appropriate net zero pathways within each asset class. There are 4 key elements in this critical part of implementation.

Portfolio Construction

There are several potential steps that investors may take here, including positively weighting towards good alignment-criteria performers for existing assets, applying screening criteria for new active assets, using the right indexes or solutions, as well as allocating to green bonds.

Engagement

Investment strategies should prioritise engagement and stewardship as a mechanism to drive alignment. For asset owners such engagement is often implemented by their asset manager.

Selective Divestment

Engagement and stewardship actions are typically recommended as the main tool to achieve alignment. However, divestment and exclusion may be considered where there is climate-related financial risk; to escalate after unsuccessful engagement or where the company’s primary activity is no longer considered permissible in terms of credible net zero pathways.

Reporting

Relevant reporting can help investors meet regulatory and disclosure obligations to beneficiaries, trustees, and other stakeholders. The right climate reporting solutions can help investors understand how their strategies perform against their investment aims, including climate-focused objectives.

Barriers, Benchmarks, and Bold Leaps

Quality ESG data is still considered a challenge and performance concerns linger for some.

Portfolio decarbonization highlights the need for bold action to either broaden tracking error allowances or move to more appropriate carbon or climate-focused benchmarks.

Data and Performance Concerns Linger

Data quality and concerns about performance remain the key barriers holding investors back from committing to decarbonization targets. This is followed by some uncertainty around which frameworks to follow and/or lack of clarity over regulations.

Performance Concerns Unfounded for Some

We constructed a low-carbon index for our passive equity portfolio to remove some of the biggest emitters. We could do that without materially impacting the diversification or the strategy of the fund. To date, it’s proven that it hasn’t impacted returns in a negative way. We’ve actually generated a small amount of alpha from that.”

—Head of External Investments, APAC Super Fund

Data Difficulties

Deciding to do a carbon footprint of our equity portfolio was not a simple exercise because the data is not there consistently. We had to estimate, basically using modelling.”

—Investment Director, US Public Pension Fund

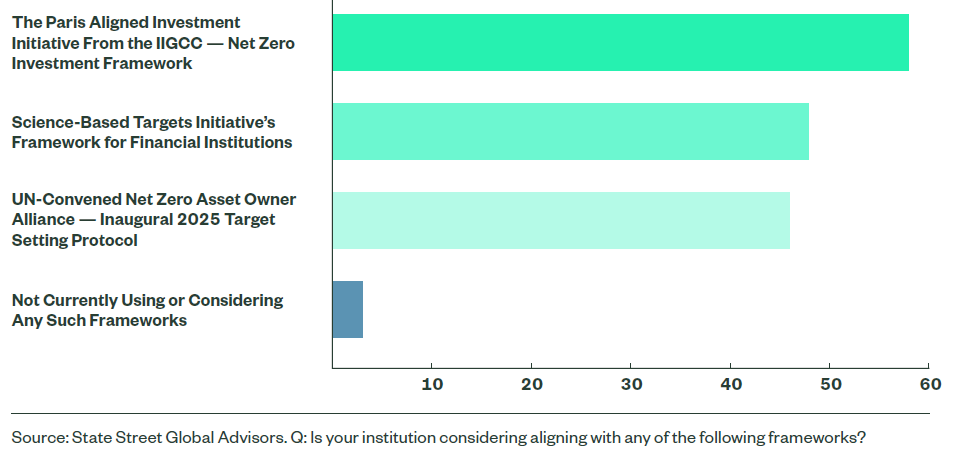

Spotlight on Frameworks

With so many variables and possible pathways to decarbonization, industry frameworks are an important element of successful implementation. We asked our respondents which of the frameworks they were adopting. The influential Institutional Investors Group on Climate Change (lIGCC) framework came out on top, with 58% of respondents saying that they used or intended to use it. State Street Global Advisors has adopted the IIGCC for its own journey to net zero.

Figure 8. Industry Framework Adoption (Percent)

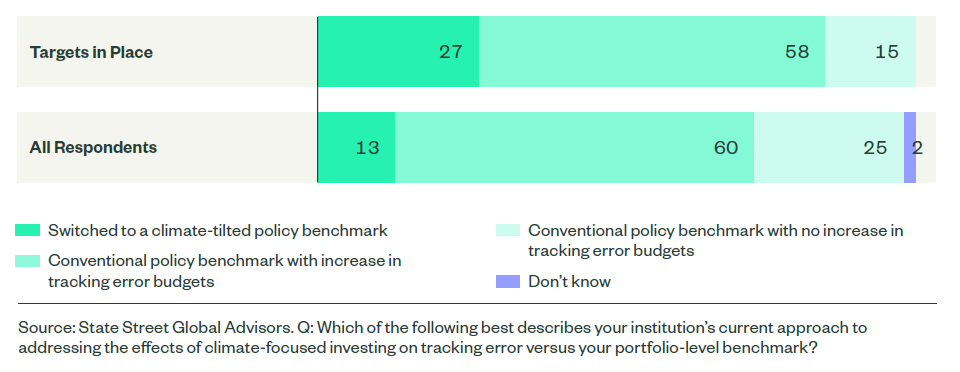

Tracking Error Allowances Increased

The majority of investors are currently sticking with conventional benchmarks at portfolio level but have increased tracking error budgets.

Figure 9. Current Approach to Addressing the Effects of Climate-focused Investing on Tracking Error vs. Portfolio-level Benchmark (Percent)

Tracking Error or New Norm?

To start with at the investment committee level, we were discussing how much tracking error would we be willing to accept? We were willing to accept a reasonable amount of tracking error to implement changes as we pursued our targets, but as we went on that journey, we transitioned to thinking, well, actually this just needs to become our benchmark—this is an undue risk of such consequence for a long-horizon investor that it needs to be reflected in our default portfolio.”

—Del Hart, Head of External Investments and Partnerships, NZ Super Fund

The Right Benchmark for the Job

We’re saying to clients, “You have passive investments. If you want to hit your net zero commitments, we need to move you to a Paris-aligned benchmark.” That starts to triangulate factors such as percentage of revenues, their TPI score, their fossil fuel reserves. If you don’t have a Paris-aligned passive benchmark to follow, the industry as a whole will struggle to get there given the weight of money tracking traditional benchmarks. It also allows you to be more precise about the risks you’re taking. The decision to become Paris-aligned is a strategic decision by the pension funds, and the benchmark should reflect that.”

—CIO, European Public Pension Scheme

A Move From Standard Index Benchmarks

Two-thirds say that moving away from standard index benchmarks will be their preference over time for passive equities and fixed income portfolios. Some 65% say switching to an ESG or climate-specific benchmark is their preference for index portfolios—this is much more pronounced in Europe (75%) than in North America (52%).

This reflects our own experience with clients and we’re seeing broad ESG mandates that incorporate carbon or climate-specific aims. The decision to move to decarbonization, towards Net Zero, toward Paris alignment is a strong statement of intent and there is often an attendant realization that the old benchmarks are not appropriate enough to fully support these intentions. For many investors a decision is made to accept greater tracking error, or perhaps even more appropriately to move to specialized carbon or climate benchmarks.

Figure 10. Preferred Approach to Addressing the Effects of Climate-focused Investing on Tracking Error vs. Benchmarks in Index-based Equity and Fixed Income Portfolios (Percent)

Thoughts on Benchmarks

By moving to a new benchmark, we put the risk in the right bucket. It’s a strategic risk, arguably, to move towards net zero relative to your market cap weighting, and it just highlights what is true alpha and what is basis risk vis-a-vis the benchmark. If those stocks have a good or bad time, they can’t be owned anyway, so it’s not alpha. I call it secular alpha, but it’s not manager alpha. They are excluded for a reason; they’re not excluded because they’re not deemed to be profitable stocks.”

—CIO, European Public Pension Scheme

Many Pathways to Paris

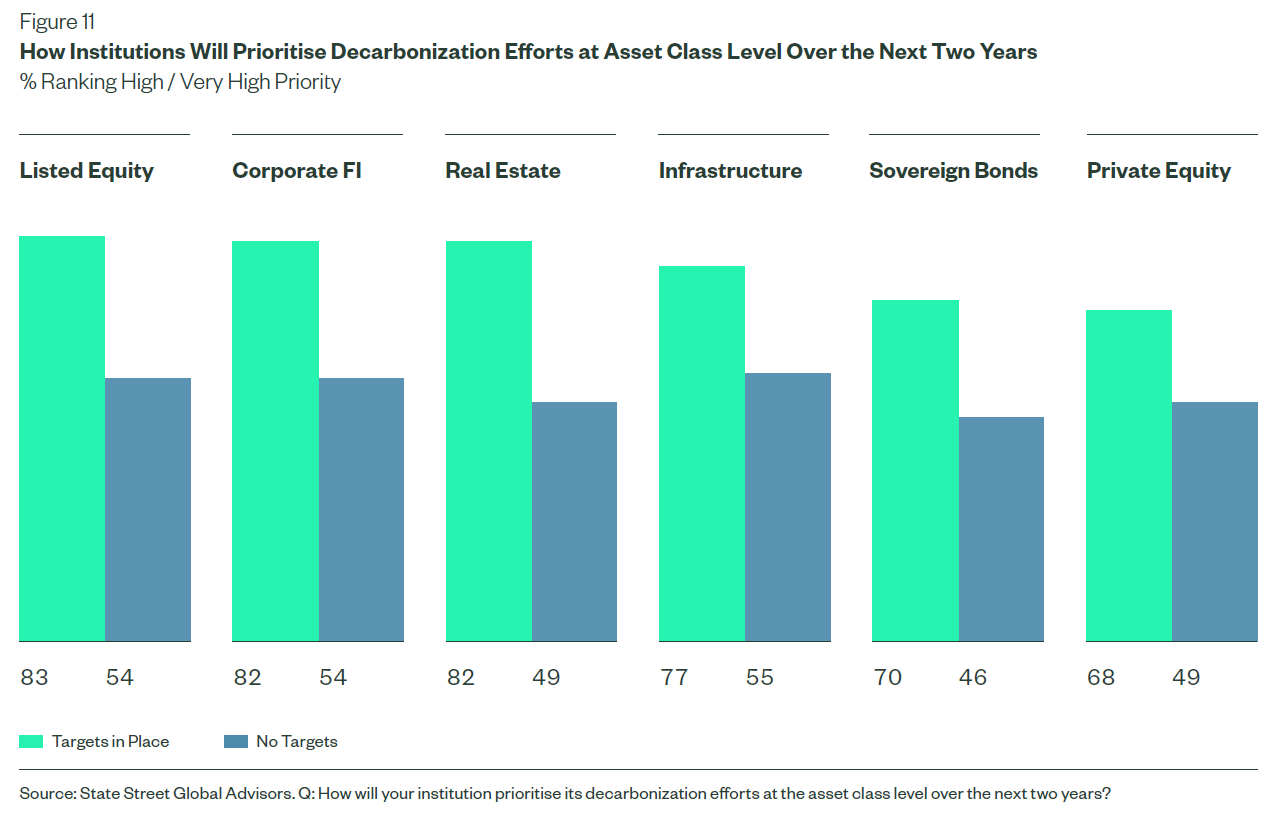

Equities and fixed income are top priorities, but all asset classes are under consideration.

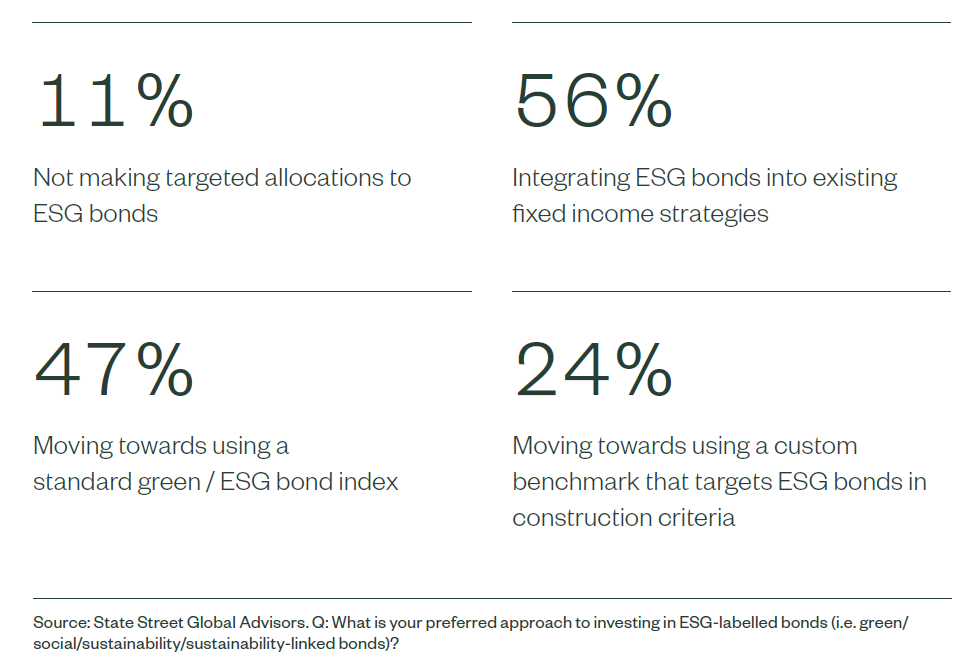

Over half of investors are integrating ESG or green bonds into existing fixed income strategies and half aim to use green bond indexes as part of their portfolio strategy.

The vast majority (80%) say increased allocations to climate-thematic funds will be highly important in the coming years.

Respondents’ preferred strategy to address climate issues is strongly asset stewardship and engagement, followed by more robust climate criteria for selecting asset managers, then supplementing existing portfolios with climate-themed managers.

All Assets in Scope

Those with targets are prioritizing decarbonization across all asset classes, but equities, fixed

income and real estate are the highest priorities.

Revealing Opportunities

What we have found over that five-year period is that we’ve increased to about 20% of our private market assets now in climate solutions, which is a significant number. So that is just hard evidence that if you really integrate climate into your risk and return understanding, your whole appreciation of opportunities is transformed.”

—Anne Simpson, Managing Investment Director, CalPERS

Spotlight on Bonds

More than half of investors are integrating ESG/green bonds into their existing fixed income strategies, and almost half aim to use a green bond index as part of their portfolio strategy.

Given the lack of data and nature of the fixed income market, the asset class has typically lagged the equity market in ESG implementation. Things are changing fast, however. The industry has undertaken substantial research into the fixed income market and there are now products that amply enable the ESG objectives of investors. And, given the nature of fixed income, such investments could be considered to help fund the transition to low-carbon—an aspect that can be very appealing for today’s real-change-driven investors.

Pushing Forward on Fixed Income

In fixed income, it’s more difficult, because the disclosure rates are nowhere near as good as they should be. Here we are showing what we think best practice looks like, asking them [managers] to adopt it, and we are mandating it. We put into their mandate that we want them to start to look like X, and report in a certain way, and push their companies for disclosure in order to sustain the mandate they have with us.”

—CIO, European Public Pension Scheme

Divestment Not Preferred

Most investors are confident in their ability to decarbonize without substantial divestment and view divestment as a last resort.

Those with portfolio decarbonization targets are unlikely to view divestment as a primary strategy for achieving their aims, a view also shared by many without targets, though fewer without targets are confident about making progress, perhaps being yet to undertake initial divestments.

Against Divestment

The ones that look “bad” today could be part of the solution. Some have the capital, the infrastructure and even have the biggest renewable businesses, but they’re just cloaked in the traditional businesses, which it could take time to run down. There are companies out there that are committing to net zero, because they’re winding down those assets—they could sell them to somebody else who would continue to develop them, but to the world, that would be a worse outcome. In a holistic sense, keeping assets in the hands of the company committed to winding them down is much better for absolute emissions, but it may make that portfolio that owns that stock look worse. All that said, disinvestment has to be a tool in the armoury, specifically when we are talking about debt markets, where withholding capital has more teeth than simply selling shares to someone else.”

—CIO, European Public Pension Scheme

Understanding the Engagement Versus Divestment Debate

Engagement

Engagement can be broadly defined as the ongoing dialogue between an asset manager and the leadership of invested companies to ensure the effective management of material financial and non-financial (ESG and climate) risks and opportunities.

Impactful engagement is particularly important for index asset managers, who cannot divest their holdings due to their investment mandates. Therefore, engagement and proxy voting become critical tools for oversight of corporate management on climate-related disclosure and practices.

Academic evidence shows that engagement and voting have the power to create positive impact and enhance value.

Divestment

In general, divestment is the selling of all or part of a holding by an investor when the investment thesis changes and can be due to multiple reasons. With respect to ESG, the traditional reason for divestment is ethics—investors wanted to exclude certain investments that did not align with their values-based beliefs. Over the last 30 years, divestment has evolved from an ethical decision to one more driven by investment considerations.

Today, investors sell or exclude specific companies, sectors or countries from their portfolios based on a variety of ESG factors.

However, the challenge for index investors, is that this approach often results in undesirably high tracking error from the benchmark. In general, companies are divested implicitly through optimisation strategies with multiple objectives leading to the reduction of particular holdings below certain thresholds to achieve ESG and return objectives. This results in de facto divestment.

A Nuanced View

While divestment is necessary at times, we believe it is not sufficient to create genuine climate impact by itself. Why?

With divestment, investors lose their impact to bring about positive and lasting change. Instead, companies can be bought by investors who lack a clear climate strategy, or they can go into the hands of private owners with no market scrutiny.

A more nuanced approach holds that rather than just divesting from non-aligned business, climate change risk may well be best controlled through active dialogue and engagement with those businesses.

The Importance of Engagement

Investors view engagement and more robust criteria for asset managers as the most important strategy to address climate issues over the next three years.

Those with decarbonization targets in place also cite increased allocations to climate thematic managers as highly important to portfolio decarbonization, which may be indicative of demand to increase their focus on climate solutions.

Towards the Future

Our survey illuminates some regional and institutional divergence on approaches to decarbonization, but some themes are clear no matter the region or investor type:

- Decarbonization targets will be very much the norm.

- All major asset classes will be affected.

- Decarbonization motivators have changed substantially over time with a desire to drive real change overtaking the purely regulatory, risk and performance concerns of the past. The industry is reflecting this with the deployment of a wealth of new climate initiatives.

- Investors need the right data to make the right ESG decisions.

- Implementation can be complex. Bold decisions will need to be made over benchmark and tracking error.

- Asset stewardship and engagement are more important than ever.

From implementation methods to benchmarks, data to divestment, investors face a number of choices to achieve net zero. Decarbonization targeting is on an upward trajectory and investors must solve these issues to get their portfolios in shape for tomorrow’s economy and the opportunities of the future.

Print

Print