Maria Castañón Moats is Leader, Paul DeNicola is Principal, and Leah Malone is Director at the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

The corporate world is never static, but the first years of this decade have presented an unusual compilation of challenges. The COVID-19 pandemic has posed a nearly unprecedented public health emergency, with lasting global implications. The stock markets have reached record highs, interest rates have fallen to record lows, and unemployment figures skyrocketed before labor markets tightened. The country weathered a divisive presidential election. At the same time, social justice concerns have taken hold. In 2020, protests for racial justice swept the country, leaving a sustained focus on how to address current inequities and past wrongs.

Against this backdrop, business now beats NGOs, governments, and the media as people’s most trusted institution, according to the Edelman Trust Barometer. Customers and consumers are looking to companies to get involved in social issues in a new way, making statements and creating policies on public concerns that wouldn’t have been top of mind before. This includes social justice issues, as well as companies’ role in dampening the acceleration and effects of climate change.

These changes have had broad impacts on companies, from their employee base to the executive suite—and up to the boardroom. Boards are historically slow to change, in part because they are relied upon as a stabilizing force for corporations. But as the world is changing, directors are driven to change their playbook as well.

Directors see that diversity and inclusion (D&I) efforts are good for both their companies and boardrooms, and they recognize the need to build a culture of belonging. With an eye toward better, more sustainable business outcomes, directors increasingly see a link between ESG and the company’s core strategy. As more workforces return to the office and as the labor market remains constrained, companies are planning for the future of work. Directors see the need to be more involved in those decisions—to develop the right workforce and a talent management strategy for the future. And they know that to confront all these difficult issues, board effectiveness is key. To be best positioned for the future, nearly half would like to see a change on their board.

As the social, environmental, and economic pressures on companies continue to swirl, directors need to be prepared to take on change.

Key findings

Focus areas for boards of directors

Our Annual Corporate Directors Survey highlights a number of areas where boards are making progress and operating with a new playbook. But the work of improving governance and board oversight is not done. Here are six areas directors say are calling for board focus.

Invest more time and resources in board ESG oversight

According to our survey, ESG is the top issue shareholders want to discuss with directors, and is a critical area of board oversight. But with just 25% of directors saying their board understands ESG risks very well, many boards have work to do to bring directors up to speed. Some boards are forming new committees to focus on the issue, but that’s not always necessary. What is necessary is giving the topic enough attention and time on the agenda, and providing directors with the education they need.

Connect ESG to company strategy

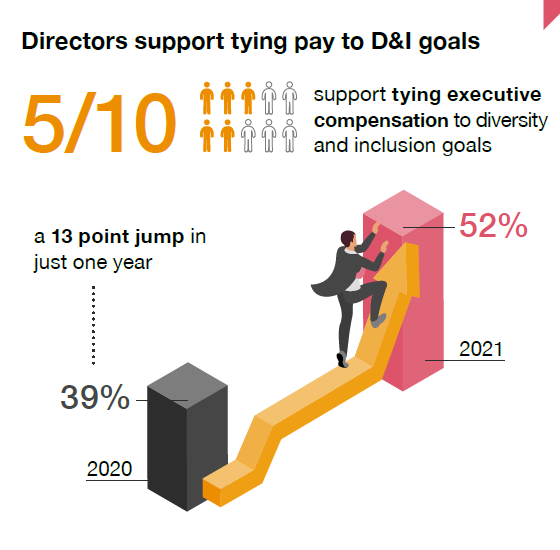

The most critical part of tackling ESG is to embed these long-term concerns into company strategy. For the 36% of directors whose boards are not doing this yet: now is the time. One way to enforce the connection is by tying executive compensation to non-financial metrics. While a growing percentage of directors support the idea, relatively few companies are doing it.

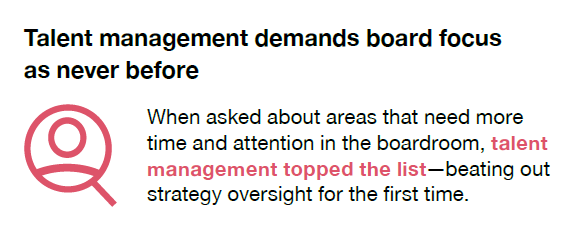

Prioritize talent management oversight and the future of work

The COVID-19 pandemic and its follow-on impact has required many employers to radically re-envision what the workplace looks like. Overseeing talent is a complex job, and according to directors, it’s the area that most demands additional board time. To be in a position to compete, companies need to attract the best talent. And directors need to understand how the company is differentiating itself in that regard. The board needs to be involved in decisions about how the company’s workforce strategy may evolve in the future, and ensure that strategy maps the way to greater diversity and inclusion among the workforce.

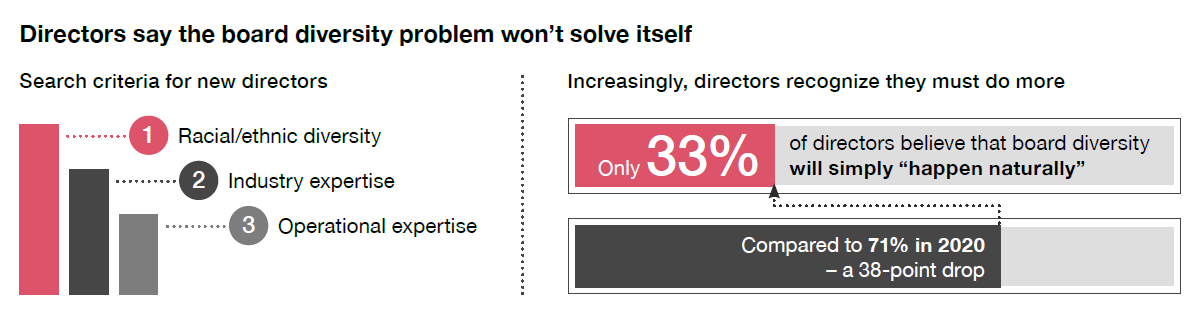

Tackle board diversity through refreshment

Directors see that board diversity is a problem that needs to be addressed, and unlike a few years ago, most now think that it won’t just fix itself. While directors aren’t ready to embrace diversity mandates, they can make significant improvements by setting goals and creating an internal succession plan. The full board should think about what its composition should look like two, three, or four years from now, and create a plan to get there.

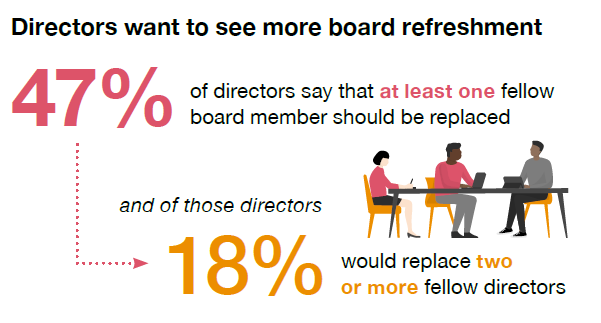

Double down on board assessments

Almost half of directors (47%) think that one or more of their fellow board members should be replaced. Boards don’t have room for directors who are underperforming, or are just no longer the right fit for the board. Every board needs to be conducting individual director assessments, every year, in order to identify the areas that could and should be changed and improved. Board chairs or lead directors should hold a one-on-one meeting with each director and share honest, candid (even uncomfortable) feedback each year.

Re-examine board priorities

When asked which areas of board oversight demand more time and attention, 34% of directors agreed that talent management tops the list. But beyond that, they showed a range of different priorities. Ensure that the topic of board priorities is given ample air time for directors to come to a consensus about where to focus next.

The complete publication, including footnotes, is available here.

Print

Print