Maria Castañón Moats is Leader and Stephen G. Parker is Partner at the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

ESG’s impact on financial statements

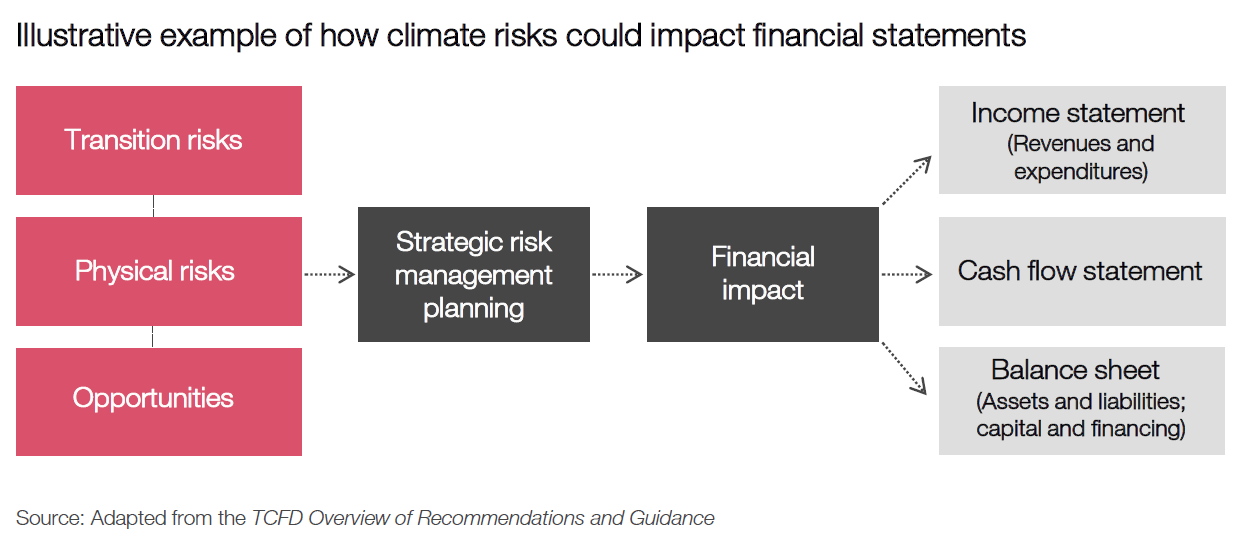

Partially in response to stakeholder pressure to integrate ESG into company strategy, many companies are doing more to address ESG risks and opportunities. Common initiatives include making net zero commitments, tying ESG KPIs to executive compensation, improving diversity in the workforce, and addressing data privacy concerns. In addition to being included in the company’s voluntary ESG reporting, these actions may have material effects on the company’s financial statements. For example, as traditional car manufacturers move away from the production of fossil fuel-powered vehicles, they may need to develop new or transform existing manufacturing plants to build electric vehicles. Initiatives of that size would certainly require the approval of the full board. But once the board has signed off on the strategic shift, it’s the audit committee that needs to pay close attention to the potential impacts such a strategy change may have on the company’s financial statements. Determining the need for enhanced disclosure and the recognition and measurement of financial statement impacts may be straightforward in some cases, while in other cases they may be more complex.

One area that requires management judgment relates to pledges like net zero commitments. Companies are facing challenges on how to account for programs, such as buying carbon offsets, that help companies meet their goals, but may not fit easily into current US GAAP.

Another area that may present some complexities is “sustainability-linked financing.” Some companies are pursuing this type of financing, in which interest rates are linked to metrics that incentivize certain ESG goals. These features may also be included in other financial instruments such as derivatives, and the features may make valuation more complex.

As companies start to integrate ESG into their strategy, they should also consider the potential impacts on their existing assets, including valuation and useful life estimates. For those companies overhauling their business models, legacy assets may even need to be assessed for impairment.

What should the audit committee be thinking about?

Audit committees will want to pay closer attention to the financial statement impacts as management integrates ESG into the company’s strategy. The importance of the timing of disclosure, the potential for significant charges due to impairments, and the lack of specific authoritative accounting guidance for certain ESG-related transactions warrants greater oversight. The audit committee may want to ask the following questions:

- What ESG programs have management put in place and how do they impact the financial statements?

- Is the audit committee informed of all new goals and milestones management has put in place and how are they tracking against those goals? Should any of that information be disclosed in SEC filings?

- How is management keeping track of guidance from regulators on ESG and its impact on the financial statements?

- How is management keeping track of any industry-specific ESG guidance and trends?

- How is the disclosure committee involved in ensuring the necessary ESG information is disclosed within the financial statements?

- How has management ensured there are no inconsistencies between public statements on analyst calls or investor presentations, ESG reporting, and the financial statements and related disclosures?

SEC current and expected rules

When the SEC announced its annual regulatory agenda in June 2021, it signaled a continued focus on increasing the transparency of a variety of ESG-related disclosures. Notable among the proposed rulemaking areas were topics relating to human capital, including workforce diversity, climate risk, cybersecurity governance, and corporate board diversity.

Human capital

New human capital disclosure requirements became effective in November 2020. Companies must provide a description of their human capital resources. This includes the number of employees as well as any measures or objectives that address the development, attraction, and retention of those employees.

In the wake of implementing these new rules, SEC Chair Gensler indicated that additional human capital disclosures, particularly related to DE&I, would be on the way. In public statements made in May, Chair Gensler said the SEC staff would propose a new rule that would address the specific disclosure of workforce or “human capital” metrics. The disclosures could include data on issues such as workforce diversity, part-time versus full-time workers, and employee turnover. The SEC is expected to issue a proposed rule in early 2022.

Climate change

Climate change-related risk disclosures are at the forefront of the SEC’s agenda. In February 2010, the SEC published an interpretive release to provide guidance to public companies regarding existing disclosure requirements as they apply to climate change matters. Since climate risk informs investment, analysis, and proxy voting decisions, the SEC recently issued more comment letters to companies asking how they have considered the impact of climate change in their current disclosures.

While the outcome certainly depends on a company’s particular facts and circumstances, registrants should be evaluating the ways climate change may trigger incremental disclosure required by existing rules and regulations. This could include the impact of legislation, regulation, international accords or treaties, a strategic shift in response to climate-related

risks/opportunities, and the physical impact climate change might have on operations and results.

As with human capital disclosures, companies and stakeholders await anticipated climate-related rules, which are expected to be issued in early 2022.

“More than 550 unique comment letters were submitted in response to my fellow Commissioner Allison Herren Lee’s statement on climate disclosures in March…Three out of every four of these responses support mandatory climate disclosure rules.”

—Gary Gensler, SEC Chair, July 28, 2021

Cybersecurity governance

Cyber risk continues to be a top area of focus for many companies, stakeholders, and regulators. The frequency and breadth of ransomware attacks, along with the shift to remote workplaces, cloud-based operations, and increased e-commerce due to the pandemic have expanded cybersecurity risk considerably for many entities.

In 2011, the SEC issued guidance on companies’ disclosure obligations relating to cybersecurity risks and cyber incidents. The guidance highlighted that, while there are no explicit disclosure requirements, companies might still be obligated to disclose such risks and incidents. In response, many companies included additional cybersecurity disclosure, typically in the form of risk factors. However, in light of the increasing frequency and severity of cybersecurity incidents, the SEC published further interpretive guidance in 2018 to assist companies in preparing disclosures about cybersecurity risks and incidents. New proposed rules are expected by early 2022 and are expected to require disclosures that would provide more transparency into companies’ cyber risks.

Other rulemaking

The SEC adopted amendments to Regulation S-K to modernize, simplify, and enhance MD&A, streamline supplementary (quarterly) financial information, and eliminate the requirement to provide certain selected financial data. The amendments reflect a principles-based, registrant-specific approach to disclosure, intended to facilitate an understanding of the company from management’s perspective and enhance disclosures for investors. The new rules are effective for calendar year registrants for the December 31, 2021 Form 10-K.

What should the audit committee be thinking about?

The SEC’s regulatory agenda is very broad and lists short- and long-term regulatory actions that the SEC plans to take. We have highlighted only a few of the items on the agenda. The audit committee may want to ask the following questions:

- What processes and controls have management put in place to support how human capital measures are calculated from period to period?

- How is management preparing for any incremental disclosure requirements related to human capital, climate-related risks or opportunities, and cybersecurity risk governance?

- What additional investment does the company believe is necessary to ensure that it can accurately measure greenhouse gas emissions if it is already being reported or expected to be in the near future—as well as assess the overall impact of climate risk on the business?

- What processes and controls has management put in place to ensure its ESG disclosures (both qualitative and quantitative) are investor grade, irrespective of whether they are included in a sustainability report or SEC filing (e.g., Form 10-K)?

- What tools or other resources does management utilize to combat cyber risk; how comfortable is management that it has the proper processes and controls in place to ensure that information is communicated accurately and on a timely basis if a cyber event were to occur?

- How has management considered whether to add additional technology expertise to its executive team or considered seeking the input of external cybersecurity experts?

The complete publication, including appendix, is available here.

Print

Print