Gail Weinstein is senior counsel, and Steven Epstein and Philip Richter are partners at Fried, Frank, Harris, Shriver & Jacobson LLP. This post is based on a Fried Frank memorandum by Ms. Weinstein, Mr. Richter, Mr. Epstein, Steven J. Steinman, Warren S. de Wied, and Brian T. Mangino.

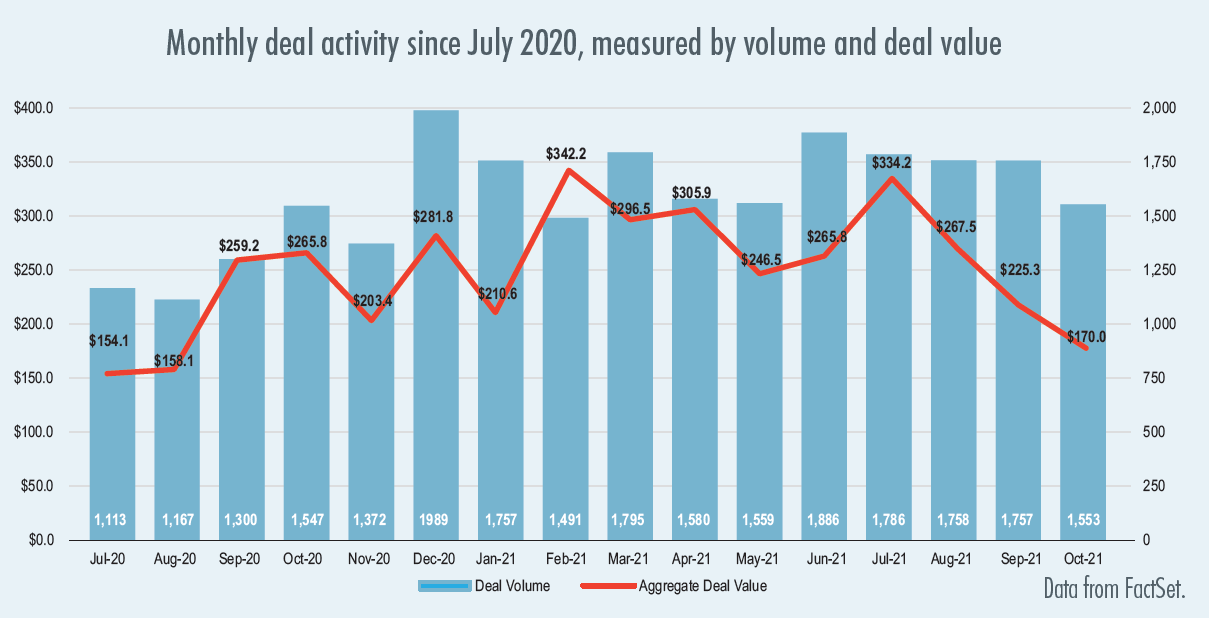

Notwithstanding Record M&A Deal Activity, Significant Drop-off in Deal Values in Recent Months

While global deal activity measured by number of deals has remained at record or near-record levels throughout 2021, average deal value has declined steeply over the second half. Average deal value fell to $109.5M in October 2021, from a high of $187M in July 2021 (reflecting a month-over-month decline trend starting in August). The median P/E ratio reflected in deal values fell to15.3x earnings for the three months ending October 2021, from almost 26x for 4Q 2020. These statistics suggest a continuing very robust deal market, but possibly with a pullback from this year’s record level.

Where Things Stand at the End of 2021

Extremely high level of M&A activity. This high level of activity is being driven by a shifting of market power among companies and between industries as the effects of the pandemic are reflected; pent-up demand from a halt in activity during the pandemic; huge reserves of dry powder and available capital at low interest rates; expanded recognition, post-pandemic, of the key role of digitalization and technology for future growth, the need for stronger supply chains, and the need to address ESG and sustainability issues; some restructurings as pandemic-related government relief programs end; and pressure on SPACs (special acquisition companies—which have proliferated) to find and complete acquisitions within the timeframe required by that structure.

Increase in “hostile” M&A activity. This increase, which began in late 2020, has been focused on companies that have struggled to find organic growth post-pandemic and whose share price has not recovered from pandemic-related market disruptions. Companies whose stock price has underperformed industry peers are generally more likely to be targets of acquirors (or shareholder activists. Shareholder activists’ focus on M&A has continued—with “bumpitrage” campaigns in friendly deals, support for hostile bids, and an increased willingness to launch unsolicited takeover bids themselves (sometimes in partnership with a strategic or private equity buyer). Structural defensive protections continue to be out of favor. (A resurgence of sorts in poison pill adoptions at the outset of the pandemic has not continued.) Stock and option watch programs continue to be important for early indications of hostile interest.

Significant increase in antitrust enforcement, with timing issues and new focus. M&A deals now face prolonged timelines and more risk on the regulatory front—including, it appears, investigation not just of competitive overlap or risk of harm from vertical integration but also other social impacts of a proposed transaction. There has been a rapid shift to increased enforcement of the antitrust laws and, in that effort, the consideration of broader novel theories of harm to competition and/or consumer protection. In September, the new chair of the FTC stated that the agency’s priorities and approaches in reviewing proposed M&A deals will differ from those in the past, with a “holistic” review of deals and a focus on the harms that “Americans are facing in their daily lives.” Further, she stated that, given “the growing role of private equity and other investment vehicles,” the agency will “examine how these business models may distort ordinary incentives in ways that strip productive capacity and may facilitate unfair methods of competition and consumer protection violations,” particularly when “these abuses target marginalized communities.” Over the past few months, the FTC, in some deals, has been seeking information during the second request stage of its investigations about topics such as unions, wages, the environment, corporate governance, diversity, and noncompete agreements.

Among other developments have been the following: suspension indefinitely of the early termination of the 30-day waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for transactions presenting no competitive concerns; issuance of an executive order that established a whole-of-government effort for more vigorous enforcement of the antitrust laws to “take decisive action to reduce the trend of corporate consolidation”; issuance of pre-consummation warning letters informing parties that the FTC has not completed its investigation of their deal within the statutory deadlines, and that, if the parties “choose to proceed with their transaction, … [they] are doing so at their own risk”; a notable shift in tone to emphasize more populist-type pocketbook issues (e.g., practices affecting labor markets or small business operations); withdrawal by the FTC from the joint FTC/DOJ vertical merger guidelines that were issued just last year; and new policy priorities at the FTC under which the staff will consider new factors, including “how a proposed merger will affect labor markets, the cross-market effects of a transaction, and how the involvement of investment firms may affect market incentives to compete.”

It remains to be seen whether the FTC will seek to challenge M&A transactions based not only on a conventional horizontal and vertical market-based antitrust analysis but also on broader societal impacts. In the most recent settlements and one merger challenge currently pending, the issues the FTC raised were of the traditional type rather than focusing of social impact concerns. There is also uncertainty as to the extent of changes to come at the DOJ, although the newly appointed head of antitrust at the DOJ is known as an advocate for stronger antitrust enforcement and the agency has been very active in challenging deals this year prior to his arrival.

Slowing of SPAC activity, but tremendous pressure on the demand for targets from existing SPACs. SPACs, which have been used for decades, became more popular starting in 2018-19 and their use surged starting in mid-2020. (A “SPAC”—special acquisition company—is a shell company that is formed to raise capital in an IPO, with the offering proceeds serving as a blind pool of funds held in trust to finance the acquisition of an as-yet-undetermined target; following which, the SPAC identifies a target and uses the offering proceeds to acquire it, with the target becoming public through the “de-SPAC” merger, as the target shareholders receive shares of the SPAC, and sometimes cash, as consideration.) Since the first quarter of 2021, however, there has been a significant drop-off in new SPACs being formed—although new formations are still at a high level and are slightly higher in the fourth quarter than they were in the third quarter. Most notably, the roughly 500 SPACs currently seeking to identify and complete acquisitions within the proscribed time period (usually one to two years from the SPAC’s IPO) have created frenzied competition for acquisition targets. Another important development for SPACs has been significant increased regulatory and investor skepticism, relating primarily to sponsors’ potential conflicts of interest inherent in the SPAC structure, allegedly rushed due diligence of targets, and a trend toward high valuation of targets. The SEC has brought several high-profile SEC enforcement actions (against SPACs, their sponsors, and target company executives); the SEC has been issuing extensive comment letters on disclosure by SPACs (focused on sponsor conflicts of interest and the disclosure of target company financial projections); and the plaintiffs’ bar has begun to bring actions against SPACs.

Rebound of shareholder activism after a pause during the pandemic. The number of new activist campaigns has been fairly constant over the past several years, other than the pause that occurred during the pandemic. The most likely targets recently have been companies whose stock prices are underperforming their peers and those hardest-hit by the pandemic; however, there have been some carry-over campaigns focused on pre-pandemic issues. High-cap companies continue to be less likely to be targeted by activists, but 20% of new campaigns in 2021 were against companies with capitalization of $25 billion or more. The ranks of activists has thinned, with a core group of well-established activists accounting for most of the campaigns. These activists have extraordinary access to capital and can acquire significant equity stakes (even in very large companies) with speed and, often, stealth. Leading activist funds have been diversifying their investment strategy—for example, Elliott Management formed private equity funds which have led or participated in buyouts targeted in Elliott’s activist campaigns.

The influence of shareholder activists in M&A transactions has continued. Activists continue publicly to oppose announced deals to seek to influence an increase in the offer price (“bumpitrage”) and to support hostile bids; now often work together, or are supported by hedge funds in “wolfpacks”; and have shown an increased willingness themselves to launch unsolicited takeover bids (sometimes in partnership with a strategic or private equity buyer). Thus, advance preparation for activist involvement, as part of the planning for an M&A deal, is critical. In addition to campaigns for board seats (which themselves almost always have a more specific, underlying value proposition), other recent areas of pressure have included board composition issues relating to diversity, tenure, overboarding, conflicts, and low share ownership. Notably, activist nominees to boards increasingly have been independent directors with industry or corporate governance experience rather than the activist’s insiders. Also, there has been a focus on ESG and Corporate Social Responsibility (CSR) issues, led by a new breed of activist funds that are focusing solely on these issues.

The trend in recent years of more cooperation between companies and activists, after an activist approach, has continued—leading to more and relatively quick settlements of campaigns (often, with the target company accepting a small number of the activist’s nominees onto its board). Finally, we note that the Williams decision issued by the Court of Chancery and affirmed by the Delaware Supreme Court, raises questions about the validity of poison pills adopted to thwart the threat of shareholder activism when there is not an “actual threat” against the company. As we interpret the court’s opinion, however, the Williams pill would not have been invalidated but for, first, the “extreme” terms (including a 5% trigger and a very broad “wolfpack”/acting-in-concert provision, and, second, the record that reflected a flawed board process in adopting the pill. (See the article below, Questions About Poison Pills After the Delaware Supreme Court Upholds the Invalidity of the Williams Pill.)

Continued expanded access to corporate books and records under Section 220 demands. Shareholders’ Section 220 demands to inspect corporate books and records most often arise in the context of efforts to obtain information, prior to closing an M&A transaction, for use in post-closing litigation to support damages claims and/or to establish that Corwin is inapplicable as a defense. Plaintiffs have been more successful in crafting claims that survive dismissal at the pleading stage—sometimes based on word-by-word comparison by the court of board minutes or other corporate records and the company’s deal disclosure. The trend generally has been for the court, in certain circumstances, to permit broader access to emails than in prior years. Accordingly, it continues to be important that directors and managers are made aware, and constantly reminded, of the need for extreme care with respect to the content of emails (and other communications). Also, notably, in a recent Delaware decision (Boeing), the Court of Chancery stated that, if the minutes of a board meeting do not reflect that a topic (in that case, airplane safety) was discussed at the meeting, then it was reasonable for the court to infer at the pleading stage of litigation that the board did not discuss that topic at the meeting.

M&A litigation judicial developments.

- Continued judicial acceptance of the new “fraud-on-the-board” theory of potential liability for directors, officers and advisors Under this theory, there is potential liability for having concealed material information from the board, even if without bad faith (or any underlying fiduciary breach). The Delaware Court of Chancery has expressly endorsed the theory in a number of recent decisions (Presidio, Columbia Pipeline, Mindbody).

- Continued judicial retrenchment of the Corwin doctrine—with focus on disclosure flaws. Corwin provides for business judgment review of challenged transactions in post-closing litigation for damages, so long as the transaction was approved by the shareholders in a “fully-informed and uncoerced” vote. The courts no longer “automatically” find Corwin applicable where a transaction has been shareholder-approved. Rather, the court in numerous cases has determined that Corwin was inapplicable because the shareholder vote was not “fully-informed” due to disclosure issues. Corwin remains a potent defense tool, however—thus, adequate disclosure (particularly of potential conflicts and process flaws) is critical.

- Possibly expanded potential for aiding and abetting liability (of buyers and advisors) in connection with a sale process. In two recent cases (Columbia Pipeline and Mindbody), the Court of Chancery found, at the pleading stage, that the buyer might have aiding and abetting liability for the target’s alleged fiduciary breaches in (i) favoring the buyer in the sale process and/or (ii) not disclosing material information in the merger proxy statement. With respect to the issue of favoring the bidder, in both cases the court emphasized that, based on the plaintiffs’ allegations, it was reasonably conceivable that the buyer knew about the favoritism and took advantage of it. With respect to the issue of inadequate disclosure, in both cases the merger agreement (as is usual) entitled the buyer to review the proxy statement and required that the buyer notify the target of known deficiencies. The court emphasized in one case (Columbia Pipeline) that it was relying on a “constellation” of allegations that, taken together, supported a reasonable inference that the buyer knew that the proxy failed to disclose certain material information. However, in the other case (Mindbody), the court relied on an apparently less extensive set of allegations. The court concluded, at the pleading stage, that it was reasonably conceivable that the buyer knew that the merger proxy did not disclose material information relating to dealings the buyer itself had during the sale process with the target’s CEO-Chairman. More notably, the court also concluded that the target may not have disclosed certain potentially material information (its preliminary quarterly revenue results) due to “concerns” about disclosing those results that were expressed by the buyer’s attorneys when the target asked the buyer for its comments on a draft press release disclosing the results (that was to be incorporated by reference in the proxy). These decisions underscore, again, the critical importance of a very careful approach to disclosure. Further, importantly, Mindbody suggests that participants in the merger process (including the buyer—as well as, potentially, for example, advisors) who suggest deletion of, or even express concern about, disclosure in a draft document may face the risk of aiding and abetting liability if a court later finds that the omitted information was material and should have been disclosed.

- Increased targeting of officers in deal litigation. Unlike directors, officers are not protected from by exculpation provisions in a company’s charter. Therefore, they may have liability even without having acted in bad faith (and even if claims against directors for the same conduct have been dismissed). In addition, the court recently has suggested that officers may have liability not just for breaches of fiduciary duties they owe to the corporation and its shareholders, but for breaches of their duties as agents of the board—that is, duties to follow the board’s directives and to provide the board with information it needs to carry out its duties (AmeriSource Bergen, which has been affirmed by the Delaware Supreme Court). As discussed above, plaintiffs have been successful in a few recent cases in having their claims against target company officers for favoring a bidder in a sale process survive the pleading stage of litigation (e.g., Columbia Pipeline and Mindbody). There also have been more cases in which claims against officers for gross negligence in preparation of proxy statements have survived the pleading stage (based on the officer having been involved in the preparation of the proxy and/or having signed it).

- Continued diminished importance of appraisal (in arm’s-length third-party transactions). Delaware courts now routinely rely on deal-price-less-synergies to determine appraised “fair value” in arm’s-length third-party transactions (even in the context of a somewhat flawed sale process). Appraisal claims have dropped precipitously in recent years, given the likelihood of an at-or-below-the-deal-price appraisal result for arm’s-length transactions. The expected increase in appraisal cases due to uncertainty of valuations during the pandemic materialized only very modestly (with a slight increase in appraisal filings in 2020 from 2019, but still fewer filings than in 2018, which itself reflected a steep dropoff from the prior years). However, appraisal remains relevant in non-arm’s-length transactions (such as take-privates).

Another appraisal-related development of note is that the Delaware Supreme Court confirmed that holders of common stock can contractually agree in advance to waive the right under the Delaware appraisal statute (DGCL Section 262) to seek appraisal of their shares—at least if the stockholders were sophisticated and informed, represented by counsel, had bargaining power, and voluntarily agreed to the waiver in exchange for valuable consideration. While prior Delaware decisions had established that appraisal rights can be waived in advance with respect to preferred stock (such stock being by nature a product of contract), the courts had not previously addressed the issue specifically with respect to common stock (Manti v. Authentix). Finally, the Court of Chancery, in one case (Regal Entertainment), although relying on the deal-price-less-synergies, based on the requirement that fair value be determined as of the effective time of the merger, found that fair value was above the deal price. That result flowed from the increase in value of the company between signing and closing attributable to the passage of the 2017 Tax Cut and Jobs Act that reduced the company’s tax rate from 35% to 21%.

Merger agreement developments.

- Regulaory. In light of heightened regulatory risk, merger agreements have contained regulatory-related provisions that are more highly tailored to the individual circumstances—including more detailed and specific provisions as to the standard of efforts (rather than simply a “reasonable” or “best” efforts standard), longer “end” dates, and more detailed reverse termination fees.

- MAC conditions and ordinary course covenants. Since the emergence of the pandemic, there has been more focus on material adverse change provisions and interim operating covenants. In the two decisions issued by the Delaware courts addressing whether the pandemic constituted a basis on which a buyer was excused from closing a pending merger agreement (AB Stable and Snow Phipps), the Court of Chancery held that the pandemic was not a MAC because the parties’ definition of a MAC in the agreement excluded “calamities” and “natural disasters,” which terms, the court concluded, encompassed the concept of a pandemic. (There is still only one case ever in which a Delaware court found that there was a MAC that excused the buyer from closing.) In AB Stable, the court held, further, however, that the buyer did not have to close because the target company’s responses to the pandemic (although perfectly reasonable) constituted a breach of its covenant to operate only in the ordinary course of business pending closing. The court rejected an interpretation of the covenant to mean ordinary course in the context of the pandemic; and held, instead, that, unless the parties expressly provide otherwise, it means ordinary course during ordinary, “normal times.” The court took the same analytic approach in Snow Phipps, but reached a different result (i.e., the buyer was obligated to close) given the different facts. In Snow Phipps, the target’s responses to the pandemic were “de minimis” and were equivalent to how the company had operated previously during times of revenue declines. Merger parties should consider whether the interim covenant should provide some flexibility to the target to respond to extraordinary events that may occur between signing and closing.

- Representations and warranties. R&W insurance continues to be prevalent. With more competition for attractive acquisition targets, the insurance package terms are now sometimes pre-arranged by the target company. Also, there has been continued attention to cybersecurity and “MeToo” issues in due diligence and the representations and warranties.

- Earnouts. There has been some increased focus on earnouts to bridge valuation gaps arising from pandemic-related uncertainty. Recent earnout cases underscore that earnouts often lead to post-closing disputes, and ultimately litigation, over the earnout itself. In seeking to avoid later disputes, it is critical that the parties set forth in the merger agreement clear, specific, business-contextualized provisions and procedures with respect to calculation of the earnout and the parties’ respective earnout-related obligations. Recent studies indicate that earnouts are used in over 60% of private company acquisitions in the life sciences industry (where the payments usually are tied to the occurrence of specific steps in the regulatory process relating to the development and marketing of the target company’s product); in roughly 23-30% of other private company acquisitions (where the payments typically are based on the achievement of specified levels of revenue or EBITDA); and in almost half of de-SPAC transactions (mergers with a SPAC acquiror).

- Judicial interpretation of merger agreements. Delaware decisions continue to highlight the courts’ strict approach in looking to the “plain language” of agreements and refusing to “read in” terms that are not expressly and clearly stated by the parties in their agreement. These decisions reaffirm the need for clear, precise drafting of merger agreements—with special attention to the interrelationships among the provisions.

Corporate governance developments.

- Build Back Better legislation. The legislation is still being analyzed but promises to affect corporate America in numerous, significant ways. Of immediate note, the law’s new surcharges on corporate stock buybacks and on very high income individuals will affect various companies.

- Stockholder engagement. Institutional investors continue to be more involved and vocal. Expanded, thoughtful engagement with institutions (including by directors at times) has continued. Boards should ensure that an effective shareholder engagement plan is in effect, that market concerns relating to the company are being monitored, and that the company is implementing an effective communications plan that is responsive to the concerns.

- Strong focus on ESG and CSR issues. Regulators, institutional investors, retail investors, and the media have maintained a strong emphasis on environmental-social-governance (ESG) issues and Corporate Social Responsibility (CSR) issues. There has been continued increased focus on these issues in board rooms. We note that, with increased interest in these issues, proxy statements are more often read by non-shareholder stakeholders and the media (increasing the risk of “cancel culture” issues arising). New SEC guidance recently issued has reduced significantly the likelihood of shareholder proposals on social issues being excludable under the “ordinary course” and “economic relevance” exceptions to the requirements for inclusion of shareholder proposals in proxy statements (under Rule 14-8).

Questions About Poison Pills After the Delaware Supreme Court Upholds the Invalidity of the Williams Pill

On November 3, 2021, in The Williams Cos. Inc. v. Wolosky, the Delaware Supreme Court affirmed the Court of Chancery’s seminal decision earlier this year that invalidated the poison pill adopted by the board of The Williams Cos. Inc. In a brief en banc ruling, the Supreme Court, without elaboration, stated that it was affirming the Court of Chancery’s ruling “on the basis of and for the reasons” set forth in then-Vice Chancellor (now-Chancellor) Kathaleen S. McCormick’s opinion.

In the first half of 2020, when the COVID-19 pandemic was emerging in full force in the U.S., there was a surge in the adoption of poison pills as many companies saw their stock prices plummet and there was extreme market uncertainty. (Almost all of these pills have now expired without being extended; and poison pill adoptions have returned to their low, pre-pandemic levels.) Williams, an oil pipeline company, adopted its pill in March 2020 when its stock price was cratering due to the pandemic as well as a world-wide oversupply of oil. The independent board’s stated purpose in adopting the pill was to ward off the potential of shareholder activist activity that could take advantage of company’s collapsed stock price during a time of enormous market volatility. Certain Williams stockholders challenged the board’s adoption of the pill, and the Court of Chancery enjoined the company’s use of the pill.

The Court of Chancery’s decision raised numerous questions that the Supreme Court’s brief ruling does not resolve. While some interpreted the lower court’s decision as casting doubt on the validity of pills generally except when adopted as a response to an actual, specific threat of hostile activity against the company, we note that the Chancellor’s opinion emphasized the “unprecedented” nature of the terms of the Williams pill. Most notably, the pill had a 5% trigger (instead of the usual trigger in the range of 10-20% in the context of an antitakeover threat). In addition, the pill had an unusually broad definition of beneficial ownership, an unusually broad acting-in-concert (“wolfpack”) provision, and an unusually narrow exclusion for passive investors. This combination of features, the Chancellor wrote, was more “extreme” than any pill the court had previously reviewed. The court stressed that the terms were so broad (in particular, with respect to the acting-in-concert provision) as to impinge on the stockholders’ fundamental right to communicate with each other and the company in ordinary ways. Moreover, with respect to the “purely hypothetical” nature of the threat to the company, we would note that there apparently was no corroboration that the board had actually identified even a general threat. For example, the board did not establish a record that it had explored what activists had done in the past in similar market circumstances, had obtained and considered the counsel of its financial advisors with respect to activist activity in this context, had considered the company’s own past experience (or other similar companies’ experience) with respect to activists in similar contexts, and/or had identified what positions or comments activists had previously taken or made relating to their opportunities and intentions in similar contexts.

Williams clearly establishes that the court will not sustain the validity of a pill with extreme terms that is adopted by a board that has not established a record substantiating a determination of a threat to the company from shareholder activism. It remains uncertain, however, to what extent a wholly non-specific threat to the company would be viewed as sufficient by the court in the context of a board that had more specifically considered the potential threat. It also is uncertain to what extent, even in the face of a purely hypothetical threat, a pill with typical, market (rather than “extreme”) terms would be validated by the court. In addition, the question remains to what extent the court, in the face of an actual and specific threat to the company, would accept a pill with “extreme” terms. It is also unclear whether the court would apply the same analysis in the context of a pill directed against hostile takeover activity rather than shareholder activism.

New SEC Guidance, Reversing Precedent, Will Limit Companies’ Ability To Exclude Environmental and Other Social Policy-Related Shareholder Proposals

On November 3, 2021, the staff of the Division of Corporation Finance at the SEC (the “Staff”) issued a Staff Legal Bulletin (SLB No. 14L) to provide new guidance with respect to public companies’ requests for no-action letters seeking relief to exclude shareholder proposals submitted to them under SEC Rule 14a-8. As a result of the new guidance, it is unlikely that shareholder proposals on social policy topics will be excluded on the basis of the “ordinary business” or “economic relevance” exceptions to Rule 14a-8. The guidance is consistent with the general position the SEC Commissioners have articulated in support of investors’ focus in recent years on environmental and social-policy (“E&S”) issues.

We note that investors have reached new heights in their attention to and support of E&S issues, including in the shareholder proposal context. In the 2021 proxy season, there were more shareholder proposals on E&S topics than on all governance- and (non-E&S) compensation-related topics combined. In addition, the number of E&S proposals receiving majority support roughly doubled in the 2021 season as compared to 2020. The most common topics were climate change, compensation parity for women, human capital, and board and workplace diversity. Large institutional investors have been increasingly willing to support shareholder proposals (for example, Blackrock supported over one-third of shareholder proposals in the 2021 proxy season, as compared to under 20% in the 2020 proxy season); and, moreover, have been increasingly willing to vote against directors at portfolio companies where ESG management is perceived as inadequate. We note, also, that shareholder activists now more often engage in the shareholder proposal process rather than focusing only on board seat challenges.

Rule 14a-8 requires companies that are subject to the federal proxy rules to include shareholder proposals in their proxy statements proposals, subject to certain procedural and substantive requirements. The “ordinary business” exception (subsection (i)(7) under Rule 14a-8) provides that a proposal may be excluded if it “deals with a matter relating to the company’s ordinary course business operations.” The “economic relevance” exception (subsection (i)(5) under Rule 14a-8) provides that a proposal may be excluded if it “relates to operations which account for less than 5 percent of the company’s total assets at the end of its most recent fiscal year, and for less than 5 percent of its net earnings and gross sales for its most recent fiscal year, and is not otherwise significantly related to the company’s business.” The new guidance in SLB 14L expressly rescinds the Staff’s years-long precedent under SLBs 14I, 14J and 14K relating to these exceptions—and makes it much more unlikely that a shareholder proposal on an E&S topic would be viewed by the Staff as excludable under these exceptions. Indeed, in the new SLB, the Staff confirms that, going forward, many proposals that previously would have been excludable under these exceptions now would not be excluded.

More specifically, the new SLB provides as follows:

- “Ordinary Business Operation” Exception—“Significant Social Policy” Issues. Where a social policy issue is the subject of a shareholder proposal, the Staff will no longer focus on determining the nexus between the issue and the company, but instead will focus on the whether the issue has “social policy significance.” In other words, the Staff will look to whether the proposal raises issues with “a broad societal impact such that they transcend the ordinary business of the company,” regardless of whether the issue relates to an important social policy of the company. Due to elimination of the company-specific approach to evaluating the significance of a policy issue for purposes of this exception, the Staff will no longer expect analysis from the board on this issue to determine whether the proposal is excludable.

- “Ordinary Business Operation” Exception—“Micromanagement.” Where a shareholder proposal seeks detail or to promote specific timeframes or methods, the Staff will not view the proposals as per se constituting micromanagement. Instead, the Staff now “will focus on the level of granularity sought in the proposal and whether and to what extent it inappropriately limits discretion of the board or management.” Further, the Staff will “expect the level of detail included in a shareholder proposal to be consistent with that needed to enable investors to assess an issuer’s impacts, progress towards goals, risks or other strategic matters appropriate for shareholder input.” The Staff also notes in the SLB that, in considering whether a proposal’s matter is too complex for shareholders, as a group, to make an informed judgment, the Staff will look to the sophistication of investors generally, the availability of data, and the robustness of public discussion. The Staff noted that, although it recently denied ConocoPhillips’ request for no-action relief to exclude a shareholder proposal requesting that the company set targets covering the greenhouse gas emissions of the company’s operations and products, going forward it would not exclude such a proposal as it did not impose a specific method for setting the targets and instead “afforded discretion to management as to how to achieve such goals.”

- “Economic Relevance” Exception. Going forward, “proposals that raise issues of broad social or ethical concern related to the company’s business may not be excluded, even if the relevant business falls below the economic thresholds [of this exception].” As a result of this new guidance, the Staff will no longer require board analysis for consideration of a no-action letter request under this

- Additional New Guidance. (i) Use of Graphics. The SLB clarifies that shareholder proposals may include graphs, images and graphics—but that exclusion of proposals may be appropriate where graphs or images would make a proposal materially false or misleading or inherently vague; would directly or indirectly impugn character, integrity or personal reputation; or are irrelevant to a consideration of the subject matter of the proposal. The SLB also clarifies that the words in graphics count towards the 500-word limit for proposals. (The SLB does not address practical issues relating to the permissible size, placement, or color for any graphics.) (ii) Proof of Ownership Letters. The SLB clarifies that no specific format is required for proof of a proponent’s continuous ownership of a company’s securities and that brokers are not required to (i.e., the shareholder proposal proponent now can) calculate and present to the issuer the share valuation. In addition, the SLB notes that companies should identity any specific defects in the proof of ownership letter, even if the company previously sent a deficiency notice prior to receiving the proponent’s proof of ownership, if the deficiency notice did not identify specific defects. (iii) Use of e-mail. Where a controversy develops as to whether an email was timely delivered, the burden will be on the sending party to show proof of receipt. The SLB suggests that, when email is used to communicate between a shareholder proposal proponent and the company, to prove delivery of an email for purposes of Rule 14a-8, the sender should seek a reply email from the recipient in which the recipient acknowledges receipt of the email. The SLB also encourages parties to acknowledge receipt of such emails when so requested.

Chancery Decision Underscores Risks to Dissident Stockholders of Not Submitting Advance Notice Director Nominations Well in Advance of the Deadline—Rosenbaum v. CytoDyn

Rosenbaum v. CytoDyn Inc. (Oct. 13, 2021) involved the rejection by CytoDyn Inc.’s board of directors of the notice of director nominations submitted by dissident stockholders under the corporation’s advance notice bylaw. The dissidents submitted the notice the day before the deadline under the bylaw. The board, having identified deficiencies in the notice, did not seek additional information from the dissidents and, a month after the notice was submitted, informed the dissidents that the notice was rejected. The dissidents promptly submitted a supplement to its notice and supplemented its proxy materials, but, the court stated, “the effort came too late.” The court wrote: “The fundamental nature of the omissions, and the ‘eve of’ timing of the Nomination Notice’s submissions, [left] no room for…equitable principles to override the decision by the Board to reject the Nomination Notice.”

The court indicated that Blasius enhanced scrutiny review could apply to nomination notice disputes—but the court held Blasius did not apply here as there was no “manipulative conduct” by the board. The plaintiffs argued that denial of the advance notice presented the “classic scenario” for enhanced scrutiny review under Blasius, as the board was “act[ing] for the primary purpose of preventing the effectiveness of a shareholder vote.” Therefore, they contended, under Blasius, the board had to prove it had a “compelling justification” for rejecting the notice. CytoDyn asserted that the issue was a contractual one, as the bylaws are a contract between the corporation and its stockholders, and the dissidents clearly did not comply with all of the requirements of the advance notice bylaw. CytoDyn pointed to the Delaware Supreme Court’s BlackStone v. Saba opinion, which stressed that advance notice bylaws are to be interpreted using contractual principles. In that case, the Supreme Court explained that “Delaware law will protect shareholders in instances where there is manipulative conduct or where the electoral machinery is applied inequitably,” but the Supreme Court declined to apply heightened scrutiny as it found no manipulative conduct. In CytoDyn, similarly, Vice Chancellor Glasscock held that enhanced scrutiny under Blasius was “not justified” because the CytoDyn board did not act manipulatively. The Vice Chancellor noted that the advance notice bylaw had been adopted on a “clear day” years before the plaintiffs submitted their nomination notice. Also, there was evidence that the plaintiffs were aware of and understood the bylaw and, indeed, had “parsed it carefully” before submitting the nomination notice. While the board “was not as responsive as perhaps it should have been,” and faced the same inherent conflicts that incumbent boards generally have, there was “no evidence that [the board] engaged in manipulative conduct in its dealings with the plaintiffs.”

The court emphasized that the notice was submitted close to the deadline, leaving no time to address deficiencies. Where the plaintiffs “went wrong,” the Vice Chancellor stated, was “by playing fast and loose in their responses to key inquiries embedded in the advance notice bylaw,” and then by submitting the notice at the deadline, leaving no time to fix any deficiencies the board might identify.

The court found that the dissidents’ notice was “clearly” deficient. In particular, the court noted, the plaintiffs were obligated by the bylaw to disclose who was “supporting” their efforts. The plaintiffs “chose to disclose nothing” regarding their supporters, although this was “vital information” and the plaintiffs had “focused” on this requirement and “emphasized it to others” in the dissident group before submitting the notice. Specifically, the notice “failed to disclose the existence of CCTV, which was founded by Rosenbaum (the plaintiff, and one of the nominees) and collected donations to support the [dissidents’] proxy fight.” The plaintiffs argued, first, that CCTV and its funders were not “supporters” because the donations were made before a candidate slate was identified and the donators were free to support whomever they wished as directors. The court found that that response disingenuously suggested that the dissidents had no support or funding for their proxy campaign. The plaintiffs also argued that the board should have sought the information if it viewed its absence as a material omission. The court stated that, as the plaintiffs had “provided no information on the subject, there was no basis for the Board to seek supplementation.”

The court also pointed to the bylaw requirement to provide information regarding potential conflicts. CytoDyn had previously considered acquiring IncellDx, a company controlled by Rosenbaum. The court stated that “a reasonable stockholder would want to know that certain of Plaintiffs’ nominees were tied to a past proposal whereby CytoDyn would acquire IncellDx for $350 million” and that they “may seek to facilitate a renewed proposal along the same lines….” The court stated that this conclusion was particularly so given that such a transaction likely would not be subject to a shareholder vote and could be approved by the board unilaterally. The plaintiffs contended that none of the nominees had any intent to propose revisiting an acquisition of IncellDx. The court responded that the CytoDyn board “legitimately suspected” that they might and “was correct in expecting” that they would disclose the past failed attempt and their current intentions one way or the other. Moreover, the court noted, there was some evidence that revisiting the transaction was “at least being contemplated by the IncellDx insiders and Rosenbaum.”

Other Decisions and Developments of Interest This Quarter

Drafting Guidance for Earnouts—Pacira and Shire. In both Pacira v. Fortis (Oct. 25, 2021) and Shire v. Shareholder Representative Services (Oct. 12, 2021), the Delaware Court of Chancery, based on the “plain meaning” of the express language in the merger agreement at issue, rejected the buyer’s argument that an earnout payment was not due. The Pacira decision indicates that buyers should seek to set forth specific restrictions on the selling stockholders with respect to any post-closing actions to influence achievement of an earnout. The Shire decision highlights that the drafting of an earnout (or any other) provision should clarify whether the phrase “as a result of” does or does not mean exclusively as a result of. See here our Briefing, Important Earnout/Milestone Drafting Points Arising from Recent Pacira and Shire Decisions.

General Partner Had Unexculpated Liability for Its Reliance on Its Outside Counsel’s “Contrived” Legal Opinion—Bandera v. Boardwalk Pipeline. In Bandera v. Boardwalk Pipeline (Nov. 12, 2021), the Court of Chancery found, in a post-trial decision, that, in connection with the take-private of a master limited partnership by its general partner, the general partner wrongly relied on a flawed legal opinion that, according to the court, was “contrived” to reach the result the general partner’s controller wanted. The Vice Chancellor found that the general partner and the controller were not exculpated from liability because their efforts to obtain the opinion constituted “willful misconduct.” The court awarded the limited partners more than $690 million in damages. See here our Briefing, Court of Chancery Awards $690M+ in Damages based on Controller’s Reliance on Outside Counsel’s “Contrived” Legal Opinion.

Settlement Is Reached in Boeing’s Caremark Litigation. The Boeing Company Derivative Litigation (Sept. 7, 2021) was another in a series of cases in recent years in which the Delaware Court of Chancery refused to dismiss, at the pleading stage, Caremark claims against a company’s independent directors for an alleged failure to have adequately overseen management of the company’s core risks. These decisions raise the question whether Caremark claims are still, as the court still characterizes them, “among the most difficult of claims to please successfully.” In Boeing, the directors allegedly overlooked airplane safety issues, resulting in two airplane crashes. All of the people on board the two airplanes died. The company was assessed significant fines and suffered severe reputational damage. It has been reported that, in October, Boeing’s shareholders and the company, with the consent of Boeing’s insurers, have proposed a payment of $237.5 million to settle the case, subject to court approval. If approved, this would be the largest monetary settlement ever paid in a Caremark case in Delaware. (The plaintiffs have indicated that they also will be seeking almost $30 million for attorneys’ fees.) The settlement agreement also provides for Boeing to create an ombudsman program, for at least five years, under which employees could raise work-related concerns, and to add to its board a director who has experience in aerospace and aviation management and product safety oversight. The settlement does not release Boeing from claims pending against it in two federal securities actions relating to the same events. See here our Briefing, Boeing Decision Continues Delaware’s Recent Trend Rejecting Early Dismissal of Claims Against Directors for Inadequate Oversight of Critical Risks.

Second Circuit Denies Rehearing of Decision that Financial Advisors’ Success Fees May Have Constituted a Constructive Fraudulent Conveyance—Tribune Co. Fraudulent Transfer Litig. The Tribune Company declared bankruptcy less than a year after completing a 2007 LBO. Among other claims made by the Trustee in Bankruptcy, claims were made against two of Tribune’s financial advisors for alleged constructive fraudulent conveyance in connection with the receipt by each of them of a $12.5 million “success” fee after consummation of the LBO. The District Court had dismissed these claims, but the Second Circuit reversed in a decision issued in August 2021. In an order issued by an en banc panel on October 7, 2021, the Second Circuit has now denied the Trustee’s petition for a rehearing of the August 2021 decision.

The District Court held in its August decision that Tribune incurred the debt for the success fees when the advisors’ engagement letters were signed, which was years before the LBO. Therefore, in the District Court’s view, the fees were an unavoidable antecedent debt. The Second Circuit disagreed, however, holding instead that, because the engagement letters called for the fees to be paid upon consummation of the LBO, the debt was not incurred or owed until the LBO was consummated. In addition, the Second Circuit found that dismissal of the claims at the pleading stage was “premature” because there were possible factual issues relating to whether the two advisors had provided “reasonably equivalent value” for the success fees. The engagement letters required the advisors to provide “customary and appropriate” services. The plaintiffs alleged that the two firms knew that the projections relied on by a third firm that rendered a solvency opinion were not an accurate forecast, yet did not inform the third firm or Tribune’s board. Although it was a “close call,” the Second Circuit decided that the claims could not be dismissed without resolution of the factual issues as to whether the advisors “failed to fulfill their responsibilities as gatekeepers retained to objectively analyze the LBO.” With respect to claims made against two other financial firms engaged by Tribune in connection with the LBO (one of which provided the solvency opinion and the other of which provided a fairness opinion), Second Circuit upheld the District Court’s dismissal of constructive fraudulent conveyance claims. The Second Circuit reasoned that these two other firms’ fees were not tied to consummation of the LBO and were due and paid before the first step of the LBO (i.e., before Tribune was insolvent).

Corporation Could Not Rely on Its Stock Ledger to Reject a Books and Records Inspection Demand When It Knew the Plaintiff Was a Stockholder—Knott v. Telepathy Labs. In Knott Partners L.P. v. Telepathy Labs, Inc. (Nov. 23, 2021), the Delaware Court of Chancery confirmed that, in general, a corporation may rely on its stock ledger to determine whether a person is entitled, under DGCL Section 220, to make a demand to inspect the corporate books and records. However, in this case, the court stated, where Knott Partners L.P., which made the demand, was not on the stock ledger, the corporation was not entitled to rely on the ledger to reject the demand as the corporation “was aware of the status” of Knott Partners…as a stockholder, but failed to acknowledge that fact on its stock ledger.” The court would not permit the corporation to “rely on [its] deficient stock ledger to achieve a dismissal” in the statutory summary proceeding under Section 220 to “forc[e] [Knotts] into the position of submitting extrinsic evidence of [its] stockholder status….” Vice Chancellor Glasscock emphasized that the decision is limited to the “narrow circumstances” presented in this “unusual case.”

New SEC Rule Amendments Will Eliminate the Key Requirements Just Recently Imposed on Proxy Advisory Firms. Proxy advisory firms (the most well-known of which are ISS and Glass Lewis) advise institutional investors regarding upcoming shareholder votes. For almost two decades, the SEC has been considering new approaches to the regulatory regime applicable to these firms. On November 17, 2021, the SEC issued proposed new rule amendments that would eliminate the key requirements it imposed on proxy firms in July 2020—namely, that proxy advisory firms have to (i) provide the company facing the shareholder vote (the subject company) with the guidance they provide to clients and (ii) make the subject company’s response available to their clients.

New SEC Rule Requires Use of Universal Proxy Card in Election Contests. On November 17, 2021, the SEC adopted amendments to the proxy rules to require the use of universal proxy cards in contested director election. The amendments apply to shareholder meetings held after August 31, 2022. The new rules require both the company and the dissident to list on the proxy card it sends to shareholders all duly nominated director candidates (i.e., its own nominees, the other’s nominees, and any proxy access nominees). The universal proxy card permits shareholders to vote for any combination of these candidates (rather than having to vote for nominees only on the company’s slate or only on the dissident’s slate). Companies had generally been opposed to a requirement for universal proxy cards based on a concern that it would make it easier for shareholders to support dissident nominees. Among the other requirements in the new rules is that director nominees must consent to being named in any proxy statement relating to the shareholder meeting at which directors will be elected. Accordingly, companies should consider changes that may be needed to their advance notice bylaws, proxy access bylaws, and director questionnaires to ensure that the requisite consent to be named is provided.

Delaware Supreme Court Holds, Based on Agreement Language, Post-Closing True-Up Had to be Calculated “Correctly” Rather Than “Consistently”—Golden Rule v. SRS. In Golden Rule Financial Corporation v. Shareholder Representative Services LLC (Dec. 3, 2021), the merger agreement provided for an increase in the purchase price if Tangible Net Worth at closing was more than $52 million, and a reduction in the price if it was less. The calculation was to be made using the “Accounting Principles [(as defined in the agreement)], consistently applied.” The Accounting Principles included that Tangible Net Worth would take into account the effect of “ASC 606” (which at that time was a new accounting principle that companies were not yet required to adopt under GAAP). When applied correctly, ASC 606 resulted in Tangible Net Worth being more than $52 million (requiring the buyer to pay more); but calculated as both parties had been doing (albeit incorrectly) since before executing the merger agreement, Tangible Net Worth was less than $52 million (requiring a price reduction). After the seller discovered the mistake, the buyer argued that ASC 606 should be applied correctly. The seller argued that the Accounting Principles were to be “consistently applied” (including as applied to determine the $52 million target). The Court of Chancery emphasized that the plain language of the agreement required that ASC 606 be used to determine the Tangible Net Worth true-up (and did not require or represent that it had been used to determine the $52 million target). The court would not second-guess the plain language, Vice Chancellor Fioravanti stated. The court distinguished the 2017 Chicago Bridge decision on the basis that, in that case, the agreement “lent itself as being interpreted as demanding consistency across all relevant time frames.” For example, in the Chicago Bridge agreement, the seller represented that the company’s pre-signing financial statements had been prepared in compliance with the same accounting principles, consistently applied, as would be used to calculate the post-closing true-up. On appeal, the Delaware Supreme Court upheld the Court of Chancery decision.

Print

Print