Susan Angele, Annalisa Barrett, and Stephen Brown are Board Leadership Senior Advisors at KPMG. This post is based on their KPMG memorandum, a version of which originally appeared in The Power of Difference by the National Association of Corporate Directors.

Pressure on corporations to increase and disclose their board’s diversity continues to intensify. The murder of George Floyd and other Black Americans in the spring of 2020 and the subsequent social unrest accelerated corporate efforts around diversity, equity, and inclusion as well as stakeholder and regulator demands for faster progress and greater transparency.

While there is a growing patchwork of regulations encouraging board diversity of gender, race and ethnicity, and sexual orientation and gender identity, the only board demographic information that all U.S. public companies are currently required to disclose is the age of each director. Nasdaq’s Board Diversity Rule is poised to have the most widespread impact to date, which will require most companies listed on its U.S. exchange to annually disclose board diversity statistics using a standardized template and to have at least two diverse directors or explain why they do not. This includes one director who self-identifies as female and one director who self-identifies as an “underrepresented minority” or as a member of the LGBTQ+ community. [1]

Nasdaq’s rule follows California SB 826 and AB 979, [2] which require public companies headquartered in California to have—depending on board size—one or more directors who self-identify as female as well as one or more directors who self-identify as coming from an “underrepresented community” (i.e., racially or ethnically diverse or LGBT). [3]

Maryland, New York, and Washington also have board gender diversity reporting requirements and/ or mandates, while Illinois has legislation aimed at promoting both gender and racial and ethnic diversity on boards through reporting requirements. [4]

It’s clear that director demographic diversity of all kinds is now in the spotlight, but stakeholders have been especially focused on board racial and ethnic diversity and disclosure over the past year (see sidebar), recognizing that without such disclosure, progress cannot be measured. “Diverse boards are more effective, and disclosure drives action,” said KPMG Board Leadership Center (BLC) Senior Advisor Susan Angele.

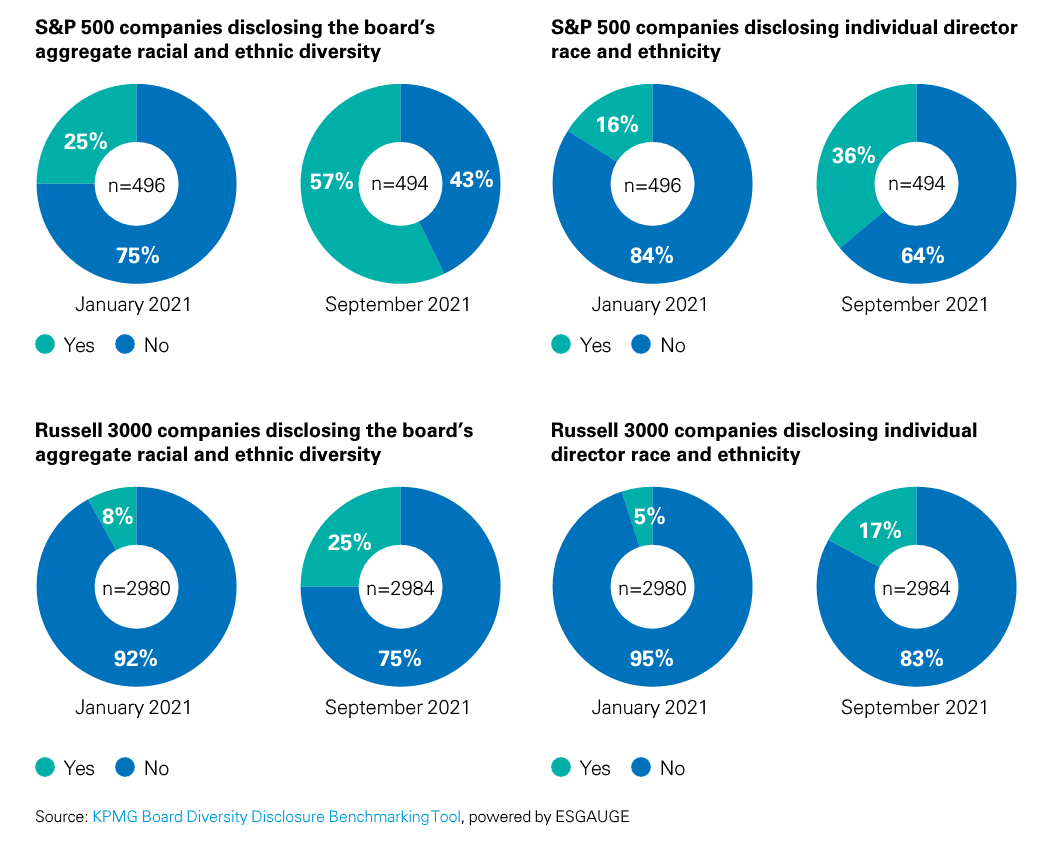

To get a sense of the current disclosure landscape, the KPMG BLC analyzed board racial and ethnic diversity disclosure by Russell 3000 and S&P 500 companies from January to September 2021, reflecting changes made during the 2021 proxy season. The data shows a large increase in the disclosure of board racial and ethnic data at U.S. public companies during this period. The analysis was based on the KPMG Board Diversity Disclosure Benchmarking Tool, powered by ESGAUGE, which compares board diversity disclosure practices by index, sector, and company size.

Pressure mounts for boards to report on racial and ethnic diversity*

- August 2020: The Diverse Corporate Directors Coalition published a Call to Action encouraging boards to disclose their demographic composition disaggregated by gender, race and ethnicity, disability status, LGBT+ identity, and veteran status. [5]

- September 2020: California AB 979 was signed into law, requiring public companies headquartered in California to submit an annual report to the California Secretary of State that indicates the total number of directors on the board from an “underrepresented community,” which includes those who self-identify as racially or ethnically diverse or self-identify as LGBT.

- October 2020: The Russell 3000 Board Diversity Disclosure Initiative, led by the Illinois State Treasurer, sent letters to Russell 3000 companies asking them to consider including board racial and ethnic data in their 2021 proxy statements. [6]

- November 2020: Institutional Shareholder Services (ISS) released its 2021 U.S. proxy voting guidelines, stating that for meetings on or after February 1, 2022, it would recommend a vote against the nominating/governance (nom/gov) committee chair of boards in the S&P 1500 or Russell 3000 with “no apparent racially or ethnically diverse members [emphasis added].” [7]

- January 2021: State Street Global Advisors (SSGA) released new guidance on racial and ethnic diversity disclosure, indicating it would vote against nom/gov committee chairs at S&P 500 boards that do not disclose the board’s racial or ethnic diversity (either individually or in the aggregate). [8]

- February 2021: The New York State Common Retirement Fund expanded its voting policies to vote against board chairs and audit committee members on S&P 500 boards that do not disclose individual directors’ race or ethnicity. [9]

- March 2021: A survey of over 3,000 U.S. adults conducted by Just Capital and The Harris Poll found that 73% believed it was important for large companies to publicly report on the demographic makeup of boards as well as the workforce. [10]

- August 2021: The U.S. Securities and Exchange Commission (SEC) approved Nasdaq’s Board Diversity Rule, which will require most companies listed on its U.S. exchange to have at least two diverse directors (or disclose why they do not), with one director self-identifying as either LGBTQ+, or racially or ethnically diverse. Such demographic data must be disclosed in a Board Diversity Matrix. [11]

*This list is not exhaustive and focuses specifically on recent actions related to board racial and ethnic diversity disclosure.

The following takeaways emerged from this analysis:

The percentage of companies disclosing the board’s aggregate racial and ethnic diversity more than doubled between January and September 2021.

Companies that choose to disclose the board’s racial and ethnic diversity may do so in the aggregate, by individual director, or both. Aggregated data might disclose the total number (or percentage) of directors who are racially and ethnically diverse—e.g., “Seven of our Directors are people of color”—or might disclose the total number (or percentage) of directors within each racial and ethnic category— e.g., “5% of our Directors are Black.” [12] Aggregate disclosure is acceptable for many stakeholders that call for disclosure on the board’s racial and ethnic composition—including SSGA and Vanguard. [13]

The percentage of companies in both indices that disclose the aggregate share of the board that is racially and ethnically diverse more than doubled from January to September of this year. As of September 2021, more than half (57%) of S&P 500 companies disclose the board’s aggregate racial and ethnic diversity, as well as a quarter (25%) of Russell 3000 companies.

More companies disclose director race and ethnicity in the aggregate than individually.

Among those boards publishing their racial and ethnic composition, disclosing such diversity in the aggregate—as opposed to disclosing the race or ethnicity of each individual director—is the predominant practice among companies in both indices to date.

Seventy-three percent of S&P 500 companies voluntarily disclose the board’s overall racial and ethnic diversity; however, only 36% disclose this information on an individual director basis. Among Russell 3000 companies, 36% voluntarily disclose their board’s racial and ethnic diversity and only 17% disclose it on an individual director basis.

Larger companies are more likely to disclose their individual directors’ race and ethnicity.

Although most companies tend to disclose the board’s racial and ethnic composition in the aggregate, the percentage of companies that do disclose their individual directors’ race and ethnicity is on the rise. The percentage of S&P 500 companies that disclose individual director race and ethnicity more than doubled from January 2021 (16%) to September 2021 (36%). While far fewer Russell 3000 companies have adopted this practice, the percentage of companies in this index disclosing individual director race and ethnicity more than tripled during this timeframe, from 5% to 17%.

Despite this movement toward greater disclosure of individual director race and ethnicity, it is still by no means a widespread practice. And some governance observers caution that individual directors may be sensitive to disclosing personal information to the public or may have difficulty identifying with a single racial or ethnic category. [14]

However, other stakeholders argue that asking each director to individually identify their demographic data aligns with the personal information already requested in existing D&O questionnaires—and fulfills requests from investors and other stakeholders. For example, Out Leadership—which advocates for LGBTQ+ inclusion on boards—recommends providing annual disclosures in a matrix format that includes “demographic data for each board member, including gender and gender identity, ethnicity/race and sexual orientation, international experience, disability, or veteran status.” [15]

Similar to asking directors to self-identify their race or ethnicity, Out Leadership argues that many LGBTQ+ directors would choose to self-identify, if given the chance. According to data from ESGAUGE, only 3% of S&P 500 companies and 1% of Russell 3000 companies currently disclose individual directors who identify as LGBTQ.

Russell 3000 companies disclosing that they consider racial and ethnic diversity in their director qualification criteria increased by 15 percentage points.

The percentage of boards specifically mentioning that they consider racial and ethnic diversity when setting qualifications for director candidates increased between January and September 2021. Of the companies that disclose that they consider diversity during the director nomination process, nearly all (97%) S&P 500 boards report that they specifically include racial and ethnic diversity, up from 89% at the beginning of the year. In comparison, three-quarters (76%) of Russell 3000 companies do so, up from 61%. Larger companies in the S&P 500—which typically adopt leading governance practices more quickly and tend to face greater scrutiny from investors—may be more likely to consider the board’s racial and ethnic diversity than the smaller companies in the Russell 3000.

Under SEC rules, public companies must describe if and how they incorporate diversity into their director search criteria. All S&P 500 companies and nearly all Russell 3000 companies (98%) refer to diversity generally in such disclosures. It is worth noting, however, that simply disclosing that diversity generally—or even racial or ethnic diversity specifically—is taken into consideration doesn’t necessarily translate into concrete action or progress on board diversity.

Our analysis indicates that a growing number of companies are demonstrating their commitment to racial and ethnic diversity through disclosure of board demographics. Disclosure enables the board to tell its diversity story. Increasing disclosure will allow investors and stakeholders to know the true level of diversity on the board, better measure progress on board diversity, and assess whether companies are achieving their publicly stated goals.

Endnotes

1U.S. Securities and Exchange Commission, Securities Exchange Act Release No. 34-92590 (order approving SR-NASDAQ-2020-081 and SR-NASDAQ-2020-082), August 6, 2021.(go back)

2California Legislative Information, SB-826 Corporations: boards of directors, October 1, 2018. California Legislative Information, AB-979 Corporations: boards of directors: underrepresented communities, October 2, 2020.(go back)

3Nasdaq defines LGBTQ+ as those individuals who identify as “lesbian, gay, bisexual, transgender, or [members] of the queer community,” while AB 979 refers to those who identify as “gay, lesbian, bisexual, or transgender.” Throughout this article references to third parties adhere to the term used by the third party and definitions may vary.(go back)

4Maryland HB1116/SB911, “Gender Diversity in the Boardroom—Annual Report,” effective October 1, 2019. New York A6330/S4278, “An act to amend the business corporation law, in relation to enacting the ‘women on corporate boards study,’” effective June 27, 2020. Washington SB6037, amending the Washington Business Corporation Act, effective June 11, 2020. Illinois HB3394, amending the Illinois Business Corporation Act, effective August 27, 2019.(go back)

5A Call to Action for Equity and Inclusion in the Boardroom from the Diverse Corporate Directors Coalition (DCDC), August 2020.(go back)

6Office of the Illinois State Treasurer, Russell 3000 Board Diversity Disclosure Initiative.(go back)

7ISS, United States: Proxy Voting Guidelines Benchmark Policy Recommendations, November 19, 2020, p. 12.(go back)

8State Street Global Advisors, Guidance on Enhancing Racial & Ethnic Diversity Disclosures, January 2021, p. 3.(go back)

9Office of the New York State Comptroller, NY State Comptroller DiNapoli Calls on Corporate America To Address Lack of Diversity, Equity & Inclusion, February 25, 2021.(go back)

10JUST Capital, A Growing Number of Companies Are Recognizing the Benefits of Racially Diverse Boards.(go back)

11U.S. Securities and Exchange Commission, Securities Exchange Act Release No. 34-92590 (order approving SR-NASDAQ-2020-081 and SR-NASDAQ-2020-082), August 6, 2021.(go back)

12See SSGA’s January 2021 Guidance on Enhancing Racial & Ethnic Diversity Disclosures, from which these examples are drawn.(go back)

13SSGA Guidance, p. 3 and The Vanguard Group Inc., Vanguard Investment Stewardship Insights: A continued call for boardroom diversity, December 2020, p. 2. BlackRock does not specifically mention individual or aggregate disclosure of directors’ race and ethnicity. See BlackRock, Our approach to engagement on board diversity: Investment Stewardship, March 2021.(go back)

14David A. Bell, Dawn Belt, and Jennifer J. Hitchcock, New Law Requires Racial, Ethnic or LGBT Diversity on Boards of California-Based Public Companies, Fenwick & West LLP, September 30, 2020.(go back)

15For a sample board matrix and example D&O demographic questions, see Out Leadership, LGBTQ+ Visibility Counts: Board Demographics Reporting Guidelines, November 2020.(go back)

Print

Print