Julia Forbess is partner and Ron C. Llewellyn is counsel at Fenwick & West LLP. This post is based on their Fenwick memorandum.

Overview

Corporate social responsibility has long factored into investment decisions, and the integration of environmental, social and governance (ESG) factors into corporate decision-making dates back nearly two decades. But in the last few years, ESG has become a common boardroom topic as investment funds with an ESG focus have raised billions and ESG’s non-financial metrics are increasingly factored into how investors and other stakeholders evaluate corporations. The SEC has also expressed an interest in ESG disclosure more broadly and has indicated the potential for rulemaking in the near future.

ESG practices and trends tend to be discussed as if there is one standard for all public companies, from the S&P 100 to small-cap growth industries. In an effort to understand the common practices of pre-commercial biotech companies, Fenwick has collected and analyzed data through the review of the public disclosures of 50 U.S.-based, development-stage public biotech companies with market capitalization ranging from $1.3 billion to $4.6 billion.

Drawing on the review of these companies’ 10-Ks, proxy statements and other corporate governance documents, we conducted an online survey of 100 executives at biotech companies with market capitalizations ranging from $100 million to more than $4 billion as well as representatives of investment banks, venture capital firms and hedge funds. For more information on our approach, please see “Methodology and Demographics” in the complete publication.

What follows is a more detailed summary of our research and accompanying analysis. We close this post with guidance about how biotech companies can adapt to the changing ESG landscape, as we believe the insights found here can start to help companies across the sector set benchmarks and plan for what’s ahead in ESG best practices, disclosures and regulation.

Key Takeaways for Biotech Companies

- Current ESG reporting among biotech companies is limited and there is no consensus on where or what to report.

- Biotech executives and investors agree that ESG should be or will be a focus in the future, but efforts to prepare for anticipated disclosure requirements vary among companies.

- Biotech companies indicated that diversity was an important area of focus, with many companies expressing the importance of disclosing board and employee composition in SEC filings. This is attributed to state laws and recent disclosure requirements by the Nasdaq Stock Market.

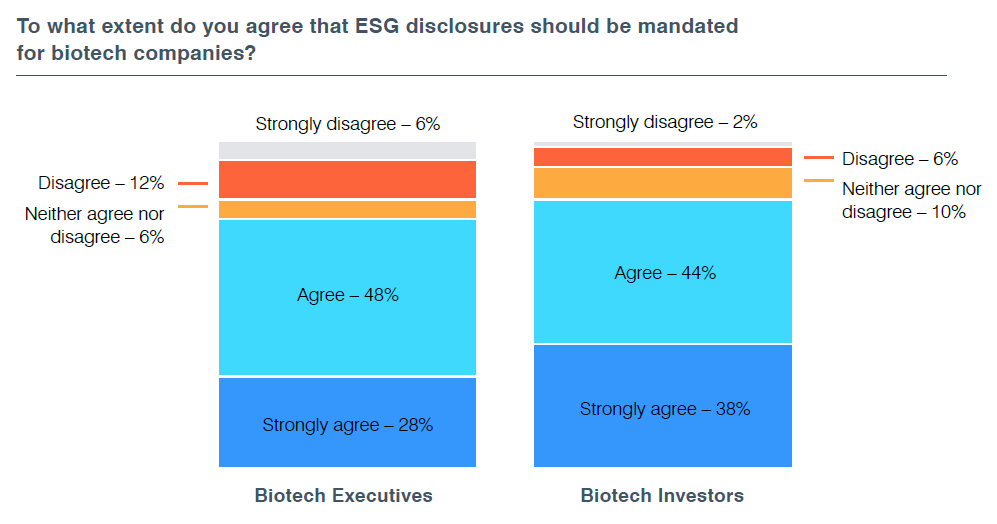

- Biotech executives and investors agree that ESG disclosures should be mandated to provide consistency and standardization.

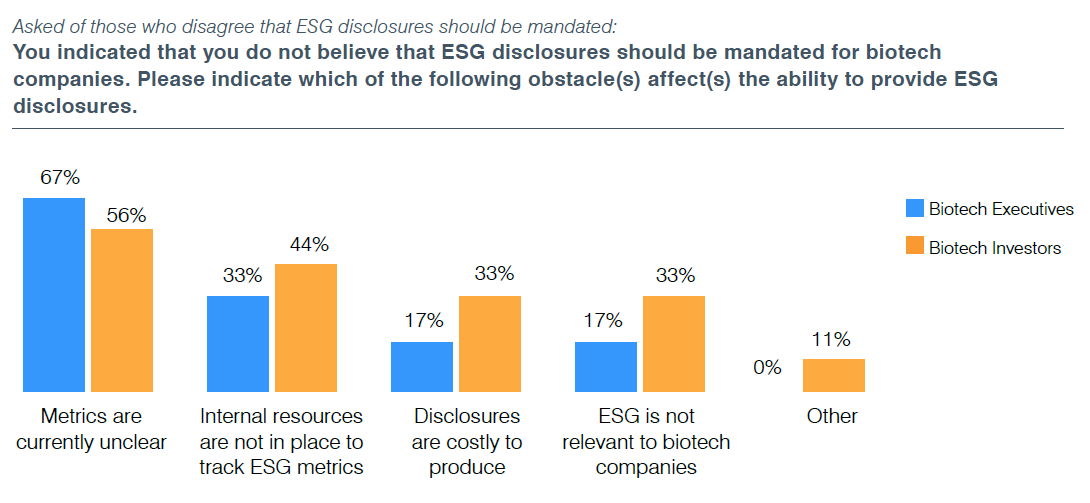

- Among the respondents who did not think that disclosure should be mandated, a lack of standardized metrics was viewed as the primary obstacle.

No “Standard Practice” for Disclosures

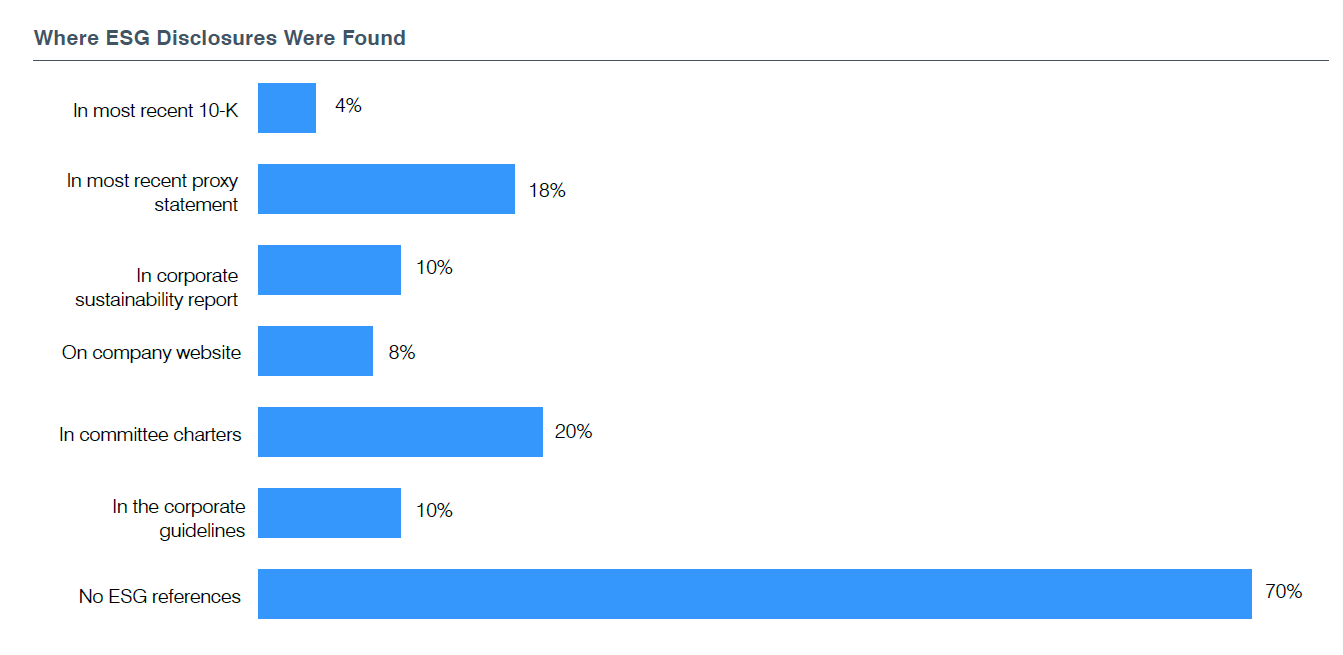

Our research found that a substantial majority of the reviewed biotech companies had limited or no explicit ESG public disclosures. Only 30% of the companies we reviewed referenced ESG (excluding diversity disclosures) in their public disclosures. Within this number, disclosure practices varied substantially, ranging from full corporate sustainability reports (CSRs) (10% of companies) to brief statements in corporate governance documents regarding board or committee oversight of ESG (22% of companies). Additionally, 18% of companies included disclosures in their proxy statements.

Defining ESG

For purposes of this post and our review, in determining whether a company provided ESG disclosure, we credited companies that specifically used the term “ESG” or “corporate sustainability” (or a similar term). Also, if a company indicated that it was managing a broad set of environmental, social and governance-related topics that it viewed as part of a unified set of risks and opportunities (even if it did not specifically use the term “ESG”), we considered it to be ESG disclosure.

Disclosure with regard to diversity was noted separately due to the heightened interest in this topic among investors and other stakeholders in recent years. Accordingly, companies that provided diversity disclosure alone and not as part of a broader program were not regarded as having ESG disclosure, given that it is now mandated by Nasdaq.

Expected Growth in ESG Importance

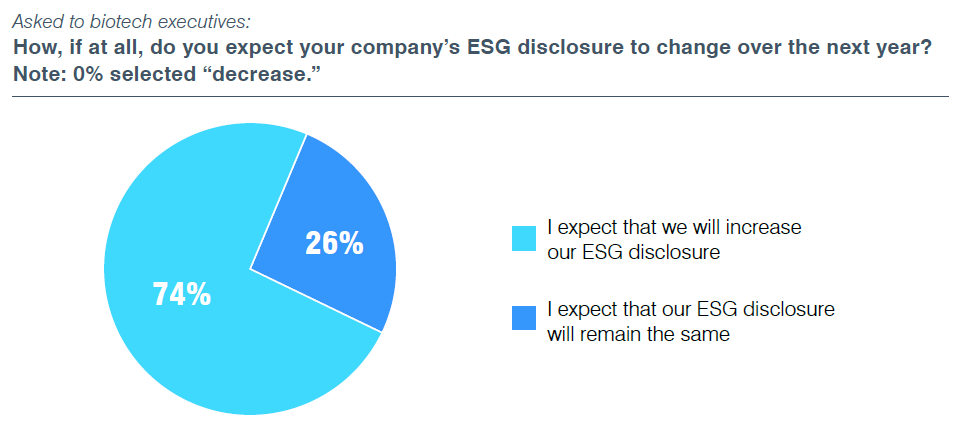

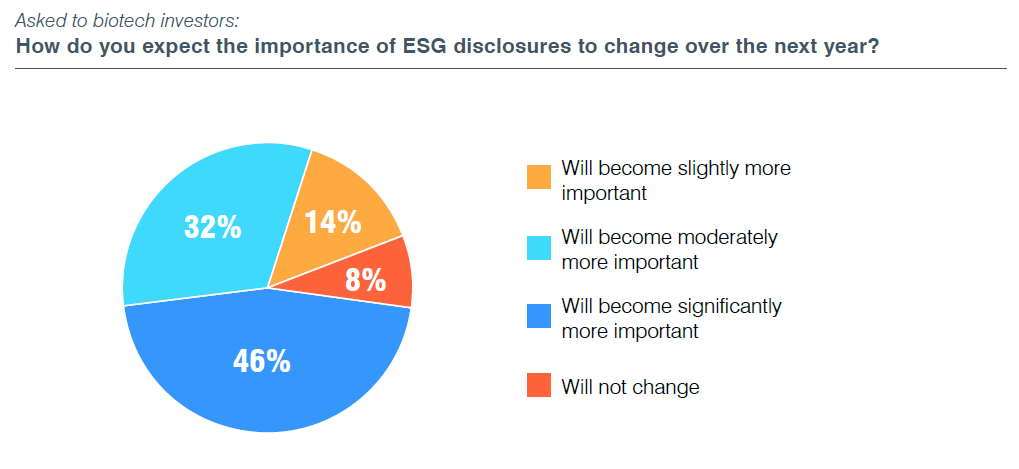

Despite the lack of standardization in current disclosures, every biotech executive as well as nearly every biotech investor surveyed told us that they expect ESG to grow in importance in the coming year. No respondents thought ESG would become less important, and nearly three-fourths of biotech companies expect to increase their ESG disclosures over the next year.

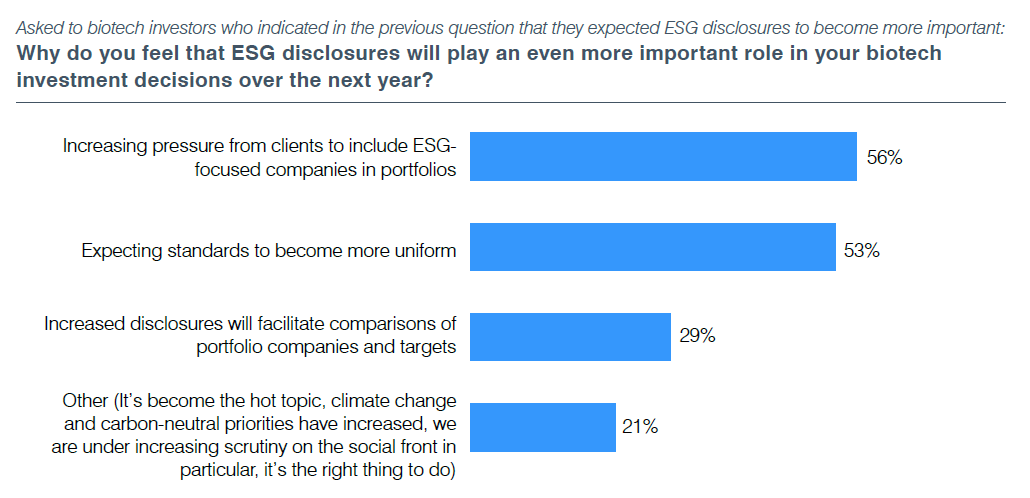

Investors who expect ESG’s prominence to grow pointed to increasing pressure from clients to include ESG-focused companies in portfolios, as well as standardization in reporting. Investors were also more likely to believe that ESG disclosures should be mandated.

ESG Measures Taken by Biotech Companies

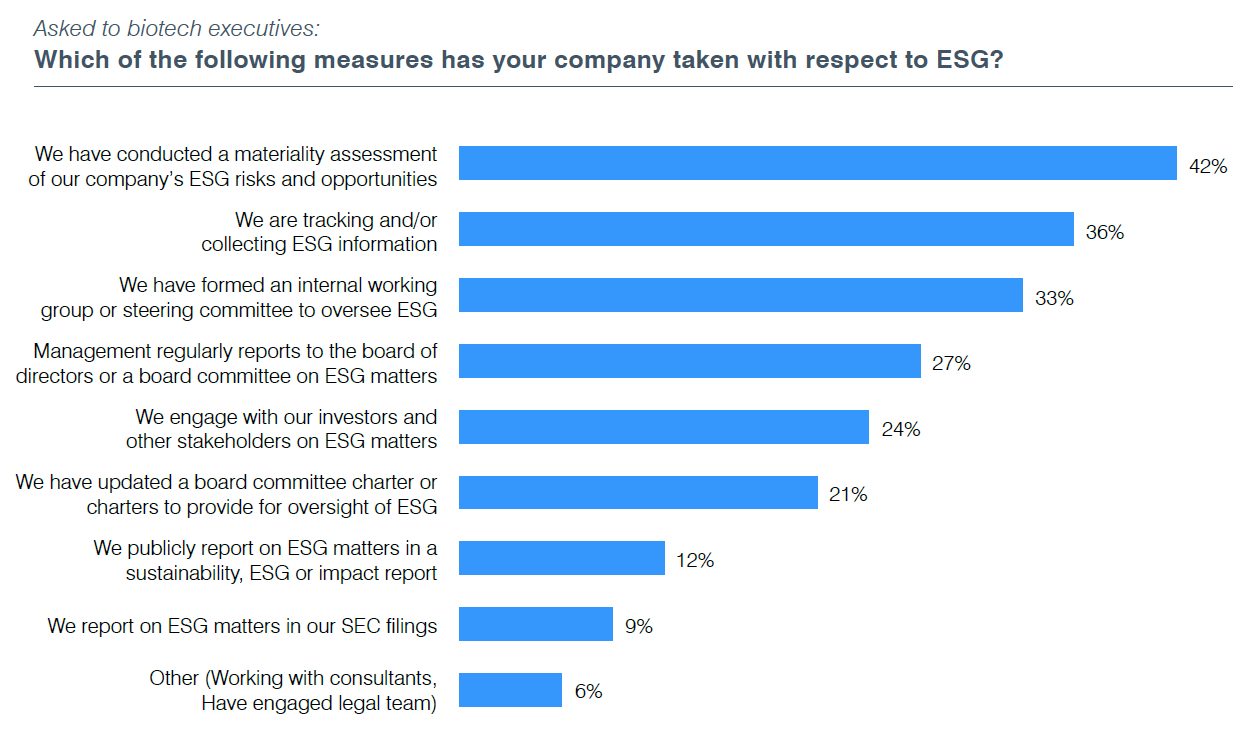

Although only 24% of the companies responding to our online survey have implemented and are currently reporting ESG measures, ESG activities seem to be on the rise. An additional 42% of companies surveyed have implemented ESG initiatives but are not yet reporting.

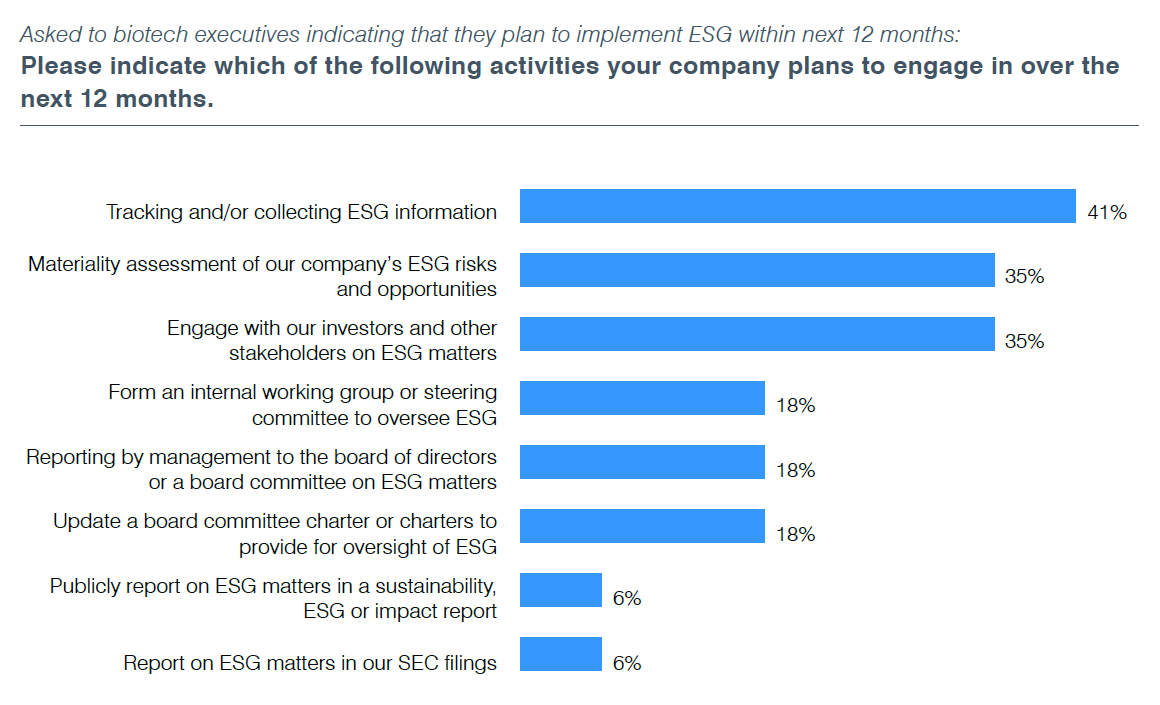

ESG activities varied with no single activity dominating, suggesting that many companies are at an early stage of implementation. Similarly, companies that had not yet implemented ESG activities disclosed a wide range of measures that they intended to take, with tracking and/or collecting ESG information garnering the highest number of selections (41%).

The likelihood of a company to report ESG practices seems to be correlated with the number of years it has been publicly traded. Given the number of recent IPOs in the biotech sector, we expect that ESG disclosure will accelerate accordingly as these newly public companies mature and expand their governance and compliance functions.

Years Public Versus ESG Disclosures (Based on Review of 50 Biotech Company Disclosures)

| Years Since IPO | Number of Companies in Range | Number with ESG | Percentage with ESG |

|---|---|---|---|

| Less than 2 | 13 | 1 | 8% |

| 2 – 5 | 16 | 3 | 19% |

| 6 – 10 | 15 | 7 | 54% |

| 11 – 15 | 2 | 1 | 50% |

| 16 – 20 | 1 | 1 | 100% |

| More than 20 | 3 | 1 | 50% |

Mandates and Standardization Widely Sought

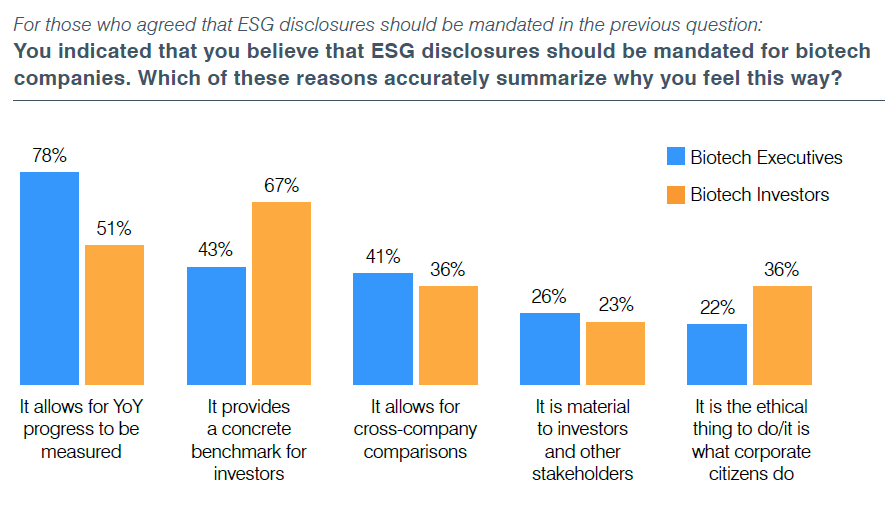

A majority of executives and investors agree that ESG disclosure should be mandated, and the top reasons given were 1) the ability to measure year-over-year progress; and 2) disclosures yielded provided valuable benchmarking information. Investors were slightly more interested in the year-over-year progress of a company, while executives were more focused on the value of benchmarking against other companies.

It appears that many biotech companies have been waiting for regulatory action or clear indications from investors before acting on ESG. As noted earlier in the report, fewer than 25% of executives said their companies are currently reporting on ESG activities despite the fact that approximately 80% of executives and investors favor disclosure mandates. Among the 18% of biotech executives (and 8% of investors) who said ESG disclosures shouldn’t be mandated, most cited a lack of standardized metrics as their primary point of contention. As one executive told us, “Until there is a standardization for the industry, relevance is not there.” Executives opposed to mandated ESG disclosures also said that they haven’t seen enough investor demand. “I don’t know what companies would fully commit to it without a mandate,” one executive said. Said another, “There has not been proper incentive for us to do this.”

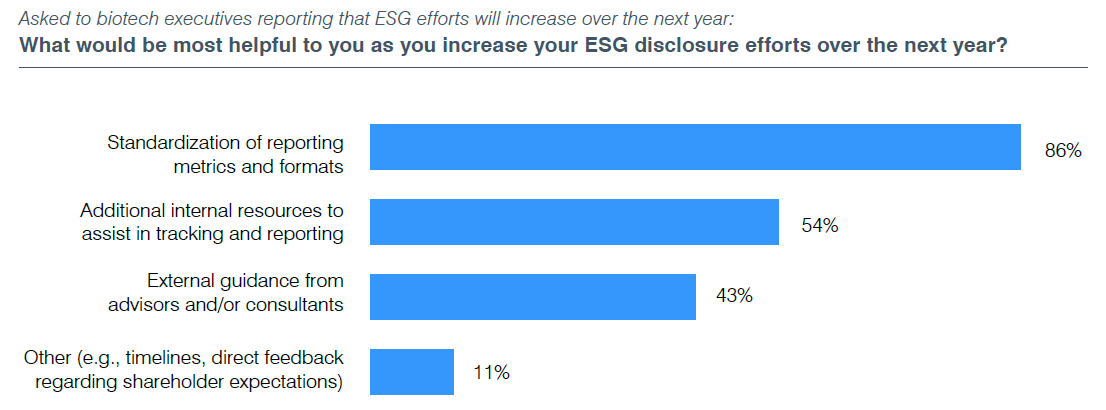

Increased standardization of ESG disclosures, whether from regulations or the consolidation of voluntary reporting frameworks and standards, will likely facilitate more ESG reporting.

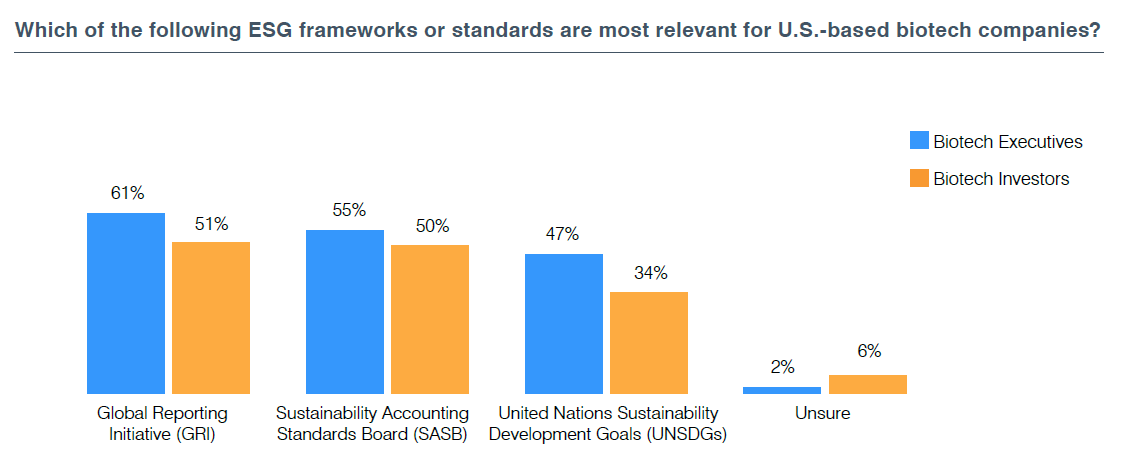

Our data shows that both executives and investors are looking for clear guidance and standardization in ESG. As it stands today, companies that choose to follow a framework or standard would likely follow standards set by the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), or report alignment with the United Nations Sustainable Development Goals (UNSDGs). That results in varying types — and levels — of disclosure that are often difficult to compare. The four biotech companies in our review that provided standalone reports said that they reported based at least in part on the SASB standards. According to our survey, executives and investors say the GRI standards are the most relevant, followed by SASB.

There have been recent and ongoing efforts to consolidate some of the major standards. For example, in November 2021, the IFRS Foundation announced the formation of a new International Sustainability Standards Board (ISSB) into which the Value Reporting Foundation, which provides the SASB standards, and another major standard-setter, the Climate Disclosure Standards Board, will merge by June 2022. The ISSB intends to develop a comprehensive set of global sustainability disclosure standards.

Additionally, the SEC has indicated that it is poised to promulgate rules requiring more disclosure of important ESG topics such as climate risk, board diversity and human capital management. A substantial majority of the executives and investors that we surveyed — 84% and 72%, respectively — believed that the SEC’s efforts would lead to some level of standardized ESG disclosures by 2023. However, even if the SEC enacts rules requiring its own set of ESG disclosures, it is likely that companies will continue to report according to one or more of the third-party standards such as SASB or GRI, because of investor expectations and demands, and because of the time and resources that they have already invested to comply with these standards.

Little Consensus on Metrics to Track

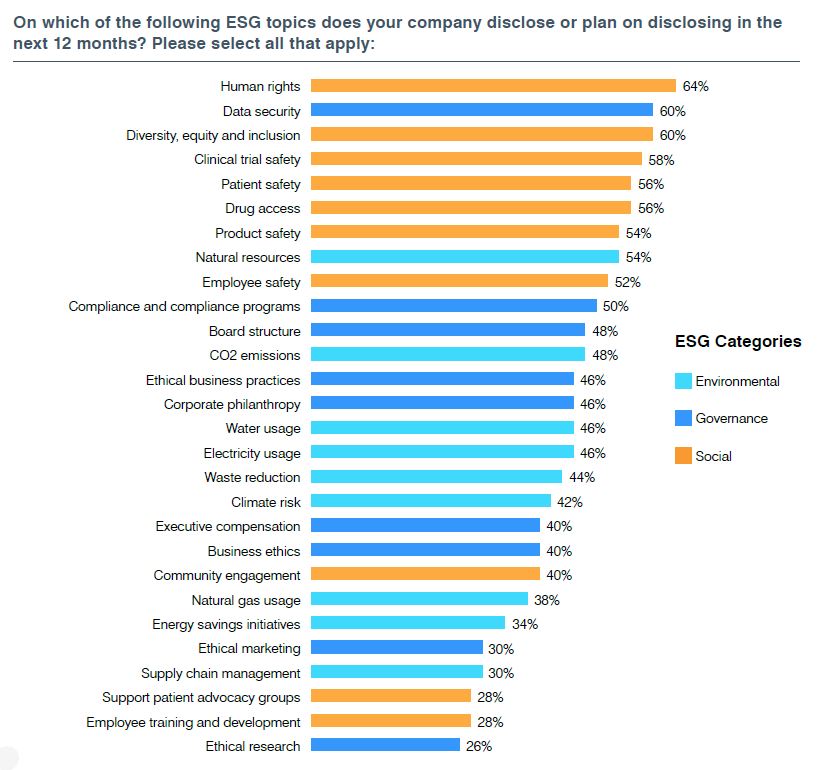

Our survey results also showed a similar lack of consensus around what to track. When we asked companies to choose which specific ESG metrics they are tracking or planning to track, none stood out from the pack. However, our results indicated that biotech companies are more inclined to gather data on social metrics than environmental and governance ones.

It’s also noteworthy that social factors were cited more often for disclosure than those related to governance or the environment. This may be attributed to the greater availability of some of the social metrics data, which facilitates their reporting.

Diversity a Growing Focus

Diversity has become one of the most prominent ESG topics and has garnered attention from many investors and other stakeholders. In August 2021, the SEC approved rules that require most Nasdaq-listed companies to have at least two diverse directors, including one woman and one member of an underrepresented community (or explain their absence), and to provide annual disclosure regarding board diversity statistics.

In addition, companies headquartered in California are required to have a minimum number of women and members from underrepresented communities on their boards. As a result, many companies are starting to disclose more information regarding their diversity programs and initiatives, including efforts to add diverse board members or employees, and diversity statistics.

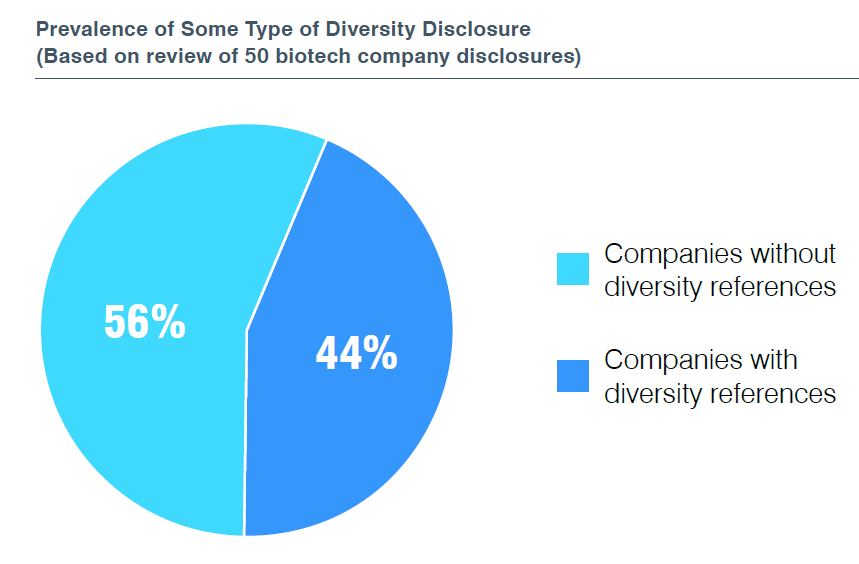

Our survey indicates that biotech companies believe that diversity is important, with an overwhelming majority favoring diversity disclosure in either the Form 10-K or proxy statement. This contrasts with less than half (44%) of the biotech companies reviewed providing diversity disclosure, though that number is expected to reach almost 100% in 2022 given the Nasdaq mandate to disclose.

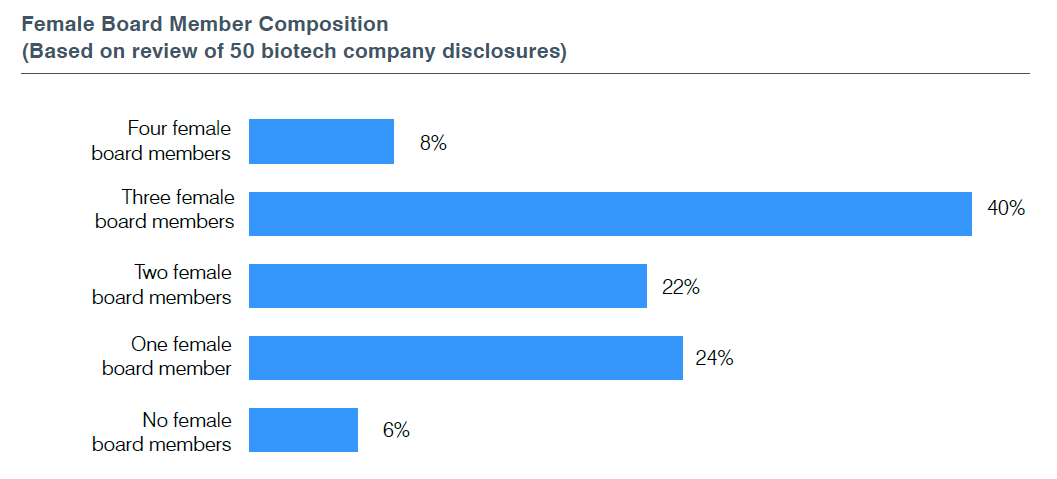

Based on our review of the companies in this post, 94% had at least one female board member and 70% had at least two female board members. Additionally, given the regulations and trends noted on the previous page, diversity-related disclosures by biotech companies will likely increase in the near future.

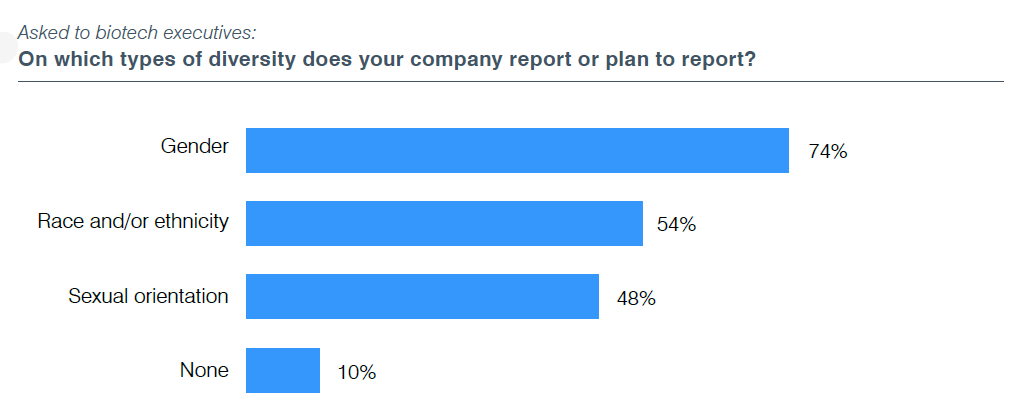

When asked about different types of diversity on which they reported, biotech executives were most focused on disclosures related to gender, and nearly three out of four said their organizations are reporting — or planning to report — that type of information. That finding, contrasted against the lack of current reporting, could signal increased reporting of diversity statistics and initiatives in the near future.

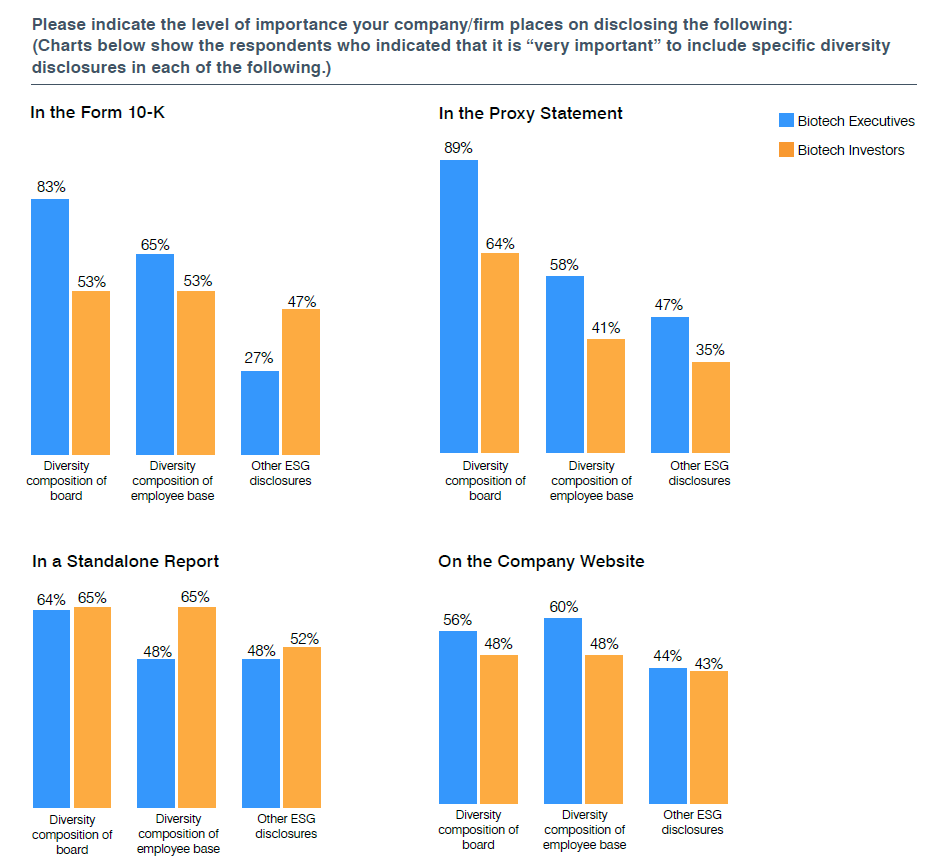

A significant majority of biotech executives thought that it was “very important” to disclose board diversity and employee diversity metrics in their company’s proxy statement and Form 10-K compared to providing such disclosure in a standalone report or on their company’s website. Investors placed greater importance on standalone reports, presumably because of ease of data collection.

The recent adoption of the Nasdaq board diversity rules and the SEC’s rules in 2020 expanding disclosure requirements for human capital resources issues such as employee diversity require increased disclosure in proxy statements and Form 10-K, emphasizing the appropriateness of these documents for disclosure placement.

How Companies Can Prepare

ESG’s importance shows no signs of abating — or of losing investor interest. As a result, here’s what companies should consider when implementing and reporting on ESG.

Determine What to Report

Biotech companies beginning the process of preparing for ESG reporting should assess the ESG issues that are most material to the business and decide how and where to report on those issues. In many cases, it will be helpful to compare the topics that similarly situated biotech companies disclose. ESG issues that may be most relevant for biotech companies include product safety, drug pricing, access to healthcare, data privacy, supply chain management and human capital management. Companies should also consider the preferences of their largest shareholders and other important stakeholders regarding the information they would like the company to disclose.

Decide on Oversight Structure

A company’s management and board will need to determine the best structures for oversight of its ESG activities and disclosure. Some companies establish multidisciplinary working groups consisting of employees and executives from departments such as investor relations, communications, relevant business units, finance and risk management. The hiring or appointment of a chief sustainability officer may aid in providing coordination of the company’s efforts and may educate management and employees generally about ESG developments and best practices. Given the wide-ranging nature of ESG, a company may need to adopt new controls and procedures for gathering such data, which differ from those used to capture financial data. With the increased demand for ESG disclosure, there will likely be demands or even requirements for third-party assurance of ESG data.

Assign Specific Internal Tasks

A company’s board of directors will have to consider how it will provide appropriate oversight of ESG. This will include deciding whether it will form a new board committee focused on ESG or assign responsibility to an existing committee, such as the nominating and corporate governance committee or audit committee. The broad range of topics that ESG encompasses may necessitate assigning responsibility to multiple committees, depending on the nature of the topic and the composition of the committee. For example, a company’s compensation committee would be best positioned to oversee employee diversity issues, but the audit committee could more appropriately assess a company’s ESG controls. The board may also look to recruit additional board members with expertise in key areas of ESG to ensure effective oversight. Finally, the entire board will need to be knowledgeable about ESG, although the board may designate certain directors to engage with investors and other stakeholders on ESG issues.

Find the Right Disclosure Platform

After a company has determined the ESG data that it wishes to disclose, it must decide on the best platform for disclosure. In recent years the number of ESG raters and rankings, on which many investors rely when making investment and voting decisions, has significantly increased. The ratings and rankings are typically based on the company’s public disclosures about its ESG practices. Therefore, companies should ensure that they are disclosing their ESG activities on a visible platform.

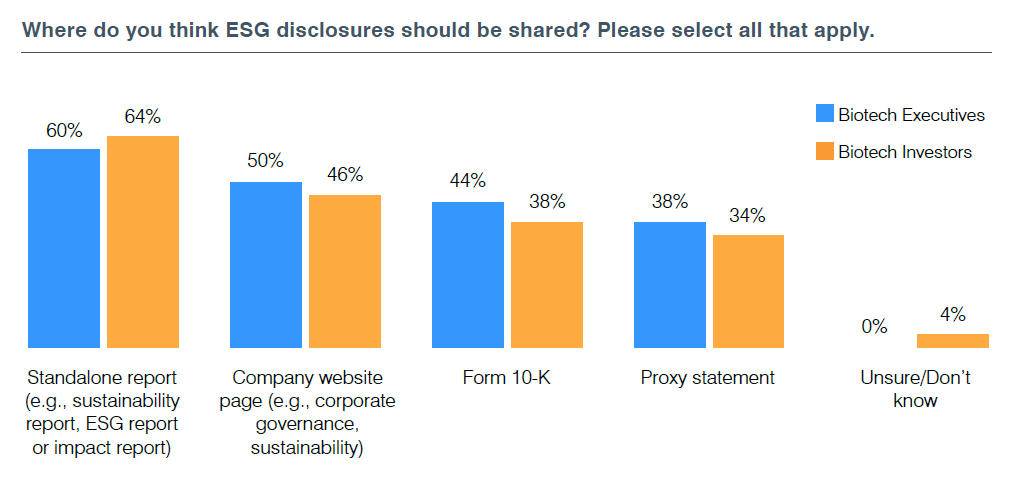

As noted earlier in this post, most survey respondents favor mandatory ESG disclosures and expect the SEC to standardize ESG reporting by 2023. At the same time, biotech executives and investors prefer that the disclosures be shared in standalone reports and company websites (over Form 10-Ks or proxy statements). This may provide opportunities for more expansive disclosure, but in the absence of SEC mandates, companies should carefully consider what they voluntary disclose, whether in an SEC filing, in a standalone report or on a website, as they could be liable for any statements that are proven to be false or misleading.

The complete publication, including footnotes, is available here.

Print

Print