Maria Castañón Moats is Leader of the Governance Insights Center, Leah Malone is Director of the Governance Insights Center, and Christopher Hamilton is Principal in Workforce Transformation at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here), and The Perils and Questionable Promise of ESG-Based Compensation by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here).

The broad area of environmental, social, and governance (ESG) issues is undeniably making its way onto corporate boardroom agendas today. Many large institutional shareholders are asking companies to focus more, do more, and disclose more about ESG efforts. In fact, ESG is now the topic most often covered during shareholder engagements that include company directors.

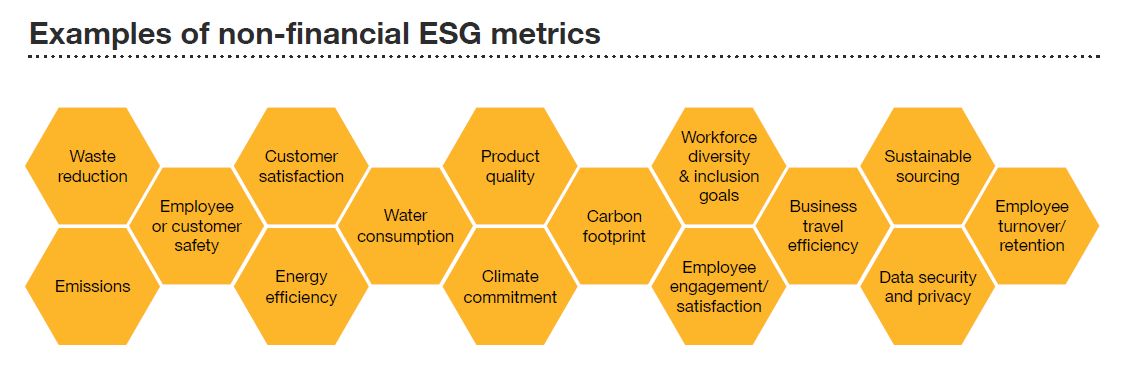

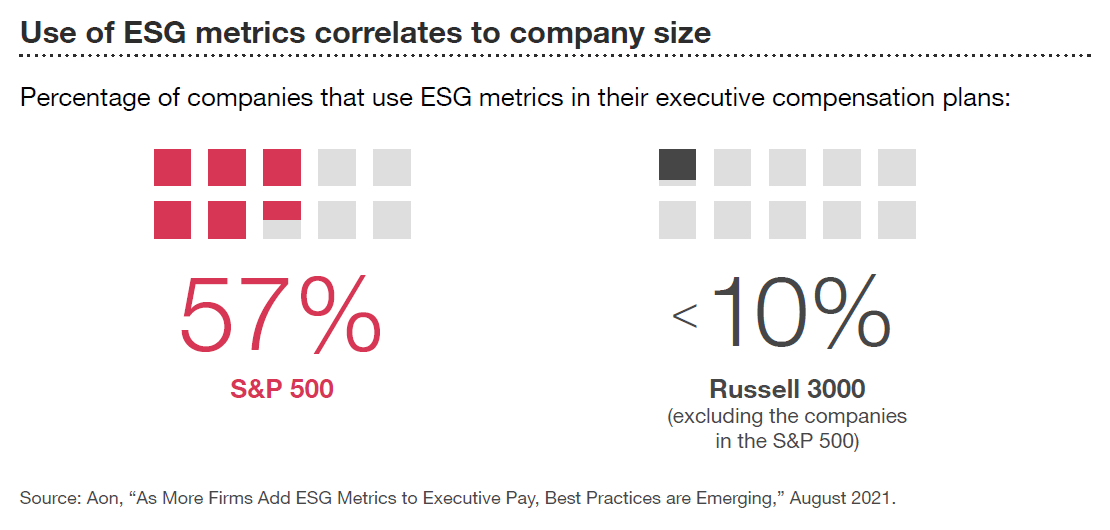

As boards work to integrate ESG concerns into discussions of company strategy, many are also considering how to create the right incentives for achievement of ESG-related goals. Incentive plans have long been driven primarily by objective financial goals. That often means quantitative goals related to things like revenue, cash flow, units sold, EBITDA, earnings per share, or total shareholder return. But at many companies, a shift is underway as non- financial goals become more common. As of March 2021, more than half of companies in the S&P 500 (57%) used at least one ESG metric in their plans.

Many investors support—or are even urging—these changes. The 2021 Global Benchmark Policy Survey published by Institutional Shareholder Services (ISS) found that 86% of investors (and 73% of non-investors) think non-financial ESG metrics are an appropriate measure to incentivize executives. But investors are also clear—if ESG metrics are to be used, it needs to be done right. Metrics should be carefully chosen and should align with a company’s strategy and business model.

In Part 1 of this post we describe the roadmap to readiness for companies that are not yet using ESG metrics in their plans. In Part 2, we consider the “how” of implementing those metrics into a company’s plans. Finally, in Part 3 we discuss the risks and pitfalls companies could encounter.

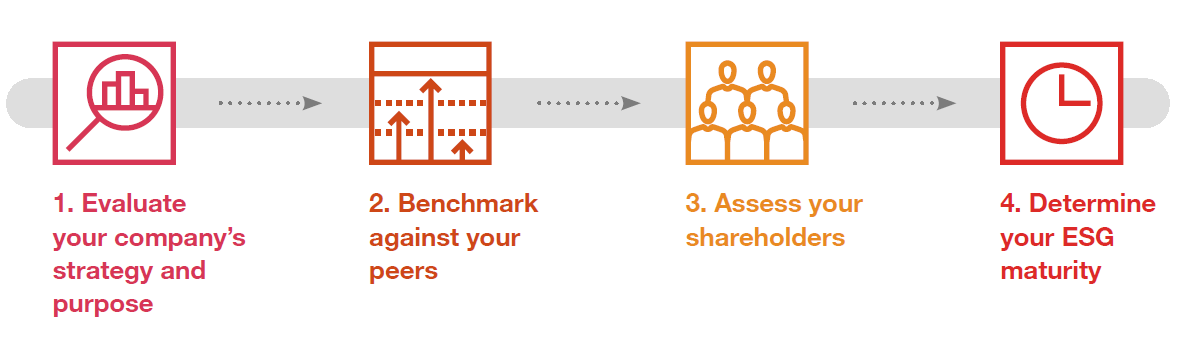

Part 1: ESG metrics: the roadmap to readiness

1. Evaluate your company’s strategy and purpose.

How does the board define the company’s strategy and purpose? How are ESG issues incorporated into that strategy and purpose—or are they not? For some companies, there is a clear business case for certain ESG metrics. It may already be reflected in the business plan or even be core to the company’s purpose. For others, ESG issues may (at least at this moment) not seem core to their mission.

The incorporation of new goals into compensation programs should always be motivated by a clear and compelling reason. Some companies bring in ESG metrics because they are looking to reflect, or change, the culture at a company. Others are looking to manage business risks or pursue opportunities related to ESG.

Targets and metrics in executive compensation plans are premium real estate—and space for new metrics is limited. Compensation committees are wise to avoid overburdening those plans with too many different goals. This keeps the organization’s main priorities front and center, and makes expectations clear. Some boards also prefer to include only easily quantifiable measures in incentive plans, which makes using ESG metrics (which can be more difficult to measure) challenging.

2. Benchmark against your peers.

While a majority of S&P 500 companies are now making use of ESG metrics, that trend doesn’t hold true for smaller companies. Fewer than 10% of companies within the Russell 3000 (excluding those companies that make up the S&P 500) are using ESG metrics in their executive compensation plans. So even though the practice has gotten tremendous attention, it is not as widespread as it may seem. For now, it is largely concentrated among large-cap companies and among companies within certain industries.

No board wants to be last when it comes to implementing new governance practices. But many don’t want their company to be the first one within their peer group either. Specific benchmarking will show what comparative peer companies are doing.

3. Assess your shareholders.

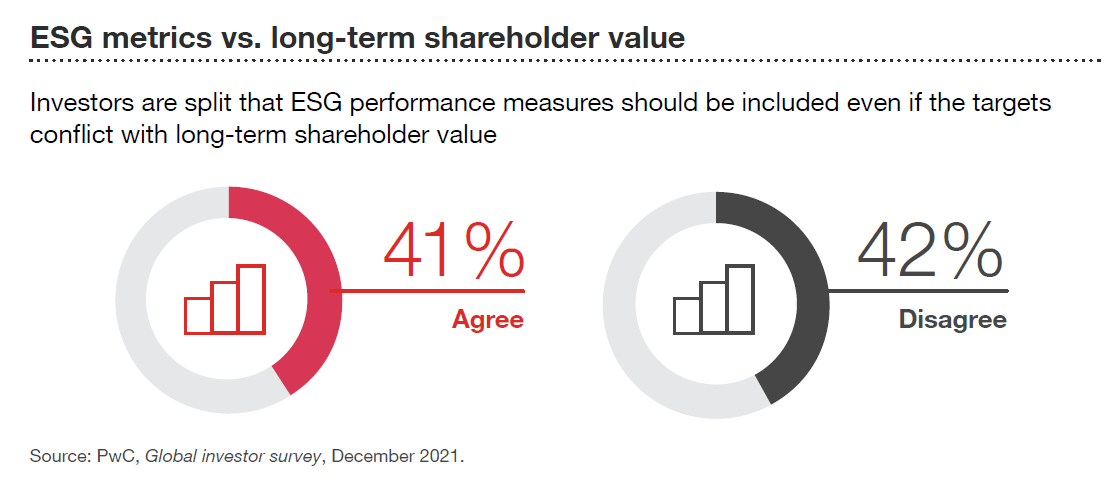

Shareholder views on the role of ESG in executive compensation are critical to understand. But investors are not a monolith, and they don’t want the same things. Even among large institutional investors, companies will find that views and perspectives on the proper role for ESG metrics will vary widely. Some investors have signaled their general support for the inclusion of ESG metrics. Others are more skeptical.

Among those that support using ESG metrics, they often disagree on what types are most appropriate and under what circumstances they should be used. PwC’s Global investor survey shows that shareholders are almost evenly split on the question of balancing ESG metrics against long-term shareholder value. Forty-one percent think those metrics have value even if they conflict with long-term returns. About the same percentage disagree.

Engaging with the company’s top shareholders on the question of ESG metrics in executive compensation plans, or becoming familiar with their public policy statements on the topic, will be an important step in setting the path forward. These facts won’t necessarily determine the board and the compensation committee’s decision on the topic. But they will be helpful data points along the way.

4. Determine your ESG maturity

Whether the compensation committee is ready to incorporate ESG metrics into the executive compensation plans will also depend on the company’s ESG maturity. Companies generally fall into three categories: laggards, middle of the pack, and front runners.

Many companies that are front runners may already be using ESG metrics in some fashion in their compensation programs. If they are not, they are likely preparing to do so now. For companies lower on the maturity curve, it may make sense to continue to refine the company’s ESG strategy before adding related elements to the compensation plans. In part, this is because ESG targets are often set with respect to 5-10 year periods—much longer than traditional incentive plan periods. While front runners may have set interim measurement periods that can align with the 1- or 3-year performance periods compensation plans often use, many other companies will not be ready to do so.

And remember: adding ESG metrics to plans is not the only way for the board to encourage certain behaviors from executives. Achievement of goals that fall into the ESG categories can also play a key role in promotion and hiring decisions. Some companies have even recognized efforts with spot bonuses or other firm-wide recognition outside of the incentive plans.

The bottom line: Don’t add new elements to an executive compensation program just to follow the trend, or because you think shareholders want it. Without the proper connection to strategy and overall compensation decisions, neither the board, the executive team nor the shareholders will be pleased with the result.

Part 2: Thinking through implementation

Once the decision is made to add ESG metrics to executive compensation plans, the work is far from done. From which metrics, to which plans, to the structure of the targets— companies and boards are using a wide variety of approaches. Each approach has different benefits and risks, and sends a different signal to executives, and to investors.

Key considerations for choosing ESG metrics:

- Importance to investors and other stakeholders

- Correlation to the company’s purpose

- Ability to measure and track progress

1. Which metrics and weighting?

Executive compensation plan goals and targets are one of the board’s most essential tools for motivating Any new goal added to a compensation plan needs to be purposeful and clear. But newly-added ESG metrics can also bring additional complications. Given the current spotlight on this trend, the metrics chosen will send a message to the company’s stakeholders about the board and the company’s commitment to ESG concerns.

Some companies are using a dozen or more different types of ESG metrics in their compensation plans. Which metrics are right for the company’s executive team will depend on a number of factors.

Currently, the most common types of metrics relate to human capital management and social issues. Among the S&P 500 companies that use ESG metrics, 41% use some kind of human capital-related metric, with diversity and inclusion (D&I) metrics being most common. Only 14% are using one or more environmental-based metric.

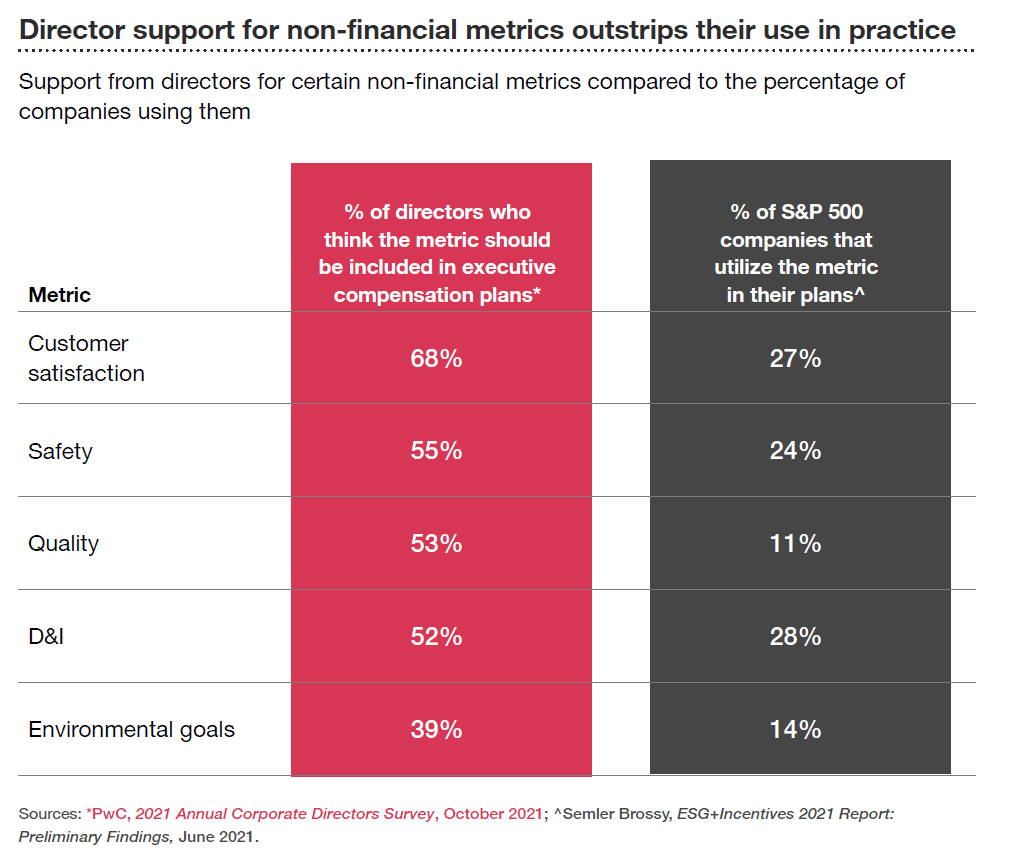

Similarly, our research has shown that public company directors are most likely to support metrics that would fall under the “social” pillar. These include customer satisfaction, safety, and quality—goals which are not necessarily new to compensation plans. D&I goals, however, were uncommon a few years ago but are taking hold quickly. The public focus on social concerns has led employees, customers, suppliers, and the media to question what companies themselves are doing to promote equity internally. The number of S&P 500 companies disclosing metrics related to D&I in their plans grew 19% from 2020 to 2021.

While the scope of metrics that fall under the broad ESG umbrella is wide, many boards choose to start with just one. For some, it may be the one that is most developed or the easiest to measure, even if not necessarily the one that is most important to the company. This might be a response to some of the most vocal shareholders, who emphasize the need for ESG targets to be objectively measurable, similar to other financial or operational targets. More than half (52%) of investors say that ESG metrics should be included in plans if they are specific and measurable. Only 34% agreed that even non-measurable targets have a place in those plans.

The value of third-party perspectives

Lawyers, compensation consultants and others will have a valuable role to play as companies navigate changes to their compensation plans. These advisors can share experiences and perspectives from other organizations, as well as help mediate metric and goal discussions between management and the board.

2. To whom should the goals apply?

Some boards start by creating goals that apply only to the Others choose to hold the entire executive team accountable, and still others create broad-based goals that apply to employees much further down in the organization. The right answer for a company might depend upon:

- How closely is the ESG goal tied to company strategy?

- What is the scope of responsibility for the metric within the organization?

A goal like customer satisfaction may be so intrinsically connected to company strategy, and so central to employees’ roles, that the goal should be more broadly applicable. On the other hand, goals that may require key strategic decisions, like carbon emissions reductions, may be more appropriately limited to the CEO and other members of senior leadership. Some boards and compensation committees also choose to start with a narrower field as they begin to implement a new goal, and widen the scope once they become more comfortable with the target.

3. How do the metrics operate?

Executive compensation plans are complex and Different types of plans present different options for building metrics. The current plans in place at a company may limit the options available now, but as the topic evolves, boards and compensation committees may start to consider slightly different plan structures depending on their goals and perspectives.

Types of ESG metrics

| Scorecard |

|

|---|---|

| Individual components |

|

| Weighted components |

|

| Underpin or global modifier |

|

| Stand-alone plan |

|

4. What time horizon is appropriate?

ESG metrics are most commonly used in annual bonus plans, rather than long-term incentive plans. Shorter-term annual plans tend to have more flexibility, allowing for strategic and/or individual performance goals. But many ESG goals do not fit naturally into a one-year time horizon. Long-term incentive plans may align better with the long-term changes companies are pursuing as part of their ESG strategy. But even then, the common three-year measurement periods may not be long enough to capture five to 10-year ESG goals. And using ESG metrics in those plans presents complications too. Long-term plans that are stock-based (as many are) have less flexibility from an accounting standpoint. If goals are not purely objective and require the compensation committee to exercise judgment, the accounting treatment may be less advantageous for the company.

Investors say they are fairly open to either structure. More than four out of five investors (81%) agree that both short-term and long-term incentives may be the right place for ESG incentives, depending on circumstances.

5. How will this affect disclosure?

Currently, sustainability disclosures are predominantly voluntary, meaning that companies take a variety of approaches to ESG reporting. Many companies publish a stand-alone report, or create a separate section of the website. Some elements might be incorporated into the company’s financial reports, but until new SEC regulations on the topic are issued, most are not.

But this changes when ESG metrics are added to executive compensation plans. A company is required to describe the executive compensation plans and goals, as well as the rationale for those choices. Then, of course, performance against those metrics will need to be described. That means that if specific ESG metrics are established with accompanying targets, the company needs to prepare for disclosure about achievement and perhaps be prepared to discuss why targets were missed.

Part 3: What can go wrong?

For boards and compensation committees thinking about adding new metrics to compensation plans, it’s important to consider the risks associated with those changes.

| Incentivizing the wrong behaviors | Setting targets and establishing metrics sets expectations for executives. But with brand new types of metrics, it’s possible to discover that you’ve incentivized the wrong behavior. An executive team might be able to meet emissions goals with a big spend on a carbon sink, for example, or meet D&I goals with a short-term hiring blitz at the end of the year. These methods may sacrifice long-term shareholder value for the sake of hitting short-term targets. |

|---|---|

| Setting the wrong targets | New metrics can create complications just by being new. Partway into the performance period, the compensation committee may realize that the targets were too far off to be reasonable, leading the committee to want to make adjustments. Those adjustments can be hard to explain and can damage the company’s credibility with shareholders. |

| Sending the wrong signal to the executive team, or to investors | In particular with goals relating to ESG, the new metrics will send a message. Does that message express the company’s values? |

| Creating just another entitlement | If the metrics or targets relate to areas that shareholders or employees assumed were non-negotiable, the compensation committee risks creating an almost guaranteed bonus. Shareholders are wary of incentive pay for something executives should be doing in any case. |

| Losing the goal in translation | For global companies—how do the goals translate to other countries? Or are different goals set? The company can risk sending the wrong message if team members across the globe are subject to different expectations on ESG issues. |

| Difficult-to-measure performance | Many ESG goals are qualitative, rather than quantitative. Success is often highly subjective, and some boards are wary of even setting specific goals because they don’t want to have to report missing targets on sensitive issues. |

| Finding comfort in the numbers | Which groups internally will be responsible for collecting the relevant data, and assessing performance? Who oversees this process? Does the company have external assurance? How confident is the compensation committee in its ability to assess performance? This is especially challenging for areas where the company is not accustomed to gathering reporting. |

| Exercising discretion | Since many ESG-related metrics are subjective, they can also allow for greater discretion in determining performance. But the compensation committee may also have situations where it wishes to exercise discretion because targets were unrealistic, or were set too low. How will the executive team and shareholders react to that? |

| Balancing ESG performance against financial performance | When determining the structure of the plan, consider how shareholders will react if ESG targets are met, but financial targets are missed. |

Conclusion

As an increasing number of companies incorporate ESG metrics into their compensation plans, best practices continue to emerge. Compensation committees and boards face the challenges of creating clear, appropriate targets that align with and reinforce an evolving ESG strategy. Managing the company’s stakeholders is critical, as is balancing the expectations of various shareholders with those of leadership. For those that have made recent changes to their executive compensation plans to account for ESG metrics: continue to monitor developments and expect an evolution in how those goals are being defined and utilized. For those who haven’t added ESG metrics yet: consider when the company will be ready, and start to lay the groundwork with the executive team.

Print

Print