David A. Bell and Julia Forbess are partners and Ron C. Llewellyn is counsel at Fenwick & West LLP. This post is based on their Fenwick memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Throughout the last few years, investors, proxy advisors, governance professionals and a number of stakeholders have expressed a keen interest in how companies are managing their environmental, social and governance (ESG) associated risks and opportunities. Given the broad nature of ESG and the general dearth of reporting mandates, ESG disclosure practices can vary significantly. This report examines how technology companies in particular are responding to the growing interest in this space and the demands for more ESG-related disclosure by looking at the ESG reporting practices of the technology and life science companies included in the Fenwick – Bloomberg Law Silicon Valley 150 List (SV 150), which can serve as a proxy for technology companies more generally.

Key Takeaways

Our analysis of the public disclosures of the SV 150 companies shows the following:

- Approximately 90% of SV 150 companies provide some level of ESG disclosure, with the vast majority of such companies (83%) choosing to disclose throughout multiple channels (e.g., sustainability reports, websites and/or proxy statements).

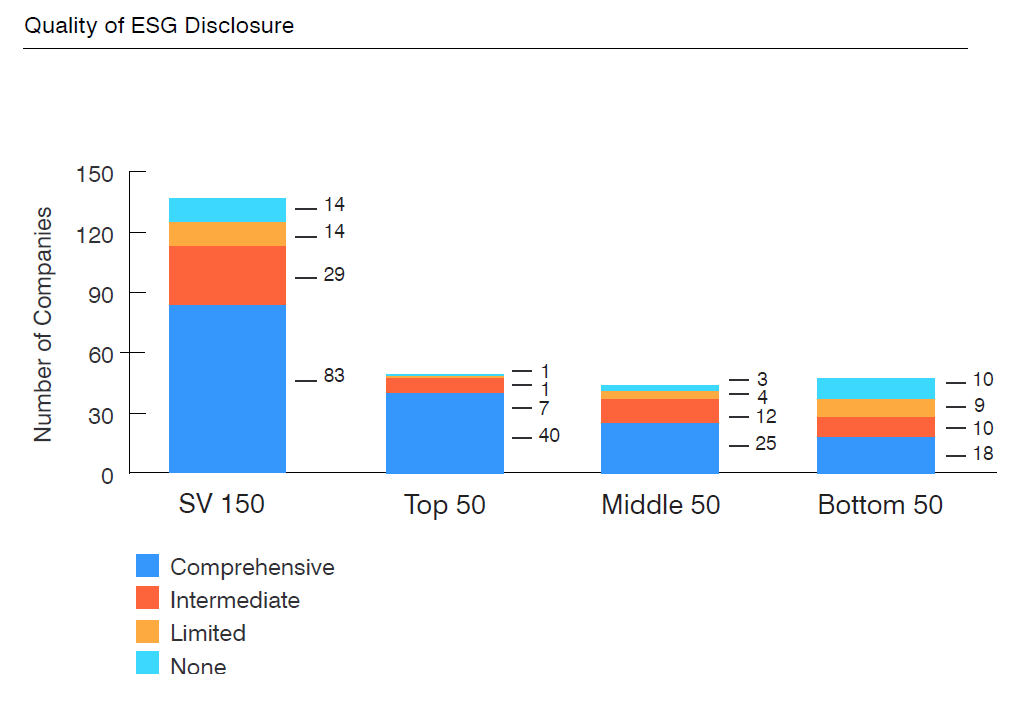

- The amount and quality of ESG disclosure varied by size of company, with the larger SV 150 companies generally providing more comprehensive disclosure, including quantitative metrics.

- ESG disclosures addressed a variety of topics, including carbon emissions and related reduction efforts, human capital management programs and initiatives, board and employee diversity, data protection and privacy. A significant majority provided disclosures related to human capital management, while smaller majorities included community impact and carbon emissions.

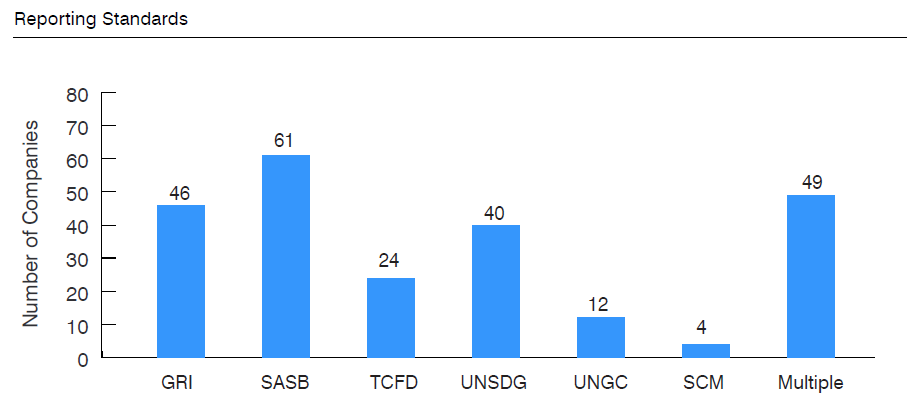

- Approximately half of the SV 150 companies reported using a third-party standard or framework to guide their disclosure.

- Only 17% of SV 150 companies provided independent assurance for their quantitative ESG metrics, such as GHG emissions.

- The vast majority of SV 150 companies delegated primary oversight of ESG to the nominating and corporate governance committee or its equivalent.

Background and Methodology

Our research examined the public disclosures, including corporate websites, standalone corporate social responsibility, ESG or sustainability reports or their equivalent (referred to as corporate sustainability reports or CSRs) and the most recent proxy statement of 140 of the 2021 constituent companies of the SV 150 (10 of the SV 150 companies have been acquired or are no longer public since the publication of the 2021 SV 150 list and were not reviewed for this report). The SV 150 companies ranged from Apple with $294 billion in revenue for 2020 to iRhythm Technologies with $265 million in revenue for 2020.

As we noted in Corporate Governance Practices and Trends – 2021 Proxy Season, SV 150 companies are generally smaller, younger and have less revenue than the large public companies of the Standard & Poor’s 100 Index (S&P 100), although some of the larger SV 150 companies are also represented in the S&P 100 and S&P 500. Because of the wide range in sizes of companies in the SV 150 we have grouped them into subcategories of top 50, middle 50 and bottom 50 companies in terms of revenue.

A company was regarded to have ESG disclosure if its specifically referenced “ESG,” “sustainability” “corporate social responsibility” or another similar term and addressed ESG risks and opportunities as a unified concept. In determining the level of disclosure, our research looked at the totality of a company’s disclosure as expressed over multiple platforms.

Overview

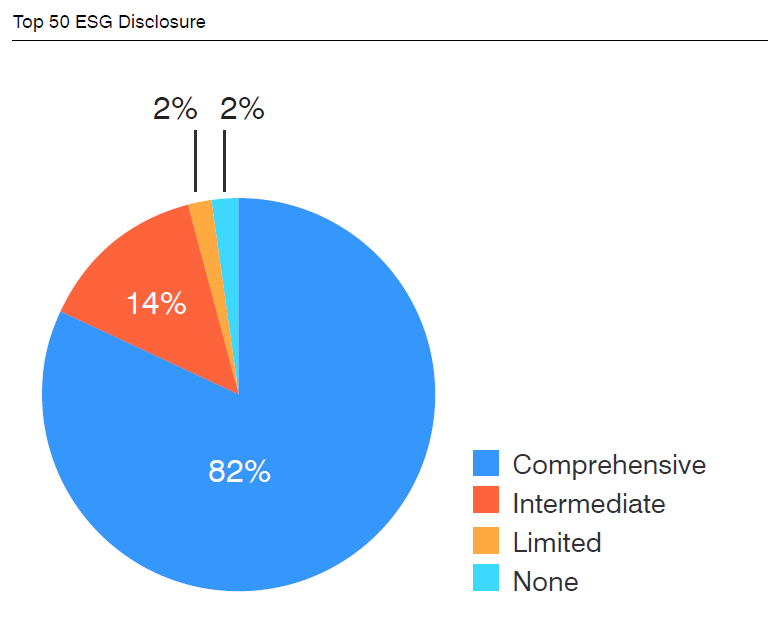

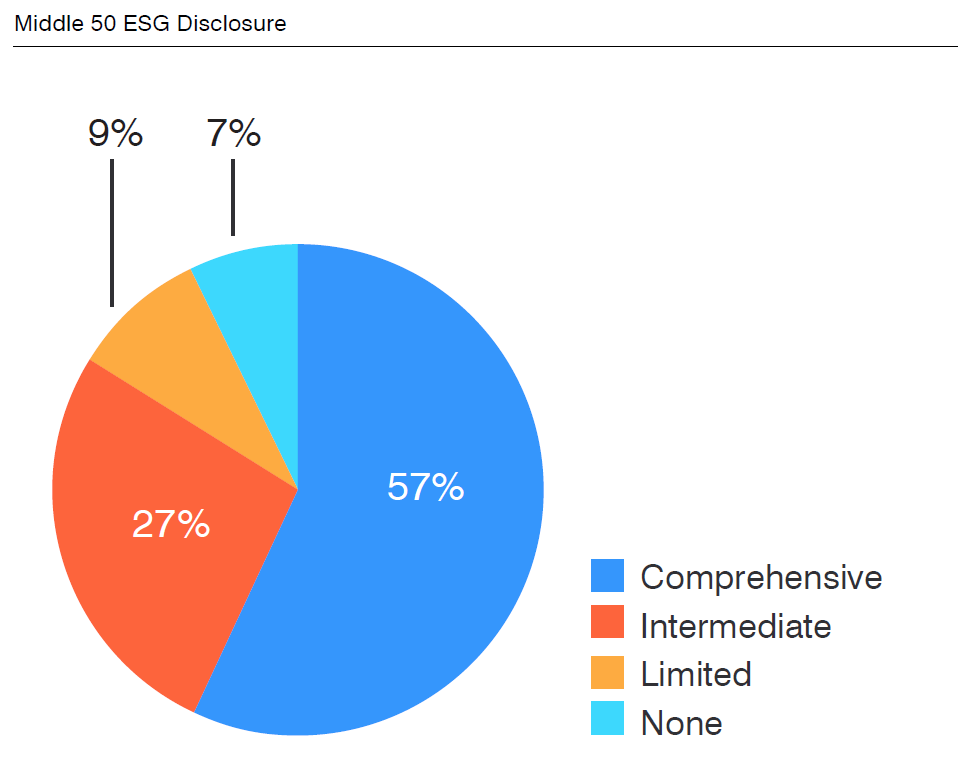

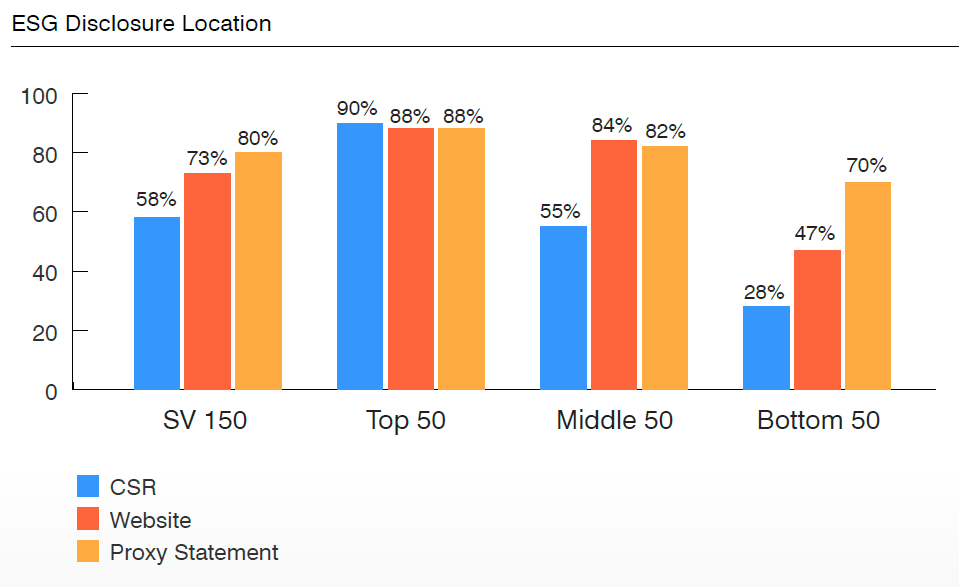

Many technology companies are disclosing ESG activities as demonstrated by the large number of SV 150 companies that provided some level of disclosure. According to our research, approximately 90% of the SV 150 companies that we reviewed disclosed some form of ESG data. Furthermore, 80% of those companies provided disclosure in multiple venues. Companies selected proxy statements most often for ESG disclosure (80%) followed by corporate webpages where 73% of companies made such disclosure. Notably, just 58% of companies disclosed ESG information in standalone reports. While a majority of SV 150 companies were found to provide comprehensive ESG disclosure (59%), the comprehensiveness of disclosure appears to be correlated with company size with 82% of top 50 companies providing relatively robust ESG disclosure compared to 57% and 38% of the middle 50 and bottom 50, respectively.

ESG Disclosure Quality

Comprehensive Disclosure

A majority of SV 150 companies (59%) provided what could be viewed as “comprehensive” ESG disclosure. The larger companies in the SV 150 tended to provide the most detailed and extensive ESG disclosure. Comprehensive disclosure was most often included in glossy, standalone CSRs that covered a broad range of environmental, social and governance topics and included quantitative data. CSRs provided vehicles for companies to provide more granular details regarding their ESG objectives and challenges and to tie their initiatives to their broader strategy. The third-party disclosure standards and frameworks often guided the disclosures (approximately 90%) with many CSRs containing indices indicating how the information in the CSR satisfied one or more standards (see “Third-Party Frameworks and Standards”). In some cases, the corporate webpage also provided extensive ESG disclosure. Included below are the three ESG categories and the type of disclosure typically provided where companies had comprehensive disclosure.

- Environmental. Environmental disclosure often provided specific metrics for greenhouse gas emissions (GHG) – (Scopes 1, 2 and 3), energy consumption (electricity and gas), water usage and waste management. Companies also discussed specific goals and commitments to reduce their carbon footprint and increase the amount of renewable energy. In addition, most companies included qualitative discussions of their sustainability initiatives such as recycling programs, LEED building certifications and hybrid/remote work policies.

- Social. Social disclosure comprised a broad set of data ranging from topics such as human resources to community impact. For example, companies would often discuss employee training and engagement, employee resource/affinity groups and workplace safety issues, as well as philanthropic activities such as corporate donations, community-based programs and employee volunteer activities. Most companies provided quantitative information regarding diversity, including the demographic breakdown of their workforce by gender, race/ethnicity and role (typically for management, technical employees and the overall workforce). In addition to these metrics companies also provided information regarding efforts to increase diversity within their ranks and programs to support underrepresented communities. To the extent that a company’s products or services had a broader social impact the tie between the products or services and societal or community benefit was noted.

- Governance. Under governance, companies disclosed information regarding board structure, including board diversity and oversight. However, companies would also discuss efforts to ensure data protection and privacy, supply chain integrity (human and raw material), business ethics and compliance. Descriptions of and links to relevant policies, documents or website disclosures would also be provided for additional information regarding board or management oversight in these areas.

Intermediate Disclosure

Approximately 21% of companies provided what could be described as “intermediate” disclosure. Such disclosure covered the topics noted under “Comprehensive Disclosure” but generally provided less detail and relatively few quantitative metrics. They typically included only high-level descriptions of ESG programs and initiatives, or there was unequal treatment of ESG categories. Companies that made intermediate disclosure typically did so in proxy statements or on corporate websites.

Limited Disclosure

Limited ESG disclosure was provided by 10% of SV 150 companies. Such disclosure ranged from just a brief mention regarding the importance of ESG or a statement regarding board or board committee oversight of ESG matters to limited descriptions of programs or initiatives that were solely focused on one prong of ESG (e.g., environmental sustainability). Companies provided limited disclosure most often in their proxy statements.

No Disclosure

Similarly, 10% of SV 150 companies provided no ESG disclosure in their proxy statement or on their website and produced no CSRs. While such companies may have to some degree addressed individual ESG topics in their disclosures, unlike the other SV 150 companies they chose not to link such topics as part of a unified set of risks or opportunities under the label of “ESG,” “sustainability” or a similar broad term.

Third-Party Frameworks and Standards

Third-Party frameworks and standards can be valuable in guiding companies on what information to disclose based on industry and stakeholder interest. Approximately half of the companies in the SV 150 followed or were influenced by a third-party standard-setter in determining what information to disclose. In addition, 70% of these companies reported to more than one standard or framework. The most prominent frameworks and standards include Global Reporting Initiative Standards (GRI), Sustainability Accounting Standards Board Standards (SASB), Task Force on Climate-related Financial Disclosure (TCFD), the United Nations Sustainable Development Goals (UNSDG), the United Nations Global Compact (UNGC) and the World Economic Forum’s Stakeholder Capitalism Metrics (SCM). SV 150 companies cited SASB most often as the standards to which they adhered, with 87% of the companies disclosing standards citing SASB. This was followed by GRI, which was cited by 66% of companies that reported to a standard or framework.

Assurance

Despite the large portion of the SV 150 providing ESG disclosure, relatively few companies sought independent, third-party assurance of their ESG data. Just 17% of companies reported getting such assurance or provided assurance statements for their data. Where assurance was provided it was most often for environmental disclosures such as GHG emissions or water or energy usage and was limited in scope. The larger companies in the SV 150 accounted almost exclusively for the companies providing assurance with the top 50 companies representing almost 88% of the companies that disclosed assurance reports or statements.

Top 50 Trends

Overall, the top 50 companies exhibited the most widespread and robust ESG disclosure practices with approximately 98% of such companies reporting. Compared to the other companies in the SV 150, the top 50 companies generally have greater resources that can be devoted to developing the necessary controls and infrastructure to provide more comprehensive reporting, including the production of CSRs. The top 50 companies include companies with revenue of approximately $2.7 billion or more and market capitalizations averaging $171 billion (based on values at the time of announcement of the most recent SV 150 list). The top 50 companies were slightly more likely to provide information in CSRs than on their websites, with 90% and 88% of companies using those platforms for disclosure, respectively. A similar percentage of companies (88%) provided ESG disclosure in their proxy statements. The top 50 companies were also likely to align their disclosure with third-party standards or frameworks such as GRI or SASB (84%). This undoubtedly contributed to the detailed level of disclosure generally provided by the top 50. Only 2 companies (4%) provided limited or no ESG disclosure.

Middle 50 Trends

The overwhelming majority of companies in the middle 50 of the SV 150 provided ESG disclosure with approximately 93% of companies reporting, however their reporting was generally less fulsome than the companies in the top 50. Only 55% of middle 50 companies provided disclosure in CSRs which tend to provide more expansive disclosure than the other disclosure avenues. Middle 50 companies favored disclosing their ESG information on their websites and in their proxy statements, with 84% and 82% of companies choosing to use those platforms for their disclosure, respectively. Approximately 57% of middle 50 companies provided comprehensive disclosure compared to 27%, that provided intermediate disclosure, and 9% that provided limited disclosure. Only three companies in this group had no ESG disclosure. Just over a third (36%) of middle 50 companies reported following one or more third-party disclosure standards or frameworks with SASB cited most often (14 companies) followed by GRI (10 companies). Middle 50 companies include companies with revenue of at least approximately $762 million but less than approximately $2.6 billion and market capitalizations averaging $15.8 billion (based on values at the time of announcement of the most recent SV 150 list).

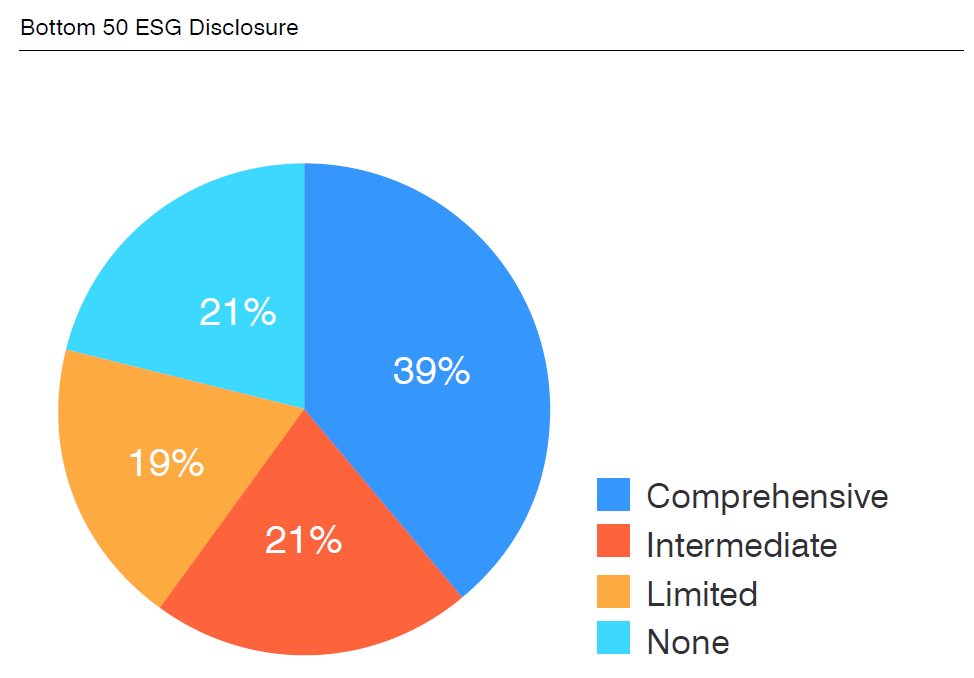

Bottom 50 Trends

Although a sizeable majority (79%) of the bottom 50 companies provided some ESG disclosure, this information was relatively brief and less detailed than the disclosures provided by the larger companies in the SV 150. Only 28% of the bottom 50 companies disclosed ESG information in CSRs and 47% made such disclosures on their websites. However, a sizeable majority (70%) of bottom 50 companies chose their proxy statements as a venue for their ESG disclosure. Consistent with the lower prevalence of ESG disclosure in CSRs, only approximately 39% of bottom 50 companies provided comprehensive ESG disclosure. Approximately 21% of this group provided no ESG disclosure at all. The bottom 50 showed similar percentages for intermediate and limited disclosure (21% and 19%, respectively). Only 28% disclosed following a third-party standard or framework, with SASB being noted most often. It stands to reason that the bottom 50 companies— which are generally younger and have less revenue than the larger companies in the SV 150— have fewer resources to devote towards providing more substantial ESG disclosure. The bottom SV 150 companies include companies with revenue of at least approximately $265 million but less than $694 million and market capitalizations averaging $8.1 billion (based on values at the time of announcement of the most recent SV 150 list).

ESG Board Oversight

Most SV 150 companies disclosed board or committee oversight of ESG, underscoring the importance of ESG information in assessing a company’s long-term viability. Failure to provide appropriate oversight of ESG risks may also subject boards to Caremark-type claims and increased scrutiny from stakeholders. The proxy advisory firms that advise many institutional investors on proxy voting and corporate governance issues have expressed the need for companies to exercise and disclose board oversight. For example, ISS may recommend votes “against” or “withhold” for directors if they exhibit “demonstrably poor risk oversight of environmental and social issues.” Similarly, Glass Lewis reviews companies’ overall governance practices and identifies which directors or board-level committees are responsible for oversight of environmental and/or social issues and will generally recommend voting against the governance committee chair if a S&P 500 company fails to explicitly disclose the board’s role in overseeing these issues.

Consequently, 73% of SV 150 companies disclosed their board’s oversight of ESG. In particular, 86% of the companies providing such disclosure stated that the nominating and corporate governance committee (or its equivalent) had primary responsibility for ESG oversight. Just 6% of disclosing companies expressed that the full board oversaw ESG while 8% disclosed that multiple committees or another committee primarily oversees ESG. Some companies that indicated that the nominating and corporate governance committee had primary responsibility for ESG also noted where other board committees oversaw aspects of ESG that were in their purview (e.g., the compensation committee overseeing the use of ESG based performance metrics in executive compensation plans, or the audit committee overseeing ESG-related disclosure controls and procedures). Companies generally disclosed board or committee ESG oversight information in proxy statements and also included responsibility for ESG oversight in their committee charters.

In our Guide to Best Practices for Establishing ESG Disclosure Controls and Oversight, we discuss recommended steps for companies to take in order to establish an appropriate program for determining, collecting and verifying ESG data, including establishing disclosure controls and appropriate management and board oversight.

Conclusion

While ESG reporting has not been mandated, most companies have opted to provide some level of ESG disclosure. The U.S. Securities and Exchange Commission and other regulators have indicated a clear interest in mandating ESG disclosures, increasing the likelihood that companies will disclose more information in a framework that is comparable in the near future. In the meantime, companies should consult with their shareholders and other stakeholders to understand the information that is most important to them. Most importantly, the board and management at the most senior levels should understand the ESG risks and opportunities that impact their companies and have a strategy for managing and disclosing them in the wake of these demands and any new regulations.

Print

Print