Rich Thomas is Managing Director, Christopher Couvelier is Director, and Leah Friedman is Vice President at Lazard. This post is based on a Lazard memorandum by Mr. Thomas, Mr. Couvelier, Ms. Friedman, Jim Rossman, and Antonin Deslandes.

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Observations on the Global Activism Environment in Q1 2022

Record Pace for Global Activism, Led by U.S.

- 73 new campaigns launched globally in Q1 marks the busiest quarter on record and, when combined with Q4, the busiest six-month period for activism since 2018

- The U.S. continues to account for the largest share of global activity, representing 60% of new campaigns and 55% of capital deployed

- Q1 activity in APAC accelerated, accounting for 16% of new campaigns vs. 2021’s recent low of 11%

- While Icahn and Starboard were both prolific in Q1 (launching four and three new campaigns, respectively), “first timers” and smaller-cap focused funds accounted for a higher proportion of activity than in prior years

Robust Activity in Europe Despite PullBack Since Onset of Ukraine Crisis

- Europe registered 15 new campaigns in Q1, representing a 50% jump in activity compared to Q1 2021

- French companies were disproportionately targeted in Q1, representing ~27% of European targets—nearly 3x the country’s historical share

- Activity has declined following the onset of the Ukraine crisis, particularly from non-European activists; agitation may have pivoted to behind-the-scenes pressure rather than public campaigns

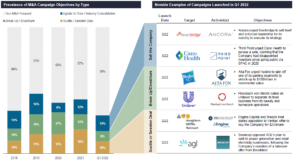

Fewer M&A-Related Campaigns, but Still Common

- 30% of all activist campaigns in Q1 2022 featured an M&A-related thesis, starting the year down slightly vs. the same period last year

- Scuttle/sweeten campaigns—the most common M&A attacks in recent periods—were down materially, in line with reduced deal volume in Q1 relative to prior quarters

- With scuttle/sweeten activism less prevalent, demanding an outright sale became the most frequent M&A attack vector, with notable examples including Everbridge/Ancora and Cano Health/Third Point

- The potential for more interplay between PE and activism is drawing attention, with activists partnering with PE to submit bids (Elliott with Vista Equity to buy Citrix and with Brookfield to take Nielsen private), traditional PE engaging in activist behavior (Hellman & Friedman’s plans to engage at Splunk) and activists pursuing their own PE strategies (Starboard Value-backed Acacia Research bidding for each of Comtech and Kohl’s)

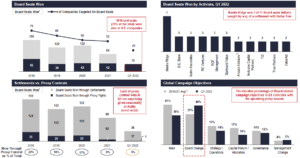

With Proxy Season Looming, Many Seats “In Play”

- 38 Board seats were won by activists in Q1 2022 and Board change was an objective in ~40% of all new campaigns initiated

- Only one Board seat has been secured by an activist via proxy fight in 2022 thus far (by Voss Capital at Griffon), with the remainder of seats secured via settlement

- Starboard’s high-profile proxy fight for four Board seats at Huntsman came to a head in late March, with all ten of the Company’s nominees prevailing at the AGM

- 85 seats remain “in play” heading into Q2, including notable potential contests at Kohl’s (10 seats), Southwest Gas (10 seats), U.S. Foods (5 seats) and Hasbro (5 seats)

Regulatory Changes Poised to Impact Activist Behavior

- The SEC’s November adoption of a universal proxy rule is poised to lower barriers to entry for nominations from both traditional activists and other constituencies (e.g., climate and labor activists, current/former employees)

- Although the rule does not officially take effect until August 2022, activists have already requested universal proxy usage in recent campaigns – notably, Huntsman, SpartanNash and LivePerson

- The SEC’s proposed 13D and 13G rule amendments—which recently concluded the public comment period—would benefit issuers by bolstering the “early warning” function of these ownership disclosure rules

Public Company ESG Pressure Grows

- Between the SEC’s long-anticipated climate change disclosure rule and the increasing number of E&S proposals submitted at U.S. AGMs, ESG scrutiny on public companies continues to mount

- Proposed increased disclosure around long-term emissions goals will, if approved, increase transparency on corporate climate strategies

- Increased transparency will potentially lead to further ESG proposal action from shareholders, which is already at heightened levels

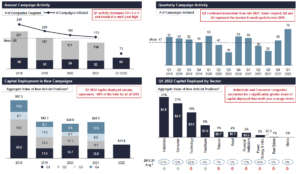

Global Campaign Activity and Capital Deployed

($ in billions)

Global Activist Activity in Q1 2022

($ in billions)

The number of activists waging campaigns in Q1—many of them “first timers”—is already over half of the number in 2021 as a whole

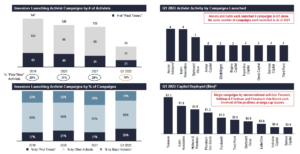

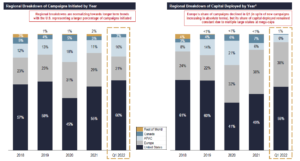

Regional Trends in Global Activity

U.S. continued to lead activity in Q1 2022, representing 60% of all global campaigns and 55% of capital deployed; campaign activity in APAC accelerated over the quarter, although capital deployed remained flat vs. 2021 as activists initiated modest positions

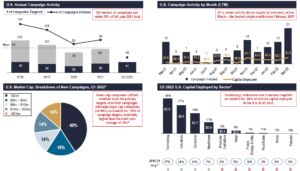

U.S.: Campaign Activity and Capital Deployed

($ in billions)

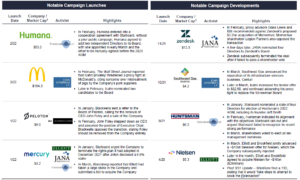

U.S.: Notable Q1 Public Campaign Launches and Developments

($ in billions)

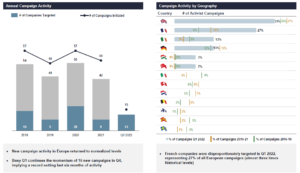

Europe: Campaign Activity and Geographic Breakdown

($ in billions)

Slowdown of Activity Pronounced in Europe vs. U.S. Amid Ukraine Crisis

- The Ukraine crisis has led to significant market destabilization and monopolization of the news cycle, potentially affecting the pace of activism as there was a steeper decline in the number of new campaign launches in Europe vs. the U.S.

- In March 2022, overall activity decreased by ~38% in Europe while it increased by ~50% in the U.S. compared to the previous month

- While the number of new campaigns between February and March 2022 increased in the U.S. by 62%, activity in Europe dropped precipitously following the Ukraine crisis outbreak with a 40% reduction of new campaigns

Increased Vocalism From Institutional Investors Turns Into Public Debate

Q1 2022 saw continued willingness from active managers to take public stances on key strategic matters, with shareholders speaking up on both sides of the debate in certain instances

Slight Decline in M&A-Related Campaigns

Coincident with the recent pull-back in the M&A market, campaigns to scuttle/sweeten deals were less prevalent in Q1 2022 as compared to typical annual levels, though transaction-related campaigns still accounted for ~30% of all campaign activity

Global Board Seats Won

Board representation is top of mind heading into proxy season; 38 seats have been won by activists to date, with 37 secured via settlement

Key Development in Focus: Potential Impacts of Universal Proxy

Although the universal proxy does not go into effect until August 2022, certain activists have already requested its use in proxy contests

Key Development in Focus: Proposed 13D Amendments

The SEC’s recent proposed amendments to the 13D and 13G filing regime promote timely and enhanced disclosure, thereby having the potential to reduce activists’ ability to capitalize on information asymmetry in the public markets

Potential Impacts of SEC Proposed Rules on Climate Disclosure

Though likely subject to change and future legal challenge, the SEC’s proposed mandatory climate-related disclosures will create more consistency in key metrics used and information disclosed by companies, allowing for better comparison across companies

Increasing Number of E&S Proposals

Though how many E&S proposals go to a final vote is yet to be seen, the number of submitted E&S proposals for 2022 AGMs thus far nearly matches 2021’s total, fueled in part by the continued growth in environmental-related proposals

The complete publication, including footnotes, is available here.

Print

Print