Subodh Mishra is Global Head of Communications at Institutional Shareholder Services, Inc. This post is based on a publication by ISS Governance Research.

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here); and Exit vs. Voice by Eleonora Broccardo, Oliver Hart and Luigi Zingales (discussed on the Forum here).

Key Takeaways

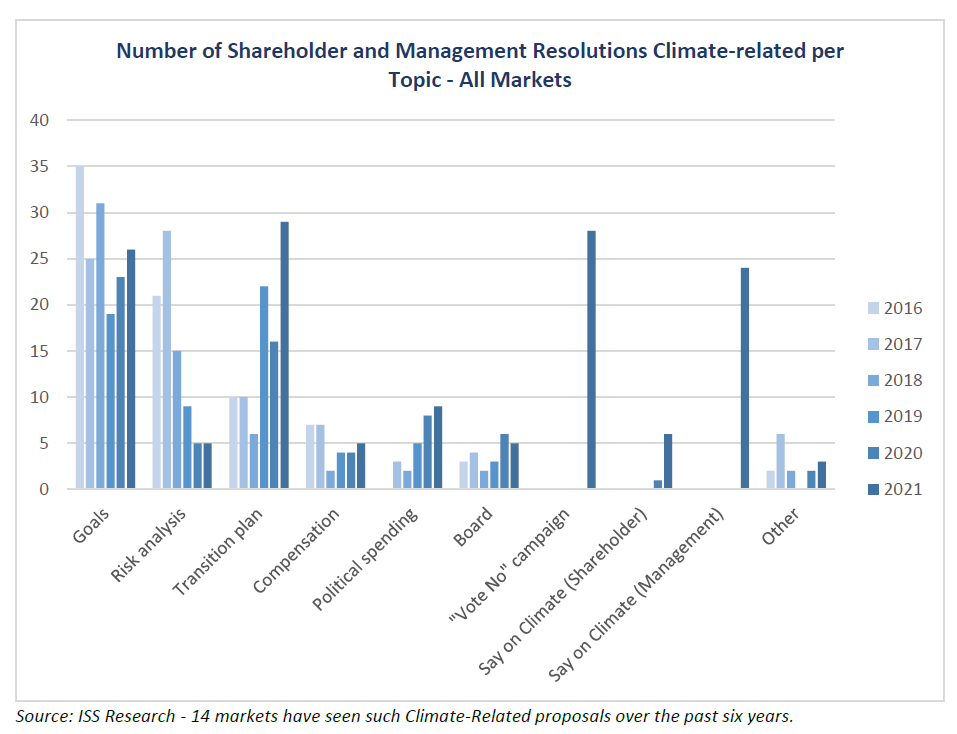

- In 2021 as in 2020, the majority of environmental and social-related shareholder proposals around the world were related to climate change and/or climate lobbying. More than half of the climate-related proposals were seen in the financial sector, the oil & gas sector, and the mining sector.

- Climate related shareholder proposals were seen in 14 markets in 2021—Australia, Canada, Denmark, Finland, France, Japan, New Zealand, Norway, South Africa, Spain, Sweden, Switzerland, the United Kingdom, and the United States—compared to 12 markets in 2020. There were 88 climate-related shareholder proposals that were voted on in 2021 compared to 65 in 2020.

- Shareholder proposals requesting disclosure of emissions reductions goals remained one of the most prolific type of climate-related proposal in 2021. Globally, the average level of support received by these proposals was 42.1 percent in 2021, up from 29.2 percent in 2020. Shareholder proposals requesting “Say on Climate” votes received average 32.7 percent support in 2021.

- 2021 was the first year in which management-presented “Say on Climate” proposals were seen, with 26 worldwide. 19 were at European companies, 3 in North America, 3 in South Africa and 1 in Australia. On average, the proposals received approximately 93 percent support in 2021. So far in 2022, the majority of similar proposals have also been at European companies.

- The number of management-presented “Say on Climate” votes in 2022 to date is already higher than in full year 2021 (36 votes to date in 2022 compared to 26 for the full year in 2021). But the extent to which this will result in a sustained rise in Say on Climate votes beyond 2022 is difficult to forecast.

Introduction

This post follows the 2020 ISS Climate & Voting report that came out last year and first documented and explained the trends of climate-related issues as seen through the lens of shareholder voting at company general meetings.

Report description

This year’s study looks globally and covers shareholder meetings with climate-related shareholder

proposals on the ballot over a period of the past six years (2016-2021) and climate-related management proposals on the ballot in 2021.

For the purpose of this report a nomenclature listing a total of ten main categories of climate-related

proposals has been established and is set out below. We have split the category of Say on Climate, covering shareholder proposals and management proposals, to allow for clearer distinction between the two different types of proposal and added another category, “Vote No” campaign:

- Goals—shareholder proposals that ask for companies to report on climate goals or to adopt climate goals;

- Risk Analysis—shareholder proposals that ask for companies to undertake and disclose an analysis of the risks related to their activities, especially assessments on their business portfolios of low-carbon scenarios;

- Transition Plan—shareholder proposals that ask for companies to adopt or report on their plans to transition to a low carbon economy (note some overlap with “goals,” but goes further and asks for strategic plans that harmonize company strategy with low or net-zero carbon scenarios);

- Compensation—shareholder proposals asking companies to adopt or to assess feasibility of adopting GHG reduction targets or other climate-related targets in executive or other compensation plans;

- Political Spending—shareholder proposals requesting greater disclosure of company funding of climate change-related lobbying, including requests for comparisons between corporate lobbying positions and those of third-party affiliated organizations (includes political spending disclosure requests that explicitly mention climate or carbon in title);

- Board—shareholder proposals for board changes such as an environmental committee and/or an independent chair where climate is clearly a driver of the proposal, especially for the oil and gas sector;

- “Vote No” campaign—director election proposals targeted by “Vote No” campaigns against directors considered to be taking inadequate steps to mitigate climate risk;

- Say on Climate (shareholder)—shareholder proposals that ask for companies to present a climate plan and report on progress to shareholders for annual approval (usually requesting a non-binding advisory Say on Climate (management) vote);

- Say on Climate (management)—new in 2021, proposals provided by management for shareholders to approve the company’s climate transition plan and/or climate strategy and/or climate progress report. In 2021 and to date in 2022 these have been non-binding advisory votes; and,

- Other—other shareholder proposals related to climate change seen at a limited number of

companies, such as proposals asking large institutional investors to assess how climate risks are taken into account in proxy voting, or requests to stop specific activities.

Over the past six years, the rise of coordinated, often global, campaigns on climate-related topics have been a strong trend in shareholder activism. The majority of shareholder proposals on climate-related topics are still in the U.S. where shareholder proposals are more of a common feature, but many other markets—Australia, Canada, Denmark, Finland, France, Japan, New Zealand, Norway, South Africa, Spain, Sweden, Switzerland, the United Kingdom—saw climate-related proposals in 2021.

New in 2021 were management-proposed climate-related agenda items giving votes on the company’s climate transition plan, strategies and/or progress. This usually came as a response to a shareholder initiative requesting something similar, whether an earlier shareholder proposal, or through investor engagement.

The non-profit group Majority Action coordinated a “Vote No” campaign in the U.S., mainly against CEO/Chairs and lead directors at companies in the banking, oil and gas, and electricity generation industries for “failing to implement plans consistent with limiting global warming to 1.5 C.” All the targeted directors received majority support for their re-elections at the companies targeted by Majority Action in 2021. Within 18 companies targeted by this campaign, the 28 director election items received on average 90.5 percent of votes FOR (the lowest support being 76 percent and the highest 97.8 percent. Eighty percent of targeted directors received support of at least 90%, the vast majority of which were between 90 percent and 95 percent).

A number of Net Zero climate-related investor initiatives came together in 2021 to provide greater structure and detailed guidance to both investors and companies around Net Zero emission ambitions and to provide tools to set their objectives towards the “less than 1.5 Degrees C” trajectory as agreed on at COP26. Hence, the Climate Action 100+ Net Zero Company Benchmark launched in March 2021 assesses “the performance of focus companies against the initiative’s three high-level goals: emissions reduction, governance, and disclosure. The Benchmark draws on analytical methodologies and datasets to provide investors and other stakeholders with a robust tool to facilitate focus company engagement and action”. [1] In September 2021, the Institutional Investors Group on Climate Change (IIGCC), an investor coalition made up of investors representing at that time over $10 trillion of assets under management, published a report detailing its expectations for oil and gas companies to align with net zero expectations. Also, it is worthwhile noting that in October 2021, the TCFD published a report providing guidance “to support preparers in disclosing decision-useful metrics, targets, and transition plan information and linking those disclosures with estimates of financial impacts. Such information will enable users to appropriately assess their investment and lending risks.” [2]

Other major trends seen in 2021 and that are expected to grow in 2022 and the years beyond are the push for disclosures of relevant scope 3 GHG emissions at financial institutions, climate risks in financial accounts and for third-party assurance of climate-related targets and plans.

It is also worthwhile noting that expectations towards the alignment between companies’ commitment to a 1.5 C trajectory and the rigor and completeness of their climate transition plans are increasing considering the challenges related to the 2025 short term and 2030 medium-term deadlines agreed at COP26, and are likely to trigger greater pressure from many investors over the next few years.

The complete publication, including footnotes, is available here.

Endnotes

1https://www.climateaction100.org/net-zero-company-benchmark(go back)

2https://assets.bbhub.io/company/sites/60/2021/07/2021-Metrics_Targets_Guidance-1.pdf(go back)

Print

Print