Jonathan M. Karpoff is Professor of Finance and Business Economics at the University of Washington Foster School of Business. This post is based on a recent paper, forthcoming in Management Science, by Professor Karpoff, Ms. Hae Mi Choi, Ms. Xiaoxia Lou, and Mr. Gerald S. Martin.

We document and examine the consequences of an important feature of enforcement activity for financial misrepresentation, that many enforcement actions for financial misrepresentation occur in industry-specific waves. In particular, one-quarter of all enforcement actions for misrepresentation initiated by the U.S. Securities and Exchange Commission or Department of Justice are clustered in 27 industry-specific waves (in 21 different industries) during our sample period of 1978-2015. As examples, the microchip industry experienced a wave of enforcement actions targeting 19 different firms during the 42-month period from August 2004 to January 2008, and the pharmaceutical industry experienced a wave of 16 targeted firms from 2001-2005.

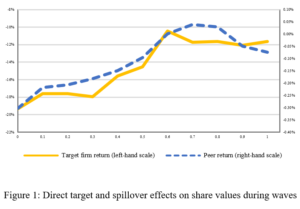

Enforcement waves have important consequences for firms’ stock price dynamics and information spillovers that affect the share values of industry peer firms. Figure 1 illustrates the pattern of returns when firms are targeted for enforcement action during waves. The first firm in an enforcement wave experiences an abnormal stock return that averages –19.3% on the day its misconduct is revealed. There is a spillover on other firms in the same industry, which experience an average abnormal stock return of –0.30% on the same day. Subsequent targets in the enforcement wave have successively smaller drops in share values and smaller spillover effects on other firms in the same industry. By the end of the wave, newly targeted firms experience relatively small drops in share values (–13.2%) and the spillover effects on other firms are close to zero.

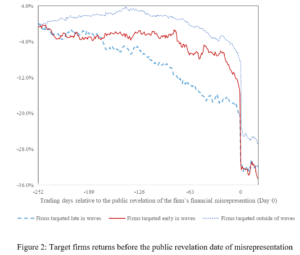

Whether a firm is targeted for enforcement action during a wave, and when it is targeted within a wave, affects the timing of its share price reaction to news of its financial misconduct. But it does not affect the total impact on share value. This finding is illustrated in Figure 2, which plots the average cumulative abnormal stock returns for early wave versus late wave firms in the 252 trading days before they are targeted for enforcement action for financial misrepresentation. Over the full 252-day period, the average cumulative abnormal stock returns for early wave and late wave firms are roughly equal (–31.9% and –31.5%, respectively). But the time paths by which the firms reach that end result differ. Firms that are targeted in the first half of a wave experience relatively large stock price drops when news of the firm’s misrepresentation is first publicly revealed (–16.4%). Firms that are targeted later in the second half of a wave have a smaller stock price drop when their misrepresentation is revealed (–11.9%). But these late wave targets have more negative pre-announcement downward drift, reflecting more information spillovers as their industry peer firms are targeted for enforcement action. When we add the cumulative effect of prior spillovers to the initial revelation of misconduct at a firm late in the wave, the total effect on the firm’s share price is similar to the total share value loss for early wave firms.

This discovery of enforcement waves and wave-related spillovers shows that a firm’s market price adjusts not only to news that the firm is the target of an enforcement action, but also to its expected cost of future targeting when its industry peer firms are targeted for enforcement action. These findings extend previous discoveries that enforcement activities have spillover effects and have four implications for our understanding of enforcement activity and its effect on firms’ values:

First, the fact that many enforcement actions occur in waves implies that the timing and frequency of such actions are not, in general, independent events, as is generally assumed in tests involving corporate misconduct. Second, the short-term share price impact of an enforcement action on the targeted firm, and its spillover effects on industry peers, depend on whether the action is part of a wave and the firm’s position in its industry’s enforcement wave. Third, short-window event study measures of the share value loss from a firm’s misconduct are lower-bound estimates, particularly for firms that are targeted late in an enforcement wave. Fourth, the total impact on firm value is not significantly related to whether the firm is targeted at the beginning or end of a wave. Together, these results indicate that share prices efficiently incorporate changes in the probability that a firm will face enforcement action for financial misconduct, even though the short window share price changes frequently understate the impact of revealed financial misconduct.

We also examine potential explanations for enforcement waves. The intra-wave pattern is not due to a tendency by regulators to target more serious cases of misconduct toward the beginnings of waves. Rather, it reflects time-varying changes in firms’ tendencies to violate financial reporting rules, as enforcement waves tend to be preceded by industry-based clusters of reporting violations. This finding is consistent with arguments by previous researchers that there are strong industry components to firms’ reporting practices and tendencies to engage in misrepresentation. The likelihood of a wave-related enforcement action is also related to increases in the SEC’s enforcement budget, suggesting that the SEC applies incremental resources to exploit industry-specific scale economies in its enforcement efforts. We do not find evidence that enforcement waves are more likely to occur during recessions, nor that waves are highly correlated with the SEC’s stated areas of enforcement priority. We infer that enforcement waves are more likely to arise from ex post revelations of misconduct, as regulators “follow the evidence,” than from the SEC’s stated enforcement priorities.

The complete paper is available for download here.

Print

Print