Susan Schroeder and Bertha Masuda are partners and Bonnie Schindler is principal at Compensation Advisory Partners. This post is based on a CAP report by Ms. Schroeder, Ms. Masuda, Ms. Schindler, Mr. Evans and Mr. Brown. Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; and Paying for Long-Term Performance (discussed on the Forum here) by Lucian A. Bebchuk and Jesse M. Fried.

Introduction

Board members at privately held and family-owned companies play an important role in governance and oversight and should be appropriately compensated for their contributions and efforts. However, the appropriate amount of compensation has been difficult to determine due to the lack of available market data on private company board pay.

To address this data deficiency, Compensation Advisory Partners (CAP) and Family Business and Private Company Director magazines conducts our Private Company Board Compensation and Governance Survey. The new 2022 third edition of the survey contains over 1,200 responses, an increase of about 300 participants from the prior full version of the survey in 2020. The high number of survey participants illustrates the enthusiasm and need for this data.

About the Survey Participants

The over 1,200 respondents represent companies in a broad range of industries and revenue sizes. Manufacturing is the most prevalent industry in the survey (25% of respondents), followed by professional, scientific, and technical services (11%); finance and insurance (9%); retail trade (7%), construction (6%), real estate, rental and leasing (6%); and wholesale trade (6%).

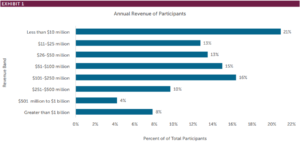

Participating companies span a variety of sizes as measured by revenue, number of employees and assets (financial services and insurance companies only). Exhibit 1 shows the distribution of responses across revenue ranges.

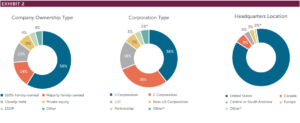

Of the participating companies, 70 percent are wholly family-owned or majority family-owned or controlled. The survey also drew participation from companies that are closely held, private equity-owned, and owned by employees through employee stock ownership plans (ESOPs). The business structures represented include S corporations, C corporations, limited liability companies (LLCs), partnerships, and other structures. Most participants are based in the United States, but the survey drew responses from all over the world. Nearly two-thirds of the respondents have fiduciary boards, while the remainder have advisory boards.

Compensation Components

The survey found that 86 percent of participants provide some form of compensation to board members. In contrast to public companies, 44 percent of private companies compensate “inside” directors (defined as family members or shareholders who serve on the board). For these companies that compensate inside directors, 67 percent compensate them on the same basis as the outside directors. The survey results reflect the differences from public company board pay. Private companies are more likely to compensate a larger group of directors and are more likely to use meeting fees in addition to annual retainers. Only a minority of private companies use long-term incentives, such as phantom and real equity, in their director pay programs.

Annual Retainer

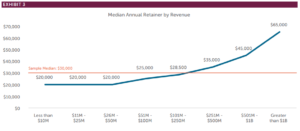

Annual cash retainers are part of a typical director’s compensation package. Of the private companies surveyed, 45 percent compensate directors through cash retainers only, while another 27 percent use both retainers and meeting fees. The median amount of the cash retainer is $30,000 for 2022, an increase from $28,000 in 2020. Board retainers are highly correlated with company size as shown in Exhibit 3.

Long-Term Incentives

Not surprisingly, the survey found that the prevalence of long-term incentives for private company board service is low since private companies do not have stock that is easily liquid.

Only 26 percent of private companies offer long-term incentives for directors, with real equity – stock options or restricted stock/units – being the favored vehicles. Typical practices for private company long-term incentive awards are to grant the awards either annually or when the director is appointed to the board, and to have the awards subject to vesting, either immediately or over three years. The use of long-term incentives indicates that private companies continue to compete for board talent and are working to retain and align board members with the company’s overall success. CAP expects the use of long-term incentives for director compensation to increase over time, especially at larger private companies.

Meeting Fees and Other Components

Other key survey findings are:

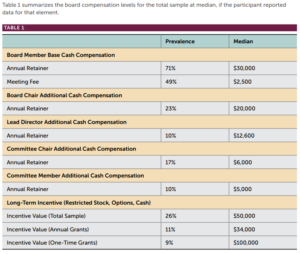

- The most common elements of cash compensation for private company directors are annual retainers (71%), travel reimbursements (53%) and in-person meeting fees (49%).

- Meeting fees continue to be used by private companies, while most publicly traded companies have migrated to retainers only. Of the private companies surveyed, 13 percent use meeting fees as their only form of cash compensation, which is down significantly from the 2020 survey.

- As with retainers, meeting fees increase with company size. (See Exhibit 4.) The median in-person meeting fee is $2,500, which is unchanged from 2020.

- The use of telephonic/virtual meeting fees is reported by 25 percent of companies in 2022, which reflects a normalized level as more companies have returned to in-person meetings. The median telephonic/virtual meeting fee is $1,000, which is unchanged from 2020.

- Some private companies provide additional compensation for board leadership roles. When the incremental leadership retainers are considered as a multiple of regular board member retainers, the median multiple is two-thirds for the incremental board chair retainer and slightly less than half for the incremental lead director retainer.

- The typical incremental retainer for a committee chair is $6,000 at median but is only provided by a minority of companies.

Governance Findings

In addition to benchmarking compensation levels and practices, the survey covers many governance issues, including board size, independence, workload, term limits, and diversity, equity & inclusion

The typical private company board size ranges from five to eight directors, with a median of six directors. This reflects a decrease in board size from the 2020 survey. The 2022 board size indicates a return to more normal levels seen in our 2019 survey. The 2022 board composition is approximately half inside directors and half independent/outside directors, with a slight tendency toward having a greater proportion of inside directors.

Other governance findings are limited to survey participants.

Diversity, Equity, & Inclusion

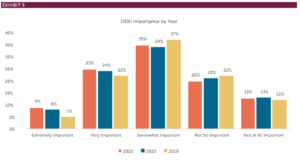

Private companies still have some work to do in the area of diversity, equity, and inclusion. The survey asked respondents about the importance of board diversity and the number of women and minority directors on the board. The 2022 survey saw an uptick in private companies indicating that diversity is “very important” or “extremely important,” a trend that was first recognized in the 2020 survey and is expected to continue in the future given the current emphasis on diversity, equity and inclusion (DE&I) issues across general industry. Of the survey respondents, 72 percent report having one or more women on the board, up from 70 percent in 2020, while only 26 percent report having one or more minority members on the board, up from 24 percent in 2020. Private companies looking to diversify their boards coupled with the competition for board talent could result in an increase in compensation levels to compete with public company boards, which are facing mounting public and investor pressure to increase the diversity and representation of their boards.

Exhibit 5 shows the reported importance of board diversity compared to the previous iterations of this survey.

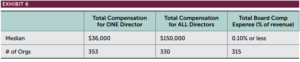

Total Director Compensation Cost

Three new questions were asked in the 2022 survey to better understand the total cost of governance for a private company. The survey asked participants to provide average annual total compensation data for ONE director and for ALL directors on the board. Additionally, participants were asked to estimate annual total board compensation expense as a percent of revenue, which is a statistic that can be used for comparison across companies. Exhibit 6 shows the median for total compensation cost for ONE director and for ALL directors for the total survey sample.

Total compensation includes annual board cash retainer, board meeting fees, any committee service retainers or meeting fees, any long-term incentives, and all other compensation (such as travel and expense reimbursement).

The total cost of governance is correlated with company size. This relationship is driven by differences in the amount of compensation given to individual directors, as well as differences in the size of the board. As a company’s revenue increases, the complexity of operations, regulatory requirements, and the responsibilities of the board also increase. To deal with this greater responsibility, larger companies may have a larger board and separate committees. Higher compensation is needed to attract qualified talent and reward them for a more significant time commitment.

Looking Ahead

Now that the full Private Company Board Compensation and Governance Survey is in its third iteration, trends can be evaluated. The 2022 results were consistent with 2019 and 2020, which is not surprising as board pay is not typically evaluated on an annual basis, so changes emerge slowly. Median annual cash retainers increased across most revenue sizes, the typical board size decreased to pre-COVID levels, and respondents indicated heightened interest in board diversity although it is still a work in progress. The main issues are finding the right skill-set and cultural fit of board member candidates.

Trends that CAP expects to see in the coming years for private company board compensation and governance include:

- Increase in retainer payments for smaller companies to keep pace with the larger ones. There seems to be a minimum or “floor” value of $20,000 that represents an opportunity cost of choosing board work.

- Movement over time to a retainer-only compensation model similar to that of public companies.

- Increased use of long-term incentives to recruit high-caliber directors and compete with public companies.

- Additional representation by women and minorities on private company boards. The importance of diversity is increasing over time, and private companies need to pay competitively to attract diverse talent to the board.

Print

Print