Martha Carter is Vice Chairman & Head of Governance Advisory, Matt Filosa is Senior Managing Director, and Rhea Brennan is Vice President at Teneo. This post is based on a Teneo memorandum by Ms. Carter, Mr. Filosa, Ms. Brennan, Oliver Parry, Lisa R. Davis, and Gaby Sulzberger. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders? (discussed on the Forum here) both by Lucian A. Bebchuk and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr; and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita.

Executive Summary

In 2022, global companies have encountered a fractured ESG landscape marked by widely divergent views. On the one hand, regulators are mandating more robust ESG disclosures from both companies and institutional investors. Regulators are also cracking down on so-called “greenwashing” – trying to hold companies accountable to ESG commitments. On the other hand, the anti-ESG movement is increasingly vocal, with some questioning the very legitimacy of stakeholder capitalism and ESG investing. To complicate matters further, an increasingly bearish stock market is presenting the first real stress-test of ESG matters in the eyes of markets and investors.

We believe it is imperative for companies to stay sharply focused on the ESG issues that are most important to their businesses and stakeholders. Large investors have expressed a strong belief that certain ESG factors can have a material impact on a company’s long-term financial health, and there are no signs that investors are backing away from that stance. In fact, as discussed in our annual proxy season review, “anti-ESG” shareholder proposals fared poorly again in 2022, averaging less than 3% support, with many failing to meet the 5% threshold for resubmission. Investors are likely to continue demanding that companies proactively manage their material ESG risks and opportunities appropriately. However, as companies continue to act on ESG, questions remain over what companies should disclose and how.

To help companies answer these and other important questions around ESG disclosure, Teneo analyzed 200 sustainability reports from S&P 500 companies published between January 1 – June 30, 2022 (“Sustainability Reports”). In this report, we have highlighted common content and design elements of 2022 Sustainability Reports, along with useful examples and recommendations.

Future State 2023 Sustainability Reports

Ten Strategic Considerations

- Follow the Rules (and the Money) Global regulators are moving swiftly to mandate ESG disclosures from both companies and investors, and large investors continue to prioritize ESG matters. Don’t let the ESG debate in the public square distract you from managing your company’s material ESG issues.

- We Are (Still) Living in a Material World A materiality assessment is an essential element to

a company’s ESG strategy, helping to identify which ESG issues are most important to the business. Since no company can be everything to everyone, a materiality assessment can also serve as a useful filter for inbound ESG requests from stakeholders. - Regulators Give SASB and TCFD the A-OK Both the Sustainability Accounting Standards

Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) disclosure

frameworks are being used as foundations for various ESG disclosure initiatives around the world. Ensuring that your company is robustly disclosing to each of these frameworks is now also a way to help ensure regulatory compliance. - Don’t Hesitate to Show Your ESG Report Card It is imperative for companies to be thoughtful and transparent in reporting progress on ESG goals. If they do not, watchdogs are likely to disclose for them, perhaps in an unfavorable manner.

- Consider Disclosing “Dynamic” Diversity Data While the disclosure of basic employee demographic data is still critical, diversity data relating to promotion, retention and hiring has become much more prominent in 2022.

- They Want Their ESG (Data)! Summary ESG data tables continue to be an effective way to satisfy investor inquires, especially if the data is downloadable in Microsoft Excel. Providing supplemental, three-year trend data is particularly well-received.

- It’s A Matter of Trust Stakeholders now expect external assurance of at least some ESG data. Based on our analysis of comments on the climate disclosure rule proposed by the U.S. Securities and Exchange Commission (SEC), limited assurance of ESG data seems to be acceptable to most investors – at least in the near-term.

- You Blinded Me with ESG Well-intentioned efforts to bring ESG microsites to life can backfire if information cannot be easily located and/or if hyperlinks are broken over time. Certain regulatory requirements will also likely prompt closer consideration around how ESG data is stored and displayed.

- Everybody Wants to Rule the World Regulatory developments in other markets can also impact U.S. companies as investors and other stakeholders push for greater global consistency of ESG disclosure.

- Under Pressure Pressure on companies from stakeholders to weigh in on social issues has never been greater. However, commenting publicly comes with risks. Having a thoughtful decision-making framework can help companies determine whether or not to publicly

speak out on a specific ESG issue.

Current State 2022 Sustainability Reports

Practical Elements

Title

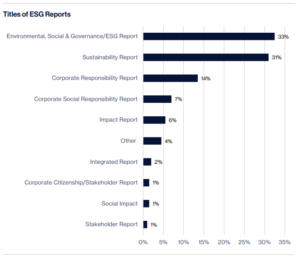

The majority of 2022 Sustainability Reports included either the term “Sustainability” (31%) or “Environmental, Social & Governance”/“ESG” (33%) in the report title. Titles including “Corporate Responsibility” (13.5%) and “Corporate Social Responsibility” (7%) were also observed. Both of these terms may evoke corporate philanthropy and/ or community initiatives, which are important, but may reflect a somewhat dated and limited view of a company’s sustainability strategy.

Length

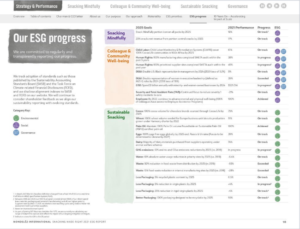

Sustainability Reports ranged from 11 pages to 273 pages in length, with an average length of 77 pages. This is slightly longer than the 2021 average length of 70 pages. The majority of reports (53%) had between 50 – 100 pages. 2022 Sustainability Reports over 100 pages were more common among companies with a market capitalization of $20 billion or above. ESG Progress Summary from Mondelēz International’s 2021 “Snacking Made Right” report.

Regardless of report length, providing a “highlights” or summary overview of sustainability initiatives can help stakeholders focus on a company’s ESG priorities and efforts. In 2022, more than 26% of Sustainability Reports produced either a summary or “highlights” report.

Data Tables

More than two-thirds of 2022 Sustainability Reports (70%) included a table with key ESG data. Data tables can help investors and other stakeholders easily find the information that is most relevant to them. In addition, companies may want to consider providing three year trend data in a downloadable Microsoft Excel format to make it even easier for investors to ingest the company’s ESG data.

Press Release

More than half of the companies that we reviewed (62%) issued a press release announcing their 2022 Sustainability Report. Press releases can provide stakeholders with an outline of the key takeaways from the report, including new initiatives or updates on the progress of ESG goals.

Timing

Most companies issued their 2022 Sustainability Report within 4-6 months of fiscal year end, with April being the most popular month (39%), followed by March (18%) and June (17%).

Format

Approximately 27% of companies included interactive ESG microsites within the company’s website. While interactive websites can be a creative way to message the company’s ESG strategy, companies should also ensure that a PDF version of the report is readily available. 93% of 2022 Sustainability Reports were made available in PDF format.

Adhering to a correct reporting format is increasingly important to ensure stakeholders get a clear picture of your sustainability efforts. For instance, the Corporate Sustainability Reporting Directive’s (CSRD) proposal to amend Europe’s Non-Financial Reporting Directive (NFRD) requirements to digitally tag information originates from challenges in finding relevant ESG data and could materially change reporting requirements for U.S. companies. This will be a critical development supporting broader standardization and dissemination of ESG data, with the requirements for machine reading and “tagged” information supporting the EU’s plans for a central “repository” of all corporate financial and non-financial data. For companies, this requires careful consideration around IT and infrastructure requirements and integration.

Strategic Elements

Letter from the CEO or Board

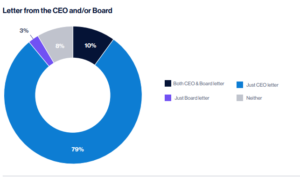

The majority of 2022 Sustainability Reports (89%) included a letter from the CEO, of which 10% also

included a letter from the Board. In a few instances, the CEO letter was penned together with either the Board or the company’s Chief Sustainability Officer. CEO letters provide companies with the opportunity to appropriately signal to stakeholders that ESG is a priority for senior leadership. A newly appointed CEO can utilize the CEO letter to communicate his or her refreshed vision for the company and its sustainability strategy. Similarly, letters from the Board can also signal its focus on ESG oversight – an issue of increasing importance to institutional investors.

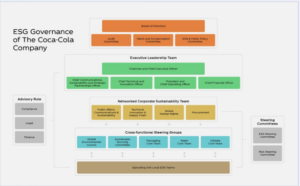

Internal Oversight

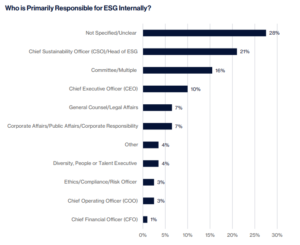

Consistent with our findings in 2021, a vast majority of 2022 Sustainability Reports described how ESG is overseen internally. While most companies stated that they take a cross-functional team approach to managing sustainability initiatives, approximately 72% of 2022 Sustainability Reports also identified the executive with primary responsibility for sustainability.

21% of 2022 Sustainability Reports noted that the Chief Sustainability Officer or another ESG-focused executive was responsible for delivering on the company’s sustainability strategy, while 10% noted that the CEO held that responsibility. As demonstrated in the chart below, companies took a variety of approaches to this issue.

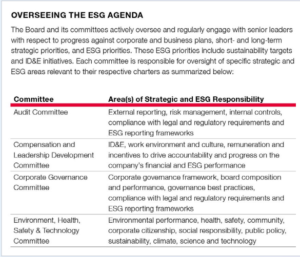

Board Oversight

Board oversight of ESG matters is also described in a vast majority of company 2022 Sustainability Reports. Sustainability was most commonly overseen by the Nominating and Governance Committees (46%), while 14% of companies noted that sustainability oversight was performed by multiple board committees. While eligibility criteria are not well-defined, 26% of 2022 Sustainability Reports mentioned a Board member with “ESG” credentials and/or experience.

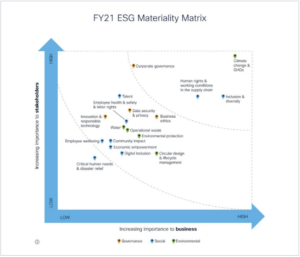

Materiality Assessment

Half of 2022 Sustainability Reports indicated that a formal materiality assessment was conducted to help determine ESG priorities. Just under half of 2022 Sustainability Reports (40.5%) also included

an actual materiality matrix, while one-third (34%),included a disclaimer or qualifier on the use of the term “materiality” to avoid any confusion with other definitions of materiality, such as the SEC’s definition. Materiality Matrix from Cisco Systems’ 2021 ESG Report.

Materiality matrixes can be a very useful tool. for stakeholders to gain insight into how the company determines its sustainability strategy. Stakeholder engagement, another common, component of 2022 Sustainability Reports, is typically the primary mechanism to inform the company’s materiality assessment.

DEI Content

DEI Reports

Diversity, equity and inclusion (“DEI”) has become a common component of 2022 Sustainability Reports. In response to increasing pressure from stakeholders to disclose details regarding DEI programs, progress and metrics, companies have also begun publishing separate DEI reports, allowing them to further articulate the evolution of their strategy and approach. In 2022, 47% of Sustainability Reports published diversity targets, 4% less than 2021. These numbers do not necessarily represent a decline in the number of companies that have publicly set diversity goals nor a decline in reporting on DEI measures. It is likely that the decline indicates that this data is housed in a DEI report separate from the Sustainability Report. Companies are advised to include DEI goals within Sustainability Reports, even if a separate DEI report is produced.

Employee Demographic Data

91% of 2022 Sustainability Reports disclosed employee demographic data, with 85% reporting diversity data at the executive/senior level. While an overwhelming majority of companies share this data and continue to disaggregate workforce diversity disclosures, there is a lack of uniformity in how companies define classifications such as executive or race/ethnicity, making it challenging for shareholders to track and compare data across companies.

In our 2021 report, we noted that companies had begun disclosing their complete EEO-1 Reports and predicted that more companies would follow suit. In fact, the number of companies who published their EEO-1 Report in 2022 increased to 54%, up from 33% in 2021. The EEO-1 Report includes defined categories for gender, race/ethnicity and job function which provides greater uniformity to companies’ demographic data. Companies commonly supplement their EEO-1 disclosure with additional narrative and data using company-specific job categories.

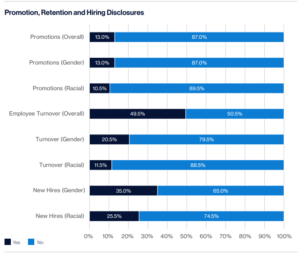

Promotion, Retention and Hiring Disclosure

Due to investor pressure, companies are also increasingly reporting recruiting, promotion and retention rates of diverse employees. Most often, companies reported on new hires by gender (35%) and race/ethnicity (26%). Promotion and turnover rates were less frequently reported (10-13%), perhaps signaling ongoing challenges in talent development efforts in the current “war for talent” environment. Companies continue to purposefully report on qualitative measures such as new programs, partnerships and initiatives that add context and demonstrate a pathway toward meeting previously defined goals.

Pay Gap Analyses

Just under one-third of 2022 Sustainability Reports included information on employee pay gaps, representing a 6% decrease from 2021. This is not to suggest that pay gap analyses are falling out of favor, as audits continue to rise in popularity. 2022 data suggests that transparency on the subject has possibly stalled, or the data has shifted from Sustainability to DEI reports.

For this analysis, 32% of companies shared their adjusted pay gaps, measuring the difference in median total compensation between demographic groups by adjusting for factors such as role, seniority, education, experience and location. Companies often noted a commitment to “equal pay for equal work.” 16% of companies reported unadjusted, or raw pay gaps, which tends to be a less forgiving figure as it does not take into consideration any of the above factors. Not surprisingly, all companies that shared raw pay gaps also disclosed adjusted pay disparities. 16% of 2022 Sustainability Reports noted that their pay gap analyses were assured.

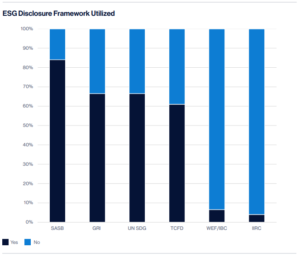

Use of Third-party ESG Disclosure Frameworks

The use of third-party ESG disclosure frameworks in 2022 Sustainability Reports continued to rise, with SASB and TCFD being the primary focus for institutional investors. This is a result of many large institutional shareholders essentially mandating that companies report to these disclosure frameworks or risk losing their support for certain incumbent directors at the next annual shareholder meeting. As was the case in 2021, not all SASB or TCFD disclosures looked the same, as some companies did not disclose every component within the frameworks. And while cross-referencing SASB and TCFD indexes in other company disclosures is common, investors and other stakeholders may prefer to have the substance of SASB and TCFD disclosures included directly in the indexes. As is the case with companies that produce a DEI report separate from a Sustainability Report, companies that report to the SASB and/or TCFD indexes separate from the Sustainability Report run the risk of investors not being able to find such indexes and concluding that the company is not disclosing the information at all.

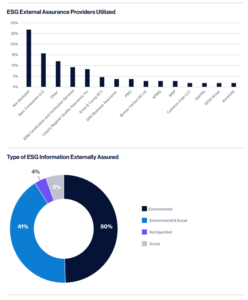

Use of External Assurance

Just over half (54%) of companies mentioned that data for the report had been externally assured. Of these, 51% had only environmental data assured, while almost 43% assured both environmental and social data. 5% of companies assured only social data, while less than 4% did not specify what ESG data was assured. Of the companies that specified the third-party providing the external assurance, Apex was used by almost 16% of companies, while ERM was used by 9% of companies.

Broader Considerations

Sustainability Disclosure Developments Outside the U.S.

Asia-Pacific

Mandatory reporting around ESG issues will become more prevalent across Asia-Pacific as regulators and exchanges seek to align with global best practice. However, there is still significant fragmentation among markets.

In Australia, climate reporting is not yet mandated but is expected to emerge under a new federal government promising greater climate action. Securities and prudential regulators both recommend TCFD reporting. In New Zealand, climate disclosures are mandatory for some companies beginning in 2023.

Singapore also has new requirements taking effect in 2023, including mandatory climate reporting for certain sectors, diversity disclosures and sustainability training for directors. The SGX has indicated that International Sustainability Standards Board (ISSB) standards will be incorporated into mandatory disclosures when published.

In Hong Kong SAR, mandatory climate disclosure for certain sectors is expected by 2025. In the meantime, the HKEX is focused on improving data transparency around issues such as board diversity with the launch of an information repository. Support has been expressed for the ISSB framework.

In China, domestic entities are now required to disclose environmental information annually from 2022, while the securities regulator also requires listed companies to disclose any environmental penalties.

These and other Asia-Pacific markets will also be closely watching international developments in sustainability reporting, which are likely to impact the regional landscape. Investor expectations will also increasingly push companies to exceed local requirements to align with standards being set in other markets.

European Union

The European Financial Reporting Advisory Group (EFRAG) launched a consultation on draft corporate sustainability reporting standards, offering a glimpse of what companies will have to report according to the CSRD. The new standards include the use of the double materiality concept and consideration of value chain sustainability factors. For example, the climate change exposure draft requires disclosure of “gross indirect Scope 3 GHG emissions in metric tons of CO2 equivalent,” which includes emissions outside of the direct control of companies, including upstream purchasing and travel. In June 2022, the EU Council and European Parliament announced that they had reached an agreement on the rules of the CSRD, achieving an important milestone towards the official adoption of the law.

UK

In the UK, ESG reporting and disclosure expectations continue to grow for both listed and private companies. As of January 1, 2022, many UK companies are required to publish their first TCFD report per the Financial Conduct Authority (FCA), a requirement already in place for larger companies. Larger listed companies and certain financial sector firms will also be required to publish a net zero transition plan under the TCFD reporting framework, detailing how they will decarbonize to meet 2050 targets. This will encourage more widespread adoption of published plans and increase the need for standards enabling consistency and comparability. Finally, many UK and overseas issuers will need to include a statement in their annual financial report for financial years starting on or after April 1, 2022, setting out whether they have met specific diversity targets.

The Future of U.S. Sustainability Reports

Global regulation will certainly shape the ESG disclosure landscape over the next few years. Final SEC rules on climate disclosure and draft rules on human capital management disclosures are expected in fall 2022. The ISSB is also expected to release its final framework for climate and ESG reporting by the end of 2022. Final rules from the European Union’s CSRD are expected in 2023. While there is optimism that there will be a measure of consistency across all three disclosure initiatives, it is likely that companies will encounter substantive differences.

As regulators also step up policing for so-called “greenwashing,” it is imperative that companies not only continue disclosure of material ESG issues, but also ensure that disclosures are verifiable. We hope that this report is a useful tool to help companies continue to progress toward that goal.

Print

Print