Mary Ann Deignan is Managing Director and Head of Capital Markets Advisory; Rich Thomas is Managing Director and Head of European Shareholder Advisory; and Christopher Couvelier is Managing Director at Lazard. This post is based on a Lazard memorandum by Ms. Deignan, Mr. Thomas, Mr. Couvelier, Emel Kayihan, Antonin Deslandes, and Leah Friedman. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, and Wei Jiang; Dancing with Activists (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

Observations on Global Activism Environment Through Q3 2022

1. Continued Robust Activity Fueled by Strong Q3

- 44 new campaigns launched in Q3, a 52% increase over prior year Q3, marking the third consecutive quarter of significant year-over-year increased activity

- Total campaigns YTD (171) up 39% over the same period last year, already approaching the total for full-year 2021 (173)

- Continuing an H1 trend, Technology companies were the most frequently targeted in Q3, accounting for 22% of new activist targets

- With 5 new campaigns in Q3, Elliott continued to accelerate its 2022 pace and has now launched 11 campaigns YTD (more than double the next most prolific names)

2. U.S. Targets in the Crosshairs

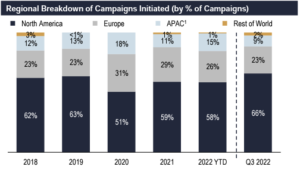

- North American targets accounted for two-thirds of all new campaigns in Q3, above H1 (55%) and 2018 – 2021 average (59%) levels

- Q3 activity in the U.S. (28 new campaigns) represented a 133% increase over prior year Q3 (12 new campaigns)

- U.S. activity YTD (96 new campaigns) is up 43% year-over-year, and has now matched the total for full-year 2021

- Recent U.S. campaigns have targeted mega-cap industry leaders (including Cardinal Health, Chevron, Disney, Pinterest and PayPal)

3. European Activity Already Approaching Record FY 2021 Level

- In spite of a relatively slow Q3 (10 new campaigns), YTD activity in Europe (45 campaigns) is up 32% year-over-year and is already approaching 2021’s full-year total (50 campaigns)

- While U.K. companies remained Europe’s most frequent targets (40% of European campaigns YTD, in-line with multi-year average levels), France witnessed a greater share of activity than in prior periods (18% of European campaigns, as compared to 12% from 2019 – 2021)

4. Campaign Demands Reflect “Do It or Sell It” Approach

- M&A-related objectives featured in 48% of Q3 campaigns, a significant rebound from 39% in Q2 and 32% in Q1

- “Sell the company” demands YTD (26 campaigns) already exceed full-year totals for 2021 (20) and 2020 (14)

- Demands around strategy/operations continued to rise in frequency in recent quarters (21% of Q3 campaigns, as compared to 20% in Q2 and 14% in Q1) and remain above the 2018 – 2021 average (15%)

5. Emerging Themes to Watch

- With the universal proxy rule now in effect and a significant portion of public company nomination windows for 2023 AGM season occurring in Q4 and Q1, campaigns focused on Board representation are poised to surge

- The role of ESG and the focus that companies and investors should be putting on it is starting to be questioned

- New activist Strive Asset Management has taken aim at several blue-chip companies for prioritizing E&S issues at the expense of shareholder value creation

- Texas has barred certain companies and funds (including BlackRock) from doing business in the state due to ESG practices at odds with the state’s energy sector

Global Campaign Activity

2022 YTD activity is already approaching full-year 2020 and 2021 levels; while regional trends YTD are in-line with recent years, Q3 saw increased North American activity

Print

Print