Maria Castañón Moats is Leader, Paul DeNicola is Principal, and Leah Malone is Managing Director at the Governance Insights Center at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

Introduction

In 2022, as both the ongoing direct impacts and unexpected side effects of the COVID-19 pandemic continue to mount, the landscape of the business world is shifting yet again. An ongoing war in Ukraine, rising global inflation, fears of recession, and the near-constant drumbeat of catastrophic environmental news and predictions are changing the geopolitical context. In the US, market turmoil, social upheaval, political polarization, looming midterm elections, and uncertain regulatory developments make the landscape feel like uncharted territory. When the path is uncertain, boards are a source for constancy and guidance.

Against this backdrop, business leaders are confronting a new trust crisis. While surveys show that the public trusts business over other institutions like the government, media, and NGOs, the picture isn’t perfect. In fact, business leaders vastly overestimate this sentiment. A recent PwC survey shows that while 87% of business executives believe consumers highly trust their company, only 30% of consumers actually do. Trust is hard won and easily lost, and stakeholders are coming to expect more from companies. This lands at the feet of the board of directors as the stewards of the company.

Their role on the board of a public company demands that directors keep their eyes on the horizon, plotting the course amid sometimes choppy waters. As shareholder and consumer expectations rise, our survey of more than 700 public company directors shows that board oversight and board practices are shifting in response. Above all, boards are becoming much more transparent. They are engaging with shareholders and providing more disclosure than ever, with the hope that it will build and maintain trust.

One of the areas drawing this increased focus and disclosure is ESG, with boards spending more time than ever on a host of ESG topics. But we see the ESG journey for boards starting to diverge based on company size. When it comes to the nature and the extent of the discussion, the boards of smaller companies have seen less progress than those of larger companies. Many of them haven’t devoted the time, aren’t as prepared for regulations, and have yet to begin integrating ESG into their strategic planning. As an emerging area of focus, many of these boards are not giving ESG equal attention—creating a blind spot in their oversight role.

But boards of companies of all sizes, from micro-cap to mega-cap, have blind spots, making it difficult for the board to navigate the company through hard times. And failing to recognize the issue hampers a board’s ability to stay ahead of the next challenge. We have identified these blind spots most commonly in areas like board refreshment, cybersecurity oversight, and ESG concerns (see page 5). Recognizing that these blind spots exist in boardrooms and examining how your own boards confront (or don’t confront) these issues is integral to bringing the company through this time of change.

Key Findings

Board blind spots

Board refreshment

Directors increasingly critical of peer performance

As the governance landscape has evolved, so too has the topic of board composition. With so much oversight responsibility held by just a dozen or fewer board members, every seat matters, and matters greatly. Investors and other stakeholders want to be sure that the board is comprised of the highest quality, most competent directors who will together, draw on a diverse set of experiences and backgrounds to effectively oversee the company.

With the intense focus on board composition, data shows that in 2021, S&P 500 boards added more new independent directors than in any recent year. But still, directors tell us that more change could—and should—be made.

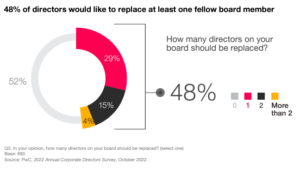

Almost half of directors (48%) think one or more directors on their board should be replaced. Nineteen percent (19%) would replace two or more of their fellow directors.

What’s more—directors are more likely to identify performance-related issues with their peers this year. Almost one in five (19%) say that fellow board members are reluctant to challenge management—up from 12% last year. Directors are also more likely to identify peers who overstep the bounds of their authority (17%, up from 11%). After a year when fewer voiced these types of complaints, directors seem more critical of their peers than in the past.

Despite discontent, boards reject refreshment tools

Directors tell us that they would like to see more turnover on their boards (see page 7). But few say their own boards would embrace policies that would set real limits on board service and drive greater turnover.

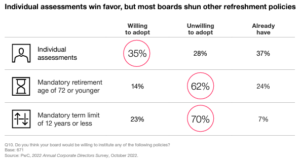

A mandatory retirement age can be a strong tool to encourage refreshment. But only 14% of directors think their board would be willing to adopt a retirement age of 72 or younger. Sixty-two percent (62%) think they would not.

Mandatory term limits are even more unpopular. Seventy percent (70%) of directors say their board would not adopt term limits of 12 years or less. Just 7% say their board has such a policy in place, and less than a quarter (23%) think their board would be willing to adopt it.

But implementing an individual assessment process may be one area that could make a difference in board refreshment. More than one-third of directors (37%) say their board uses the practice, and another 35% think their board would be willing to adopt it. A rigorous assessment process can help identify the board’s strengths and the areas that need improvement—including, ideally, when a director is no longer the right fit for the board.

Directors take a conservative view on overboarding

The demands of public company board service are significant. Directors can spend upwards of 250 hours per year in their role, and major events like a CEO search or an activist investor can increase that time commitment even more. Ensuring that directors have enough time and attention to devote to their role is critical.

Investors and proxy advisors have honed in on overboarding as a significant concern for director performance. Directors who serve on too many boards, and especially those who have active executive careers at the same time, might not have the bandwidth necessary for effective board service.

Investor overboarding policies vary, but many have converged around four or five boards as an upper limit for independent directors. For directors who are active CEOs or executive officers, policies usually allow for two total boards (including the executive’s own board, if applicable).

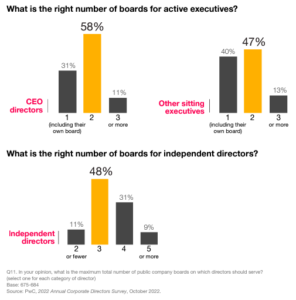

Directors take a more limited view. While they most commonly agree that CEOs and NEOs should serve on no more than two total boards (including their own), almost one-third (31%) think CEOs should not serve on another board at all. And 40% say the same about other sitting executives. Few investors have such a narrow view of executives’ ability to serve on outside boards.

When it comes to independent directors, directors most commonly say that three boards should be the upper limit (48%). Thirty-one percent (31%) think up to four boards is appropriate, and just 9% think it’s acceptable for directors to serve on five or more boards.

Board diversity

Diversity of thought comes in many forms

Board diversity has been an area of intense focus from investors for years. Voting policies have evolved as large institutional investors have made stricter and more specific calls for diversity. Regulations, including a listing standard for NASDAQ companies, push boards to ensure certain types of individuals are represented on the board. Much of the focus, especially when it comes to meeting certain specific diversity requirements, has been on gender, though there is increasing focus on other “under-represented communities” as well.

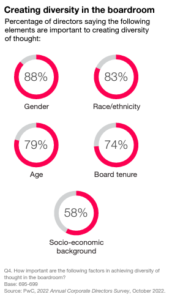

This trend is clear among directors as well. When we ask about what is important to create diversity of thought, gender diversity is still the most commonly cited (88%). But the percentage saying the same about racial/ ethnic diversity is not far behind at 83%. This reflects a 6-point increase since 2019. Directors are also likely to say that diversity of age and board tenure (79% and 74%, respectively) are important.

The percentage of directors who think diversity of socio-economic background is important has increased significantly since 2019, from 39% to 58%. As the concept of cognitive diversity in workplaces and boardrooms continues to evolve, it’s becoming more apparent that the traditional view of what makes a “diverse” board will need to evolve as well.

Board diversity has been an area of intense focus from investors for years. Voting policies have evolved as large institutional investors have made stricter and more specific calls for diversity.

Drive for diversity leads to change

As investors push for board diversity, boardrooms have felt the impact. The new independent directors joining S&P 500 boards in 2021 represented the most diverse group ever. And it’s not just the S&P 500—directors regardless of company size tell us their boards are making changes in response to calls for diversity.

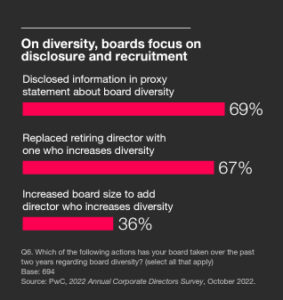

Almost all directors (96%) say their board has done something in the past two years regarding board diversity. Their most common action: increased disclosure. The percentage of directors saying their company disclosed information in the proxy statement about board diversity jumped 15 points from 54% in 2021 to 69% this year.

Two-thirds (67%) of directors say their boards replaced a retiring director with one who increases the board’s diversity, showing that the need for diversity has impacted succession planning in a significant way.

Finally, more than one-third (36%) of directors say their board increased its size to add a director who increases the board’s diversity. In fact, in 2021, 78 boards in the S&P 500 expanded their size to add one or more female directors, and 88 increased their size to add racial/ethnic diversity. For boards without looming vacancies, increasing the board size can be an effective way to add diversity to the board without forcing a vacancy at an inopportune time.

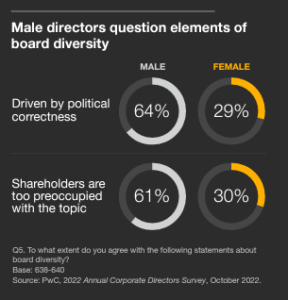

As boards diversify, some directors are skeptical

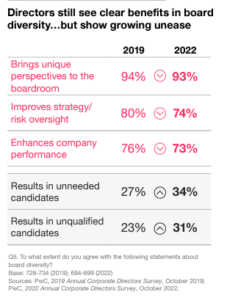

Among public company directors, there is agreement that board diversity has real benefits. More than nine out of ten directors (93%) say that diversity brings unique perspectives to the boardroom. But while a majority of directors also see benefits such as improving relationships with investors, improving strategy/risk oversight, and enhancing company performance, we don’t see a growing consensus in those areas. The percentage of directors who agree with those statements hasn’t increased as boards have become more diverse. In many cases, the percentages have actually declined.

What we do see growing is the share of directors who see issues with the new diverse candidates. Compared to 2019, directors are quite a bit more likely to say that efforts to diversify boards results in unneeded candidates (34%, up from 27%). Almost one-third of directors (31%) say that the push for diversity is resulting in unqualified candidates—up from just 23% three years ago.

ESG oversight

Confidence is high, even as demands grow

ESG (environmental, social, and governance) has evolved from what was once a peripheral topic to one that is central in the boardroom today. It dominates how many investors analyze a company and its stewardship priorities.

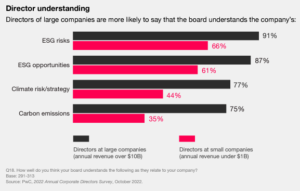

The expectation that directors be deeply involved in a company’s ESG strategy is a central aspect of board service at most companies. So it’s encouraging that the vast majority of directors (86%) say their board understands the company’s ESG strategy. Another 82% say the board understands the company’s ESG risks, and 77% think the board understands the opportunities ESG presents.

Directors are even more confident of the board’s understanding in traditional areas of oversight that fall under the ESG umbrella. This includes talent and culture, which 92% of directors say the board understands. Ninety percent (90%) of directors also tell us that their board understands both the company’s diversity and inclusion efforts and its data privacy and cybersecurity policies and practices.

But directors are much less confident in emerging areas like climate risk and related regulations. Fewer than two-thirds of directors say their board understands the company’s climate risk/strategy or the internal processes and controls around data collection. And just more than half (56%) think they understand the company’s carbon emissions. With SEC regulations pending in this area, boards may find it is the next area that calls for significant focus and learning.

ESG is on the agenda, but fewer directors see a connection to the bottom line

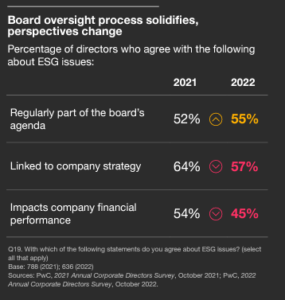

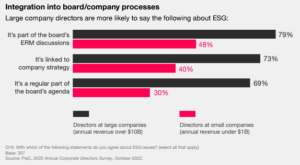

As boards continue to grapple with ESG oversight, they are settling on more systematic board processes. Almost two-thirds of directors (65%) say that ESG is part of the board’s enterprise risk management (ERM) discussions, meaning it is being built into the central board discussions of company-wide risk calculations.

We also see an increasing percentage of directors (55%, up three points from last year) who say ESG is regularly a part of the board’s agenda. And directors are more satisfied with their oversight, with only 24% saying the board needs more definition around the process.

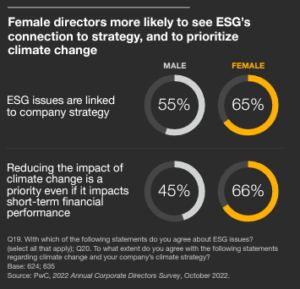

But at the same time, directors are less likely to see a connection between ESG and company fundamentals. Just 57% of directors say ESG issues are linked to company strategy, down from 64% last year. And only 45% of directors think that ESG issues have an impact on company performance, down nine points from a year ago. So even as processes become more solidified, the connection between ESG and the fundamentals of the company may be less obvious, at least in directors’ eyes.

The ESG topics few boards are discussing

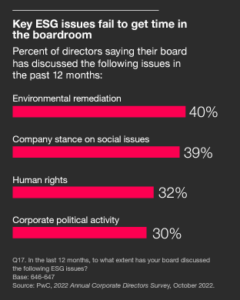

Although more than half of directors say ESG is regularly on the board’s agenda (see page 16), the term “ESG” is broad and covers a wide range of topics. Among these areas, the level of discussion in the boardroom varies widely.

Which topics are usually covered? Over 90% of directors say their board has discussed data security and talent management in the past 12 months. Almost as many (86%) say the same about board composition. These areas are important elements of ESG, but they are also well-trodden areas of board oversight.

What’s less common is board attention on newer, emerging areas. Just 39% of directors say their board has somewhat or substantially covered their company’s stance on social issues in the past 12 months. Less than one-third say they’ve covered human rights issues and only 30% say the same about corporate political activity.

These may be areas that are less central to company strategy, but they are topics where investors are looking for company action. When stakeholders expect companies to make statements and take positions, board oversight should not be absent.

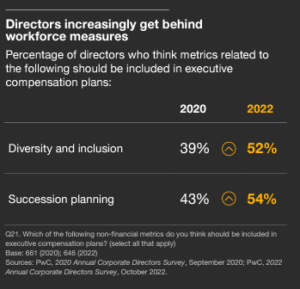

Support for ESG measures in executive compensation shifts

As boards and companies work to integrate ESG concerns into company strategy, many are also considering how to create the right incentives for executives. Where once executive compensation plans were focused primarily around financial goals, companies are now adding non-financial metrics as well. Some companies use these metrics because they are looking to reflect, or change, the culture at a company. Others are looking to manage business risks or pursue opportunities related to ESG. As of last year, more than half of companies in the S&P 500 (57%) used at least one ESG metric in their plans.

More than nine out of ten directors (92%) agree that some type of non-financial metrics are appropriate, and the most commonly supported measure is customer satisfaction (62%). But this year we have seen rapidly increasing support for workforce-related measures as well. More than half of directors (52%) support using diversity and inclusion metrics, compared to just 39% in 2020. More directors also show support for metrics related to employee engagement (57%, up from 54% in 2020) and succession planning (54%, up from 43% in 2020).

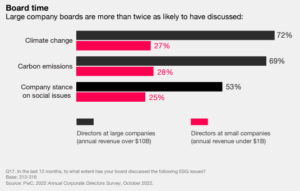

How company size dictates the board’s ESG path

In many areas, the experiences and views of directors at public companies, both large and small, are similar. They have fairly consistent views about board refreshment and diversity, and about board practices—except when it comes to the core ESG issues. We hear from directors on the boards of large companies (more than $10 billion in annual revenue) that they spend more time on ESG issues, and they understand the core areas and how they connect to company strategy more commonly than directors on the boards of small companies (less than $1 billion in annual revenue). Their boards are more likely to see how ESG integrates with company and board practices. They also put more value on ESG expertise on their board, and they are more likely to believe that actions in the area will impact their relationships with stakeholders.

Shareholder engagement

Shareholder engagement reaches new heights

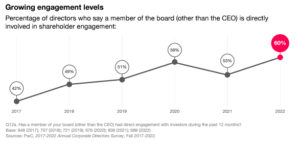

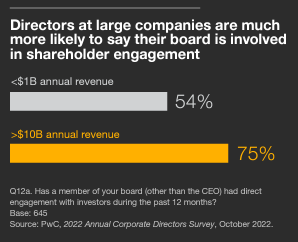

The once-unusual practice of having non-executive directors meet with investors is now the norm. While just 42% of directors reported this practice in 2017, in 2022, 60% of directors say that a member of their board (other than the CEO) had direct engagement with shareholders in the past 12 months. This represents almost a 50% increase in prevalence compared to five years ago.

For the companies where board members are not involved in these meetings—what’s keeping them away? Most commonly, directors say it’s because shareholders were not interested (49%). Investors have limited time and want to spend it wisely, while also respecting the time of directors. If they don’t have specific reasons to meet with directors, they will make that clear, but will typically appreciate the offer to have a director available.

A large percentage of directors (42%) also tell us that their boards don’t think direct discussions between investors and directors are appropriate. With shareholder engagement becoming more and more expected, these directors may find themselves out of step with current trends and expectations.

Another nearly one in five (19%) say management prefers that directors not have a role in shareholder engagement. For directors on those boards, it may be time for a deeper discussion on the topic. If shareholder requests to meet with a director are rebuffed, this could be seen as a red flag, indicating either a lack of trust between management and the board, a lack of critical knowledge among board leadership, or other issues that would call for some skepticism about the board’s involvement and oversight.

Directors give shareholder engagement positive reviews

Most directors whose boards engage with shareholders have a positive experience. More than four out of five (84%) say the discussion was productive. Eighty-three percent (83%) say investors were well prepared, and 81% say the level of discussion was appropriate. These are strong reviews for a practice that seemed unusual a decade ago.

And directors don’t just say that the meeting was positive. They also say that their board took some action as a result of the discussion. Most commonly, directors say that the engagement impacted board discussions of certain topics (41%). It may have brought up issues the board had not previously identified or discussed, or it may have impacted the way those topics were considered.

Another 28% of directors say their board made a change to their public disclosure in response to the engagement. Nearly one in five (18%) said their board asked different questions of management. A small percentage say their boards made changes to their governance policies (12%), revised an element of company strategy (11%), or changed their board succession plan (5%).

These findings show that a productive engagement with shareholders doesn’t have to result in upheaval on the board. Simple steps like shifting the discussion in the boardroom can make a difference and make the engagement a valuable tool. That type of feedback/discussion can improve the board’s performance and enhance their oversight without calling for wholesale changes.

Shareholder engagement can lead to changes without upheaval. Even simple things like a shift in boardroom discussions can be valuable.

Directors forecast shifts in investor focus

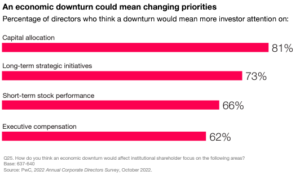

With inflation numbers reaching levels not seen in decades, rising interest rates, and increasing market turmoil, the economic outlook is becoming more uncertain for companies and for their shareholders. Institutional investors, who have put a heavy focus on governance improvements and on ESG concerns over the past decade, have done so largely within a bull market. How do directors think an economic downturn would affect their views?

A majority of directors think that a downturn would shift more attention to capital allocation (81%), long-term strategy (73%), short-term stock performance (66%), and executive compensation (62%).

The area least likely to be affected, according to directors, is board diversity. Almost half of directors (45%) think a downturn would have no effect on the amount of shareholder focus on the issue.

The areas directors think would receive less attention: carbon emissions and climate risk. Sixty-one percent (61%) of directors think a downturn would mean less shareholder focus on each of those issues. This could be related to the fact that only 45% of directors think that ESG issues have a financial impact on the company—and are therefore issues that would become less important to shareholders when company financial performance might be in question.

Trust and transparency

Searching for ways to impact stakeholder trust

Amid social and economic disruption, the public increasingly sees corporations as agents of stability. In fact, business is the most trusted institution in America, according to the Edelman Trust Barometer. But stakeholder trust is hard to win and easy to lose. To maintain trust, companies must be intentional when it comes to thinking through their stakeholder relationships.

When it comes to board actions that could increase trust, directors look to increasing transparency and accountability. Seventy-one percent (71%) of directors say that engaging directly with shareholders would enhance stakeholder trust. This compares to the 60% of directors who say their boards are doing this (see page 23). While 60% represents a new high of shareholder engagement, the gap also indicates that more boards could be finding a benefit in this area.

Second to engagement, directors point to enhanced shareholder communications. Seventy percent (70%) of directors say that enhancing disclosure or reporting can have a positive impact on stakeholder trust. Making governance changes in a central focus area can also help. Almost two-thirds (64%) of directors say increasing board diversity can improve trust.

Less likely to have an impact: actions around social/political issues. Just 24% of directors think making statements about social issues improves trust, and only 21% say that being more transparent about political spending will have a positive impact.

The complete memorandum is available here.

Print

Print