Richard Alsop, Doreen Lilienfeld, and Gillian Moldowan are Partners at Shearman & Sterling LLP. This post is based on a Shearman & Sterling piece by Mr. Alsop, Ms. Lilienfeld, Ms. Moldowan and Lona Nallengara and is part of the 20th Annual Corporate Governance Survey publication of Shearman & Sterling LLP.

The Survey consists of a review of key governance characteristics of the Top 100 Companies, including a review of key ESG matters.

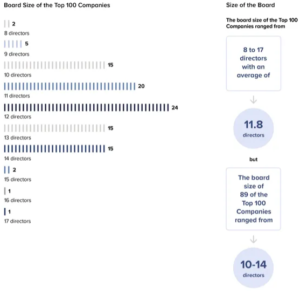

Board Size and Leadership

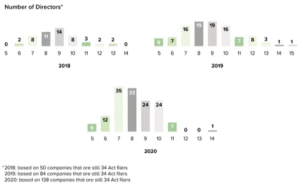

The average size of the board of the Top 100 Companies has decreased from 12.5 directors in 2015 to 11.8 directors in 2021, and 46 of the Top 100 Companies have split the CEO and board chair positions.

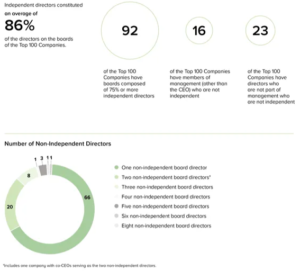

Director Independence

Over the last 10 years, the number of companies at which the CEO is the only non-independent director has increased significantly.

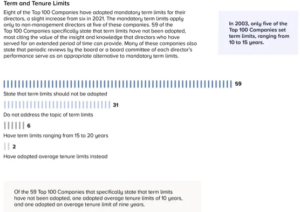

Board Refreshment

Board refreshment continues to be one of the key issues facing nominating and governance committees, and boards as a whole, as they are increasingly under pressure to change the face of the boardroom by re-examining topics such as director tenure, experience, performance and diversity, with gender and ethnic diversity at the forefront.

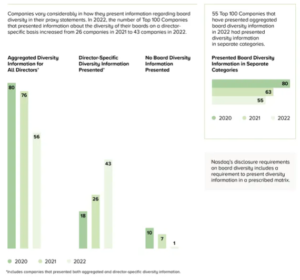

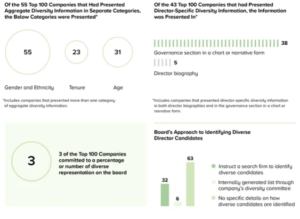

Board Diversity

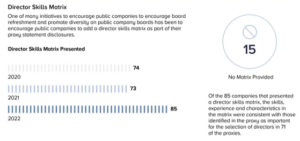

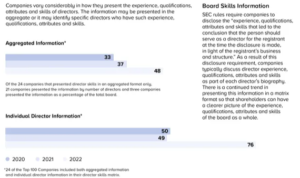

Director Skill Set

Women in Leadership

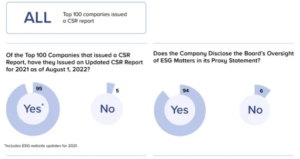

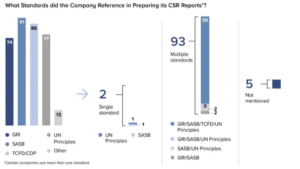

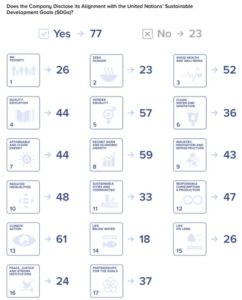

ESG Disclosure and Governance

Format of Annual Shareholder Meetings

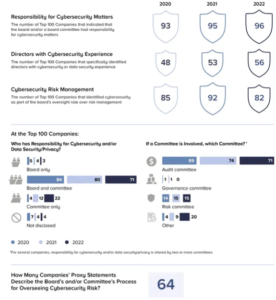

Cybersecurity

Cybersecurity and data protection and related risk-management discussions continue to be areas of focus for directors.

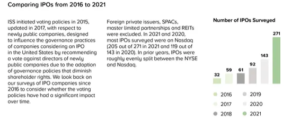

IPO Governance Practices

IPO companies continue to adopt the corporate governance practices that are disfavored by proxy advisory firms.

Human Capital Management

Share Ownership Requirements

Equity Plans

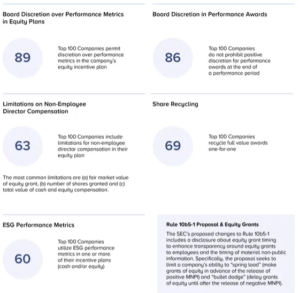

99 of the Top 100 Companies maintain equity plans to compensate employees and non-employee directors. We highlight trends in the Top 100 Companies with regard to board discretion, non-employee director compensation and share recycling.

Say-on-Pay

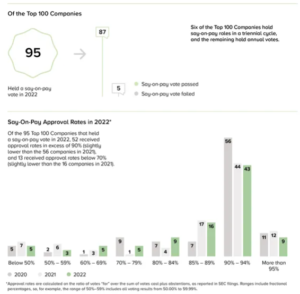

2022 represented the 11th proxy season under the Dodd-Frank Act’s mandatory say-on-pay regime. Although most Top 100 Companies continue to receive high approval rates, this year saw an increase in say-on-pay failures.

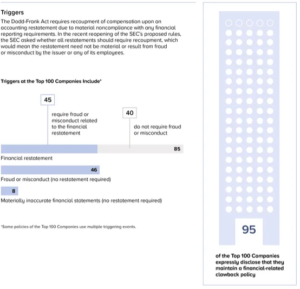

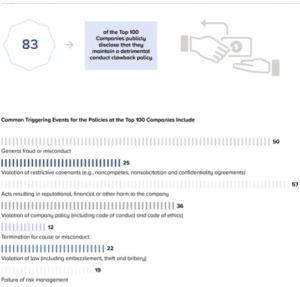

Clawback Policies

The SEC proposed rules implementing Section 954 of the Dodd-Frank Act in 2015. In October 2021 and again in June 2022, the SEC reopened the comment period on the proposed clawback rules with an indication that the final rule could be broader than the 2015 proposal. Notwithstanding the lack of final rules, many Top 100 Companies voluntarily maintain clawback policies as a best practice. Their policies, however, are not uniform. Should the SEC finalize its rule, many companies will need to reassess their policies.

CEO Pay Ratio

Executive Perquisites

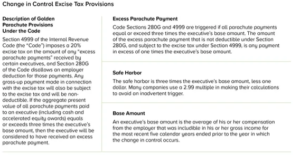

Golden Parachute Provisions

With the advent of say-on-pay and increased focus by institutional investors on executive compensation, golden parachute gross-up provisions have become all but obsolete at the Top 100 Companies. Many of the Top 100 Companies are implementing reduction provisions intended to protect executives from the excise tax known as either “cutback” provisions or ”better-of” provisions.

The link to the complete piece is located here.

Print

Print