Yamika Ketu is a Senior Associate, and Todd Miller is a Manager of Governance at Ceres. The post is based on a Ceres memorandum by Ms. Ketu, Mr. Miller, Steven M. Rothstein, Anne Kelly, Heather Green and Adam Vaccaro. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy – A Reply to Professor Rock (discuss on the Forum here) by Leo Strine; Stakeholder Capitalism in the Time of COVID,(discussed on the Forum here) by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita; and Corporate Purpose and Corporate Competition (discussed on the Forum here) by Mark J. Roe.

Introduction

In July 2021, Ceres issued a groundbreaking report to assess climate policy lobbying among America’s largest companies. The Practicing Responsible Policy Engagement report found that, even as the largest U.S. companies were increasingly integrating sustainable and climate-friendly practices into their own operations, corporate America was largely failing to use its influence to advocate for the economy-wide policies necessary to address the climate crisis and achieve businesses’ climate goals.

Now, after a year that has brought more harrowing evidence of the effects of climate change as well as significant debate over federal climate policy, our new assessment suggests important and noteworthy progress in this area. Half of the S&P 100 companies we analyzed advocated for climate policies over the past three years that align with the Paris Agreement.

The number is a meaningful touchstone, indicating that companies are increasingly prioritizing smart climate lobbying, even if it lags behind other internal corporate efforts to acknowledge climate risk and act to address it. And this promising data has seemed to come to life in the headlines, as corporate support for climate policies at the federal and state levels continues to grow.

However, our analysis still finds some glaring points of weakness. Just 11 of the S&P 100 companies we assessed publicly supported the Inflation Reduction Act of 2022, the largest and most significant climate legislation in U.S. history, as it was passed into law. At least 19 additional S&P 100 companies publicly urged Congress to pass ambitious federal climate legislation in 2021 and 2022 as part of the process that ultimately yielded the historic package, and many companies not listed in this assessment strongly supported it. However, the relatively low level of support for such important legislation among America’s largest companies indicates that there is still much room for improvement in this area.

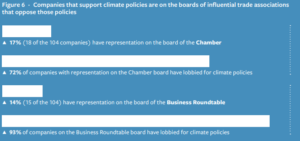

Moreover, powerful trade organizations, including the U.S. Chamber of Commerce and the Business Roundtable, while claiming to speak for the U.S. business community, still sought to block several critical policies that many of their members supported. And many of the companies that support ambitious climate policies neglect to hold their trade associations accountable for their obstructive lobbying on climate issues, in direct contradiction of their own climate targets and advocacy efforts. In some cases, top executives at companies that claim to support these policies serve in leadership positions at trade groups that aim to undermine them.

Until this misalignment is addressed, corporate leadership on climate policy will continue to represent a significant weakness in the U.S. business community’s growing efforts to lead the transition to a clean, resilient, and sustainable economy.

This review of the climate-related risk management, governance, and policy engagement practices of the S&P 100 is intended to help companies find their voice to advocate for the policies that will advance sustainable growth, while giving investors actionable insight into which businesses are establishing best practices and which are falling behind.

Wielding enormous influence and bipartisan credibility, major companies have the power to help establish a policy environment that will enable their businesses and their investors to avert the most dire climate risks and take advantage of the multitrillion dollar opportunity of this generational economic shift. They also stand to burnish their own reputations by establishing their leadership in a critical policy area. And, because investors are seeking to put their money in places that have prioritized smart climate policies, corporate policy support will help bolster the competitiveness of the U.S. economy in the coming years.

In this make-or-break decade, corporate America cannot sit on the sidelines. As important as the policies approved this year are to meeting the 2030 U.S. emissions goals, more will be needed to meet that target, reduce companies’ and investors’ climate risks, and build a competitive, innovative, and prosperous clean energy economy.

State of Affairs

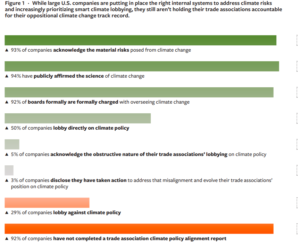

Overall, our latest analysis finds that some companies have significantly improved their performance in establishing internal processes and systems for addressing climate change as a systemic risk. For example:

- More companies acknowledge the material risk that climate change poses to their business: 93% of the benchmarked companies recognized either the physical risks (that increasing frequency and intensity of extreme weather will damage property, disrupt business operations, and harm employees) or the transition risks (that shifts in business conditions — including consumer preferences, new technology, laws, or regulations due to the shift to a clean economy —could impact business models) associated with climate change in their 10-K filings. That marked an 18% increase from last year’s report.

- The percentage of companies that have conducted climate-related scenario analyses jumped to 78% from 67% in the 2021 Benchmark. Of these companies, 62% of assessed companies are using a climate-related scenario analysis that is recommended by the Task Force on Climate-Related Financial Disclosures (TCFD), indicating acceptance of a disclosure framework that, notably, the U.S. Securities and Exchange Commission’s proposed climate risk disclosure rulemaking is based on.

- 50% of companies have set or committed to set a target through the Science-Based Targets initiative, which provides a clearly defined pathway for companies to reduce greenhouse gas (GHG) emissions.

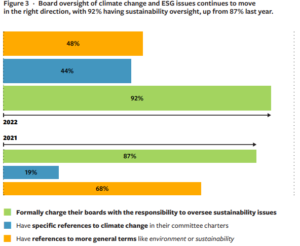

- Board oversight of climate change and ESG issues also continues moving in the right direction: this year’s report found that 92% of boards oversaw issues related to climate change and ESG, up from 87% last year.

There has also been significant, albeit slower, improvement in companies’ direct lobbying efforts on climate policy. However, powerful trade associations continue to lobby against Paris-aligned policy, often undermining the positions of member companies and their investors.

- Half of the 104 assessed companies have lobbied in the last three years for Paris-aligned climate policies. This number is encouraging, suggesting significant growth in responsible policy engagement. However, it also indicates that companies’ political practices are far behind the steps they are taking to implement climate risk into their internal processes and governance, and have significant room to grow. This is further evidenced by only 11% of companies publicly supporting the Inflation Reduction Act as it was passed into law, despite its monumental federal investments in climate and clean energy action. (At least 19 additional companies voiced their support for strong federal climate legislation in the months before the Inflation Reduction Act was unveiled in the Senate. That means 29% of S&P 100 companies participated in the widespread advocacy efforts that ultimately led to its passage. While that figure does show significant support, it still falls well short of other metrics in this assessment.) Meanwhile, 29% of the assessed companies still lobbied against Paris-aligned policies — even though nearly all of them have either set or plan to set emission reduction targets that the policies will help them achieve.

- There has also been little change in companies addressing their indirect lobbying efforts through trade associations. Most assessed companies have disclosed their trade association memberships, but only a small number have conducted an internal assessment of their trade associations’ alignment on climate policy, and even fewer have acknowledged the associations’ obstructive lobbying or engaged the associations to address it.

It is clear that most companies broadly recognize the systemic nature of climate risk, as they take increasingly ambitious steps to address climate change across their strategies and systems while boards assume explicit oversight of the issue. But the timeframe to slash greenhouse gas emissions in half by 2030 is shortening, and we are at risk of failing to limit warming to the Paris-aligned goal of 1.5°C. To achieve this target and meet their own climate goals, more companies must align their internal action with their policy advocacy, and work to eliminate climate policy obstruction by their trade associations.

Investors Are Focused on Climate Lobbying

The current misalignment of corporate climate action and climate lobbying is exacerbating the risk that investors face, especially as the number of global investors adopting and implementing their own net zero climate commitments has rapidly accelerated over the past few years. Investors are continuing to step up their engagements with companies, pushing them through direct engagement, letters, shareholder resolutions, and investor initiatives to ensure that their direct climate lobbying and their trade associations’ lobbying is in step with the latest climate science.

- The Climate Action 100+ initiative, which is made up of 700 investors who manage $68 trillion in assets and who are engaging with the highest-emitting companies, publishes a benchmark that assesses companies on a list of indicators, including climate change lobbying.

- During the 2022 shareholder proxy season, among the record 110 agreements between investors and companies on climate-related shareholder resolutions were 17 on climate lobbying and how it aligns with the Paris Agreement. Climate Action 100+ investor signatories reached agreements on shareholder resolutions on climate lobbying disclosure with American Airlines, ExxonMobil, GE, Lockheed Martin, and The Southern Company.

- Ensuring that direct or indirect policy advocacy is in line with climate science is one of the principles of the Net Zero Asset Managers Initiative, an international group launched in December 2020 that is made up of 273 investors who manage a combined $63 trillion in assets and who are committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner.

- In September 2022, The Investor Agenda issued a statement ahead of United Nations Climate Change Conference of Parties (COP27) calling on governments to strengthen their climate commitments and emphasized the need to adapt climate policies necessary to reduce emissions to zero. The statement was signed by 532 investors with nearly $39 trillion in collective assets.

“Our expectations are that companies align what they say with what they do. Marketing, sustainability reports, and Net Zero commitments get companies accolades all over. But if a company has not evaluated what they are lobbying against through their thirdparty memberships, suddenly it’s a waste of resources for shareholders.”

— Marcela Pinilla

Director of Sustainable Investment, Zevin Asset Management

The Assessment in Brief

This is our second analysis of how the largest publicly traded U.S. companies performed against Ceres’ 2020 Blueprint for Responsible Policy Engagement on Climate Change (“the Blueprint”), which laid out expectations for how companies should incorporate their exposure to climate change risks into their decision-making on climate change lobbying. The Blueprint calls for companies to practice the “risk-aware and responsible” Paris-aligned climate policy advocacy their investors increasingly demand. It set forth a series of steps that companies should adopt to make sure that their efforts are calibrated to the risks that climate change poses to their businesses. The Blueprint calls on companies to:

- Assess climate-related risks to the company, including physical and transition risks

- Systematize decision-making for climate risks, including climate lobbying, across the company

- Advocate in favor of Paris-aligned climate policies

- Engage their trade associations to support Paris-aligned climate policies

In 2021, we conducted a detailed review of the climate change risk assessment, governance, advocacy, and engagement practices of the companies listed on the S&P 100 in 2019. (The list was ultimately reduced to 96 due to mergers and acquisitions prior to publication.) This year, we have again benchmarked the same cohort of companies against the Blueprint, as well as an additional eight companies that were added to the S&P 100 in 2020 and 2021, bringing this year’s assessment total to 104.

In addition to expanding the number of companies, there are a few methodological differences between the 2021 and 2022 Benchmark reports.

While the 2021 Benchmark graded company actions on a “yes” or “no” binary, this year’s report grades on a three-tier system — “yes”, “partial”, or “no” — to indicate where companies are starting to make progress but can improve their climate action efforts. However, because of the way we tallied these results each year, we are still able to make year-over-year comparisons for many of the topics within this report. Additionally, this year’s report evaluated corporate climate lobbying in the past three years, rather than five, to capture more recent engagement on climate policy.

We have also incorporated board governance indicators from the Center for Political Accountability’s Zicklin Index to evaluate the level of oversight corporate boards have over corporate political giving.

And while last year’s examination of trade group activity was narrowly focused on the U.S. Chamber of Commerce, this report applies a similar analysis to company membership in the Business Roundtable and leading industry associations like the National Association of Manufacturers and the Advanced Energy Economy.

Additional expectations on how companies can responsibly engage in policy advocacy on climate and other ESG issues can be found in the Ceres 2030 Roadmap.

Below, this report explores how companies are performing in each of the four stages in the Ceres Blueprint: Assess, Systematize, Advocate, and Engage.

1. Assess Climate Change Impacts

Integrating risks from climate change within companies’ larger financial risk assessment frameworks is crucial for managing the low-carbon transition. Impacts from climate change are already materializing as physical and transition risks and will only continue to do so as the socio-economic and policy landscapes evolve.

The Blueprint for Responsible Policy Engagement recommends companies assess their systemic climate-related risks by using well-established internal processes, such as enterprise risk management systems, materiality analyses, and robust climate scenario assessments.

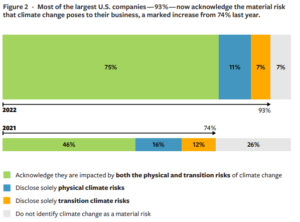

93% of assessed companies acknowledge in their 10-Ks that climate change poses a material risk to their enterprises, up from 74% last year. Of those 97 companies, 75% recognize the physical and transition risks of climate change as a material risk, while 18% only recognize either physical or transition risks as material.

Just 7% of the assessed companies still make no reference to climate change in their financial filings, a notable improvement from 26% in our 2021 report. The 7% of companies failing to reference climate change are at odds with the increasing investor and regulatory focus on climate change as a systemic risk.

While that data may suggest strong overall performance, some details within the disclosures continue to fall short of expectations. Notably, just one out of the 104 companies in the Benchmark acknowledged the lack of robust federal climate policy as a risk. In its 2021 10-K filing, Dupont De Nemours stated, “the current unsettled policy environment in the U.S., where many company facilities are located, adds an element of uncertainty to business decisions, particularly those relating to long-term capital investments … An effective global climate policy framework will help drive the market changes that are needed to stimulate and efficiently deploy new innovations in science and technology, while maintaining open and competitive global markets.”

No other company made a similar point within their financial disclosures about the business threat of a lacking climate policy environment. Given the importance of Paris-aligned policy to addressing climate risks, companies should regard Paris-aligned climate policies as a positive force for their enterprises, providing important policy certainty for future investments, as well as a roadmap for resilient operations.

Statements asserting climate risk as material in financial filings are only one piece in the puzzle of corporate climate risk management. These statements must be followed by action. As one of the first steps for any organization to meet its climate objectives, companies must set emission reductions targets for their entire value chain, including net zero goals and the establishment of targets related to their scope 3 emissions. Companies can then determine the best ways to meet those targets by conducting a science-based climate-related scenario analyses and developing climate transition plans.

The Science-Based Targets initiative (SBTi) provides a clearly defined pathway for companies to reduce greenhouse gas (GHG) emissions, and 47% of the companies in the Benchmark have either set or committed to set a target through the SBTi. It should be noted that just because a company has not set a target through the SBTi, that does not mean it lacks a robust emissions reduction methodology. For example, more than 100 of the world’s biggest banks have set net zero targets under the Net-Zero Banking Alliance, a global financial initiative created to drive commitment to net zero by 2050 that provides a framework for climate action.

Companies are starting to incorporate climate change scenario analyses to gauge the resilience of their business models against a range of global warming pathways. 62% of assessed companies are using a climate-related scenario analysis that is recommended by the Task Force on Climate-related Financial Disclosures (TCFD), indicating that companies are becoming more aware of the importance of stress testing.

Critically, almost half the companies state that they have started to develop climate transition plans, which translate a company’s global targets for emissions reductions into a concrete plan with specific, measurable, and time-bound goals. It should be noted that the area of climate transition plans is rapidly evolving. Today, there is little consistency about what companies are including in their climate transition plans and how they are integrating them into their overall business strategy and governance structures. Organizations like Ceres are still working to establish the core components of robust climate transition plans across sectors.

Assess Indicator Guidance

The Benchmark evaluated companies on the following metrics to measure the extent that climate risk is considered systemic in a company’s risk management systems:

1. The company has set a target through the Science-Based Target initiative: Provides insight into the degree warming target a company has set and the time horizon it hopes to achieve that goal.

2. The company has developed a climate transition plan: Provides insight into an action oriented and climate science-led strategy that will keep the company’s business (and its value chain) on the pathway to 1.5° C and its business model relevant in a net zero economy.

3. The company has conducted a climate-related scenario analysis: Provides insight into the resilience of the company strategy and whether it has taken into consideration different climate-related scenarios, including a 1.5° C or lower scenario, where such information is material.

4. The company’s 10-K recognized the physical and transition risks of climate change as a material risk: Provides insight into whether the company publicly recognizes the climate crisis as a risk that significantly affects the business.

2. Systematize Decision‑Making on Climate Change

After analyzing climate change risks, companies must incorporate those considerations across governing structures within the organization, including their public policy operations.

The Blueprint addresses climate risk at both the management and board levels. At the management level, companies can establish cross-organizational teams throughout various departments including government affairs, legal, finance, and risk management. These teams should ensure that the company’s policy decisions integrate the risks arising from climate change-related impacts. It is also crucial for management to keep their companies’ boards informed on climate change risks and opportunities, especially as it relates to public policy.

At the board level, assigning formal oversight of climate change to one or more board committees certifies that the board is systemically discussing climate-related risks within the context of strategic planning and risk management. Additionally, the board should be aware of how the company is engaging directly and indirectly on matters relating to climate policy, and about company funds that are being allocated to such activities.

92% of assessed companies formally charge their boards with the responsibility of overseeing sustainability issues, up from 87% last year. 44% of those boards have specific references to climate change in their committee charters, whereas 48% have references to more general terms like environment or sustainability.

78% also have the systems in place for boards to oversee the company’s political activity and spending, according to Center for Political Accountability’s Zicklin Index, which measures the level of political accountability and disclosure of S&P 500 companies. (We incorporated metrics from the Zicklin Index in this year’s report to provide a more comprehensive analysis of board involvement in political policy making and spending.)

While companies are performing well on giving their boards governance over climate change and political activity, these disclosures about board oversight do not speak to how corporate leadership approaches climate change policy as part of its risk management process. Additionally, the Zicklin Index provides a comprehensive picture of a company’s election spend but the picture on lobbying related expenditures remains murky. There is insufficient disclosure on how these decisions are made at the management level, and what cross-organizational teams are involved. Paris-aligned climate policies function to mitigate corporate climate risk exposure in the short, medium, and long run. Company boards, as well as management, should be discussing these matters from a risk mitigation angle, especially as it relates to political giving.

| In 2021, the Center for American Progress released a list of “climate deniers” in the 117th Congress which showed there are 139 elected officials who still deny the science of climate change and the consensus that it is a direct result of human activity. Data from OpenSecrets revealed that the majority of companies in the S&P 100 have contributed funds to those elected officials, helping to foster a policy landscape that fails to acknowledge or address the financial and economic risks of climate change. |

Given the increasingly polarized state of U.S. politics, companies are being held more responsible for their involvement in election and lobbying spending, a reflection of their ability to vastly influence the policy landscape. The public is looking to American businesses to lead on societal issues that they need to work with government to address, according to the 2022 Edelman Trust Barometer. And climate change is the No. 1 topic that the public wants more business leadership on, the same survey found.

Systematize Indicator Guidance

The Benchmark evaluated companies on the following metrics to measure the extent that climate risk is built into systemic decision-making:

1 The board has assigned formal oversight of climate change to one or more standing committees: Provides insight into whether climate change is a priority at the oversight and leadership level.

2 The board regularly discusses the risks posed from climate change: Provides insight into how frequently the board is discussing risks arising from climate change.

3 The board formally oversees the company’s corporate political activity: Provides insight into whether political activity is a priority at the oversight and leadership level. This is made up of the following sub-indicators:

a The company has a publicly available policy that the board of directors regularly oversees the company’s corporate political activity.

b The company has a specified board committee, composed entirely of outside directors, that oversees its political activity.

4 The company has appropriate policies and governance mechanisms in place for oversight of political expenditures: Provides insight into systems in place for decision-making of political activity. This is made up of the following sub-indicators:

a The company has a specified board committee that reviews the company’s policy on political expenditures.

b The company has a specified board committee that reviews the company’s political expenditures made with corporate funds.

c The company has a specified board committee that reviews the company’s payments to trade associations and other tax-exempt organizations that may be used for political purposes.

d The company has a specified board committee that approves political expenditures from corporate funds.

e The company discloses an internal process for or an affirmative statement on ensuring compliance with its political spending policy.

Additional guidance on the board’s role in overseeing ESG issues can be found in Ceres’ Running the Risk: How Corporate Boards Can Oversee Environmental, Governance and Social Issues report.

3. Advocate for Paris‑Aligned Climate Policy

Having internalized climate risks and incorporated them into their governance and decision-making, companies should use their influence to publicly support the Paris-aligned climate policies needed to meet the ambitious U.S. target of cutting greenhouse gas emissions by 50% to 52% by 2030. Paris-aligned climate policies drive the foundation of a policy and regulatory environment that best positions companies for resilient growth within the transition to a low-carbon economy, and are critical to helping companies successfully meet their own Paris-aligned climate change targets or net zero goals.

The Blueprint calls on companies to publicly affirm climate science and the goals of the Paris Agreement. This affirmation from leading companies is imperative, given the politicization of climate change as a special interest issue. To counter this misrepresentation, companies must make clear that climate change represents a material risk to companies, supply chains, capital markets, and the economy. Building on this, the Blueprint calls on companies to advocate for relevant Paris-aligned policies publicly and consistently across all their engagement platforms.

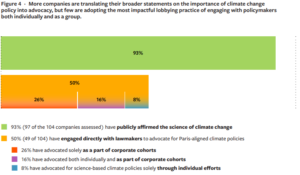

93% have publicly affirmed the science of climate change, a 19% increase from last year. Because corporate America is the most highly trusted institution in the U.S., according to the Edelman 2022 Trust Barometer, statements that acknowledge climate change science are critical to opposing climate science denialism, affirming the urgency for climate action, and highlighting the threat of climate change to business operations. For example, in its 2020 Climate Resiliency Report, AT&T stated, “Climate change is one of the world’s most pressing challenges, and weather events associated with climate change pose a significant threat to the safety of communities and infrastructure everywhere.” This affirmation is a clear indication from AT&T that the organization believes in climate change and the risk of its impacts.

Support for the Paris Climate Agreement also continues to grow among assessed companies, with 68% publicly supporting the pact, up from 52% last year. This increase is notable considering the ambitious emission reduction targets the Biden administration set in line with the Paris Agreement in 2021, as well as the various commitments the U.S. made later that year at the COP26 global climate conference. Expressing support for the Paris Agreement also indicates whether a company is amiable to global climate diplomacy efforts.

Additionally, 65% have broadly acknowledged the need for Paris-aligned climate change policies, up from 57% last year. These numbers show that companies continue to evolve in their support for effective climate policy.

Our data also shows that 50% have engaged directly with policymakers to advocate for Parisaligned climate policies. Because of changes in report methodology, we cannot make a direct yearover-year comparison; however, the figure still suggests a significant increase from 40% in the 2021 report. The apparent growth is a promising sign, because corporate advocacy is vital to persuading lawmakers to advance the needed policies and exhibit that the company’s broader statements on climate change are genuine. As noted previously in this report, ambitious climate policy engagement is an effective risk management tool for companies to ensure the policy and regulatory environment reduces the threat of economic and financial damage from climate change.

However, the result still lags behind other assessment indicators. This suggests that not all companies that say they support ambitious policies that will help them meet their climate goals are lobbying for them. More companies must adopt these lobbying practices, and quickly, in order to build the policy environment that will help businesses and the nation meet their climate goals.

It is more common for companies to either lobby only as individual organizations (8%) or as part of a group (26%). Ideally companies would be lobbying on an individual and coalition basis, as lending the full weight of corporate America towards passing Paris-aligned climate policies would result in meaningful progress.

| Climate Policy Leadership in Action

Where there is corporate support of Paris-aligned climate policies, companies are lobbying in favor of GHG emissions regulation, clean energy measures, and government backed emissions trading schemes. Companies are advocating for these policies through various means, both individually and collectively. Amazon, for example, directly advocated to policymakers in Washington state to reduce carbon emissions from transportation fuels by sending a letter in support of a proposed Low Carbon Fuel Standard. Leading up to COP26, a number of companies in the Benchmark, including Adobe, Biogen, Netflix, and PepsiCo, advocated for policymakers to commit to ending new coal power developments and financing, along with coal phase-out plans by 2030 in advanced economies and 2040 in other countries. Eleven companies in the benchmark — Alphabet, Duke, Exelon, Ford, General Motors, Intel, Microsoft, Morgan Stanley, Salesforce, Southern, and Walmart — made public statements in support of the Inflation Reduction Act in the weeks between its introduction in the Senate and its August passage. At least 19 other companies offered some level of support for strong federal climate legislation over the more-than-ayear of Congressional negotiations that ultimately led to the Inflation Reduction Act: 3M, Adobe, Amazon, American Express, Apple, Bank of America, Biogen, BlackRock, Citi, Dow, DuPont, GE, Meta, Netflix, NextEra, PayPal, PepsiCo, Tesla, and Verizon. Broader corporate advocacy for federal climate legislation in the run-up to the Inflation Reduction Act was substantial, with more than 2,900 companies of all sizes voicing their support for its climate measures by the time it passed. Companies should follow these examples to publicly advocate for Paris-aligned climate policies and regulations using all available methods, including writing (or co-signing) statements directed at policymakers on policy options, meeting with policymakers, and providing testimony on policy options at the federal and state level. Public engagements with policymakers have the benefit of being direct, open, and transparent. While private meetings with legislators can be an effective tool, they leave no public record of what was said, making it difficult for investors and others to understand the nuances of the company’s position and the response from the legislator or regulator. Since 2009, Ceres has organized multiple opportunities for corporations to meet with lawmakers on both sides of the aisle to express their support for Paris-aligned policy measures. Hundreds of businesses have participated in these campaigns in the last few years, highlighted by the annual LEAD on Climate (Lawmaker Education and Advocacy Day) events on Capitol Hill. |

29% of assessed companies have lobbied in opposition to Paris-aligned climate policies in the past three years, even though nearly all of them have either set or plan to set emission reduction targets that the policies will help them achieve. The climate lobbying practices of these companies present troublingly incongruous behavior that has directly contributed to the sluggish progress on climate action on Capitol Hill and in states across the country. Such contradictory practices also place the individual companies at risk of significant reputational damage, decreased investor confidence, and higher compliance costs in the future if action to address climate change is delayed.

The companies lobbying against Paris-aligned climate policy often advocate for policies that weaken GHG emissions standards, rely on nonexistent technology, and continue the use of fossil fuels.

For example, the CEO of Chevron recently testified to Congress in support of continuing oil and gas production and infrastructure development, going against the latest findings of the International Energy Agency, which states that new oil and gas projects must stop immediately if we hope to limit the rise in global temperatures to under 1.5°C and avoid the worst impacts of climate change. In 2021, Dow Chemical expressed support for HB17, a bill in Texas that would prohibit limitations against any type or source of energy, thus ensuring the continued use of fossil fuels in the state and prevent any mandates in favor of adopting renewables.

Both Chevron and Dow Chemical have affirmed the reality of climate change and have made statements supporting the need for climate action, but their lobbying record is in direct contradiction of those statements.

Nearly half (12) of the companies that lobbied in opposition to Paris-aligned climate policies in the past three years also lobbied for Paris-aligned climate policies. The mixed climate lobbying records of these companies present a complex picture, demonstrating that companies have higher appetites for some Paris-aligned policies than others. A sector-specific lens is important in this regard, especially in evaluating any progress going forward.

In one striking example, Tesla, the leader in electric vehicle deployment, has lobbied both for and against climate policy. The company commented in favor of California’s proposed Advanced Clean Cars II regulation, which would require an increasing percentage of new light-duty electric vehicle sales each year until achieving a 100% zero emission vehicle mandate in 2035. However, Tesla CEO Elon Musk has spoken out multiple times against consumer electric vehicle incentives.

Advocate Indicator Guidance

The Benchmark evaluated companies on the following metrics to measure their direct lobbying efforts on climate policy:

1 The company has stated support for climate action. This is made up of the following sub-indicators:

a The company has publicly affirmed the science of climate change: Provides insight into whether the company recognizes the science of climate change in order to counterbalance the outdated narrative of climate science denialism in the U.S.

b The company has made statements supporting the need for ambitious climate policies: Provides insight into whether the company has signaled its broad support for the need and value of climate change legislation and regulation that is aligned with climate science.

c The company has publicly supported the Paris Agreement: Provides insight into whether the company recognizes the need for science to inform policy making and the importance of U.S. participation in a coordinated global approach.

2 The company has publicly and individually supported specific Paris-aligned climate policies in the past three years: Provides insight into whether the company is engaging with policymakers to advocate for the issuance of specific rules and legislation in alignment with climate science.

3 The company has publicly advocated for Paris-aligned climate policies as a part of a coalition of companies in the past three years. Provides insight into whether the company is engaging with policymakers to advocate for the promulgation of specific rules or passage of legislation in alignment with climate science as a part of a corporate cohort, demonstrating broad corporate support for the importance of Paris-aligned climate policies.

4 The company has refrained from opposition to Paris-aligned climate policies in the past three years: Provides insight into whether the company has engaged in a constructive manner on climate policies across the enterprise’s positions and over time.

4. Engage Trade Associations to Support Science-Based Climate Policies

Business trade associations have enormous sway on U.S. climate policies. Member companies of trade associations are strategically positioned to influence their climate positions and advocacy practices so that they align with the companies’ best interests and manage the risks that companies face from the climate crisis. Such influence is especially important at major trade groups, such as the U.S. Chamber of Commerce, which have played a pivotal and obstructionist role in recent decades on climate science and climate policies.

The Ceres Blueprint calls on companies to assess the extent to which their various trade groups engage on climate policy and whether that engagement aligns with climate science. Based on the results of such an assessment, companies should publicly engage with their trade groups to ensure their positions are aligned.

Because trade associations themselves often do not divulge the names of their members, it is imperative that companies provide complete disclosure to give transparency to investors and other stakeholders concerned about the immense effect these groups have on climate policy.

Major trade associations’ obstruction of climate policy persists to this day. While in recent years the U.S. Chamber of Commerce and the Business Roundtable have each claimed to support climate policy, both organizations strongly lobbied against the legislation that ultimately became the Inflation Reduction Act — the most ambitious climate policy in U.S. history.

Given the severe economic and financial consequences of the climate crisis and the business opportunity that the shift to a clean energy economy represents, this means the nation’s largest trade organizations are often lobbying against their members’ best interests on climate policy. Because many member companies support Paris-aligned climate policy, this also means that trade organizations are often lobbying against their own members’ policy positions.

However, the vast majority of large U.S. companies are not publicly accounting for or publicly addressing their trade groups’ obstructionism. Lobbying spending that runs contrary to the company’s climate commitments indicates a lack of cohesion in the company’s strategy and execution. Since supportive public policy is essential for a company to achieve its climate goals, a company’s public policy advocacy activities and spend should be aligned and coordinated, including support for third-party organizations that engage in lobbying. It is critical that Chamber and Business Roundtable members, particularly large companies, use their voice and power within their trade associations to ensure that the climate positions and advocacy of the groups are in line with the member companies’ own business risks and reflect their support of Paris-aligned climate policies.

Just 8% of companies have conducted an internal assessment of their trade associations’ positions on climate change. While some large U.S. companies have provided broad statements to say they review the positions of their trade associations on climate change, a very limited number — including Duke Energy, Ford, General Motors, and Johnson & Johnson — have publicly disclosed assessments of their trade associations’ climate lobbying

That number is low but nonetheless marks an increase from last year’s Benchmark, which found only 4% of companies had completed an assessment of their trade associations. Yet even the completed assessments are sometimes lacking. Some companies disclose that the Chamber and the Business Roundtable do support strong climate policy based only on the groups’ public statements, despite their continued lobbying against the policies themselves.

Moreover, only 5% of companies acknowledge the obstructive nature of their trade associations’ lobbying on climate policy, and just 3% of companies disclose they have taken action to address that misalignment and evolve their trade associations’ position on climate policy.

Misalignment in ActionLast fall, companies including Amazon, Apple, 3M, LinkedIn, and Netflix publicly endorsed the federal clean electricity standard that was under consideration at the time, going against the Business Roundtable’s position. The companies remain members of the trade association |

Companies that have distinguished themselves from the Chamber and the Business Roundtable and engaged the associations are doing so in a variety of ways. The U.S. Chamber’s Climate Solutions Working Group issued a statement in October 2021 supporting the urgent need for substantial federal climate legislation at a time when the Chamber itself was actively opposing it. The statement was signed by S&P 100 companies, including American Express, Bank of America, Citi, Exelon, Morgan Stanley, and Salesforce.

Companies have also included attempts to influence their trade associations’ stance on climate in their CDP responses. In the 2021 survey, companies were asked to “enter the details of those trade associations that are likely to take a position on climate change legislation.” Johnson & Johnson took the opportunity to address the mixed alignment between its position on climate policy and that of the Business Roundtable and National Association of Manufacturers, in addition to listing specific actions the company had taken to address the misalignment.

Advocacy in favor of Paris-aligned climate policies is a top priority for investors, who are growing frustrated by trade associations’ obstruction — as evidenced by a letter from institutional investors urging the U.S. Chamber to lobby for policies that “significantly reduce GHG emissions, stabilize our climate, and re-envision our energy economy.” The misalignment between trade association lobbying, corporate lobbying, and internal corporate action poses not only material risks to corporate enterprises, but increased portfolio risks for investors as well. Shareholders are keen to see public disclosures that address the misalignment between companies and their trade associations. Future editions of this report may examine the ties between publicly traded companies and the associations that are advancing state policies designed to punish investors who prioritize climate and sustainability, such as the State Financial Officers Foundation and the American Legislative Exchange Council.

Critical Trade Association DisconnectThere is an especially notable disconnect among the companies with representation in trade association leadership. 18 of the 104 companies in the Benchmark have representation on the board of the U.S. Chamber, and 15 of the 104 have representation on the Business Roundtable. Notably, 72% of those assessed companies with representation on the Chamber board, as well as 93% of those on the Business Roundtable board, have lobbied for climate policies, putting their businesses in direct opposition to the trade organizations they help to lead. Most prominently, the Business Roundtable opposed the Inflation Reduction Act, with an accompanying media campaign designed to prevent the passage of the bill — even though the chair of the Business Roundtable, Mary Barra, is also the CEO of General Motors, a company that expressed support for EV-related provision of the Inflation Reduction Act. Similarly, Microsoft is represented on the board of directors at the Chamber and supports the reporting requirements in the SEC’s proposed climate disclosure rule, even as the Chamber calls for the rule to be weakened. Our findings also reveal that 68% of the assessed companies that serve on the board of the U.S. Chamber have not conducted an internal assessment of their trade associations’ climate policy engagements, and only 26% acknowledge the U.S. Chamber’s climate policy obstruction. Comparably, 64% of benchmarked companies on the board of the Business Roundtable have not conducted an internal alignment assessment, and only 21% acknowledge the Business Roundtable’s obstruction on climate policy. Taken together, these findings demonstrate that companies are entering into positions of leadership within trade organizations despite their negative impact on climate policy and the economic damage it will cause, and often without even publicly accounting for it. |

Engage Indicator Guidance

The Benchmark evaluated companies on the following metrics:

1 The company has disclosed a list of its trade association memberships: Provides insight into whether a company is transparent about its trade association memberships.

2 The company has conducted an internal assessment of its trade associations for climate policy alignment: Provides insight into whether a company is actively considering whether its trade association is acting in a manner that is consistent with climate change and the company’s own risk exposure.

3 The company is a member of the U.S. Chamber of Commerce, Business Roundtable, and an industry association: Provides insight into whether the company is a member of a trade association that has an oppositional climate change track record.

4 The company engaged with key U.S. trade associations to influence their stance on climate change: This is made up of the following sub-indicators:

a The trade association lobbies on climate policies in line with the Paris Agreement: Provides insight into the benchmarked trade associations’ records on climate lobbying.

b The company acknowledges climate policy obstruction by these trade associations, where it exists: Provides insight into whether the company indicates awareness of the trade association’s oppositional track record on climate policies and is distinguishing itself from those positions.

c The company disclosed activities through which it seeks to evolve the positions of these trade associations toward Paris-aligned climate lobbying: Provides insight into whether the company has engaged with its trade associations on their climate change positions and activities to align with climate science.

Print

Print