Mike S. Kesner is a Partner at Pay Governance LLC. This post is based on his Pay Governance memorandum. Related research from the Program on Corporate Governance includes Insider Trading via the Corporation (discussed on the Forum here) by Jesse M. Fried.

Summary of Key Provisions

On December 14, 2022, the Securities and Exchange Commission (SEC) released the final Rule 10b5-1 requirements for preplanned trading plans for officers, other insiders, directors, and companies to qualify for the “affirmative defense” rule for such plans (i.e., the stock transaction was not entered into based on material nonpublic information).

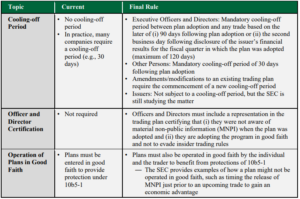

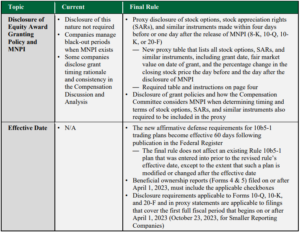

The table below summarizes the impact on 10b5-1 plans and the related disclosure requirements.

SEC Rule 10b5-1 Implications and Considerations

Executives and directors who wish to avail themselves of the affirmative defense afforded trading plans under Rule 10b5-1 may need to consider whether to adopt such a plan prior to the effective date of the revised rule (60 days after the final rule is published in the Federal Register) as it would be subject to fewer restrictions and the new disclosure requirements.

Companies and their advisers may also want to revisit their policies regarding the use of 10b5-1 compliant trading plans to buy and sell company stock. Several companies encourage, but do not require, the use of 10b5-1 plans while other companies require they be used or do not have a formal policy. Given the additional restrictions to qualify, some companies may be reluctant to require the use of such plans.

It is also advisable that companies establish rigorous internal controls for collecting and reporting the adoption, modification, and cancellation of both qualified 10b5-1 and non-qualified pre-established trading plans, as both types of arrangements are subject to quarterly reporting requirements.

Finally, compensation committees will need to discuss and approve a policy regarding the granting of stock options (and other forms of equity compensation) when they are in possession of MNPI, as the policy must be disclosed in the company’s proxy.

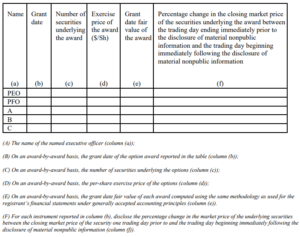

Stock Option Grant Table

As noted above, the following table is triggered by stock options, SARs, or similar instruments granted four days before or one day after the release of MNPI.

Print

Print