Shaun Bisman is a Partner and Jared Sorhaindo is an Associate at Compensation Advisory Partners. This post is based on their CAP memorandum. Related research from the Program on Corporate Governance includes Paying for long-term performance (discussed on the Forum here) by Lucian Bebchuk and Jesse M. Fried; and Rationalizing the Dodd-Frank (discussed on the Forum here) by Jesse M. Fried.

ISS recently issued Frequently Asked Questions (FAQs) documents related to equity compensation plans, the peer group selection methodology and issuer submission process, and compensation policies. The equity compensation plan FAQs cover topics under the rubric of ISS’ Equity Plan Scorecard (EPSC) and the compensation policies FAQs cover compensation topics more broadly. This update highlights select new and materially updated questions.

Equity Compensation Plans FAQs

Burn Rate

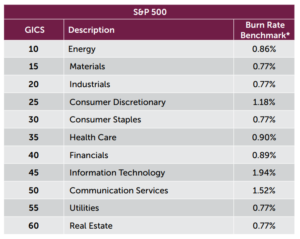

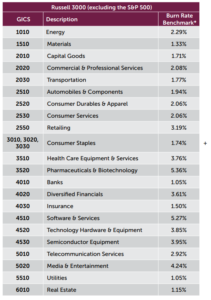

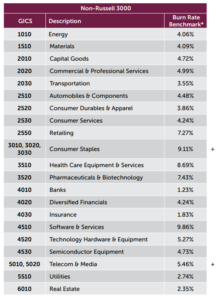

As discussed in our previous CAP Alert, “ISS Publishes Proxy Voting Guidelines Updates for 2023,” dated December 6, 2022, ISS changed its calculation of burn rate and now calls it the Value-Adjusted Burn Rate (VABR), which will go into effect for meetings on or after February 1, 2023. A company’s 3-year average adjusted burn rate as a percentage of weighted average common shares outstanding, as compared to a benchmark, is a scored factor in certain models of the Equity Plan Scorecard. The VABR benchmarks are broken out by the company’s two-digit GICS group (S&P 500) and four-digit GICS group (Russell 3000, excluding the S&P 500, and Non-Russell 3000). ISS also established a de minimis benchmark threshold separately for each of these three groupings. The VABR benchmarks and de minimis thresholds can be found in the Appendix of the FAQs and are also presented below this article.

Changes in Index Membership or GICS Classification

If a company’s index membership or GICS classification has changed in the past three years, ISS will use the newer classification. Any changes that occur after the relevant quarterly data download will generally not change the EPSC model that is applied to the company.

S&P Dow Jones Indices and MSCI Inc. have announced certain revisions to GICS groupings that will take effect in March 2023. These changes will be reflected in ISS analyses following the June 1, 2023 quarterly data download, i.e., it will be in effect for companies with meetings on or after September 1, 2023.

Changes to ISS’ EPSC

ISS has changed the passing thresholds under the EPSC. Effective for companies with meetings on or after February 1, 2023, the threshold passing scores will be increased from 57 to 59 for S&P 500 companies, from 55 to 57 for Russell 3000 companies (excluding the S&P 500), and from 53 to 55 for ISS’ Non-Russell 3000 Model. The threshold passing score is 53 for all other models.

Scoring and Weighting of EPSC Factors

ISS clarifies that not all factors under the EPSC are weighted equally. Each factor is assigned a maximum number of points, which may vary depending on the applicable model. Most factors are binary, but some are not: they may result in partial or negative points on the EPSC. The only factor change for the 2023 policy year pertains to the burn rate factor or VABR calculation.

ISS’ Evaluation of Clawback Policy for EPSC Purposes

ISS explains that to receive credit on the EPSC, a company’s clawback policy should authorize recoupment upon a financial restatement and cover all or most equity-based compensation for all Named Executive Officers. This includes both time- and performance-based equity awards. Simply adhering to the minimum rules of the SEC’s finalized rules will not receive points on the EPSC “because the final rules generally exempt time-vesting equity from compensation that must be covered by the policy.”

Peer Group FAQs

Publicly Disclose Updated Peer Group Information for ISS

New for 2023, ISS encourages issuers to disclose in the proxy the stock ticker for each peer alongside the peer company name to provide for greater certainty that ISS and investors are considering the correct peers. In another update, ISS explains that if there is a significant unexplained discrepancy between peers submitted to ISS and those disclosed in the proxy, ISS may remove a company from a future peer submission process.

Compensation Policies FAQs

Pay for Performance Screens

The quantitative pay for performance screens remain unchanged, but there are updates to the methodology used for the Financial Performance Assessment (FPA) measure as well as the “Eligible for FPA Adjustments” thresholds. Previously, the FPA only impacted the overall concern level for companies that were a Medium concern on any of the primary quantitative pay for performance screens (Relative Degree of Alignment, Multiple of Median, Pay-TSR Alignment) or that were a Low concern but bordering on Medium concern. Beginning with February 1, 2023 shareholder meetings, certain High concern companies with strong FPA performance may become Medium concern companies and some Medium concern companies with poor FPA performance may become High concerns. Specific details will be covered in ISS’ Pay-for-Performance Mechanics white paper, which will be published in January.

Factors ISS Considers in Qualitative Review of Pay for Performance Analysis

ISS added to its list of factors that it considers in its qualitative pay for performance assessment. These new factors include clear disclosure in the proxy of any adjustments made for incentive plan purposes to any financial/operational results, both absolute and relative to peers, and recent pay program changes and/or any forward-looking commitments. New for 2023, ISS emphasizes that the disclosures concerning compensation should be made in the company’s proxy as shareholders “should not be expected to comb through other separate filings to find key information around executive compensation decisions. Accordingly, information that is not fully disclosed in the proxy statement may not receive mitigating weight in ISS’ pay-for-performance analysis.”

ISS’ Evaluation of CEO Transition Pay, Including Inducement and/or Make-Whole Awards

It is generally understood, expected, and accepted that an incoming executive will receive temporarily increased pay in the form of inducement awards and/or make-whole awards. ISS expects the pay level to normalize after the CEO transition. Inducement awards should be predominantly performance-based and have guardrails such as limitations on award vesting in the event of a termination. The company should disclose how it determined the size and structure of the award. For make-whole awards, companies should disclose that the new grant is economically equivalent to forfeited pay and disclose information regarding termination terms. Companies should clarify the amounts that relate to inducement awards and the amount that relate to make-whole awards.

ISS generally does not expect performance criteria to be attached to make-whole awards, but companies must clearly disclose the portion of awards that are attributable to inducement/sign-on awards vs. those that are strictly make-whole awards.

ISS’ Evaluation of Modifier Metrics

Companies should clearly disclose the magnitude of modifiers’ impact on payouts, as well as the modifiers’ goals and achieved performance level. ISS may take a negative view of modifiers that significantly increase a payout; if a company does not disclose the percentage by which a payout can be increased by a modifier; and if modifier metrics contribute to an overemphasis of committee discretion within the pay program.

Overly Complex Programs

ISS may raise concern if it views a program as “overly complex”, as this can make pay programs opaque to investors. Examples of overly complex programs include “a disproportionately large number of metrics, modifiers, and/or award vehicles, complicated vesting or award determination formulas, or convoluted pay program disclosure without clear and compelling rationale.” ISS may raise concerns when a pay program contains overly complex features, particularly when a quantitative pay-for-performance misalignment is identified.

Problematic Pay Practices

As discussed in our previous CAP Alert, if a severance payment is made when a termination is not clearly disclosed as involuntary, ISS will consider this to be a problematic pay practice that may result in an adverse vote recommendation.

ISS Considerations of Disclosures Required by SEC’s Pay-Versus-Performance Rule

ISS research reports will display certain elements of the company’s pay-versus-performance table (required by the SEC’s new finalized rule), including the Summary Compensation Table total compensation for the CEO, the Compensation Actually Paid value, the company’s TSR, the peer group’s TSR, the company’s most important financial metric, and the other disclosed important metrics used in determining CEO pay. The new information will not be included in ISS’ quantitative screen. The disclosure may be considered in the qualitative review but is “not expected to replace investors’ prior disclosure expectations around incentive pay.”

COVID-Related Pay Decisions

Companies are expected to revert to pre-pandemic decision-making and incentive program structures. Any shifts in annual incentive metrics, targets, and/or measurements or programs that are heavily discretionary will be viewed negatively. Changes to in-flight awards’ cycles, or shifts to predominantly time-vesting vehicles or shorter periods, will also be viewed negatively. ISS’ expectations concerning one-time awards and responsiveness to a low say on pay vote result will be the same as in pre-pandemic years. Any COVID-related pay changes or decisions should be clearly disclosed as such.

CARES Act

Some companies that received financial assistance from the federal government under the Coronavirus Aid, Relief and Economic Security (CARES) Act are subject to caps on executive compensation. ISS will negatively view any one-time awards or significant increases in pay intended to offset or replace forgone compensation due to the aforementioned pay cap.

2023 Value-Adjusted Burn Rate Benchmarks by Segment

*A de minimis threshold of 0.77% was established for the S&P 500 index.

* A de minimis threshold of 1.05% was established for the Russell 3000 index less the S&P 500.

+ Benchmark based on all companies in the 2-digit GICS due to insufficient number of companies to analyze within the 4-digit GICS.

* A de minimis threshold of 1.23% was established for the non-Russell 3000 index.

+ Benchmark based on all companies in the 2-digit GICS due to insufficient number of companies to analyze within the 4-digit GICS.

Print

Print