Ethan Klingsberg and Pamela Marcogliese are Partners, and Elizabeth Bieber is Counsel at Freshfields Bruckhaus Deringer LLP. This post is based on a Freshfields memorandum by Mr. Klingsberg, Ms. Marcogliese, Ms. Bieber and George Ter-Gevondian and is part of the Delaware law series; links to other posts in the series are available here. Related research from the Program on Corporate Governance includes Monetary Liability for Breach of Duty of Care? (discussed on the Forum here) by Holger Spamann.

Toward the end of last summer, the Delaware General Corporation Law (DGCL) was amended to permit companies to exculpate officers for breaches of their duty of care. This amendment permits officers to benefit from Section 102(b)(7) of the DGCL, in most instances, in the same way that this valuable section has long insulated directors from liability for actions taken in good faith. However, the catch is that this new right of officers to exculpation will take effect if, and only if, the charter of the company in question provides explicitly for this right. This means a charter amendment and, therefore, a shareholder vote will be required.

Approximately six months following the amendment of Section 102(b)(7), we have not changed our view: we believe the benefits of exculpation are significant and, at most companies, worth the costs of pursuing shareholder approval of a charter amendment. The market data from companies with off-cycle meetings within the last six months supports this view.

As a practical matter, extending exculpation to officers has the potential to reduce both the volume and scope of lawsuits alleging breaches of fiduciary duties by officers. This, in turn, reduces the indemnification burden on companies since such lawsuits are now more likely to be resolved earlier in the progression of the lawsuit (on a motion to dismiss, for example) or at lower cost of settlement. As a result, companies may see reduced D&O insurance premiums. Companies may also experience less quantifiable benefits, such as avoiding or truncating negative press cycles attendant to such lawsuits. However, companies should be aware that extending exculpation to officers will not insulate these officers from derivative lawsuits (i.e., a lawsuit by the board, on behalf of the corporation) against officers.

How Are the Votes Faring?

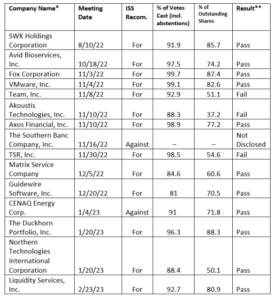

Between August 10, 2022 and February 23, 2023, 15 companies have held votes to amend their charters to update the exculpation provision to include officers. The voting results and ISS recommendation for each are below.

*Source: ISS

** Voting standard for each vote was based on percentage of the shares outstanding, except for Guidewire Software, which measured votes cast.

Proxy advisory firm support: Of the 15 companies, ISS recommended FOR the proposals at all companies except for two companies. Both of the AGAINST recommendations involved unusual facts. The first of these two companies did not release a proxy statement (or disclose results) and ISS recommended against all proposals on the ballot. The other was holding a meeting to vote on its de-SPAC transaction, which ISS opposed along with every other proposal on the agenda for the meeting. For the remaining 13 companies, ISS recommended FOR the exculpation amendment proposal each time. This group that garnered ISS endorsements for their exculpation amendment proposals included companies with less than perfect records on governance and even some where ISS was recommending against the company’s director nominees and/or say-on-pay proposals.

ISS notes in its voting guidelines, which it finalized in late November 2022, that it will recommend votes on a case-by-case basis on proposals for officer exculpation, taking into account the stated rationale for the vote. This final policy represents a change from the proposed proxy voting guidelines initially published in early November 2022, where ISS proposed having a policy generally to recommend a vote for the proposals. ISS’ policy change reflects input from investors between the proposed and final guidelines. But practically speaking, absent other very significant issues unrelated to the proposal, ISS’s practice to date indicates that the proxy advisory firm will be supportive of officer exculpation proposals.

Glass Lewis’s voting recommendations are less accessible, but its proxy voting guidelines provide that they will make a recommendation on these proposals on a case-by-case basis (Glass Lewis states that the firm expects to recommend against these proposals unless there is a compelling rationale and the provision is reasonable). Given the high level of support to date, it does not appear that Glass Lewis recommendations against such proposals, if any, have had a significant negative impact on these votes.

Pass or Fail? Three of the 14 disclosed votes failed, when measured using the required voting standard set forth in the company’s charter – a percentage of outstanding shares. However, two of these votes received majority support as a percentage of outstanding shares but nonetheless failed because the charter required a supermajority of the outstanding shares to pass. However, votes as a percentage of outstanding shares do not capture true voting sentiment, as many companies have a significant number of shareholders that do not vote. To determine how popular the proposals are with voting shareholders, we have reviewed the voting results as a percentage of votes cast, including abstentions. Under this threshold, every vote received supermajority support, with the lowest support at 81% of the votes cast, and 10 of the 14 disclosed votes receiving support of greater than 90% of the votes cast.

Future votes: An additional seven companies have filed definitive proxy statements that include upcoming votes to amend their charters to provide for officer exculpation. ISS has already released its recommendations for six of these companies. Four of the six received FOR recommendations, while two received AGAINST recommendations. One AGAINST recommendation was in connection with approval of a de-SPAC transaction, which is consistent with its recommendations on this proposal in de-SPAC contexts (as described above) and the other was at a company where all of the directors up for election received withhold recommendations. However, consistent with its prior practices noted above, for one of the upcoming votes, ISS made a FOR recommendation despite recommending withhold votes for five directors for unrelated reasons, including members of the compensation committee and the chair of the governance committee. We expect that many more proposals for exculpation will occur in this proxy season and receive ISS support.

Institutional investors: Institutional investors have not waded into policymaking on the subject, but the high levels of support for the votes suggest that there is significant institutional support for these proposals.

Considerations for Companies Evaluating Charter Amendments

Procedural point: As companies plan for their proxy filings, companies that seek votes on charter amendments should remember that the inclusion of a vote on a charter amendment will trigger the need for a preliminary proxy filing. As a result, companies will need to adjust their internal proxy timelines to accommodate the earlier filing requirement.

Supermajority provisions: As noted above, vote failures tended to occur at companies that had supermajority requirements to amend the relevant charter provisions. Companies with supermajority provisions should review past voting records to determine whether the average voting turnout would be sufficient to pass the charter amendment. If historical records do not favor passage, consider early season discussions with the company’s proxy solicitor and counsel about shareholder engagement and disclosure considerations that would improve supportive turn-out.

Litigation: Two companies, Snap, which adopted the charter amendment by written consent, and Fox, which held a vote, have been sued in Delaware Chancery Court in connection with the vote to amend their charter to allow for officer exculpation. These companies have capital structures that include “no vote” shares and held votes that did not provide an opportunity for the “no vote” shares to vote. Plaintiffs claim that Section 242(b)(2) of the DGCL requires separate class votes on charter amendments that adversely affect the powers or rights of stockholders of a class and that therefore a separate class vote of the “no vote” shares was required to approve these charter amendments that limit the claims that stockholders may assert against officers. The claims against Snap and Fox are aggressive because there is no disproportionate treatment of any class or series of shares that arises from an exculpation amendment. Given the dearth of Section 242(b)(2) case law, these two cases are worth watching by all companies with dual or multi-class capital structures. Plaintiffs have now moved for summary judgment in each of the cases and briefing is ongoing.

Takeaways

With the number of lawsuits against directors and officers increasing, there is a significant benefit to seeking to provide the same legal protections to officers as provided to directors under the charter, particularly for the CEO as a dual officer and director. Early voting patterns are favorable, with shareholders overwhelmingly supporting the proposals and proxy advisory firms generally supportive of these proposals. As a result, we continue to recommend that Delaware corporations, particularly those with only one class and series of stock, seek a vote to amend their charter at their next annual meeting to provide for officer exculpation.

Print

Print