Pietro Bonetti is an Assistant Professor of Accounting and Control at IESE Business School, Christian Leuz is the Charles F. Pohl Distinguished Service Professor of Accounting and Finance at the University of Chicago, and Giovanna Michelon is a Professor of Accounting at the University of Bristol. This post is based on their recent paper.

Disclosure mandates is becoming more popular as a key policy tool to regulate environmental externalities and wider corporate impacts. In the US, the Dodd-Frank Act introduced (among others) disclosure requirements on so-called conflict minerals and mine-safety. More recently, the SEC has proposed a rule requiring companies to report climate related disclosures in their filings. In Europe, the mandatory disclosure of material social and environmental issues has been introduced by the Directive 2014/95/EU (Non-Financial Reporting Directive) for all companies listed on regulated EU markets. The Corporate Sustainability Reporting Directive envisages the adoption of sustainability reporting standards that the European Financial Reporting Advisory Group is currently drafting.

Although targeting corporate environmental impacts with disclosure is not a novel policy tool, (e.g., U.S. 1986 Emergency Planning and Community Right-to-Know Act), we still have relatively little evidence on whether mandated disclosure works for behaviors with dispersed negative externalities as well as how it produces the intended effects.

In our paper, we exploit the staggered implementation of a disclosure mandate to investigate the effectiveness of targeted transparency in addressing environmental externalities and the role that public pressure, spurred by disclosure regulation, plays in driving the changes in firm behavior. Our study examines the role of disclosure mandates in the context of unconventional oil and gas (O&G) development, which combines horizontal drilling with hydraulic fracturing (HF) to extract shale gas and tight oil in deep formations. HF is a highly controversial practice. Although HF has dramatically increased U.S. energy production and lowered energy prices for consumers, it has also triggered several concerns about the use of potentially highly toxic chemicals in the HF fluids, and the related production of large amounts of wastewaters, with negative implications for water quality. Recent evidence finds such surface water impact.

Absent a federal regulation, starting around 2010 many U.S. states have introduced mandatory disclosure rules for newly fractured wells. The rules require HF operators to disclose details on their drilling activity and the chemical composition of the HF fluids. Many voiced skepticism that the disclosure rules would make HF safer or reduce its environmental impacts, especially considering the trade secret exemptions provided by most states to the HF operators and the lack of penalties for non- or misreporting. Others, however, pointed to the potential benefits of these disclosure rules, suggesting that these rules could increase public pressure on operators.

Our analysis assesses the effects of this major regulatory change for HF operators with respect to drilling activity and surface water quality. Our sample comprises a large geo-coded database of 154,324 HF wells from 16 states and 325,351 surface water-quality observations from 2,209 watersheds with and without HF activity. Watersheds are homogenous geologic areas that drain or shed surface water into a specific waterbody. There are roughly 22,000 watersheds in the U.S. The sample spans 14 years (2006-2019). Our water quality analysis focuses on the concentrations of four ions: bromide (Br¯), chloride (Cl¯), barium (Ba) and strontium (Sr). These four ions are a likely mode of detection if and when surface water impact exists (Vidic et al., 2013, Brantley et al., 2014).

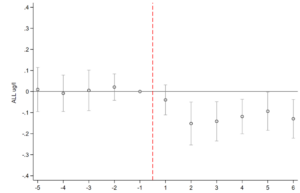

We find that watersheds with HF activity in the pre-disclosure period exhibit a significant reduction in surface water impact after the state disclosure mandates become effective (Figure 1). Our estimates imply meaningful declines in ion concentration levels relative to their baselines, ranging from 4.4 percent for Sr to 17.8 percent for Cl¯.

Figure 1 – Temporal Analysis

Figure 1 shows OLS coefficients, together with the respective 90% confidence interval, estimating the annual impact of the state disclosure mandates on ion concentrations in watersheds with HF activity relative to changes in ion concentrations in watersheds without HF activity in the pre-disclosure period. Year 1 comprises all water measurements that take place within the first 365 days from the state-specific entry-into-force date. Year -1 comprises measurements in the 365 days before the entry-into-force date. So we are counting from mandate in either direction. The coefficient for the year before the disclosure mandate is omitted from the regression and therefore serves as benchmark. The figure plots coefficients from the model in Column 12 in Table 3 in the paper.

We further investigate whether the documented improvements in water quality come from less HF drilling activity or changes in drilling practices and technology that reduce the per-well impact on water quality. We find that HF well entry-rate declines by roughly 5 percent relatively to conventional well entry-rate. The extensive margin contributes to about 14% of the overall decrease in water pollution in the post-disclosure period.

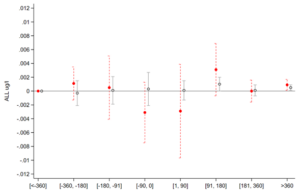

We also document substantial changes in HF operators’ practices along the intensive margin. First, after the disclosure mandates came into force, the per-well impacts on water quality decrease. Moreover, the per-well water impact drops substantially especially in the window between 91 and 180 days after well spudding, further suggesting a substantial change in operator practices (Figure 2). Second, O&G production per unit of water pollution increases after the disclosure mandates. Third, there is a decrease in the use of hazardous chemicals and chloride-related chemicals in HF fluids after the disclosure mandate. Fourth, the number of HF-related incidents, especially those related to the handling of wastewater and fracking pits, declines.

Figure 2 – Per-Well Impact Before and After Disclosure Regulation

Days relative to well spud date

Figure 2 plots OLS coefficients, together with the respective 95% confidence interval, for separate HF well counts calculated over fixed time intervals around the well spud dates for the pre- and post-disclosure period, respectively. The red (gray) dots mark the estimated coefficients for HF wells spudded in the pre-disclosure (post-disclosure) period. The figure plots coefficients from the model in Column 5 in Table 7 in the paper.

We also explore how targeted transparency operates. One likely channel for disclosure mandates to be effective is enabling social movements, environmental groups, local communities, and the media to exert public pressure on HF operators. For instance, social movements can shame operators for their use of toxic chemicals. Alternatively, knowing the composition of the HF fluids could allow NGOs, watershed groups or regulators to tie back contamination to a particular well. So, spills would become much more costly for operators. Consistent with these ideas, improvements in water quality after the disclosure mandate are greater in counties where public pressure is higher, as proxied by high presence of local environmental NGOs and with more local newspapers. Public pressure (i.e., media coverage and internet searches) intensifies after the disclosure mandates, and the improvements in water quality are more pronounced in counties with more news articles on HF and water pollution, and in states with more Google searches for HF after the disclosure mandate. We also document that water quality improves in those areas where there is a larger fraction of wells held by publicly listed firms, which –we argue– are likely facing more public scrutiny than private operators.

All these results underscore that disclosure mandates can effectively reduce water impacts associated with HF via public pressure. More generally, these results are important in that they show that disclosure regulation can have a meaningful impact on corporate activities with dispersed externalities such as water pollution or carbon emissions, especially it leads to public scrutiny and attention.

Download the complete paper here.

Print

Print