Maria Castañón Moats is Leader, Paul DeNicola is Principal, and Matt DiGuiseppe is Managing Director at the Governance Insights Center at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

Using transparency to build trust

Trust is earned by saying what we will do, sharing why, and delivering what we said we would—transparently. When things don’t work as expected (and every so often, they won’t), we explain and try again. This is certainly true for building trust with the stakeholders of a corporation. However, the information asymmetry that exists between management, the board, and shareholders is unlike any other in business. And often competitive, legal, confidentiality, and other concerns mean that the board cannot be as transparent as it would like. This makes establishing trust between the board and its key stakeholders a challenge.

The challenge is not insurmountable. At its core, corporate governance is putting in place the structures that will allow for effective decision making so that stakeholders can trust the oversight process even if they can’t observe it. For many years, the prescribed disclosures regarding a company’s practices and procedures were sufficient to establish trust. However, that trust appears to be eroding at a time when the board’s mandate is expanding, and the quality of board oversight is receiving additional attention.

Recognizing this development, boards should lean into opportunities to provide more windows into the boardroom for all stakeholders, such as:

- Leveraging the proxy statement, the company’s website, and other forums to create more transparency with employees, customers, regulators, and of course shareholders.

- Engaging with stakeholders, when appropriate, to gain direct feedback to inform their decision making.

- Finding opportunities, like the annual board assessment, to share the impact of governance processes to demonstrate that they work and are not static.

Why is trust important?

By enhancing trust, corporations and their boards create positive stakeholder dynamics that enhance enterprise value. On the other side, however, if the company and board lose stakeholder trust, they likely lose employees, customers, and the benefit of the doubt of other critical stakeholders, like regulators.

However, there is a trust deficit in American society. Americans have lost a large measure of trust in institutions they once greatly respected—non-governmental institutions, media, government, and corporations to some extent. Although corporations suffer from this loss of trust, they continue to be trusted more than other institutions.

The fact that corporations are more trusted relative to other institutions presents them with an opportunity to do the work needed to reinforce and enhance trust. Many people believe that corporations have an affirmative responsibility to take actions needed to further increase trust levels.

What can investor voting tell us about trust in the board?

Historically, directors did not need to worry much about retaining their board seats. Once recruited to a board, long-tenured and unchallenged service was the norm. That is no longer the case.

Investor votes “For” and “Against” directors are a key indicator of investor trust. They indicate that investor trust in the board is declining. Notably, in the past five years:

- Overall support for director elections in the Russell 3000 has fallen.

- The percentage of directors receiving qualified support (below 95%) has increased from 22% to 30%.

- The percentage of director nominees failing to receive majority support (or more Against than For votes, a plurality) has increased slightly.

The decline in support can be attributed in part to a combination of investor voting guidelines that have more reasons to withhold support from directors and an increase in the frequency of “vote no” campaigns. Together, these factors point to the emergence of a “trust but verify” mentality among investors. Common reasons for voting against directors include lack of board diversity, oversight failures, poor climate risk management disclosure, failed engagement activities, executive compensation issues, and overboarding.

Additionally, with the advent of new SEC rules requiring the use of a “universal” proxy card in contested director elections, activist nominees will appear on the same ballot as individuals nominated by the company. Investors will be able to select their preferred nominees from the full nominee list rather than being forced to pick the full company or the activist slate. This change will markedly reduce the initial cost of putting forward alternatives to company nominees, making it easier for activists who have lost trust in a director or board to put forward their alternative nominees.

What does the data tell us about trust among management, the board, and shareholders?

Based on several recent surveys conducted by PwC, the trust deficit extends beyond shareholders to management and even the directors themselves.

The board should consider these activities and oversight areas in its effort to enhance trust with both management and investors.

Do boards know and have what it takes to increase trust?

Our research suggests that directors believe they can enhance stakeholder trust through enhanced transparency and accountability with shareholders.

These responses suggest that directors are primarily focused on building trust with shareholders. Directors seem less convinced that boards can have an impact with other stakeholders.

By emphasizing investor trust over trust from other stakeholders, directors may be missing an opportunity to leverage the invaluable contribution that multi-stakeholder trust can make to enterprise success over the long term. Creating that success and capturing that value requires building trust with

employees, recruits, suppliers and vendors, customers, and a public that needs to grant the social license to operate.

How can boards enhance trust beyond investors?

Most companies and directors accept and acknowledge that investor trust matters. They have officers and resources devoted to the company’s investor relations function and investor outreach. Those activities are a critical element of building the trust needed to effectively compete for capital—both equity and debt.

But companies and directors are also competing for the hearts and minds of other stakeholders. Identifying key stakeholders, evaluating the relationships, and undertaking activities to build those relationships may take time and resources, but can be an investment in growth and increased future stability—just as an investor relations function does with investors.

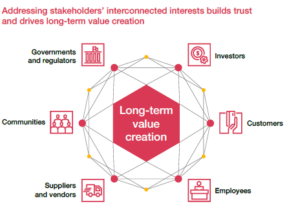

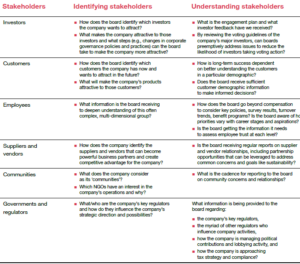

To build and maintain trust with varied stakeholders, boards must be intentional. The first step is a framework to identify, understand, prioritize, and address the sometimes-competing interests of its varied stakeholders. In The board’s role: building trust in a multi-stakeholder world, PwC identified several key stakeholders: investors, customers, employees, suppliers and vendors, governments and regulators, and communities—including NGOs.

Boards should delve into the composition of each stakeholder group and what makes each unique to the company. A key first step is assessing what information management and consultants are providing to the board about those stakeholders. Once identified, the work continues to understand the company’s varied stakeholders. This effort should not be underestimated.

57% of executives think their boards do not understand the concerns of other key stakeholders, suggesting that serious remedial work in this regard is required.

Director interactions with shareholders, employees, customers, and other key stakeholders are additional opportunities to learn about stakeholder interests, aspirations, and concerns—as well as to build trust. As always, active listening during engagement produces the greatest learning for both parties.

Enhancing trust with varied stakeholders

Enhancing trust with varied stakeholders

Prioritizing: Companies cannot be all things to all people. They must define their purpose and values, and then decide where they will focus their efforts to align with their purpose and values. A key part of building a different and better relationship with varied stakeholders is mapping out the qualitative and quantitative ways that stakeholder trust enhances a company’s long-term value. Some key steps to consider include:

- Strategic values matrix: Defining the values-driven priorities that the company will act on by engaging with stakeholders and assessing how aligning with stakeholder values can enhance long-term economic success

- Execution strategy: Integrating those values-driven priorities in the long-term strategy by setting long-term goals, interim milestones,

and incentives - Internal reporting structures: Building the necessary internal structures to communicate the values, goals, and milestones through the organization, and accurately tracking and reporting on progress

- Strategic narrative: Creating a concise narrative that brings together these processes and provides the board and executive leadership with the right information in the right form to assessw hether these trust-building measures are accretive to long-term value

Particularly as it relates to social and political issues—and even internal events and issues that come to the fore—the company should identify the issues that align with the company’s purpose, values, and business, and then consider the role of the company and the board in responding to or commenting on these issues or events. Conducting that preparedness exercise enables a quick but appropriate response to an important event. This may avoid reactively taking a “side” on a fraught issue on which many of the company’s stakeholders are likely to hold different views.

Identifying opportunities for boards to increase trust

What are proxy voting results telling the board?

- The number of ESG-related proposals submitted was stable from 2018-2021, but then it almost doubled from 2021 to 2022, including both more prescriptive ESG proposals and more effectively-worded anti-ESG proposals. ESG is an area of oversight that the board cannot ignore.

- Support for shareholder proposals fell for the first time in years. However, there were pockets of strong support in the areas of climate and human capital. Those deserve board and management attention and action plans to address them.

- Support for “say on pay” continued to fall, as investors appear to be taking a more critical posture. Focusing on the link between compensation and strategy can provide additional clarity.

- Overall support for director elections declined—a trend that has continued for several years—while activism is evolving and likely to increase further with the advent of the universal proxy card. Investors have pointed to expanded board bios as an effective tool for building confidence in the directors they

are electing.

Enhance disclosure. Enhance trust.

In a multi-stakeholder environment, expectations regarding transparency and disclosure are increasing and multi-dimensional. Varied stakeholders are looking for new, additional, and more nuanced information about boards and companies. For example: Who are the board members? What are board and company policies? What processes does the board use to manage its work and assess its effectiveness? Stakeholders are looking for information that adds dimension to the required disclosures.

The proxy statement is no longer merely a compliance document—it is very much a communications tool and can be a one-stop trust-building document. It is a major opportunity to build trust with the company’s varied stakeholders, and companies are considering enhancements to get ahead of the new universal proxy rules. For this reason, the company’s proxy statement should tell the board and company’s story—how and why it works.

What are stakeholders looking for in today’s proxy statements?

- Board self-assessment processes and the resulting actions taken. Being transparent about the board’s “ways of working,” self-assessments, and follow-up actions can provide stakeholders with valuable insights into how the board thinks about and conducts its work. Including a brief description of how agendas are set can be very enlightening. In addition, annual board and committee self-assessments often review how responsibilities are allocated among the board and its committees, resulting in an update of committee charters or structure to address new and evolving responsibilities. There can be much in a name change and/or charter changes—if there is also follow-through reflecting the updated scope of responsibilities.

- More comprehensive and nuanced board composition data. Expand on the traditional skills matrix and explain how the skills captured in the matrix relate to the company’s business and strategy. It’s no longer sufficient to indicate which skills; the proxy statement needs to say why those skills are important.

- Expanded director biographies. These support claims in the skills matrix and give stakeholders a better sense of the nominees and how they acquired the skills and experience the board is relying on in making nomination/renomination decisions.

- Board’s response to votes on shareholder proposals, say on pay, or nominees the prior year, and what it learned from investor engagements. For example, consider providing a summary of common themes that were heard that led to boardroom discussion and action.

- The board’s commitment to transparency and disclosure. Including language about how the board operationalizes transparency and accountability (e.g., publishing an annual voluntary report of political contributions policy).

These enhanced disclosures go well beyond disclosure required by state law and the SEC, but they would make the case to investors that directors warrant re-election (or election).

What are stakeholders looking for on your company’s website?

The proxy statement is not the company’s only communication vehicle. The company’s website can be a powerful tool for timely and substantive communication with varied stakeholders—as often it is the first source of information about a company and its board.

Some things to consider for your website include:

- Videos or video transcripts with the board chair and committee chairs – Talking about their role or an area of focus, for example, is something that boards can do to promote transparency and create a more personal connection with stakeholders.

- Accurate and credible ESG disclosure – With the continuing interest in information about companies’ environmental and social disclosures and proposed requirements from the SEC and global standard setters and regulators, the need for companies to ensure that their ESG disclosure is both accurate and credible is essential. So-called “greenwashing” can quickly destroy trust.

- Accessibility to the board – Showing how the board and company approach engagement with key stakeholders can enhance trust. If the board has a policy about meeting with investors and other stakeholders, post it on the website and summarize it in the proxy statement. This can help set reasonable expectations

Incorporating a company’s varied stakeholders into board actions

Stakeholders want to place their trust in companies that incorporate stakeholders into planning for the company’s future. They see value in actions the board takes to do so. Incorporating stakeholder considerations into decision making and disclosing in the proxy statement how the board is doing that can be a powerful trust builder.

Incorporating stakeholder focus into leadership decisions

Forty-seven percent (47%) of executives say trust is more bottom-up than top-down, built from customers, employees, and other stakeholders rather than senior leadership. Yet, only 27% of customers and 35% of employees say the same, indicating that they are looking to the C-suite to lead more on trust. This data suggests that boards, when evaluating current company leadership and when selecting and developing future leaders, should look for individuals who understand and address employee and customer (as well as other stakeholder) trust expectations.

Incorporating stakeholder focus into strategy

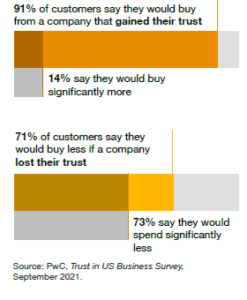

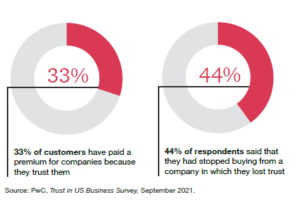

Trust is fundamental to value creation—making trust a strategic advantage. For this reason, it behooves boards to take varied stakeholders’ trust into account when setting the company’s long-term strategy. For example, customers are a key stakeholder group that companies and boards should focus on. Recent studies show customer trust-building can directly impact your bottom line. Refer to the appendix for a more detailed example.

What can boards do now?

A few suggestions to take with you into the boardroom.

- Reinforce in board and committee discussions that stakeholder trust is important to the company’s long-term success, and, therefore, important to the board. Communicate to management the rationale for elevating “trust building” as a corporate imperative.

- Seek advice of counsel to ensure that the board understands any limitations (under applicable state law) of prioritizing the building of long-term stakeholder trust. In other words, do certain board decisions taken to enhance stakeholder trust and returns over the long term negatively impact the company’s short-term share or results?

- Press management to work with the board to identify meaningful actions and metrics based on the company’s purpose, values, industry, and circumstances.

- Consider what investments in “trust building” are needed. Discuss how those investments are incorporated into annual operating plans. For example, have funds and resources been designated for supplier workplace condition audits by third parties? Workforce compensation equity studies? Sustainability initiatives?

- Ask management how they factor the company’s various stakeholders into the decision-making process—both in terms of consistency with company values and long-term value creation for the company. Request enhanced information on stakeholder trust in reports and discussions.

- When appropriate, incorporate those actions and metrics into executive evaluations and compensation decisions. Discuss those actions and metrics in the company’s Compensation Discussion and Analysis.

- Don’t think of “trust building” as a standalone agenda topic. Rather, incorporate questions regarding trust into board and committee discussions on strategy, marketing, workplace safety, risk management, supply chain, talent development, and management selection.

- Enhance shareholder engagement and enhance transparency into what is happening in the boardroom.

- Consider what changes can be made to make the proxy statement a more effective vehicle for communicating the board’s trust-building actions. In particular, consider what additional information can be included in the proxy statement to assist investors in their assessment of nominees.

Appendix

Incorporating stakeholder focus intostrategy – Example: Customers

When asked what leads customers to trust a company, customers most frequently mention: 1) quality and products at a fair price, and 2) fair treatment of employees. While those two priorities have remained the focus of customers, how customers assess product quality and fair treatment of

employees has evolved.

Today, customer perceptions of “quality” often include end-to-end sustainability from raw materials, through production to use to reuse/disposal. Increasingly, customers do not consider products that abuse the environment (or the people who make them) to be quality products.

In general, boards should understand what affects long-term enterprise success and have a long-term time horizon for achieving that success. This imperative may be mismatched with that of CEOs and management who take a shorter-term view. This disconnect can create friction in addressing a relatively long-term topic such as ESG. One way for companies to alleviate this friction is by better linking long-term compensation to long-term strategy, and by disclosing how the company sets and measures short-term incentive compensation, including ESG goals.

Print

Print