Patrick Bolton is a Professor Economics and Finance, Mirabelle Muûls is an Assistant Professor in Economics at Imperial College London, and Adrian Lam is an Assistant Professor of Finance at the University of Amsterdam. This post is based on their paper.

The start of 2023 has seen prices of permits on the European Union’s carbon market rise to record levels, rising above 105 euros per ton of carbon in February. Launched in 2005, the EU Emissions Trading Scheme (EU ETS) is one of the first carbon markets in the world and is currently in its Phase 4 (2021-2030). The ETS aims to drive reductions in greenhouse gas emissions and to incentivise the transition to a net-zero carbon economy. This paper examines whether the EU cap-and-trade system has had a material financial effect on the companies that are under the scheme and whether it has induced them to reduce their emissions. Determining the effects of carbon pricing on corporate profitability is crucial to inform policymakers and assess whether the EU ETS has the desired effects of creating incentives to limit carbon emissions.

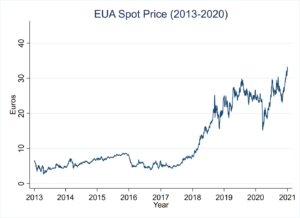

Our study covers Phase 3 (2013-2020) of the scheme, during which it underwent significant changes and achieved maturity. We focus on firms listed in European stock exchanges and that have installations that are subject to the EU ETS. Information for each year about the total amount of permits allocated for free to the firms and the firm-level regulated emissions allows us to capture firm-specific exposures to EU carbon prices. We combine that data with daily stock returns data from Datastream, daily carbon price data from the European Energy Exchange, annual corporate financial data from Orbis, and annual carbon emissions data from Trucost. The latter reports both EU-level and global emissions of the listed firms.

Figure 1. Daily EUA Spot Prices (2013-2020). The EUA price languished in between 5 and 10 euros per ton until 2018, after which it surged to 33 euros by the end of 2020.

Figure 2. Proportion of firms with free permits covering less than 50% of verified emissions. The proportion of firms with a significant permit shortfall rose from below 20% in 2013 to close to 40% in 2020.

We estimate different specifications of a regression model associating daily company stock returns (or yearly return on assets and emissions) with daily changes in carbon prices (or the log of the year-end carbon price). A central explanatory variable is whether the company has a shortfall of carbon allowances or a surplus. Our analysis proceeds in three steps. First, we determine the total exposure to EU carbon prices of listed companies by identifying which installations are subject to the EU ETS, measuring the regulated emissions of each installation, and aggregating over all installations owned by each listed company. Through a careful data collation, we link installations (or plants) in the EU ETS Union Registry to the firm they are part of, based on their firm identifiers and names. This is a significant challenge, as it requires identifying which of the over 14,000 ETS installations in the EU ETS Registry are owned by EU listed companies. We identify around 3,000 installations that are owned by 284 listed companies in Europe.

In a second step, we associate carbon prices and stock prices for these companies, controlling for industry, time, and company characteristics. Analysing daily variations, we find that the impact of EU carbon prices on stock prices depends on how much a company’s regulated emissions are covered by freely allocated permits. If the company has a shortfall in emission permits, an increase in the EU carbon price is associated with a decline in the stock price. However, if the company has a surplus in emission permits, the increase in the EU carbon price is associated with an increase in stock price. Our study indicates a high level of informational efficiency of financial markets, with stock traders responding in real time to changes in carbon prices, taking account of disclosed information on carbon permit coverage. When carbon prices became material in the later years of Phase 3 we find that they materially affect firms’ financial performance.

In a third step, we look at each company’s total carbon emissions (whether they are regulated under the EU ETS or not, and whether they are in the EU or not) and ask how changes in the EU carbon price affect not only the company’s regulated emissions but also its total emissions. Our main finding is that while companies with a significant shortfall in emission permits do lower their regulated emissions in the EU, they do not lower their emissions globally. Together, these findings suggest that while the EU carbon price has reached levels in the later years of Phase 3 that materially penalize firms with a shortfall in free permits, it is likely that the EU carbon price only exerts an effect on corporate carbon emissions in the EU.

With increasing levels of carbon prices and an expansion of the number of carbon markets being introduced in different countries, evidence of the impact of carbon pricing on firms can help shape policies needed to achieve the 2050 net-zero targets of countries around the world.

Print

Print