Rafael Copat is an Assistant Professor of Accounting at the University of Texas at Dallas. This post is based on a recent paper forthcoming in the Journal of Accounting Research by Professor Copat, K. Ramesh, Herbert S. Autrey Professor of Accounting at Rice University; Karthik Balakrishnan, Vernon S. Mackey, Jr. & Verne F. Simons Distinguished Associate Professor of Accounting at Rice University; and Daniela De la Parra, Assistant Professor of Accounting at the University of North Carolina Chapel Hill. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value add Value (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) both by Lucian Bebchuk, Kobi Kastiel, Roberto Tallarita; and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.

Diversity, equity and inclusion (DEI) is a highly debated topic in the corporate world these days. Although research has provided only a limited understanding of the impact of DEI on firm value, particularly with regards to race and ethnicity, both firms and regulators have taken actions to expand corporate DEI initiatives. For example, 46% of S&P 500 firms include some DEI metric in their incentive plans (Semler Brossy, 2022). In addition, ISS currently recommends a vote against the chair of the nominating committee for Russell 3000 firms that have no racial diversity on their board. Furthermore, NASDAQ now requires most listed companies to have at least one board member identified as belonging to an “underrepresented minority” or explain why they failed to do so.

In our study, forthcoming at the Journal of Accounting Research and available on SSRN, we examine the valuation effects of a firm’s exposure to race-related diversity issues. We refer to such exposure as “diversity exposure.” We also explore how firms respond to social pressure for racial justice, and what the economic consequences of these responses are.

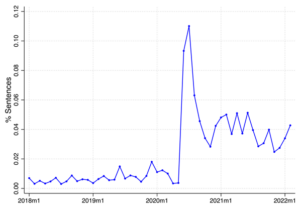

Our analyses are centered around the murder of George Floyd, a crime that triggered social unrest across the United States. After George Floyd’s murder, many firms revealed their exposure to racial diversity issues in prominent disclosure channels. We employ a novel text-based methodology to extract a measure of corporate diversity exposure from transcripts of conference calls. We find that roughly 29% of all firms in our sample have a diversity-related discussion in at least one conference call following the murder of George Floyd. More importantly, as shown in Figure 1 below, we observe a significant increase in the percentage of sentences that contain diversity terms immediately after the murder.

Figure 1: Average Percentage of Diversity Sentences in Conference Calls by Calendar Year-Month

This figure presents the average of the percentage of diversity sentences across all firms in our sample for each calendar year-month from January 2018 to February 2022. The percentage of diversity sentences is calculated as the number of diversity sentences to the total number of sentences in the conference call.

We next examine the valuation effects of a firm’s exposure to racial diversity issues. We conjecture that a higher diversity exposure makes firms more likely to bear the consequences from customer boycotts, employee turnover, social activism, and regulatory pressure. These stakeholder actions could reduce expected cash flows or increase the firm’s discount rate, having an adverse effect on firm value. We find a negative 0.7% stock market reaction to conference calls that discuss diversity issues after the murder of George Floyd. We provide evidence that this effect is attributable to the firm’s exposure to race-related, and not gender-related, issues.

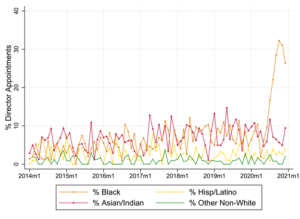

We also explore how firms respond to George Floyd’s murder. We initially focus on Black director participation on corporate boards because we expect that the lack of diversity at the corporate helm could be seen as a glaring omission. As shown in Figure 2 below, we document that the number of appointments of Black directors increases significantly after the murder of George Floyd. In addition, using our proxy based on textual analysis, we find that firms with diversity exposure are more likely to appoint and retain Black directors following the murder.

Figure 2: Percentage of New Director Appointments by Ethnicity

This figure shows the average percentage of director appointments belonging to different racial groups by calendar year-month in our sample period.

To examine other types of firm responses to George Floyd’s murder, we explore a database put together by As You Sow, a nonprofit activist firm. We find that, after the murder of George Floyd, firms with greater diversity exposure are more likely to undertake diversity-related actions. In particular, these firms are more likely to establish DEI departments, appoint DEI leaders, set explicit diversity goals, establish programs to improve diversity in their supply chains, increase their community engagement, and increase their donations to racial justice causes.

In our last set of analyses, we examine the economic consequences of the actions taken by firms. When benchmarked against White directors, we find that on average the stock market views appointments of Black directors more favorably after the murder of George Floyd. Interestingly, this effect is muted when the appointment is made through a board enlargement. Such finding is consistent with the market perceiving the appointment as symbolic or resulting in “overboarding.” We also examine the type of skills that Black directors bring to the board. We find that Black directors have on average less leadership experience, less experience in the company’s industry, and more skills relevant for stakeholder relations. However, we do not find that these skills differ significantly after the murder of George Floyd. Therefore, our findings that the stock market reacts more favorably to Black appointments after George Floyd’s murder cannot be explained by changes in director skills.

Our paper contributes to the literature by establishing that exposure to racial diversity issues impacts shareholder wealth. We develop a time-varying, text-based measure of exposure to racial diversity at the firm level that can be employed by other researchers to further study such issues. Additionally, our study informs standard setters and lawmakers by shedding light on whether disclosures of diversity information are material to shareholders. We document that the market reacts to an increased demand for diversity, indicating that the race-related information is potentially material. Finally, given our finding that firms address their diversity issues over time, our study implies that political actions to address DEI issues may not be well served by ad hoc mandates.

Print

Print