John Galloway is Global Head of Investment Stewardship at Vanguard, Inc. This post is based on a publication by Vanguard Investment Stewardship.

Our four principles

Board composition and effectiveness

Good governance starts with a company’s board of directors. Directors are elected to represent the interests of shareholders and have important responsibilities that they carry out in accordance with their fiduciary duties to shareholders. These include selecting and appointing the CEO, being involved in company strategy formation, overseeing material risks, designing executives’ compensation plans, and ensuring that shareholders’ rights are protected.

Our primary focus when evaluating a company’s governance practices is ensuring that the individuals who serve as board members and represent the interests of shareholders are independent, capable, and appropriately experienced. An effective board should reflect diversity of skill, experience, and opinion, as well as diversity of personal characteristics (such as gender, race, and ethnicity), as research shows that diverse boards can make better decisions. Well-composed, effective boards can set in motion a virtuous cycle that enables a company to innovate, seek out new customers, and enter new markets, enabling long-term shareholder value creation for investors in their company.

Oversight of strategy and risk

When we discuss strategy and risk with portfolio companies, we work to assess how well the board of directors understands the company’s strategy and how effectively it is involved in identifying and governing material risks. We look for directors to bring a wealth of experience and diverse perspectives to the boardroom and to provide counsel to company leaders. We look for directors to be well-informed on competitive dynamics and seek outside opinions to better challenge management’s assumptions. Ultimately, boards should work to prevent risks from becoming governance failures and/or long-term underperformance.

Executive compensation

Sound, performance-linked compensation (remuneration) policies and practices that extend well beyond the next quarter or year are fundamental to sustainable, long-term value. Compensation expectations and norms vary by a company’s industry, sector, size, and geographic location; therefore, we do not take a one-size-fits-all approach. In our engagements on this topic, we seek to understand the business environment in which pay-related decisions are made and how a board structures pay programs to incentivize outperformance relative to the company’s peers over the long term. Companies should provide clear disclosure about their compensation practices and how they are linked to performance and the company’s stated strategy. This disclosure gives shareholders confidence that the practices are aligned with the creation of long-term shareholder value.

Shareholder rights

Shareholder rights empower shareholders to use their voice and their vote to ensure the accountability of a company’s board. Shareholders should be able to hold directors accountable through governance provisions such as annual elections that require securing a majority of votes. While the Vanguard-advised funds do not themselves put forward nominees for portfolio company boards, we support the right of an appropriate proportion of shareholders to call special meetings and/or to nominate directors for consideration by all shareholders; this provides shareholders the ability to exercise their voice and vote in instances where a strategic case for change in a company’s strategy is identified and/or when a board appears resistant to shareholder input. We believe that a well-functioning capital markets system requires that companies have in place governance structures that safeguard and support foundational rights for shareholders.

At a glance

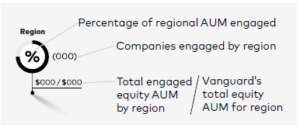

In 2022, our team of more than 60 investment stewardship professionals engaged with 1,304 companies representing 67% of the Vanguard-advised funds’ total assets under management (AUM). As we continued to globalize our program, we engaged in 34 different markets.

Regional roundup

Topics and trends that shaped the global governance landscape in 2022

In 2022, Vanguard’s Investment Stewardship team engaged with company boards on and analyzed proposals that focused on a range of important topics. The team conducted 1,802 engagements with 1,304 portfolio companies in 34 markets around the world. The funds voted on 184,521 proposals at 13,490 companies in the 12 months ended December 31, 2022.

The year 2022 was difficult for many portfolio companies in the Americas, as they faced issues including rising interest rates and inflation, disruption in global supply chains, and the ongoing impact of the waning COVID-19 pandemic on everything from consumer demand for goods and services to the evolution of a constrained talent pool. In spite of these hurdles, investors still expected companies to focus on their long-term strategies to create value; this is precisely the type of environment where we believe that well-governed companies are best poised to serve their shareholders’ long-term interests.

Our primary focus when evaluating a company’s corporate governance profile is on assessing board composition and effectiveness as we seek to understand how boards select and appoint management, oversee company strategy, and seek to mitigate material financial risks. Many of our conversations with leaders of U.S., Canadian, and Latin American portfolio companies focused on this topic in 2022. Through our discussions, we sought to understand how directors serve as engaged, effective stewards of shareholder capital and look after company success over time. In the U.S., many of our discussions touched on boards’ refreshment and self-evaluation processes. In Latin America, many of our conversations were centered on the adoption of governance best practices for board independence, risk oversight, and disclosure.

We noted that compensation committees used discretion to reward executives with one-time awards, often citing the need for a retention tool in a tight labor market. Our evaluation of executive compensation programs and payouts continued to focus on the alignment of executives’ incentives with long-term shareholder returns.

Despite representing a very small proportion of the matters we voted on in 2022—only 1.7% of ballot items in the U.S.—shareholder proposals received significant attention through various channels and grew substantially in volume year-over-year. This was due, in part, to revised Securities and Exchange Commission (SEC) guidance limiting the ability of companies to exclude certain shareholder proposals from proxy ballots. In 2022, the number of environmental and social shareholder proposals in the U.S. rose sharply (to 298 shareholder proposals, up from 159 in 2021). At the same time, we observed a rise in the number of shareholder proposals at U.S. public companies that, in our view, were overly prescriptive in dictating company strategy or day-to-day business operations or were not sufficiently linked to issues of long-term shareholder value at the company in question.

On behalf of Vanguard-advised funds, we evaluate all shareholder proposals on a case-by-case basis with a focus on what is in the best long-term financial interests of fund shareholders. Many shareholder proposals in 2022 continued to focus on diversity and inclusion and climate-related topics. With respect to the former, we observed an increased number of shareholder requests for disclosure on boardroom diversity as well as the effectiveness of companies’ workforce diversity, equity, and inclusion strategies. Other shareholder proposals requested racial equity and civil rights audits, disclosure on the use of concealment clauses, and pay-gap reporting.

With respect to climate-related shareholder proposals, many requested that companies set and disclose greenhouse gas reduction targets. In the U.S. and Canada, we observed a trend toward more prescriptive requests in such proposals dictating the pace of a company’s climate transition strategy or asking a company to exit a business line or otherwise change its strategy. Through our case-by-case analysis of each proposal, we found that in many instances companies that received these proposals had demonstrated progress in their disclosure and governance of greenhouse gas emissions and related material risks. When evaluating material climate-related risks, Vanguard-advised funds are grounded in a belief that boards are responsible for determining an appropriate risk mitigation strategy to maximize long-term shareholder value for investors in their company. The funds are unlikely to support proposals that would undermine a board’s latitude in determining how best to discharge that responsibility.

Download the full report here.

Print

Print