Amit Batish is Senior Director of Content at Equilar, Inc. This post is by Mr. Batish and Courtney Yu. Related research from the Program on Corporate Governance includes Stealth Compensation via Retirement Benefits by Lucian Bebchuk and Jesse M. Fried.

The 2023 proxy season has officially come to a close. Over the last few months, public companies across the U.S. filed their proxy statements with the Securities and Exchange Commission (SEC), disclosing key elements of their policies related to corporate governance and executive compensation. The marquee topic of this proxy season was Pay Versus Performance (PvP), as it was the first year that companies were required to disclose tabular and narrative information reflecting the relationship between compensation actually paid (CAP) to a company’s named executive officers (NEOs) and the company’s financial performance.

Since the SEC’s announcement of the new PvP rules in August 2022, human resources, finance and legal teams have worked diligently to address the requirements and provide a crisp and clear proxy disclosure. To better understand and unveil how companies addressed first-year requirements, Equilar examined the proxy statements of the Equilar 500—the largest U.S. public companies by revenue. This post features a summary of findings from the analysis and a first-look at trends captured from PvP disclosures and calculations.

Due to the complex nature of the PvP disclosure, many internal teams began collaboration on calculations months in advance of proxy season. Among the topics discussed in those early meetings was the concept of the CAP calculation—one of the most critical components of the disclosure requirement. The goal of the CAP calculation is to capture the change in fair value of previously granted awards to named executive officers (NEOs), painting a clear picture of how much an executive has gained from equity awards over time. Separately, companies are also required to disclose their total shareholder return (TSR) and the TSR of their peer group.

According to Equilar research, 76.7% of Equilar 500 companies saw TSR and CAP for principal executive officers (PEOs) move in the same direction, indicating that either both figures increased or both figures decreased. Meanwhile, 23.3% of companies disclosed figures that moved in opposite directions. Among those companies, 29.9% saw an increase in CAP as TSR decreased, and 70.1% saw CAP decrease as TSR increased. While it may be too soon to draw conclusions from the information and data captured in first-year disclosures, shareholders may find some comfort in the fact that the data shows, for the most part, alignment remains present. On the other hand, if there is discrepancy between CAP and TSR directionality, it may be in the best interest of the issuer to understand and be prepared to provide a crisp explanation into what led to the discrepancy.

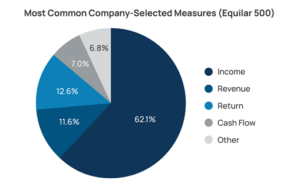

Of course, another critical component of the PvP disclosure requirement is the company-selected measure (CSM). The CSM is a financial measure selected by a company as its most important financial performance indicator, linking CAP to the company’s performance during the most recent fiscal year. The rules state that if the CSM is not a financial measure under GAAP, then additional disclosure is required. Nevertheless, companies meticulously selected their measures for 2022, as they may have potential impacts on future year PvP disclosures.

Perhaps to no surprise, income-related metrics led the way by a large margin this proxy season, with 62.1% of Equilar 500 companies disclosing these metrics as their CSM. Return metrics, such as return on capital, were the next most common measures at 12.6% prevalence, followed by revenue at 11.6%.

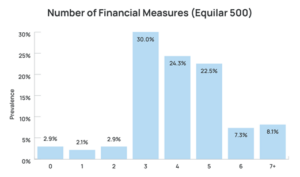

In addition to the CSM, issuers are also required to disclose a tabular list of three to seven* of the most important financial measures used to link CAP to company performance for the most recent fiscal year. Given the nature of first-year disclosures, there was some level of uncertainty as to how many measures a company should disclose. The data shows that three prevailed as the most common number of disclosed financial measures across the Equilar 500, as 30% of companies fell in this category. Four and five were the next most common number of measures at 24.3% and 22.5%, respectively. Meanwhile, 8.1% of companies disclosed seven or more financial measures in their PvP disclosures.

The spotlight around Pay Versus Performance has grown brighter each day since the SEC’s August 2022 announcement. With the 2023 proxy season now complete, companies may breathe a sigh of relief that first-year PvP disclosures are now in the books. The overall impact of disclosures on Say on Pay or investor scrutiny may not be clear this year, and the jury is still out whether or not PvP disclosures provide new insights to investors. Ultimately, time will tell how PvP fits into the larger conversation on executive compensation.

*Companies that do not grant performance-based compensation did not disclose any financial measures. Companies that disclosed one to two financial measures utilized under three measures in their incentive plans.

Print

Print