Claudia H. Allen and Patrick A. Lee are Senior Advisors, and Ari Weinberg is a Director at KPMG’s Board Leadership Center. This post is based on their KPMG memorandum.

Adding value to private company boards

From board structure and agenda priorities to the role of independent directors, private company governance continues to evolve in response to an increasingly complex and challenging business and risk environment.

As highlighted in our survey, over the past few years, private company boards have made strides in improving their effectiveness in a number of areas, including overseeing strategy and agenda setting (two areas that nearly three quarters of directors in our 2020 survey cited as being most in need of improvement). Directors in our most recent survey said that over the past few years their boards have also made improvements in communicating with management, conducting board meetings, and communicating with other directors.

Despite this progress, directors report that the biggest opportunities for improvement going forward involve strategy, talent and succession, cybersecurity risk and risk management more generally, as well as the company’s governance processes.

Perhaps not surprisingly, strategy, risk, and talent also seem to be the top reasons for private company board focus on the “E” and “S”—the environmental and social factors of ESG. And as to stakeholder engagement—beyond equity owners—private company boards appear to be embracing the growing importance of their companies’ engagement with employees and customers.

With that backdrop of progress, priorities, and opportunities for improvement, the role and value that

independent directors bring to the business—particularly advising on strategy and counseling the CEO and executive management (as noted in our survey findings)—will continue to be pivotal to private companies in navigating the challenges ahead. At a time when CEOs and boards need to be challenging assumptions and widening their company’s aperture on strategy, risk, and talent, the value of having independent voices in the boardroom will be more important than ever.

Key takeaways

To gain a better understanding of the challenges facing U.S. private company boards today—what is working and where they could improve—the KPMG Board Leadership Center surveyed nearly 600 private company directors. Survey respondents included independent directors; founders and other executives; investment firm partners, employees, and operating advisors; family members; and ESOP trustees.

Board composition, structure, and leadership

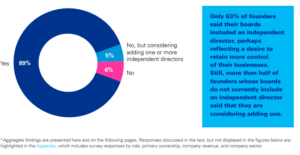

Independent directors. Notably, nearly 90% of respondents said that their boards have at least one independent director. Three quarters of respondents said that an independent director can add the most value to the business by serving as a sounding board for the CEO and other executives, advising on strategy, and helping to balance the views of management and owners. Even for boards with independent directors, figuring out how to best draw on their talent and skills can be difficult. One independent director at a closely held company observed that “few business owners know how to utilize independent directors effectively.”

- Does your board include at least one independent director, a non-executive director who is

unaffiliated with the company other than serving as a corporate director?*

2. Where do you believe an independent director can add the most value to the business? Select up to 5.

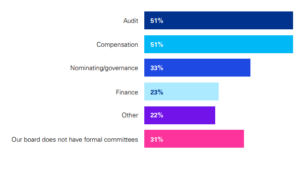

Standing committees. In terms of board committee structure, 51% of respondents said that their boards have an audit committee, and the same percentage reported having a compensation committee. Potentially reflecting the need for more structure and a mechanism to delve more deeply into issues as companies scale, nearly threequarters of respondents from companies with revenue above $500 million said that their boards had audit and compensation committees. Boards with nominating/governance, finance, or other committees were a distinct minority. Notably, one-third of respondents said that their boards do not have any standing committees, and 54% of founders said that their boards did not have standing committees.

3. Which of the following standing committees does your board have?

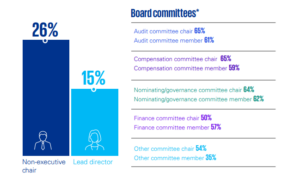

Independent directors in board leadership. Twenty-six percent of respondents said that an independent director serves as board chair and another 15% said that an independent director serves as lead director. Founders reported the lowest percentage of independent directors serving as board chairs, at 9%. Of the survey respondents who indicated that their boards had audit or compensation committees, two thirds said that those committees are chaired by an independent director. Investment professionals were the least likely to use independent directors as committee chairs.

4. Which of the following roles does an independent director serve on your board?

24% of respondents said that their boards did not include independent directors in leadership positions or on committees.

Board performance and priorities

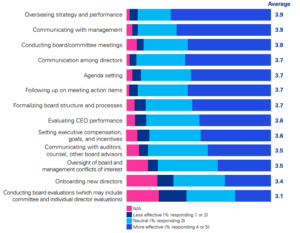

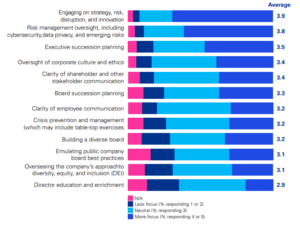

Effectiveness and focus. Most respondents said that in recent years, their board has become more effective at overseeing strategy and performance, communicating with management, communicating among directors, setting the board agenda, and conducting board and committee meetings. However, they reported little improvement in conducting board and individual director evaluations, which can be critical to creating a high functioning board with the requisite skill sets. Most respondents also reported that their board has increased its focus on strategy, risk, and disruption, as well as oversight of risk management, including cybersecurity, data governance, and emerging risks. They reported no similar increase in their focus on board diversity, director education, and diversity, equity, and inclusion (DEI). Investment professionals reported the strongest increase in focus on oversight of DEI as well as building a diverse board, while founders reported low levels of change on these topics.

Although private companies are often not experiencing the same pressure as public companies to address DEI, employees are increasingly focused on this issue as well as other environmental and social issues, meaning such issues could affect the ability of private companies to attract and retain talent.

5. Over the last few years, how has your board’s effectiveness changed with respect to the following processes? [1-Significantly less effective to 5-Significantly more effective, N/A]

6. Over the last few years, to what extent has your board’s focus changed with respect to the following activities? [1-Significantly less focus to 5-Significantly more focus, N/A]

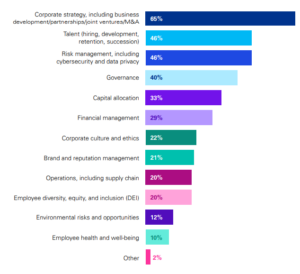

Opportunities for improvement. Despite the areas of increased effectiveness and focus identified above, respondents said that the biggest opportunities for improvement in oversight continue to be strategy (including business partnerships and M&A), followed by talent (including hiring, development, retention, and succession), risk management (including cybersecurity and data privacy), and governance. Respondents did not include environmental risks or DEI among their greatest opportunities for improvement in oversight.

7. Where does your board have the greatest opportunity for improvement in oversight?

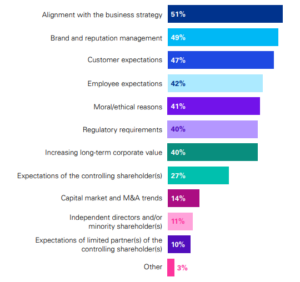

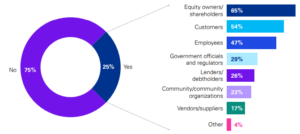

Stakeholder engagement beyond equity owners. A significant majority of respondents, particularly investment professionals, recognize the importance of—and have increased their board and management’s engagement with—employees and customers. In fact, respondents identified customer and employee expectations as having the most significant influence on the board’s consideration of environmental and social issues, after alignment with strategy and brand and reputation management.

8. How important is the engagement of management and/or the board with the following stakeholders? [1-Not very important to 5-Very important, N/A]

9. To what extent has management and/ or board engagement with the following stakeholders changed over the last few years? [1-Significantly decreased to 5-Significantly increased, N/A]

10. Which factors have the greatest influence on your board’s consideration of environmental and social issues affecting the company? Select up to 5.

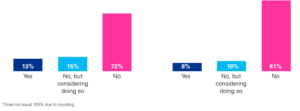

In terms of demand for environmental, social, and governance (ESG) data, only a quarter of respondents said that their company’s stakeholders are asking for more detailed ESG information, although 41% of investment professionals reported such demand. Only 13% said their company publishes a sustainability report, and only 8% said the company receives third-party assurance on ESG data. Based on the responses, private equity-controlled companies are more likely to publish a sustainability report and receive assurance on ESG data (or to consider both), compared to other private company ownership types.

11. Is the company being asked by its stakeholders to provide more detailed quantitative and/or qualitative information on environmental, social, and governance (ESG) issues affecting the company (such as climate change, and DEI), including in its supply chain?

12. Which stakeholders are requesting this information? Select all that apply.

13. Does your company publish a sustainability report, or include environmental, social, and governance (ESG) data on its website or in other publicly available information?

14. Does your company obtain third-party assurance on ESG data?*

The complete report is available here.

Print

Print