Nathan Williams is a Lead Consultant, and Jamie McGough and Donald Kalfen are Partners at Meridian Compensation Partners. This post is based on their Meridian Compensation Partners memorandum.

Shareholder proposals are a common part of the governance landscape. It is useful to understand who gets them, how common they are, the various types of proposals and the magnitude of support.

Overall Prevalence

The large majority (70%) of shareholder proposals are received by S&P 500 companies. This is no surprise. Shareholders spend more time on larger investments than smaller ones. Also, to the extent shareholders are attempting to generate a change in certain forms of governance, larger, more prominent companies are much more likely to precipitate a trend in changes across companies than would smaller companies.

The number of Russell 3000 and S&P 500 companies receiving proposals from shareholders increased modestly between 2021 and year-to-date 2023. Over the three-year period, 10% of companies in the Russell 3000 and 40% of companies in the S&P 500 proxies included shareholder proposals.

Prevalence of Types of Proposals

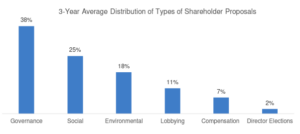

Shareholder proposals generally fall into one of six categories – governance, social, environmental, lobbying, compensation and director elections. The graphic below depicts the distribution of relative prevalence of each type of proposal among S&P 500 companies (the prevalence is nearly the same among Russell 3000 companies).

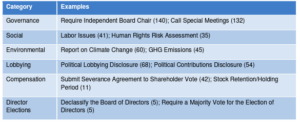

The following table provides the most prevalent examples within each category. (Numbers in parentheses indicate the average number of proposals over the three-year period in the S&P 500.)

It is particularly notable that compensation-related proposals are among the least common shareholder proposals among Russell 3000 and S&P 500 companies, accounting for only 7% of all shareholder proposals in each index.

Types of Compensation Proposals

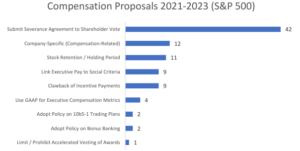

The absolute number of compensation related proposals among S&P 500 companies is not that significant (92). The graphic depicts the breakdown of these proposals.

Recently, nearly half of all compensation proposals have been related to severance agreements being submitted to shareholder vote.

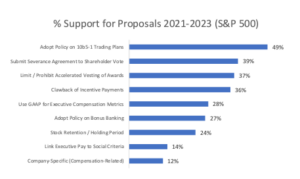

The level of support for compensation-related proposals varies. It is notable that those with material support were often few in number, suggesting they reflected company-specific circumstances rather than a widespread trend. For example, while there was an average of 49% support for adopting 10b5-1 plans there were only two such proposals. Alternatively, there were 42 proposals related to submitting severance arrangements for shareholder vote and average support was 39%.

Proposals Typically Fail but Not Always Unsuccessful

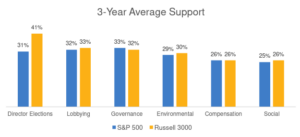

Gaining approval for shareholder proposals is a heavy lift. Of the six categories, average support was generally similar in the Russell 3000 and S&P 500, except for Director Elections. A number of companies in the Russell 3000 continue to have classified Boards and a plurality vote standard to elect Directors, and proposals to eliminate these practices tend to receive high levels of support.

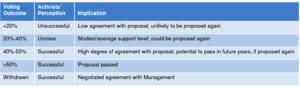

From an activist investor’s standpoint, “success” does not necessarily require a passing vote. Some proposals are withdrawn when an agreement is reached with management prior to the meeting. Of those that remain on the ballot, support as low as 40% could signify sufficient traction to pursue the proposal again or simply gain widespread recognition and a potential trend toward adoption over time.

Summary

Shareholder proposals are a common part of the governance landscape. Compensation-related proposals are among the least common, and indeed even among the compensation proposals that do occur, only a few are notable in number and receive material support. This in part reflects the annual Say on Pay process whereby shareholders are able to express their views on compensation related items. However, it is more than this since Say on Pay is a broad topical area and not particular issues. It may be safe to infer that shareholder proposals on compensation are rare because executive compensation practices have been subjected to intense scrutiny for more than 20 years from a variety of parties. The rigor and intensity of governance by both boards and management teams around executive compensation is considerably greater than two decades ago. During this time nearly every aspect of executive compensation has been reviewed, analyzed, scrubbed and subjected to internal and external examination. Practices that have emerged over time, widely accepted as “better” or “preferred”, have become dominant. Meanwhile other practices seen as otherwise, even if once common or popular such as excise tax gross ups, have largely disappeared.

Print

Print