Jonathan Ostroff is Senior Director and Geoffrey Weinberg and Gerry Davis are Managing Directors at Morrow Sodali. This post is based on a Morrow Sodali memorandum by Mr. Ostroff, Mr. Weinberg, Mr. Davis, Tom Margadonna, Michael Verrechia, and Paul Schulman. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian Bebchuk, Alon Brav, and Wei Jiang; Dancing with Activists (discussed on the Forum here) by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

In our analysis of the equity investment positions of the MS40* Activist Investors for the 2nd quarter of 2023, we observed the following notable trends:

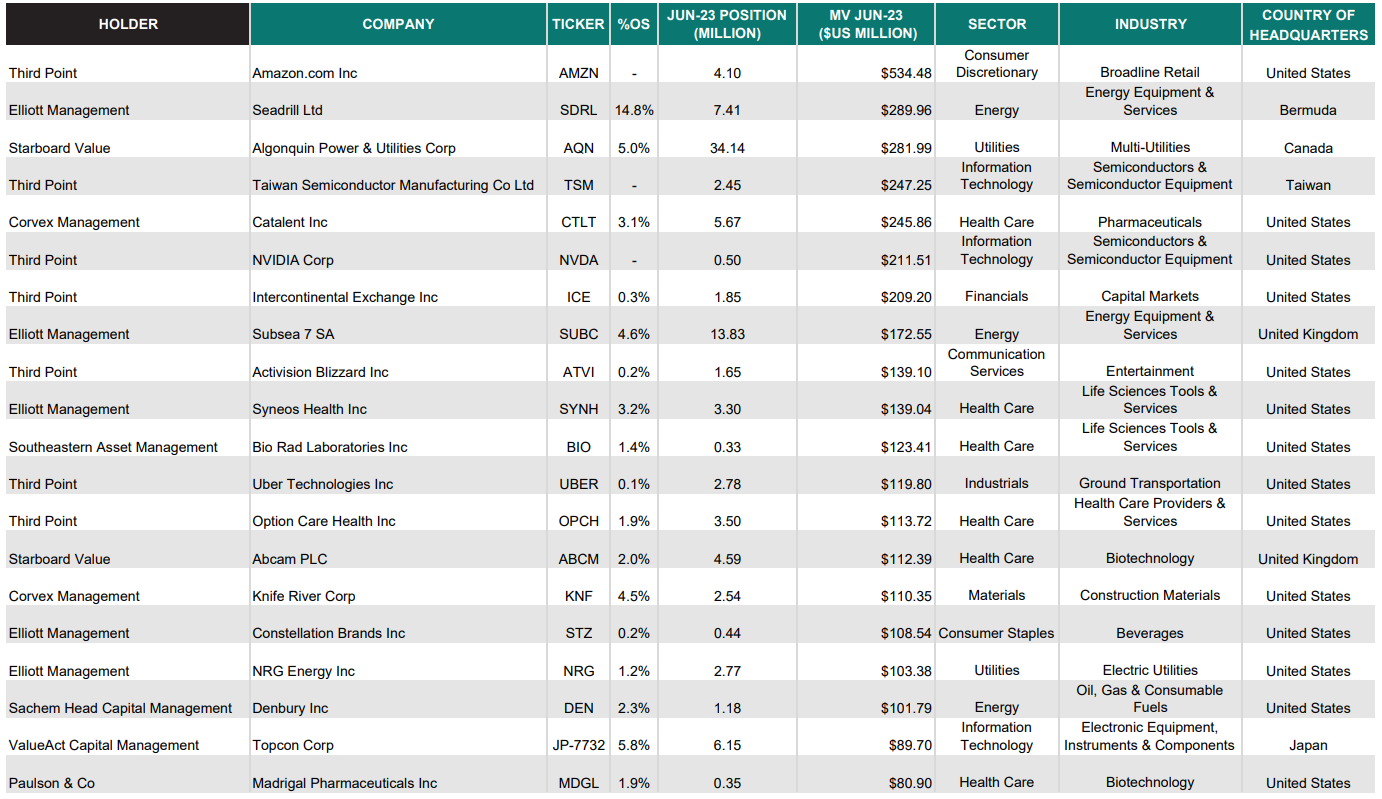

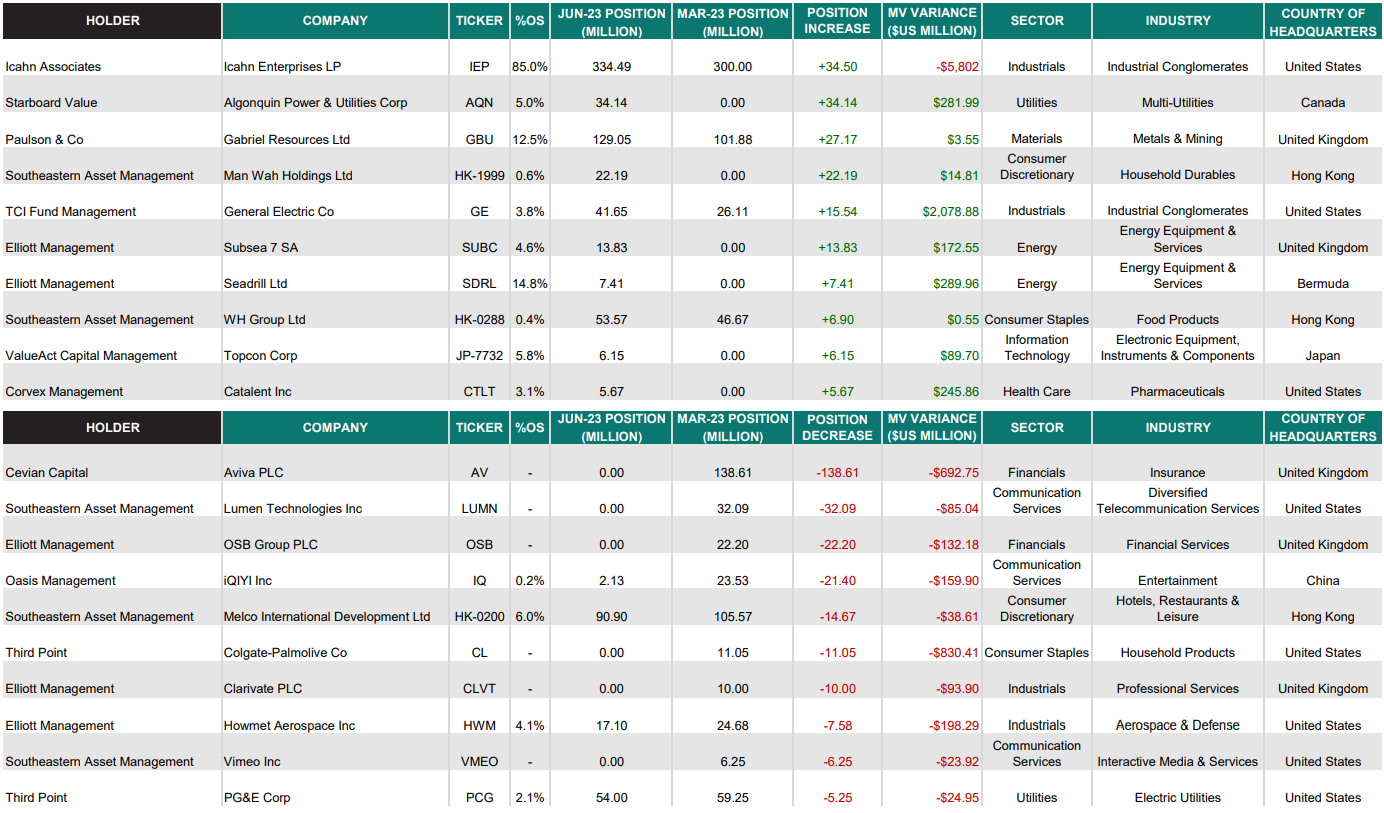

1. While Third Point initiated seven of the largest twenty new positions this quarter and Elliott was responsible for five, the largest position increase was Icahn Associates’ holdings in Icahn Enterprises as a defensive response to Hindenburg Research’s public short position.

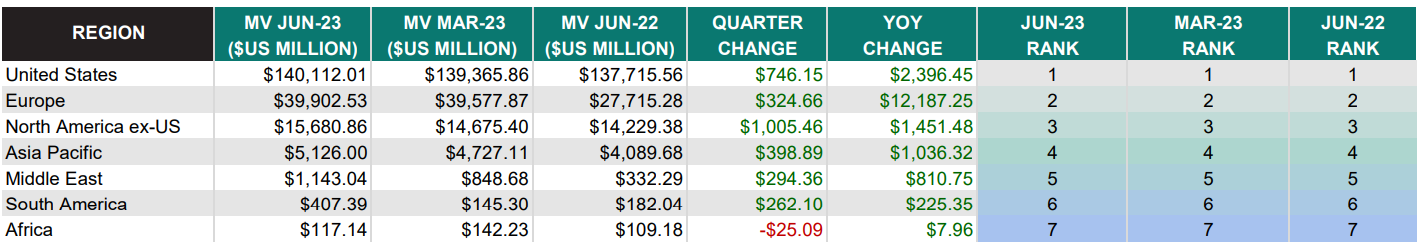

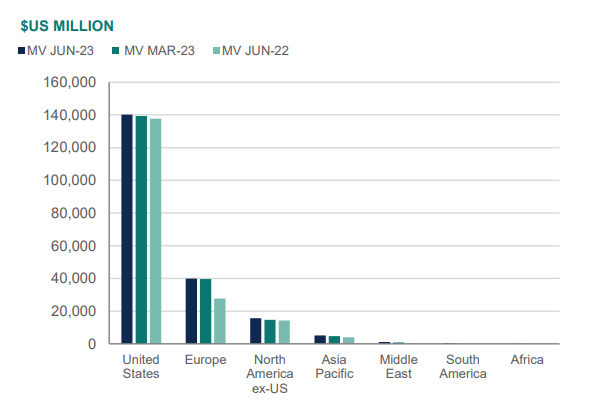

2. With Elliott’s new position in Seadrill and Starboard’s stake in Algonquin Power & Utilities, North America (excluding the US) saw the largest increase in MS40 ownership, with a $1 billion quarter over quarter increase.

3. For the quarter, non-US investments by the MS40 was 31% of the total, the highest point in the past year. In a year-over-year comparison, non-US investment represented only 25% in 2Q2022.

4. The number of MS40 investments in SPACs was once again down, for the quarter saw a 40% decline in market value to $1.6 billion, in 4Q2022 it represented $5.4 billion dollars, and during the 2Q2022 high, it was $8.3 billion. There are under 300 positions in SPACs, a drop from 500 in the previous quarter.

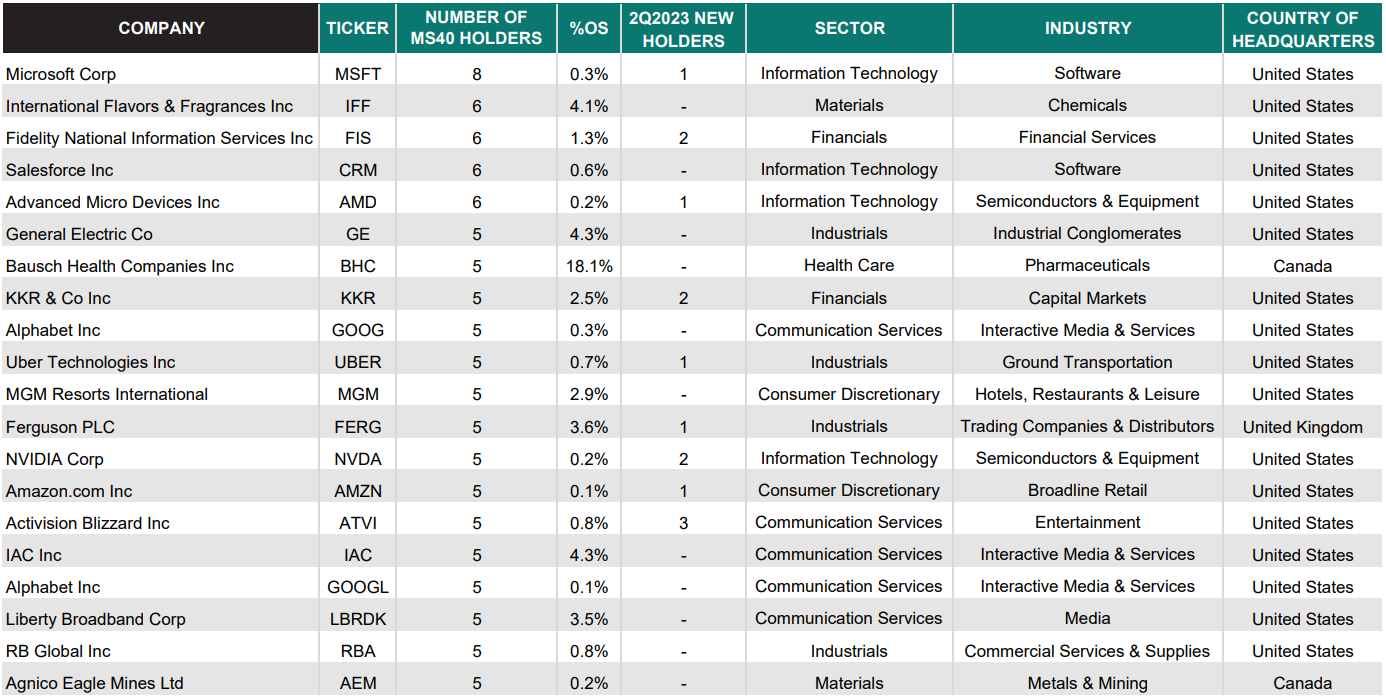

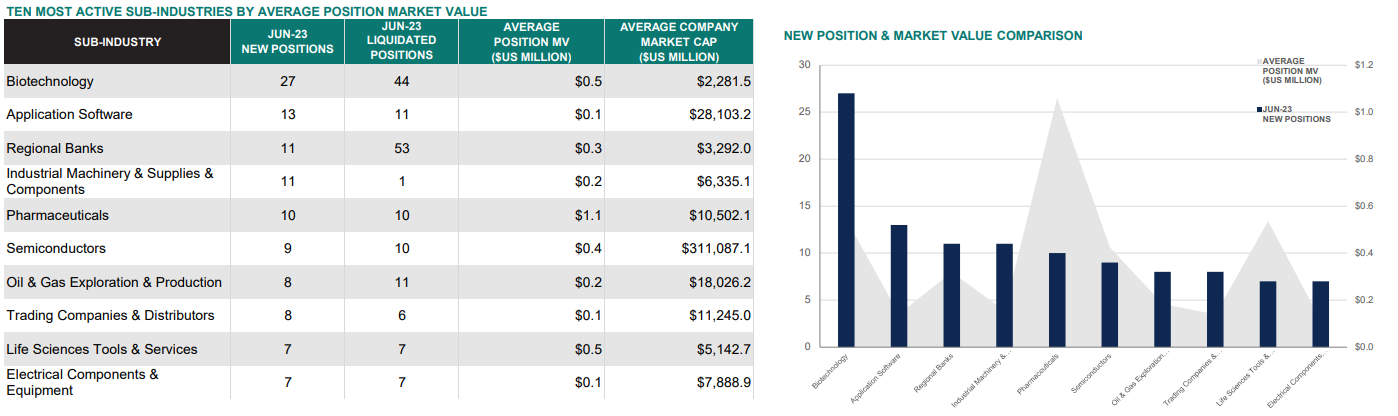

5. We saw Biotechnology shift back into being the most active sub-industry group with the initiation of 27 new positions and 44 liquidations. Application Software was once again the second most active group, and Regional Banks, despite their recent turmoil, saw the liquidation of 58 positions, fading from last quarter’s spotlight.

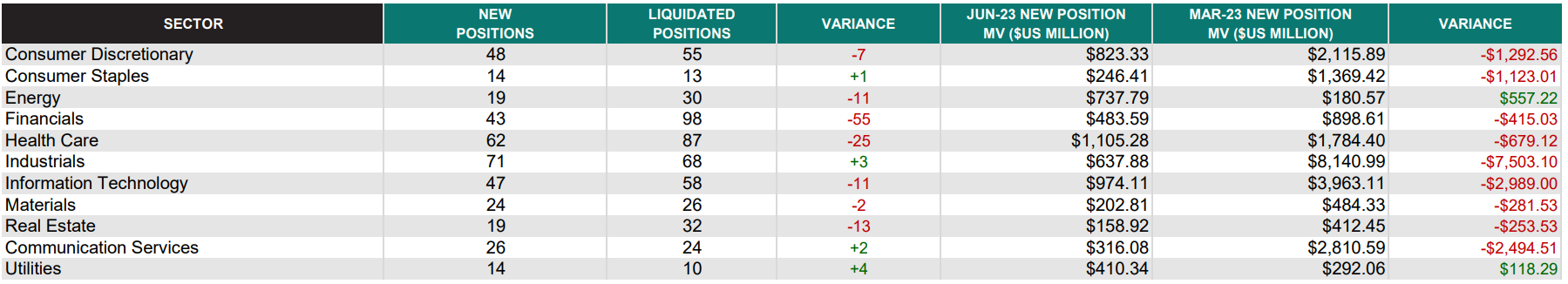

6. Among the quant investors, the largest sector exposure was in Information Technology (Semiconductors/Software) and Industrials (Machinery/Ground Transportation) with a shift away from the Financials (Financial Services/Capital Markets). DE Shaw made the largest contribution to these changes with increases at Nvidia, Meta, Microsoft, and Uber and shifts out of Visa and Charles Schwab. This helps to explain the variance in the chart below as just four sectors saw net increases among MS40 holders, while five experienced double-digit declines in the number of positions held.

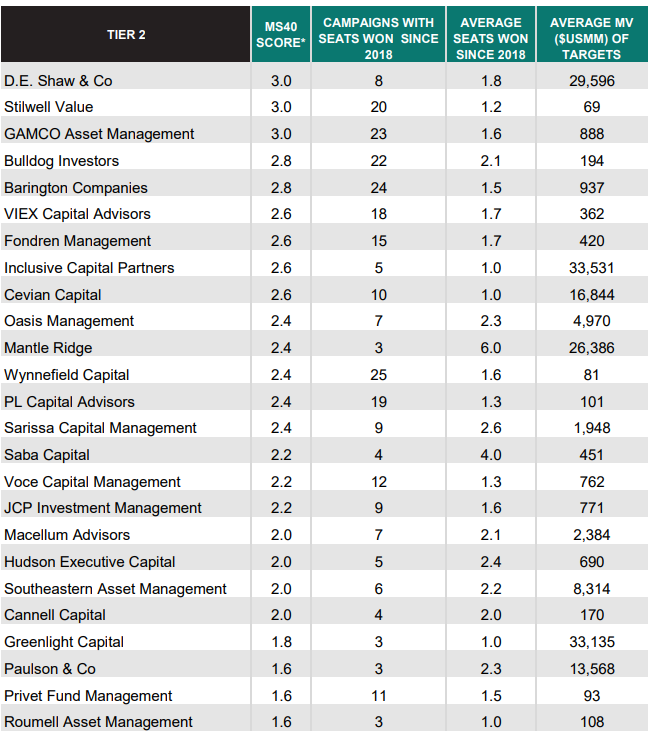

The Morrow Sodali Top 40 Activists (MS40) is a scoring system created using a proprietary model which quantifies criteria such as reputation, number of campaigns/outcomes, tactics/focus, board seats won, and recency of engagements. The MS40 is compiled across two tiers based on propensity for an active engagement. It should be noted that this analysis solely reviews the equity ownership in publicly traded companies and excludes warrants, debt, ETFs and funds. This document outlines the major trends occurring globally amongst activist investors’ portfolios.

Largest New Positions

Largest Buys & Sells

MS40 Ownership Concentration

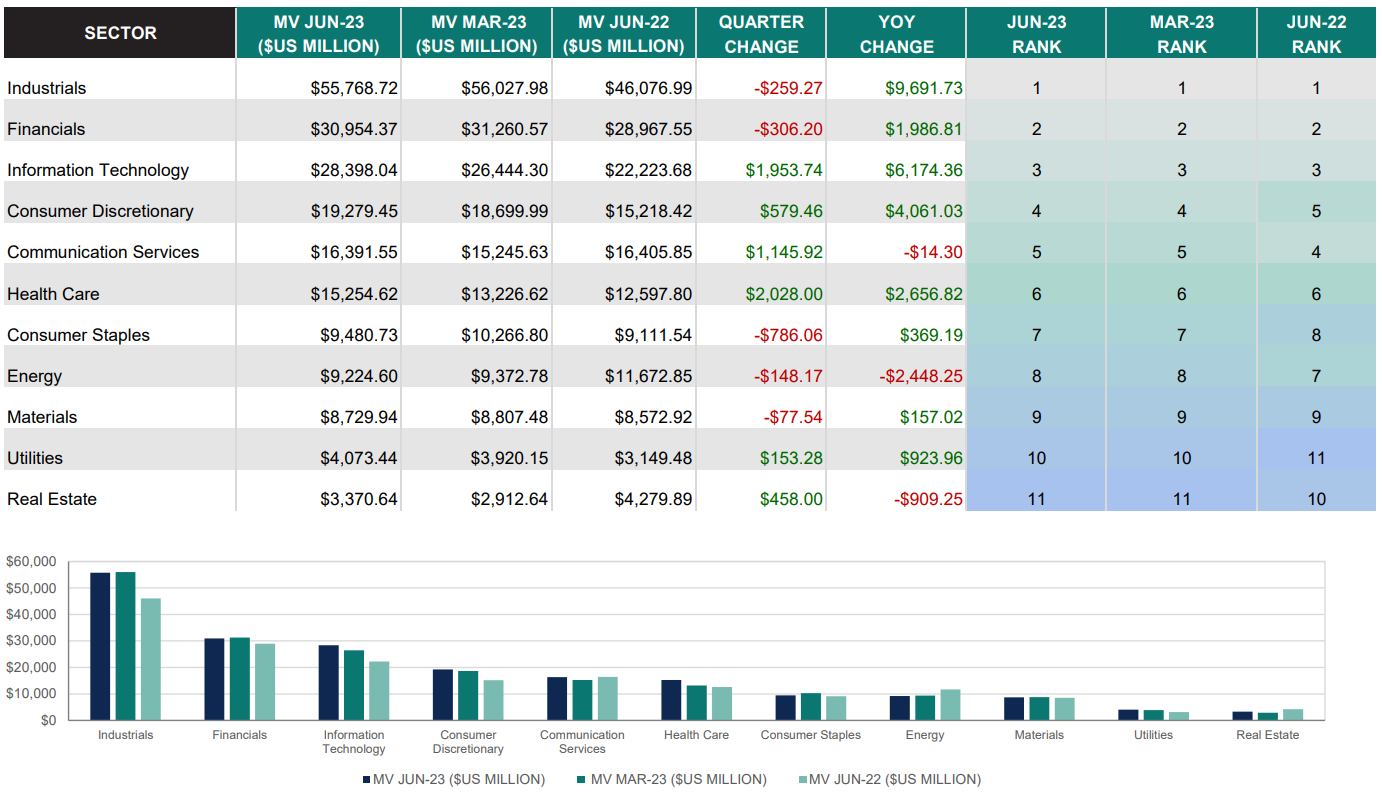

Activist Sector Exposure

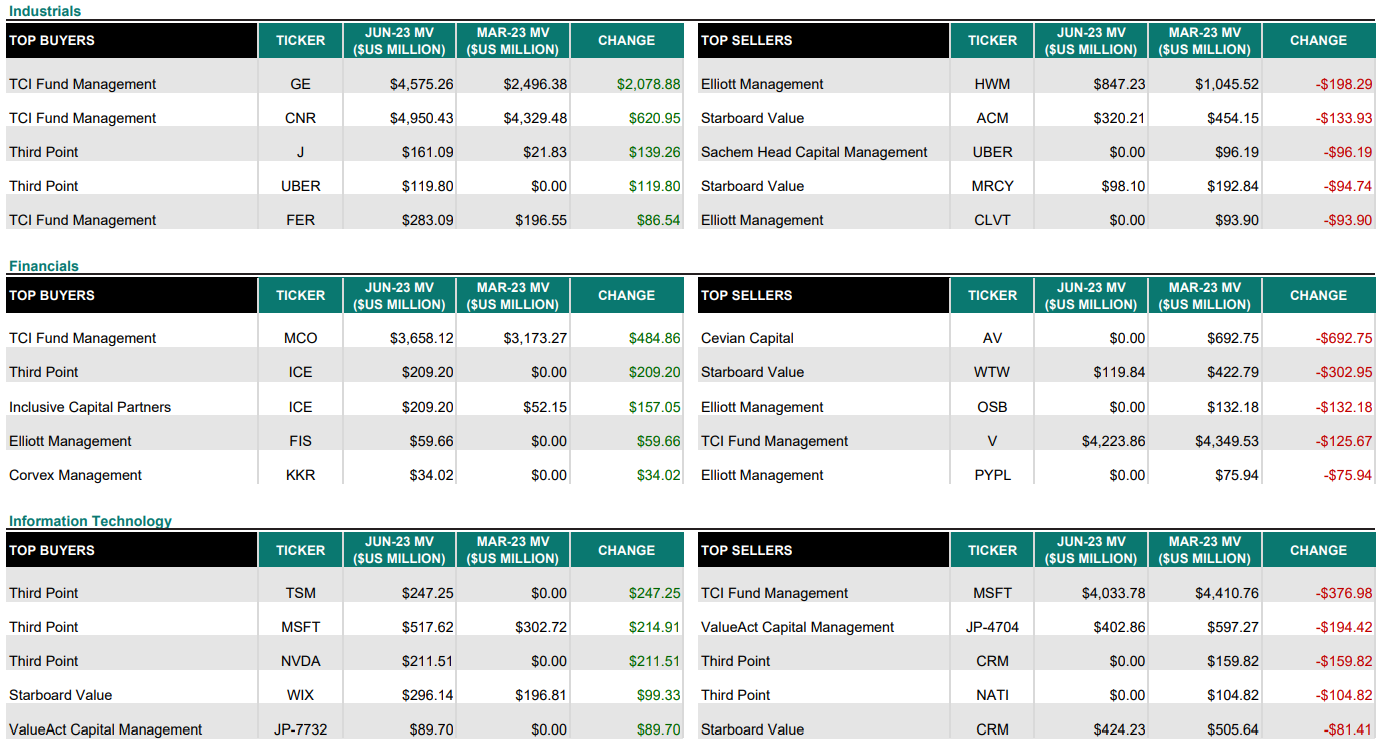

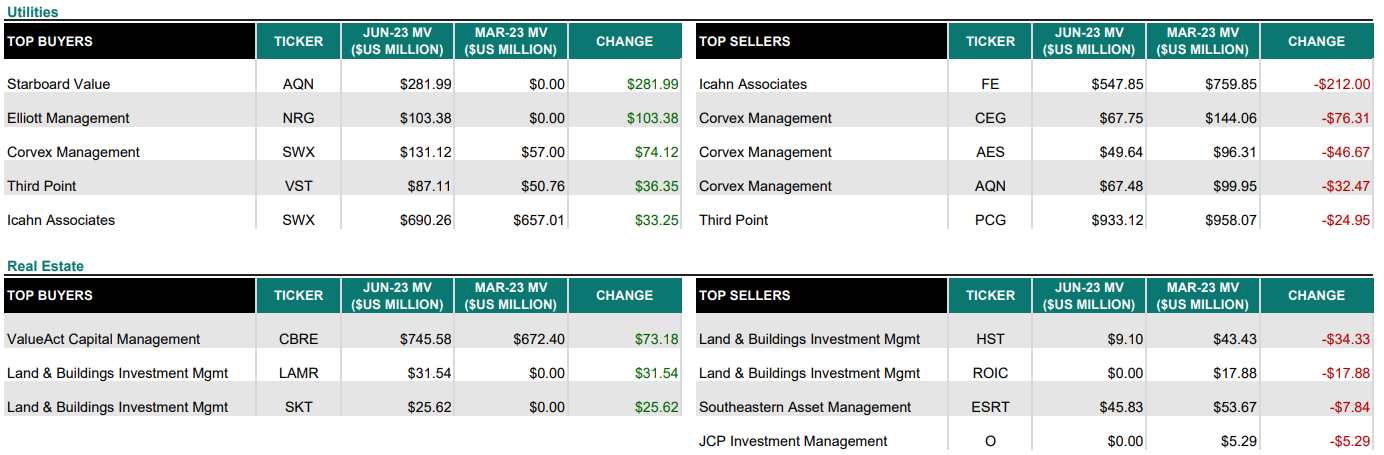

Sector Ownership Analysis

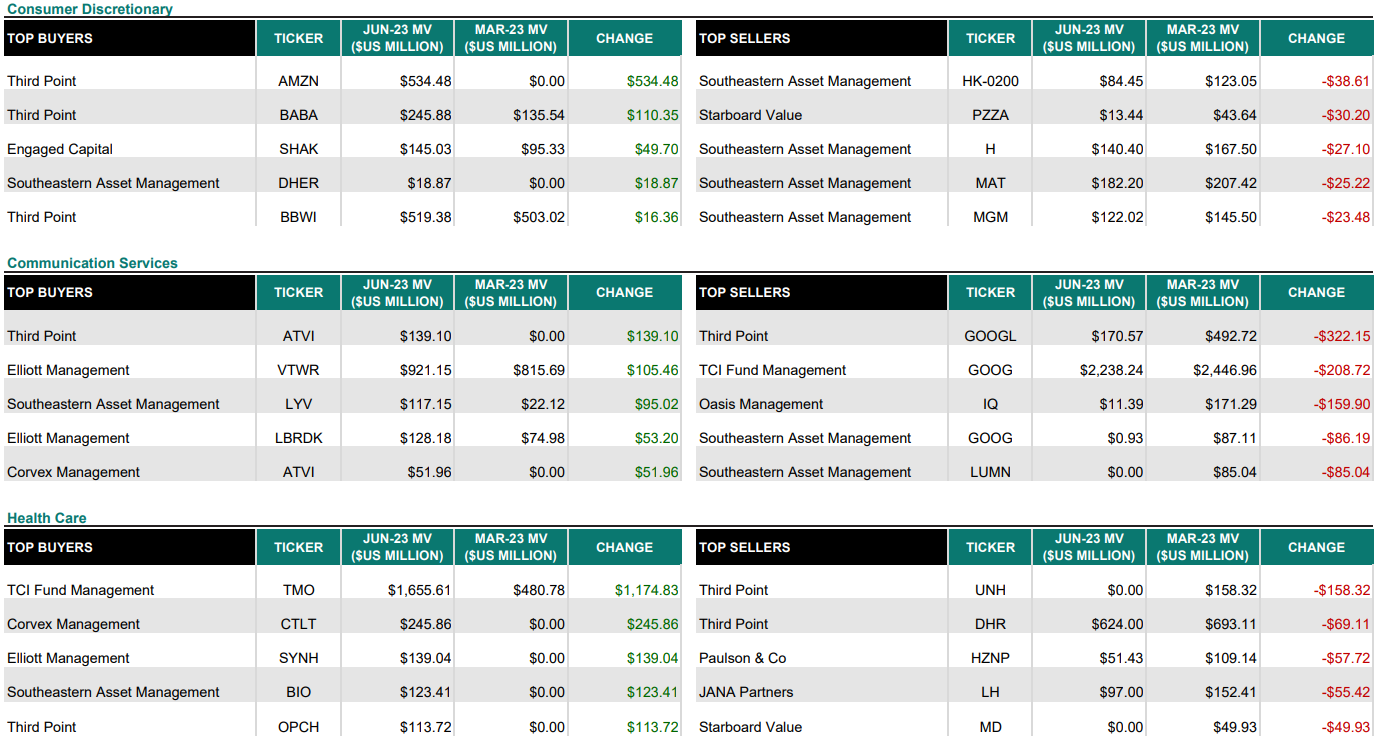

Sector Ownership Analysis

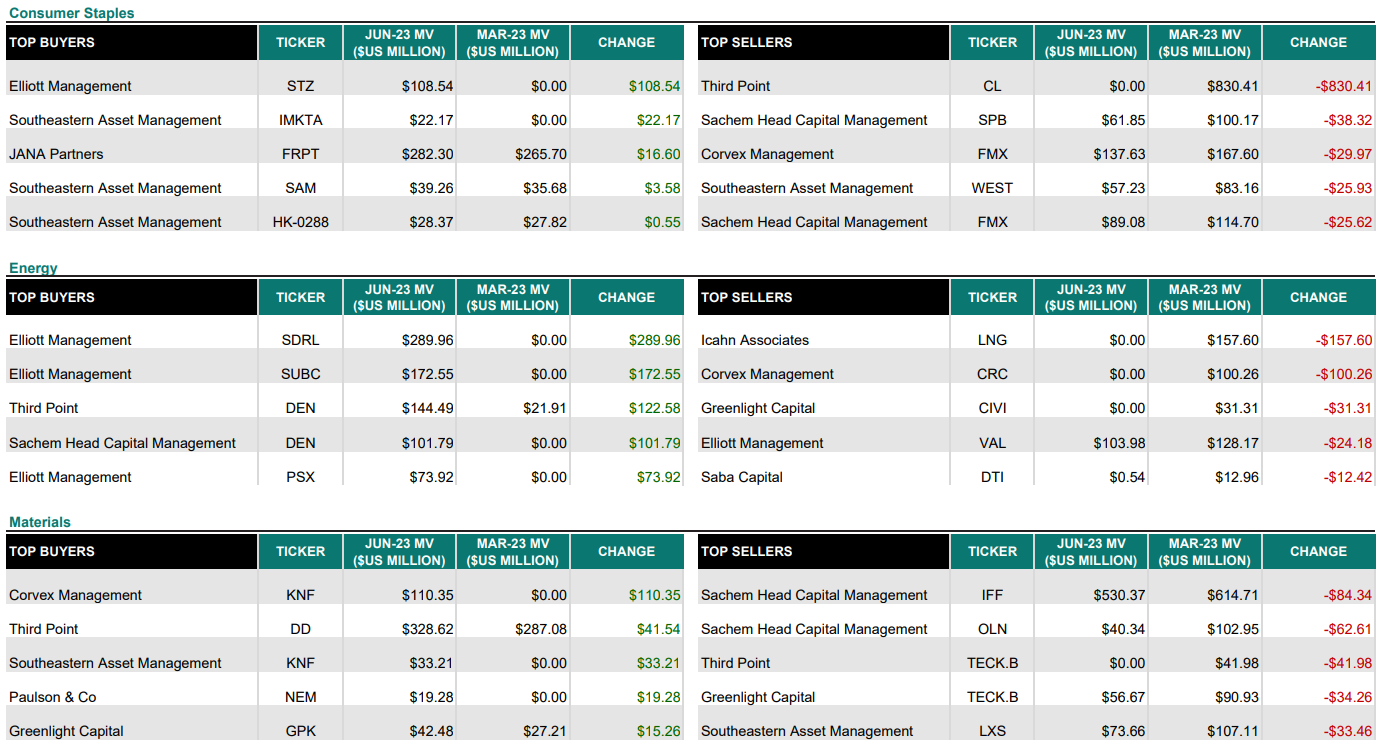

Sector Ownership Analysis

Sector Ownership Analysis

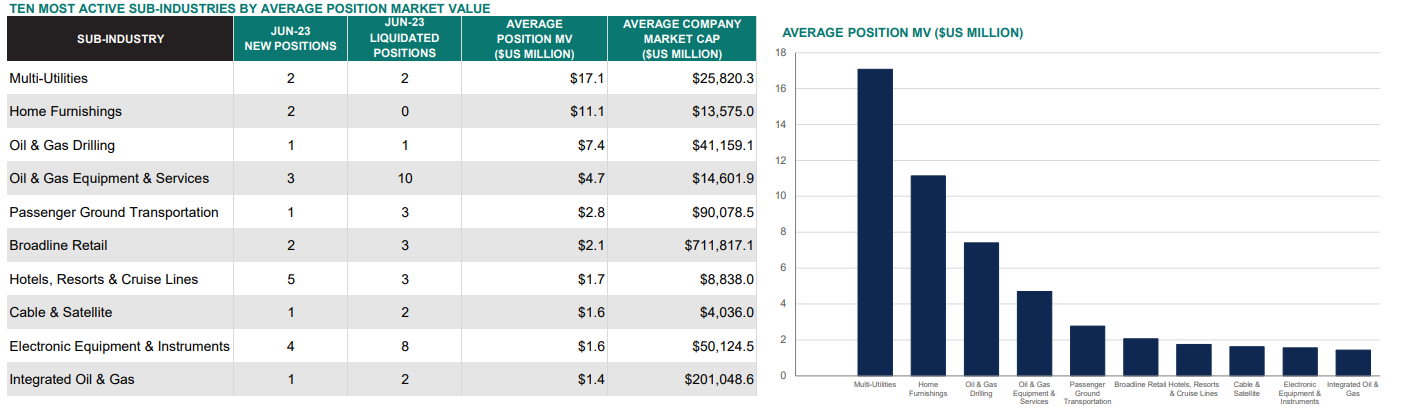

Sub-Industry Analysis

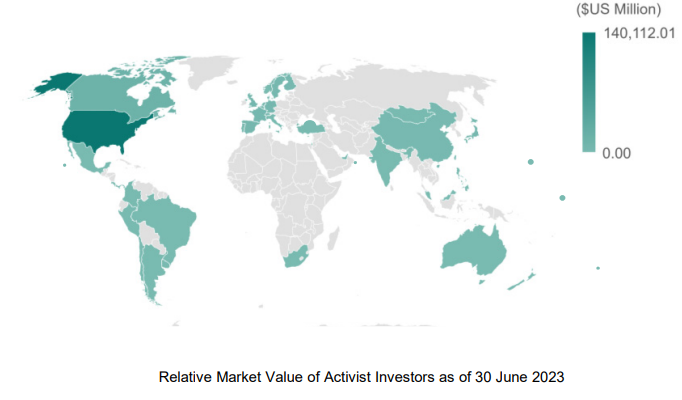

Activist Regional Ownership

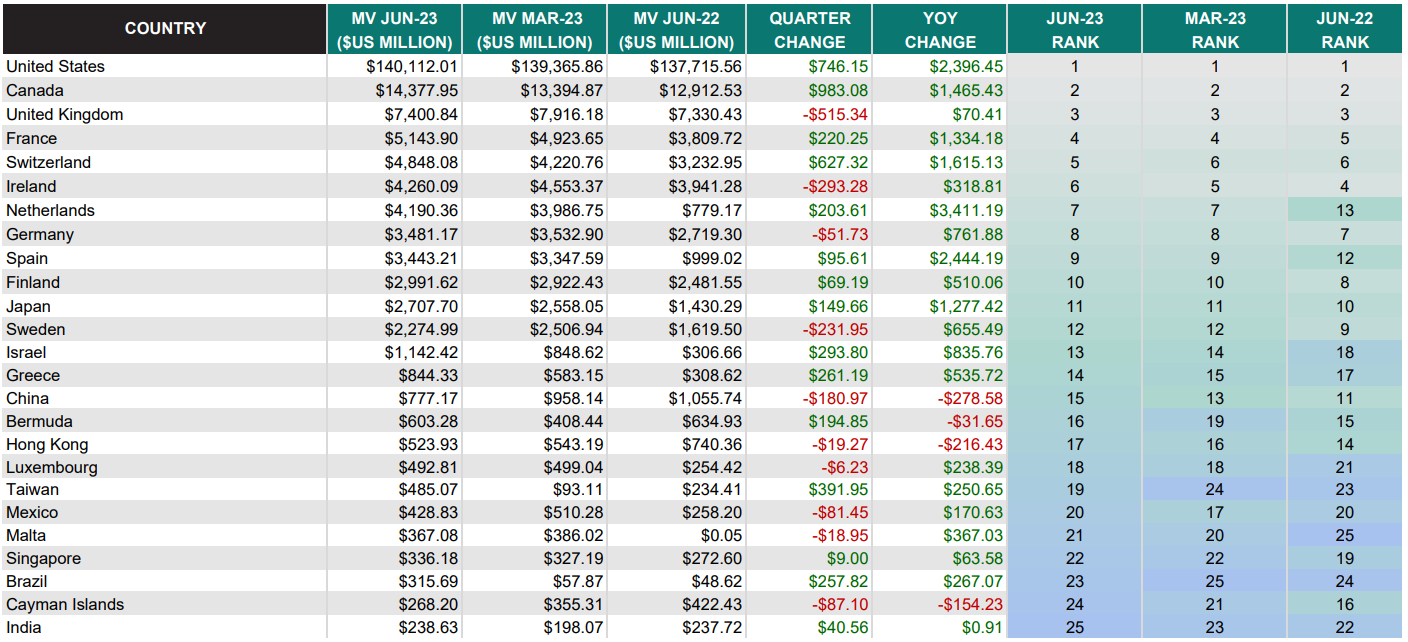

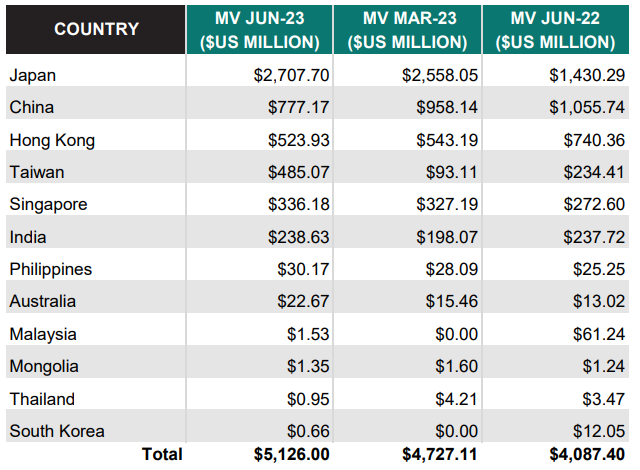

Top 25 Markets

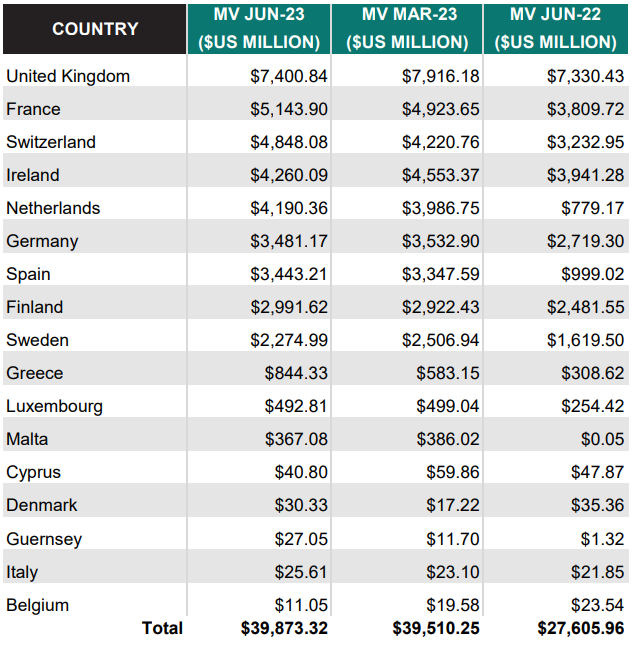

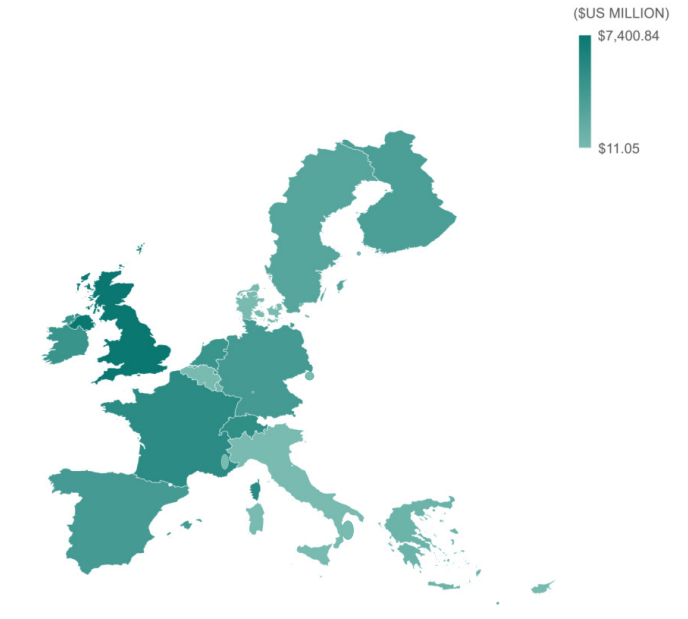

Activist Penetration – Europe

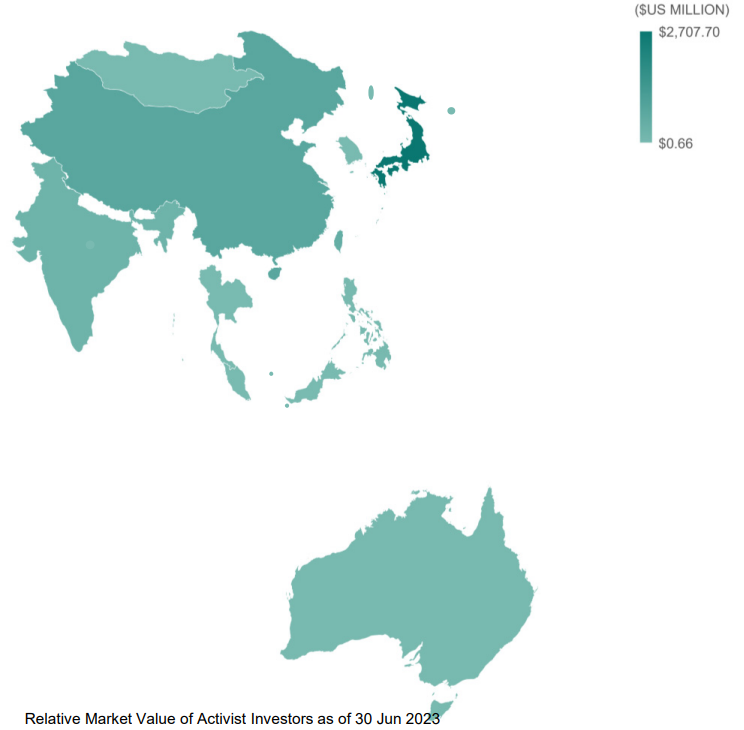

Activist Penetration – APAC

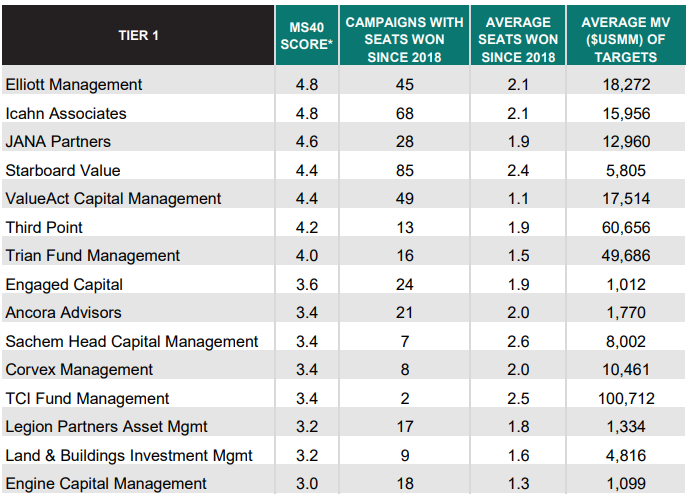

MS40 Activist List

The Morrow Sodali Top 40 Activists are structured in a two-tier system underscoring the inherent risk of engagement when the institution takes a new position in a company. The MS40 Score averages the ranking of each institution based on its quintile in each of the following five criterion:

1. Reputation

2. Recency of engagements

3. Total number of activist engagements since 2018

4. The average number of seats won per engagement since 2018

5. The market value of their targets

Following public comments from Pershing Square and Engine No 1 regarding their future

activism outlook, they have been removed from the MS40

Data for this article is derived from the following sources:

US ownership data is from Edgar, Non-US is from a combination of press releases, news & Factset.

Print

Print