Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS) Inc. This post is based on an ISS memorandum by Toby Huang, Associate, Data Analytics; and Sandra Herrera Lopez, Ph.D., Vice President, ESG Content & Data Analytics at ISS Corporate Solutions.

Introduction

Each year during proxy season, ISS Corporate Solutions (ICS) analyzes recently collected data from Russell 3000 company filings. This year we focused on director support and diversity, executive compensation, and shareholder proposals. In this season-ending review, we aggregate our findings for a comprehensive lookback on the 2023 proxy season.

Key Takeaway

- Boards continued to diversify while director support levels trended slightly lower.

- Failed Say-on-Pay proposals were down, but median support levels are also declining.

- One year Say-on-Pay frequency is increasingly becoming the norm among smaller companies.

- ESG-related performance metrics are gaining popularity in executive compensation packages.

- Environmental and Social shareholder proposals are gaining prevalence but support has weakened.

Board of Directors

- Director Vote Support Declining

- Diversity among Boards of Directors

- Percentage of Women on the Board in Leadership Roles

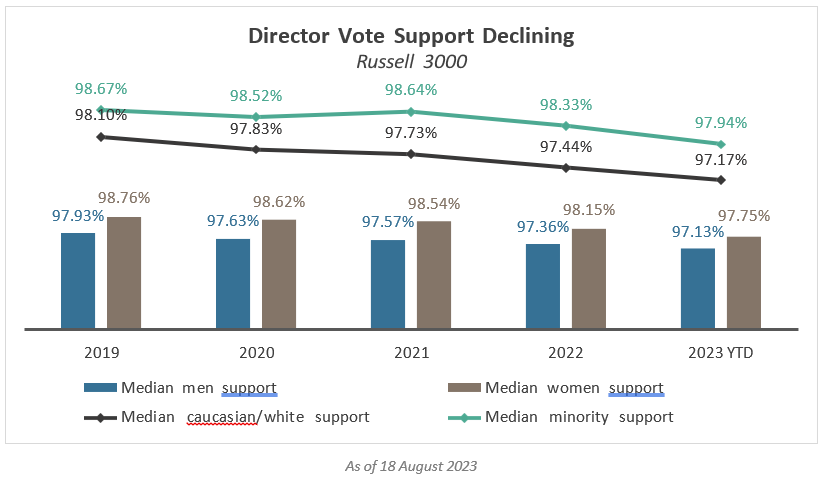

Director vote support has eroded steadily by about 1% over the past five years. Women and ethnic minorities enjoy 0.5%-1.0% higher support than their counterparts.

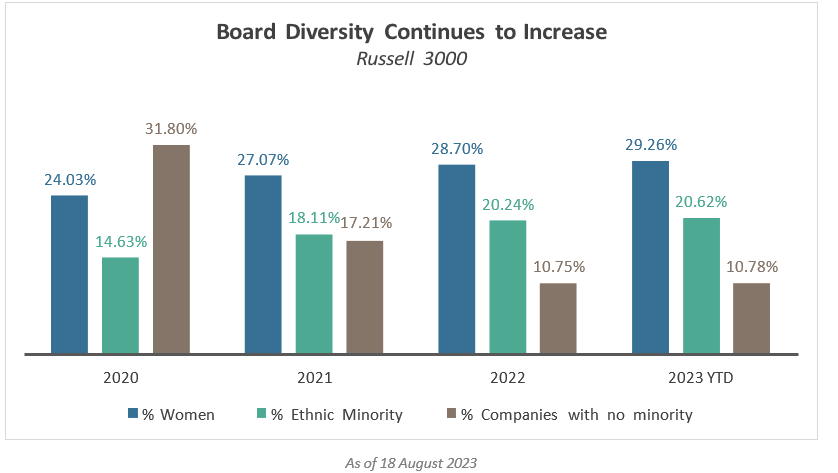

Women and ethnic minorities increased their presence among corporate boards by 5% and 6%, respectively, since 2020. About 11% of US companies have no ethnic minorities, down from nearly 32% four years ago.

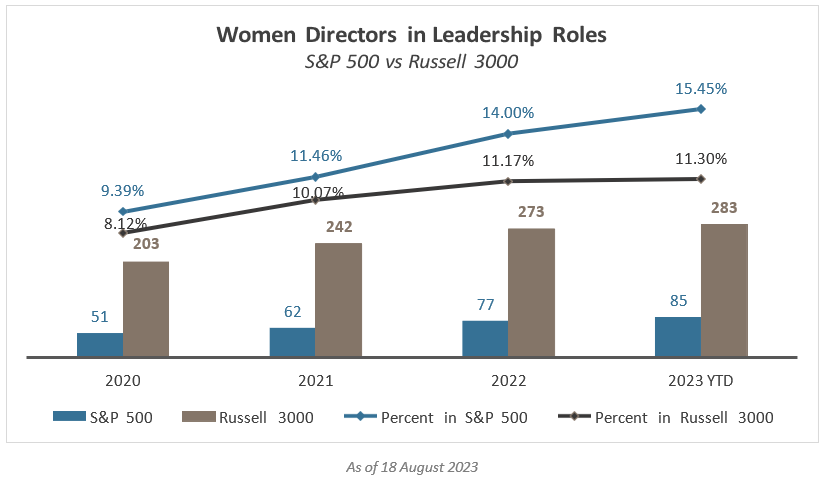

Female board leaders are also gaining prominence, particularly among large-cap companies, where 16% serve in such a capacity versus just 11% among the broader Russell 3000.

Executive Compensation

- Women CEO Prevalence Remains Low

- Median Say-on-Pay Support Down • Failed Say-on-Pay Proposals Down from All-Time Peak

- ISS Say-on-Pay Against Vote Recommendations Down

- Companies with Say-on-Pay Below 70% are Down

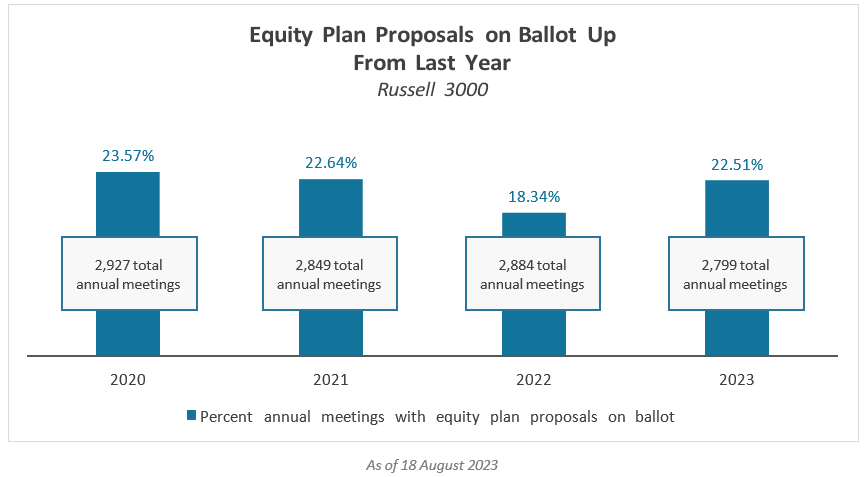

- Equity Plan Proposals on Ballot Up from Last Year

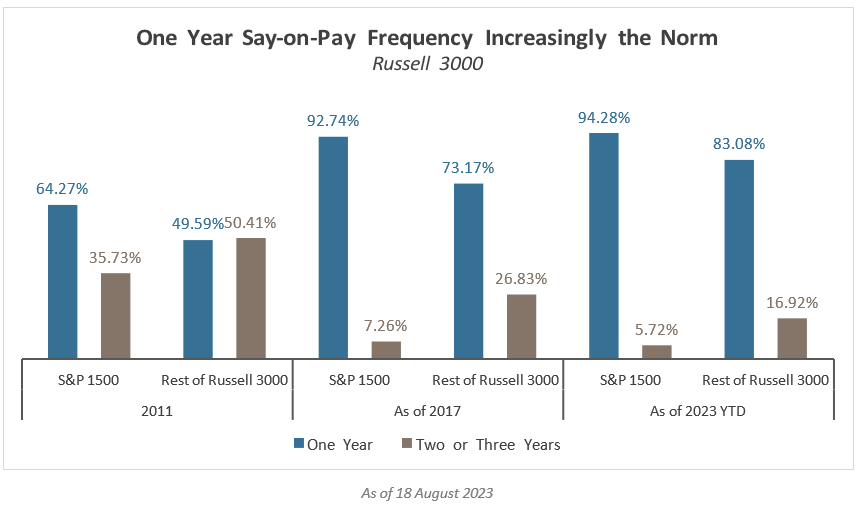

- One Year Say-on-Pay Frequency Increasingly the Norm

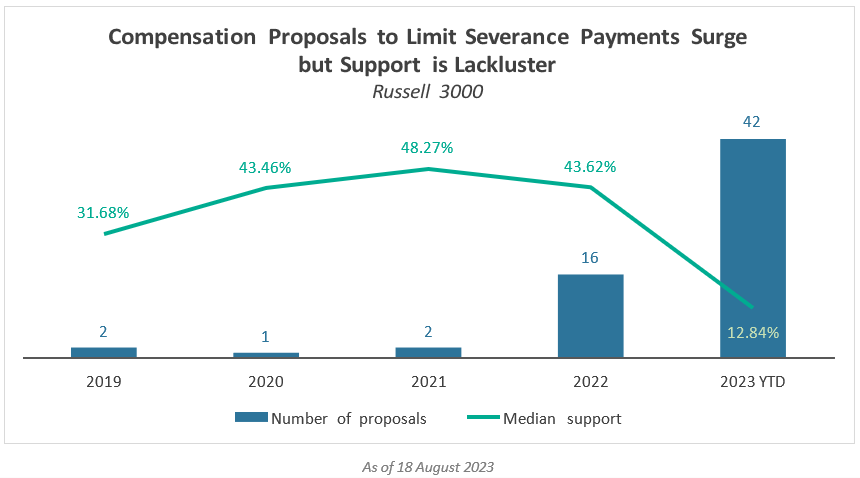

- Compensation Proposals to Limit Severance Payments Surge but Support is Lackluster

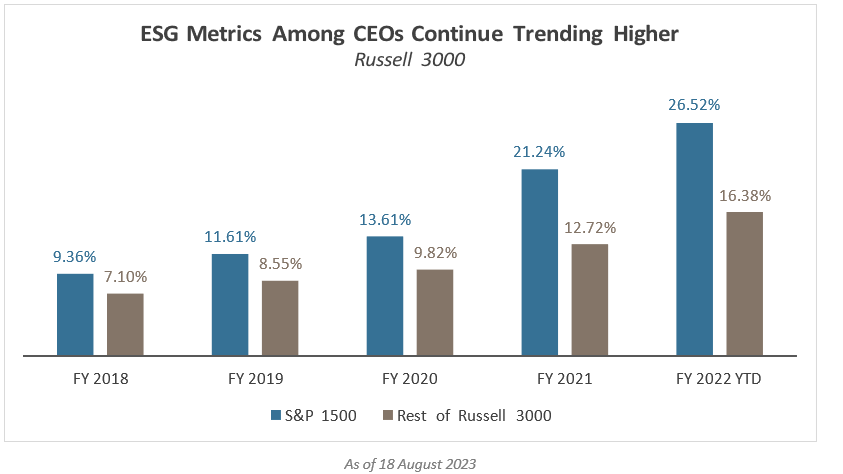

- ESG Metrics Among CEOs Continue Trending Higher

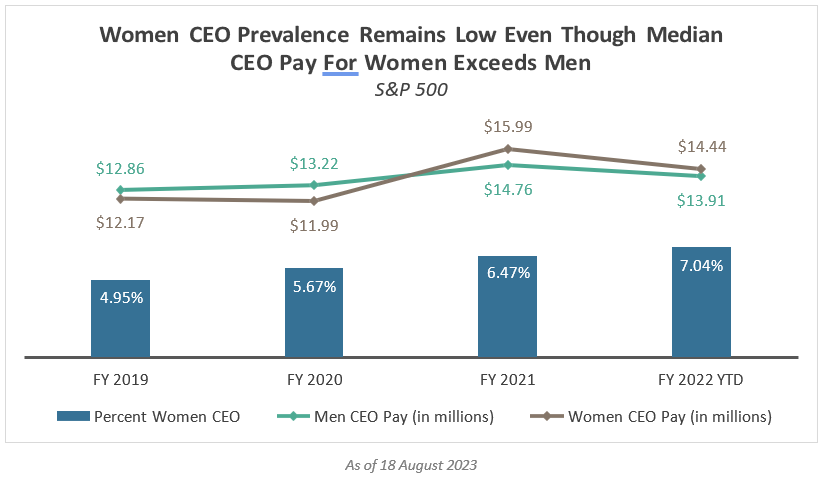

While pay for women CEOs increased in fiscal year 2021, the prevalence of female CEOs remains low (7%) despite growing 2% in four years.

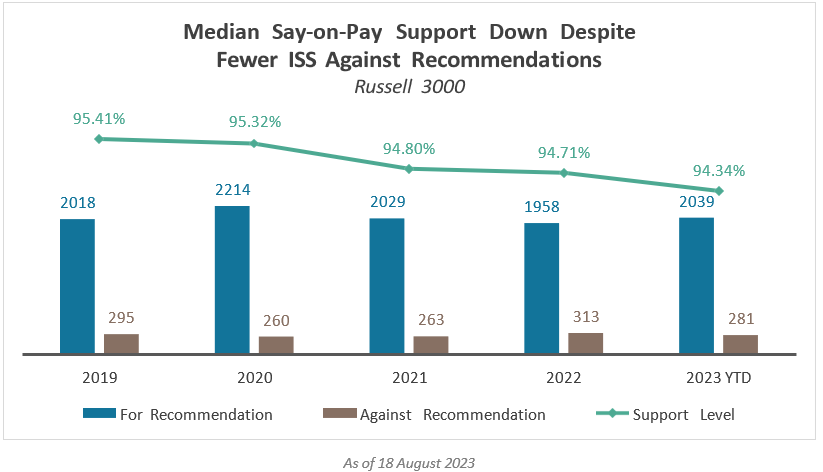

Say-on-pay support has declined each year, down 1% since 2019, despite steady support from Institutional Shareholder Services.

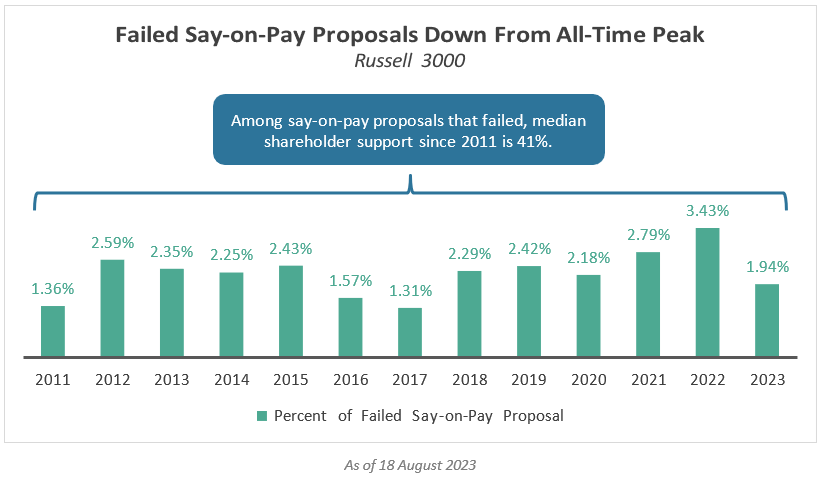

Coming off an all-time low in 2017, the number of say-on-pay failures reached a record last year. This year about 2% failed, close to the historic average.

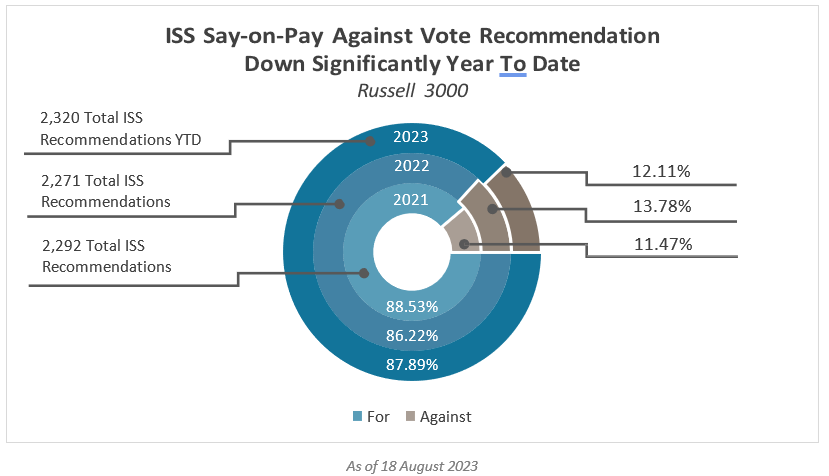

ISS supported about 88% of say-on-pay proposals this year, up from last year and in line with 2021.

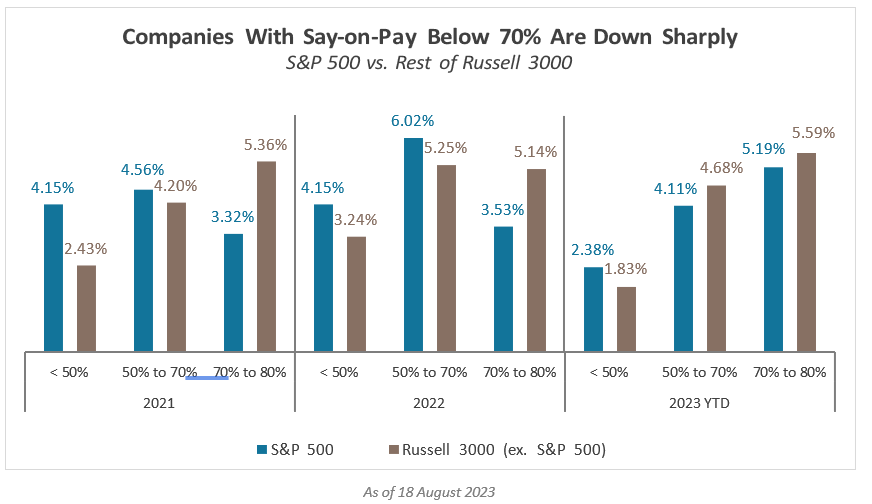

Say-on-Pay failure rates dropped this year, but the number of companies facing significant opposition (50-80% support) is largely unchanged from 2022.

Equity plan proposal volume rebounded from last year and was in line with the previous two years.

One year Say-on-Pay frequency, widely practiced among larger companies, is increasingly becoming the norm among smaller ones as well.

While shareholder proposals to limit severance payment have increased significantly, they remain relatively rare and have not gained traction among investors.

CEO pay is increasingly tied to ESG metrics, especially among larger companies.

Shareholder Proposals

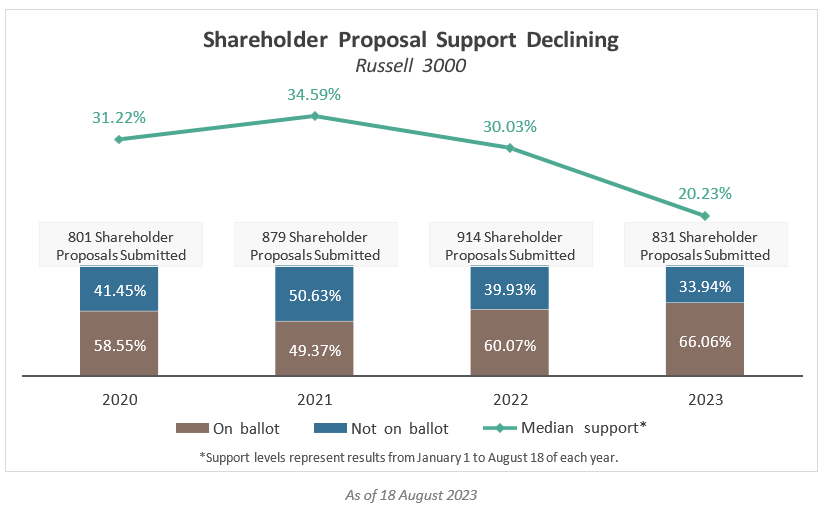

- Shareholder Proposal Support Declining

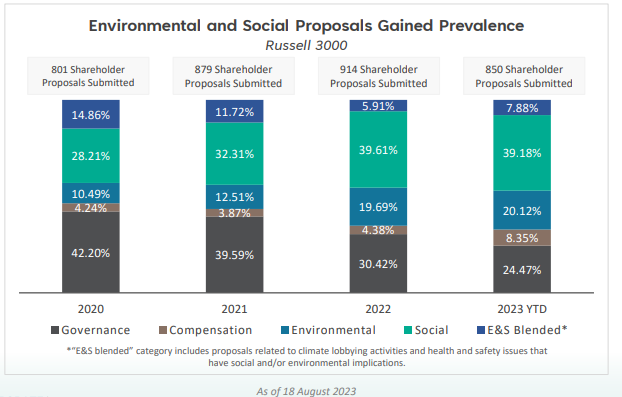

- Environmental and Social Proposals Gained Prevalence

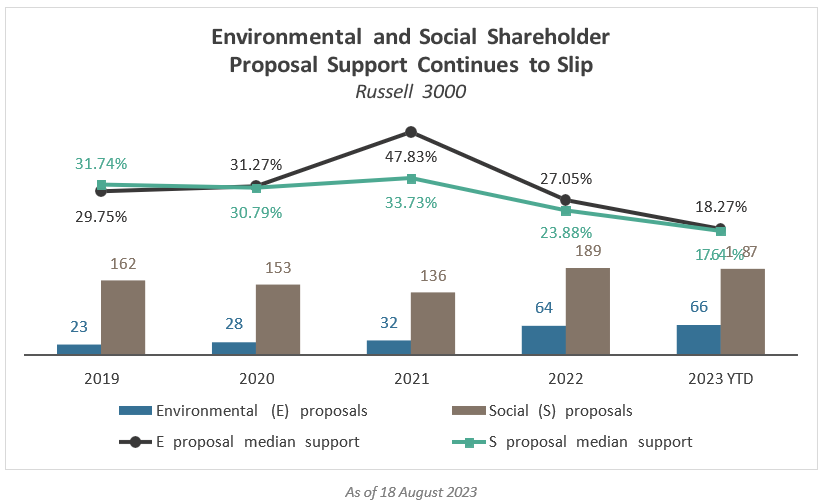

- Environmental and Social Shareholder Proposal Support Continues to Slip

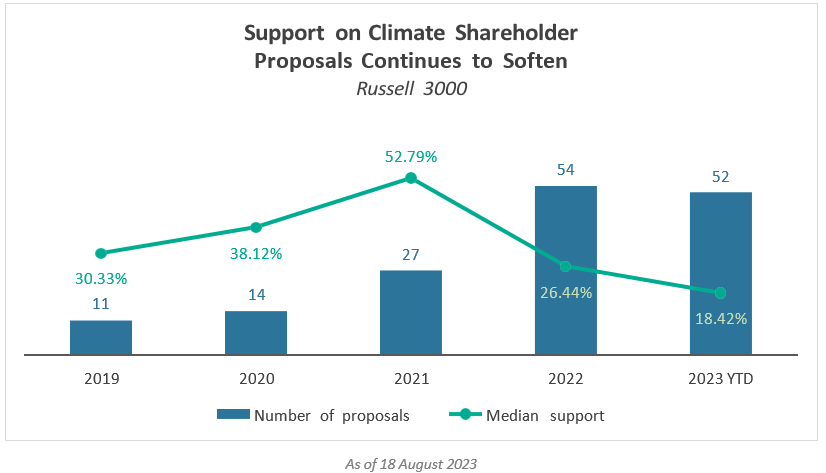

- Support on Climate Shareholder Proposals Continues to Soften

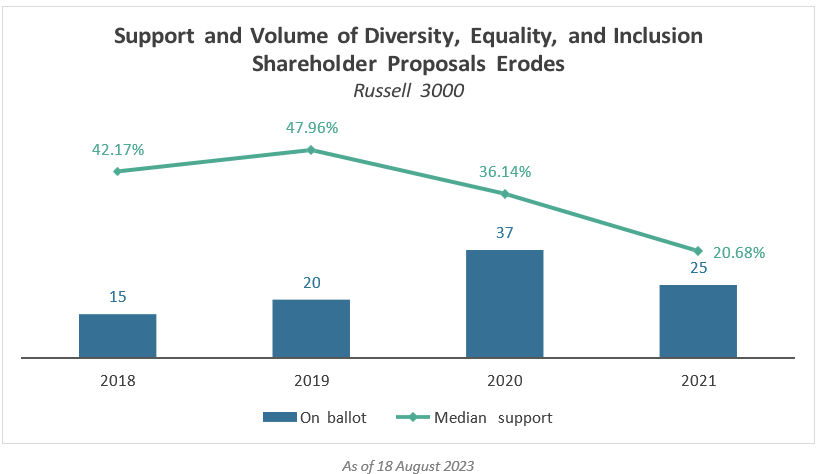

- Support and Volume of Diversity, Equity, and Inclusion Shareholder Proposals Erodes

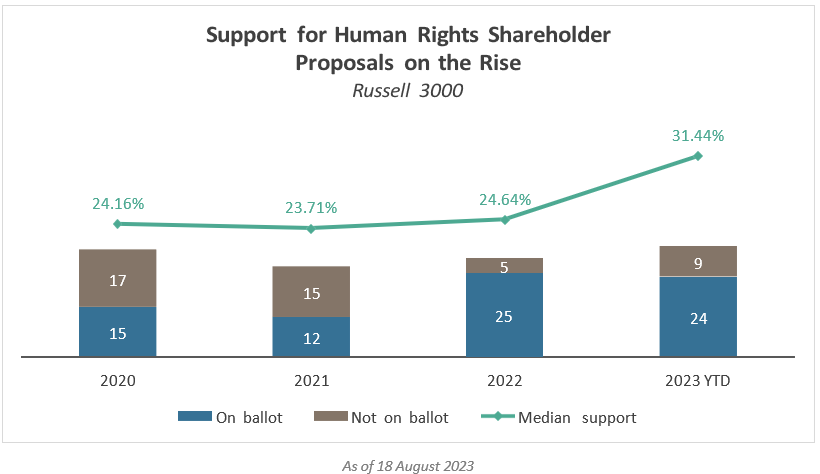

- Support for Human Rights Shareholder Proposals on the Rise

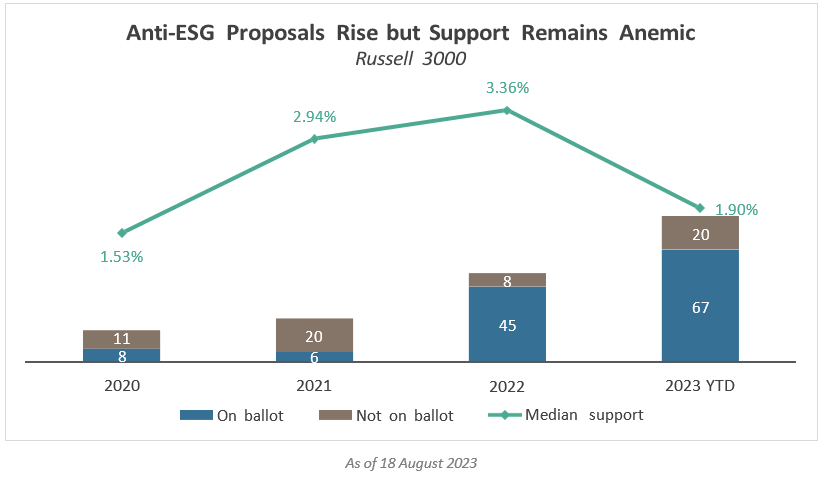

- Anti-ESG Proposals Rise but Support Remains Anemic

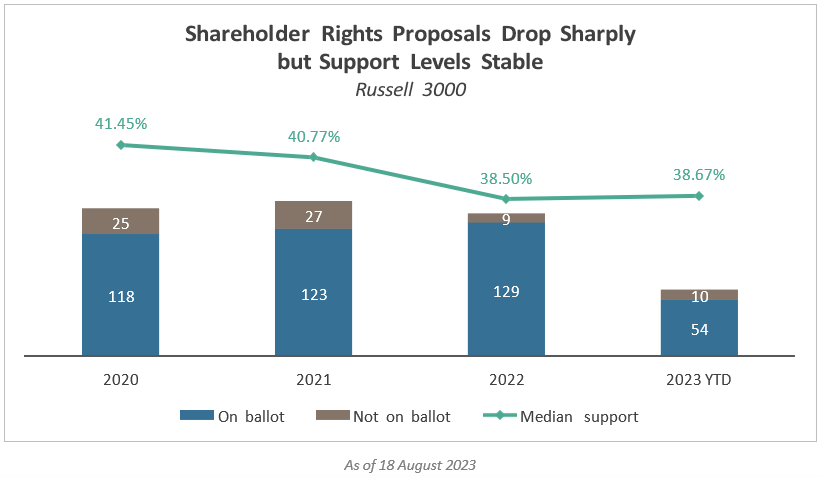

- Shareholder Rights Proposals Drop Sharply but Support Levels Stable

In 2023, total shareholder proposals slipped and the percentage landing on the ballot also fell, while median vote support fell by almost one-third compared with last year.

As a proportion of the total, environmental and social shareholder proposals increased from just over one-half to over two-thirds since 2020.

Median support for environmental proposals drops further, now down by almost two-thirds since 2021 when popularity peaked.

Climate-related proposals are on the rise since 2021, in sharp contrast to the median support level.

Diversity, equity, and inclusion proposals dropped from their 2022 peak as support wanes significantly.

Human rights proposals are back up to 2020 levels while support rose meaningfully in the past year.

Anti-ESG shareholder proposals continued to rise sharply despite minimal investor support.

Shareholders Rights proposals have dropped significantly, down by more than one-half since 2020.

Print

Print