Nathan Atkinson is Assistant Professor at the University of Wisconsin Law School. This post is based on his recent article that was published in the Yale Journal on Regulation.

In 2015, the Environmental Protection Agency entered a settlement with ASARCO LLC for violations of the Clean Air Act at a copper smelting plant in Hayden, Arizona. ASARCO was required to spend an estimated $150 million to come into compliance with regulations that ASARCO had been in violation of since 2005. Moreover, the firm had to pay a $4.5 million penalty, and was required to spend $9 million on supplementary projects including paving a local county road and performing lead-based paint abatement in nearby towns.

Was ASARCO’s noncompliance with the Clean Air Act profitable even after paying penalties? After all, the company avoided ten years of compliance, and during this period the firm did not have to spend resources complying with the law, and the savings could be paid to investors or profitably reinvested in other areas of the business.

This case exemplifies a common practice in corporate misconduct: firms fail to comply with the law, and years later are faced with an injunction to come into compliance and a fine for noncompliance. In a recently published paper in the Yale Journal on Regulation, I explore whether compliance with environmental laws is profitable even after paying penalties.

Recognizing that firms may benefit from delayed compliance, EPA policy stipulates that “any penalty should, at a minimum, remove any significant economic benefits resulting from noncompliance.” To calculate a penalty, the EPA uses a specially-designed computer program to estimate the benefits from noncompliance. The program uses data on construction costs, inflation, and firm finances to estimate how much the firm saved by delaying compliance. In the case of ASARCO, the program provides an estimate of how much money ASARCO saved by delaying compliance from 2005 until 2015.

Using the EPA’s data and reconstructing the EPA’s computer program, I find that the fine imposed on ASARCO should have been at least $32.5 million. That is, because ASARCO was able to avoid compliance costs for a decade, the firm profited. And given that ASARCO only had to pay a $4.5 million fine and $9 million in supplementary projects, the firm profited at least $19 million net of paying fines, according to the EPA’s own methodology (in the paper I detail how this number is likely a gross underestimate of the true profit).

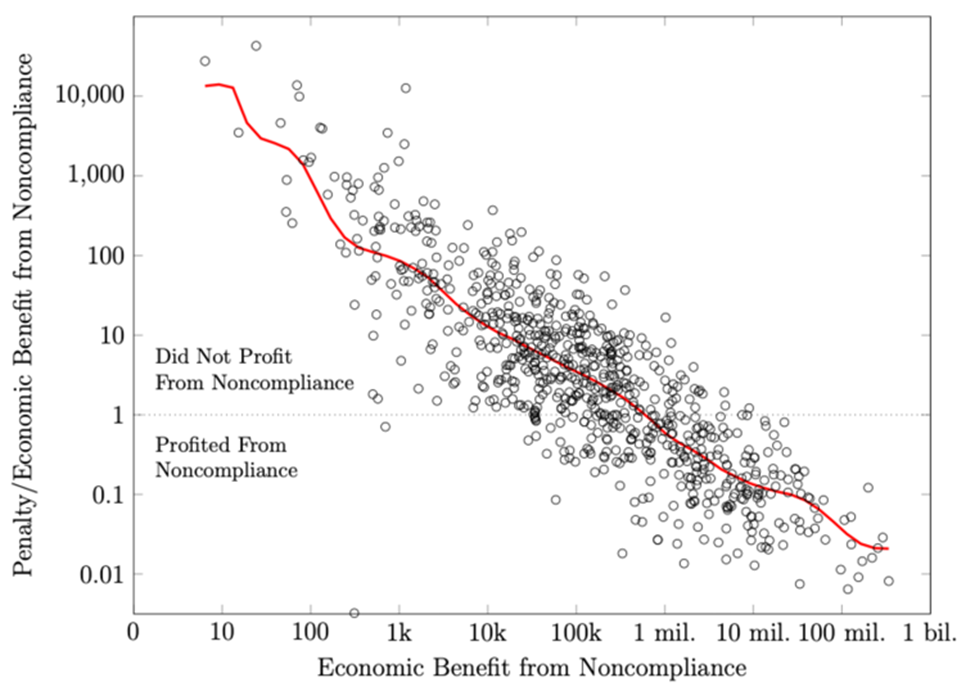

In my paper, I apply the same method to the universe or judicial enforcements of Clean Air Act Violations by stationary sources emitters (e.g. power plants, refineries, and other large industrial sources). The results are conveyed in the following figure:

Each point is an enforcement. On the horizontal axis is the economic benefit from noncompliance, as calculated using EPA data and methods. The vertical axis is the ratio of the penalty imposed to the economic benefit of noncompliance. The EPA’s policy of removing the economic benefit from noncompliance means that the ratio should never fall below 1—the horizontal dashed line—otherwise the firm will have profited from noncompliance, even after paying fines.

The results are striking. Using the EPA’s method and the EPA’s data, I find that 36% of firms benefit from noncompliance, even after penalties are imposed. Moreover, the data reveal that the results are skewed by the size of the violation. While small violations tend to have relatively large fines, almost all of the largest violations are profitable even after fines are imposed. Indeed, for the largest violations, the penalty is a small fraction of the benefit from noncompliance. In aggregate I estimate that EPA fines would have to be increased at least five fold in order to achieve the EPA’s goal of removing the economic benefits from noncompliance.

In the paper I show that the aggregate profitability is robust to alternative assumptions about firms’ cost of compliance or duration of noncompliance. Nonetheless, the EPA’s calculation of the economic benefit depends further on price indices and assumptions about firms’ cost of capital. In principle, these values can help tailor the calculation of the economic benefit to the individual firm, but this also complicates the calculation. For this reason, the EPA further stipulates rule of thumb that “the economic benefit of delayed compliance may be estimated at: 5% per year of the delayed one-time capital cost for the period from the date the violation began until the date compliance was or is expected to be achieved.” That is, instead of the complicated computer program, assume that firms can make 5% per year on any money saved by noncompliance.

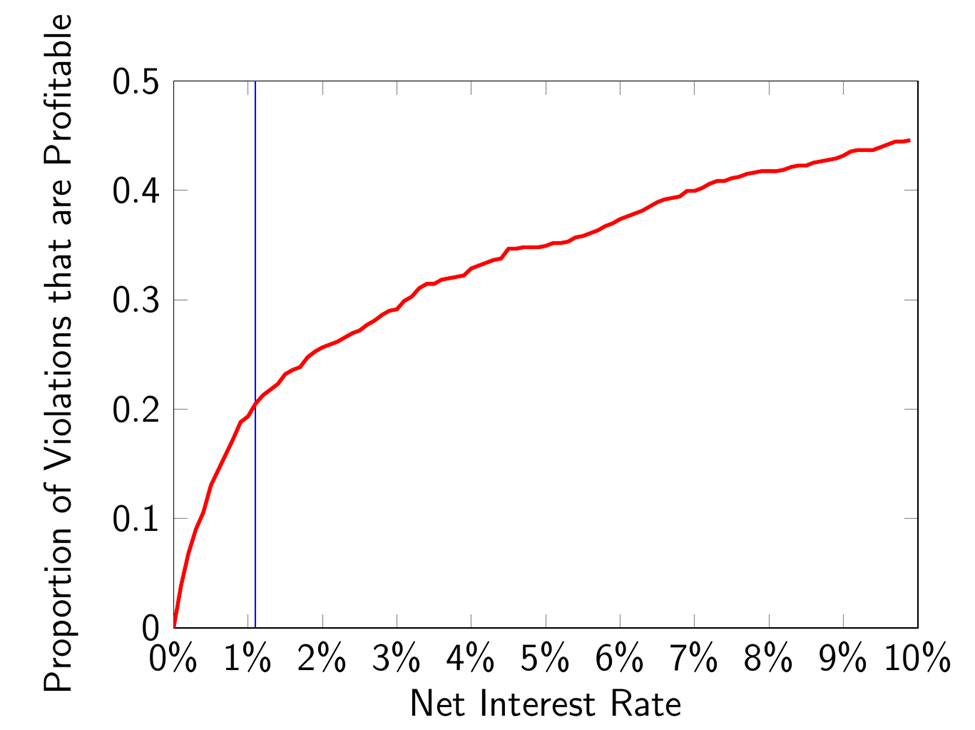

The following figure plots the proportion of violations that are profitable as a function of a constant rate of return. The plot is centered around the EPA’s rule-of-thumb interest rate of 5%. This shows that over 30% of violations are profitable at a 5% rate of return. As in the main analysis, these profits are concentrated at the largest violations.

The blue vertical line at 1.1% indicates the net interest rate at which the net profit from all violations is equal to zero. That is, if the EPA is achieving its goal of eliminating the economic benefit from noncompliance, then we must maintain the assumption that firms have net returns of at most 1.1% per year from any money saved from noncompliance.

Taken together, this research reveals that there are large economic benefits from noncompliance with environmental laws. In aggregate firms profit from noncompliance, and almost every large violation is profitable—often extremely so—even after paying penalties. To the extent that penalties remain low, we should expect firms to pollute with relative impunity.

Print

Print