Harrison G. Hong is the John R. Eckel, Jr. Professor of Financial Economics and Edward P. Shore is an Economics PhD student at Columbia University. This post is based on their article forthcoming in the Annual Review of Financial Economics. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value add Value? (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita; and Corporate Purpose and Corporate Competition, (discussed on the Forum here) by Mark J. Roe.

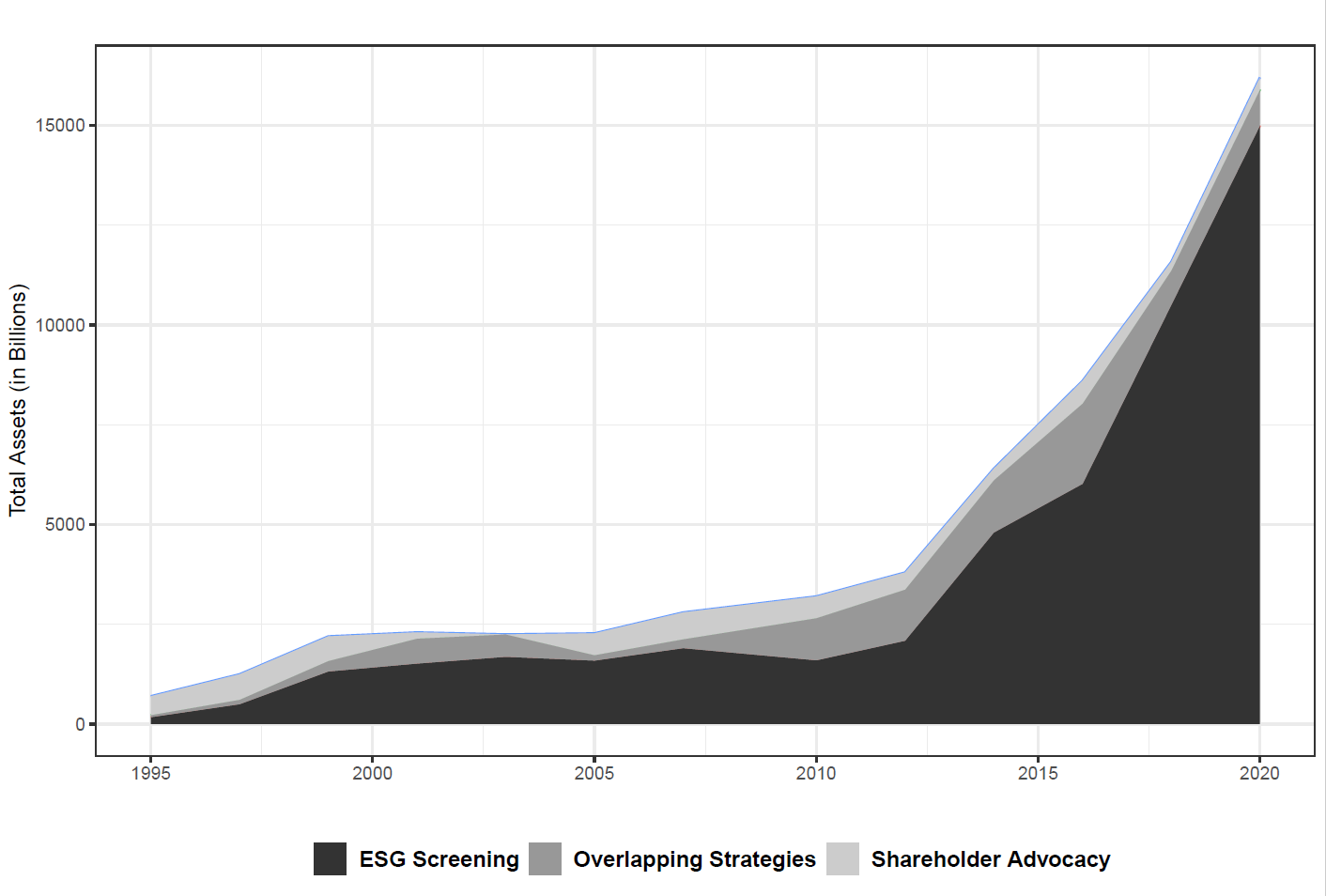

In recent years, shareholder support of Corporate Social Responsibility (CSR) has increased considerably. The period from 2012 to 2020 saw a threefold increase in assets under management considering environmental and social impacts (left panel of Figure 1). Investment strategies now often involve screening for compliance with specific environmental and social standards. Additionally, the frequency of majority-supported shareholder proposals on firm responsibility has risen, from a mere fraction pre-2015 to about 20% currently (right panel of Figure 1). In contrast, governance-focused proposals, previously passing at a 30% rate, now see less than 20% approval. Do these shifts reflect shareholders’ willingness to pay for the mitigation of societal externalities such as global warming — a non-pecuniary motive? Or do shareholders increasingly believe investments in CSR will increase in shareholder wealth— a pecuniary motive?

Figure 1: Comparative Analysis of Sustainable Investing and Shareholder Proposal Trends in the United States. Left panel illustrates the growth in Environmental, Social, and Governance (ESG) investing, mainly through ESG incorporation, as reported by US SIF’s 2020. Right panel depicts the trend of the pass rate of Governance and Socially Responsible Investing (SRI) proposals over time, based on data from the ISS database, highlighting the yearly proportion of passed proposals in both SRI and Governance categories

In our Annual Review of Financial Economics survey (Hong and Shore (2023)), we organize evidence from the literature into seven tests to evaluate whether shareholder motivations for supporting CSR are pecuniary or non-pecuniary in nature. For instance, under the non-pecuniary view — where investors are willing to pay for mitigation by accepting a lower dividend yield — firms that are responsible should command a lower cost of capital than the market (i.e. a greenium) and portfolios of responsible shareholders should underperform the market. Other tests examine which types of institutions (universities versus hedge funds) are more likely to own responsible stocks or involve the use of survey evidence to solicit shareholders’ willingness to pay.

Aggregating the results of these tests presents notable challenges. These include the growth nature of responsible stocks, variability in factor models used for analysis, and concerns about omitted risk factors, as financially healthy firms are more likely to engage in CSR. Additionally, discrepancies in responsibility ratings across different data vendors add to the complexity of measuring firm responsibility.

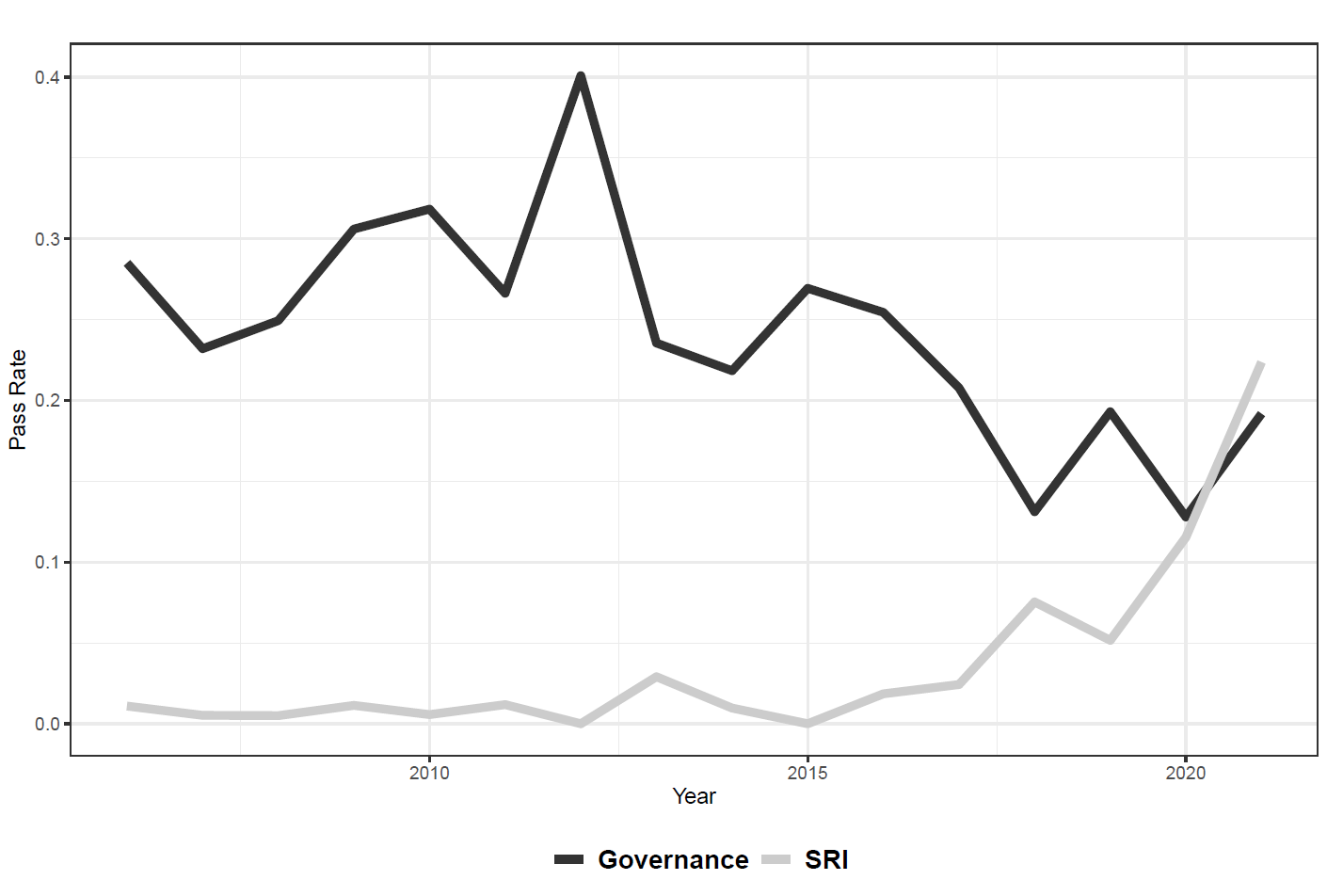

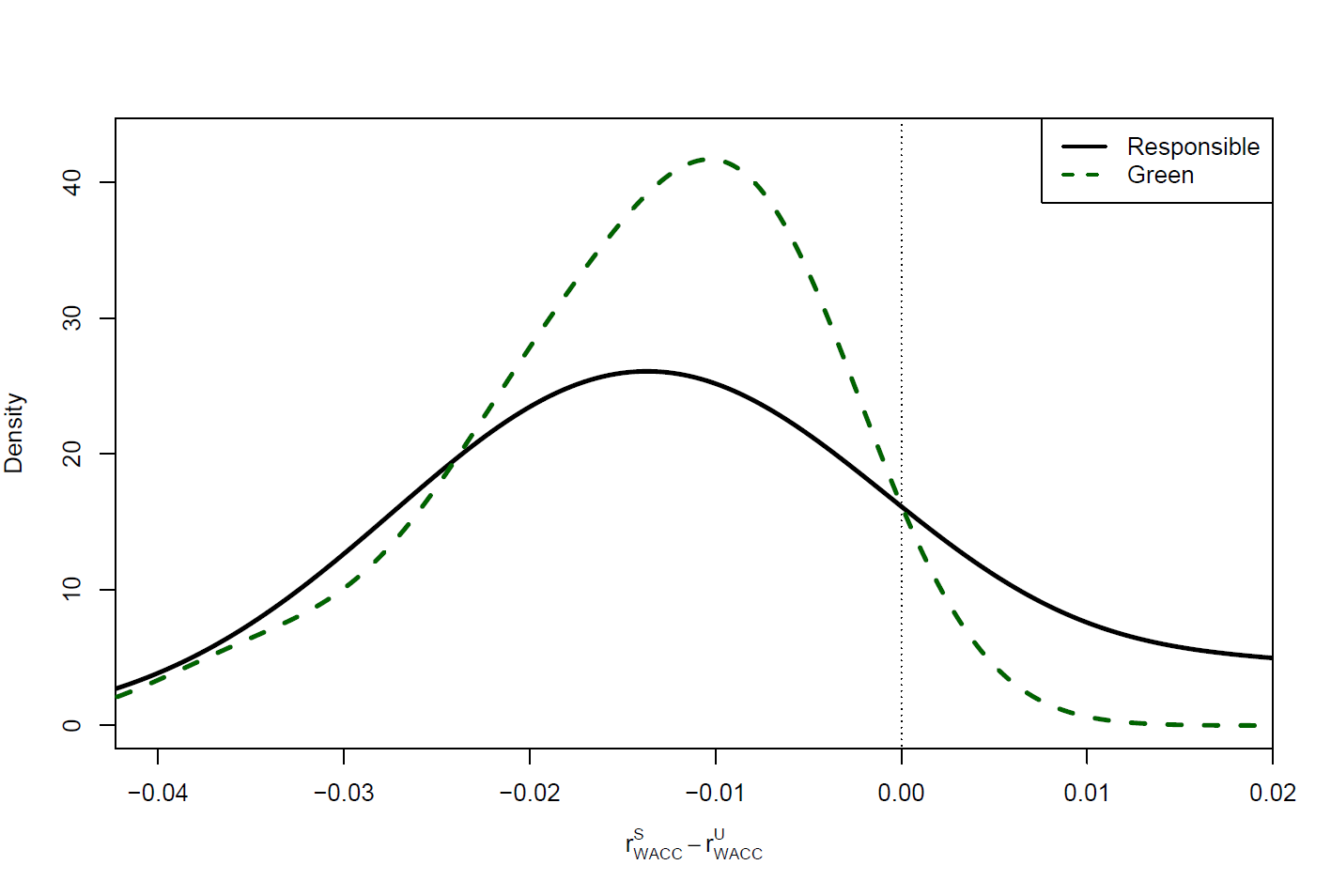

Despite these hurdles, and the diversity in study periods and data types, we find that a significant fraction of research published in top finance journals (approximately 80.3% of the studies we document) supports the non-pecuniary view of shareholder support of CSR. For instance, in Figure 2 we find that green (sustainable) firms have a mean weighted average cost of capital (WACC) premium of -1.41% relative to unsustainable firms, with a standard deviation of 0.86%. When broadening the scope to encompass all responsibility mandates more generally, we reveal a similar mean value, albeit with a higher standard deviation. These findings, derived from risk-adjusted return differences, underscore the financial impacts of sustainability in corporate finance.

Figure 2: This figure shows a binned kernel density estimate of the size of the weighted average cost of capital (WACC) premium achieved by `sustainable’ vs. `unsustainable’ firms, i.e. rS – rU. We calculate the WACC premium using the equity return premia estimates provided in the articles we discuss in our paper.

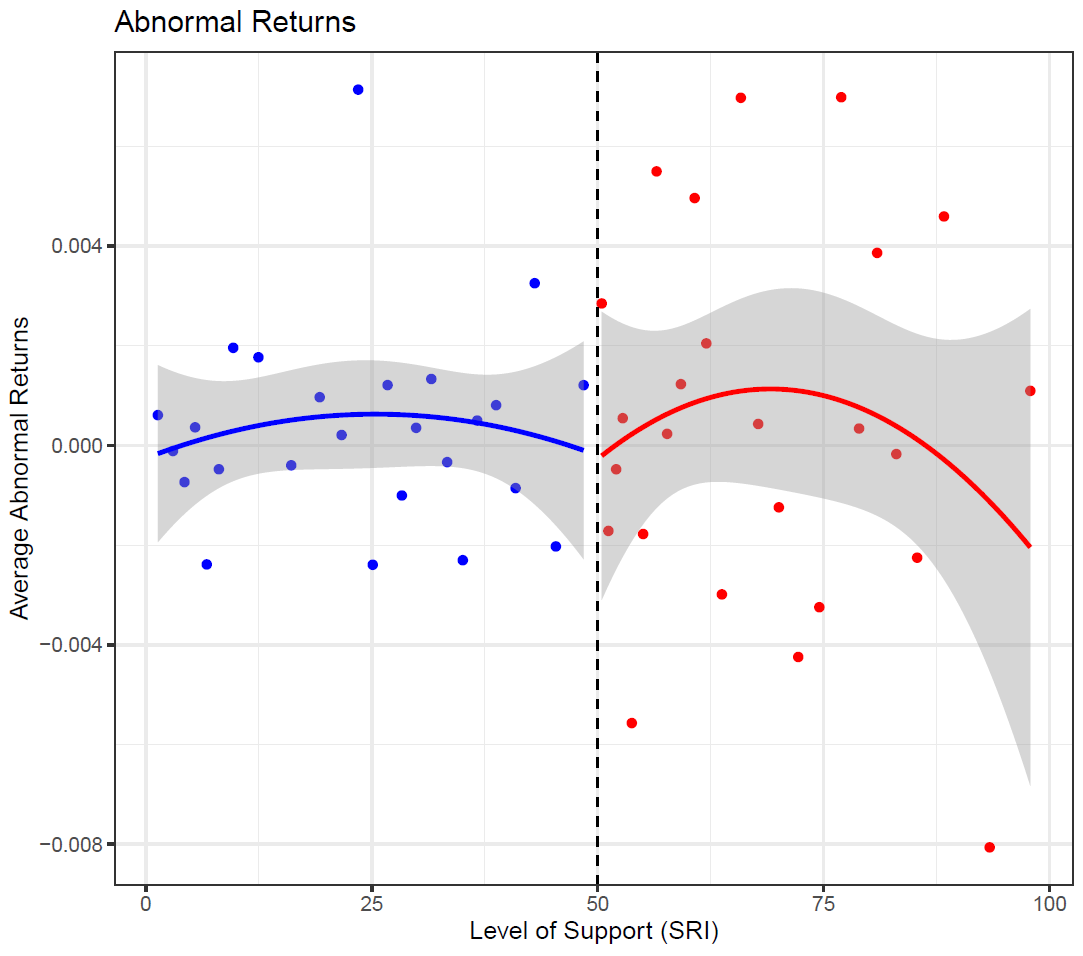

One of the few tests where we find unsettled results is concerning shareholder proposals. As we demonstrated in the figure above, responsibility proposals are much more likely to pass after 2015; but whether they enhance shareholder value is unclear as earlier studies use data before 2015 — when few proposals are near the majority threshold. Hence, we conduct an empirical analysis using recent data. We employ a Regression Discontinuity Design (RDD) to assess the impact of Socially Responsible Investing (SRI) proposals on firm value. Specifically, we compare the abnormal returns (adjusted for standard factors, like the market) of firms that just pass the SRI proposal to those that just fail to pass.

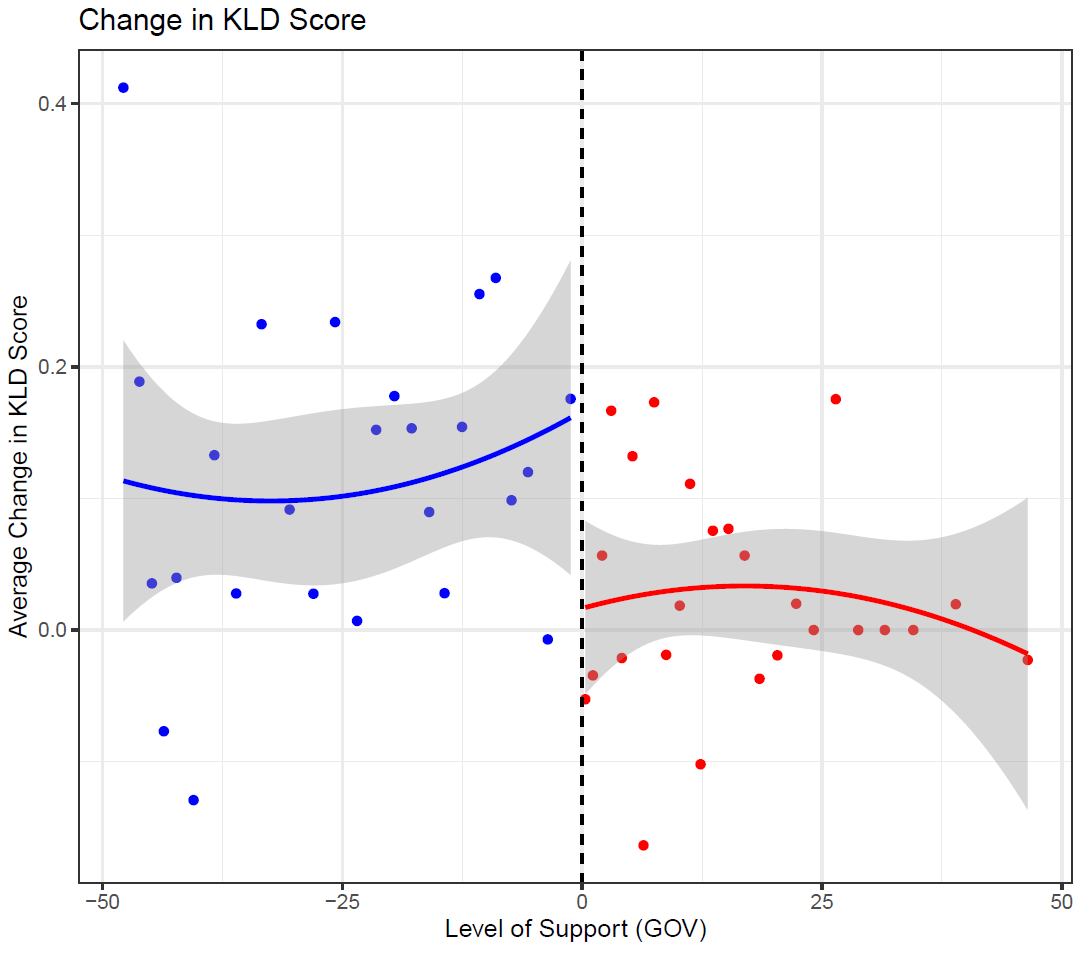

In the left panel of Figure 3, we find no evidence that these recent proposals increase firm value, i.e. there is no jump in the abnormal returns going across the majority threshold. In the right panel of Figure 3, we examine what happens to a company’s responsibility scores when a governance proposal passes. Governance proposals are typically viewed in the corporate finance literature as being pecuniary in nature and value enhancing. Using the same RDD design as in our analysis of SRI proposals, we find that governance proposals significantly reduce ESG scores from MSCI-KLD. This result, which incorporates recent data up to 2021, further supports the narrative that CSR proposals are not value-enhancing and their proposal by shareholders are non-pecuniary in nature.

Figure 3: Visualizations of regression discontinuity analysis on the impact of shareholder proposals on firm outcomes. Left panel: Comparison of abnormal returns for firms passing versus not passing Socially Responsible Investing (SRI) proposals. Right panel: Comparison of annual changes in MSCI-KLD ESG Scores for firms based on the outcomes of Governance (GOV) proposals.

In summary, our survey finds that shareholder support for CSR is predominantly driven by non-pecuniary motives. CSR driven by a non-pecuniary motive has a number of implications for corporate finance, corporate governance and capital markets. For instance, the size of the greenium from Figure 2 can influence capital structure and investment decisions. Shareholders’ embrace of non-pecuniary CSR also fundamentally impacts the shareholder-value maximization thesis of corporations in modern capital markets.

Print

Print