Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain (discussed on the Forum here) by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita; How Twitter Pushed Stakeholders Under The Bus (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Anna Toniolo; and Corporate Purpose and Corporate Competition (discussed on the Forum here) by Mark J. Roe.

Growing Gaps in 2023

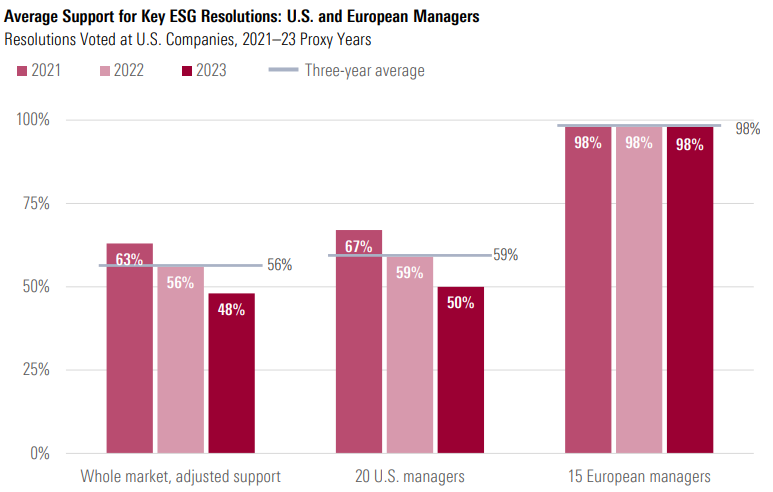

The gap between U.S. and European managers voting on ESG grew in 2023, but there’s also greater divergence among U.S. managers.

U.S. Managers’ Falling Support for Key ESG Resolutions Contrasts Sharply With Those in Europe

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Chart shows data for proxy years ended June 30. Averages of U.S. and European managers are the equal-weighted arithmetic mean for each period.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Chart shows data for proxy years ended June 30. Averages of U.S. and European managers are the equal-weighted arithmetic mean for each period.

Analyzing voting records on key shareholder resolutions in the United States can give a good indication of an asset manager’s stance on environmental, social, and governance topics more broadly. This is due to the prevalence of such resolutions in the U.S., addressing a wide range of topics. There were 227 key ESG resolutions in the last three proxy years: 53 in 2023, 102 in 2022, and 72 in 2021.

Adjusted support for these resolutions fell below 50% for the first time in over three years in 2023, amid manager concerns that U.S. shareholder resolutions were becoming inappropriately prescriptive. Our previous research noted that the two largest voters, BlackRock and Vanguard, were instrumental in that decline. This new study indicates that many other large U.S. managers also pulled back their support for ESG proposals, even well-supported ones.

The U.S. managers’ voting record stands in stark contrast to that of European managers. We examined the voting records of 15 of the largest European managers of equity funds, finding that their support for key ESG resolutions was consistently very high, averaging 98% over the last three proxy years.

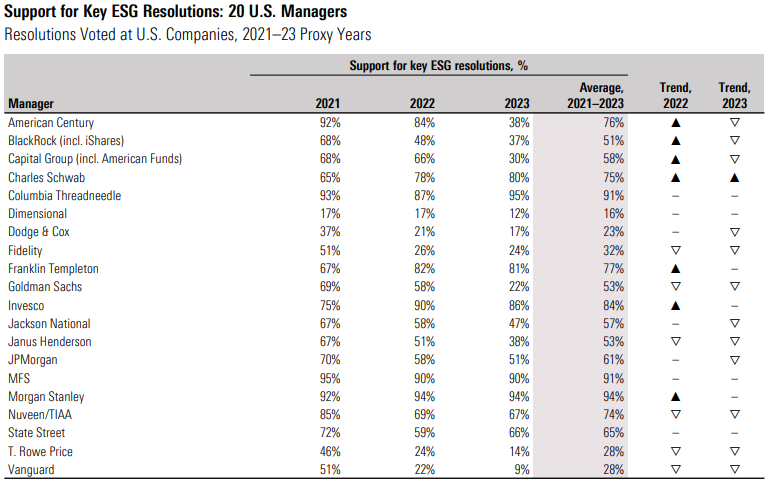

Most of the Largest U.S. Managers Now Show Negative Trends in Support for Key ESG Resolutions in 2023

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Chart shows data for proxy years ended June 30. Support trends are shown as rising (▲) if support in the most recent proxy year is more than 5 percentage points above the three-year average, falling (▽) if it is more than 5 percentage points below, and stable (–) otherwise.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Chart shows data for proxy years ended June 30. Support trends are shown as rising (▲) if support in the most recent proxy year is more than 5 percentage points above the three-year average, falling (▽) if it is more than 5 percentage points below, and stable (–) otherwise.

This study examines the voting record on key ESG resolutions for the 20 largest U.S.-based managers of equity open-end and exchange-traded funds on a worldwide basis. According to Morningstar Direct, these managers run over USD 17 trillion of equity fund assets between them, and all are among the global top 30 managers of equity funds. The table opposite shows not only the 20 managers’ percentage support for key ESG resolutions for each of the last three proxy years but also the three-year average. We observed a sharp change in the 20 managers’ trends in support in the most recent year. (We assess the trend by comparing a manager’s support in the most recent year to the three-year average.)

The 20 managers showed a mix of support trends in the 2022 proxy year. Seven managers showed a positive trend in support for key ESG resolutions, while six showed a negative trend. The remaining seven showed stable trends. By 2023, most of these managers showed a falling trend in support. Only one, Charles Schwab, maintained its positive support trend. Twelve firms turned negative in 2023, three of which showed a positive trend the year before: American Century, BlackRock, and Capital Group.

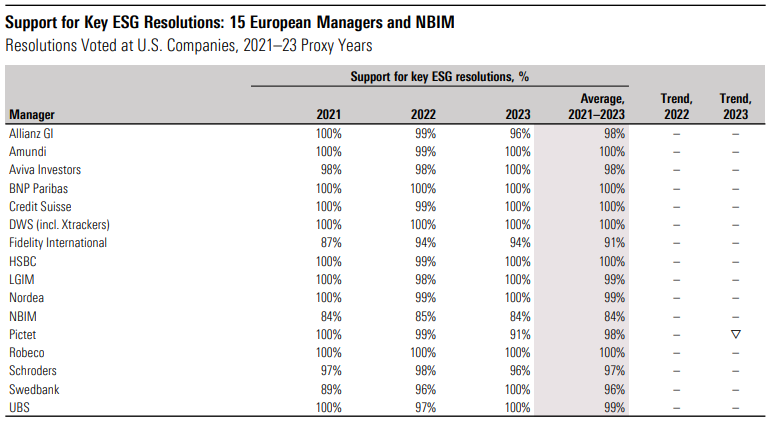

Large European Managers Consistently Show Very High Support for Key ESG Resolutions

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Chart shows data for proxy years ended June 30. Support trends are shown as rising (▲) if support in the most recent proxy year is more than 5 percentage points above the three-year average, falling (▽) if it is more than 5 percentage points below, and stable (–) otherwise.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Chart shows data for proxy years ended June 30. Support trends are shown as rising (▲) if support in the most recent proxy year is more than 5 percentage points above the three-year average, falling (▽) if it is more than 5 percentage points below, and stable (–) otherwise.

For comparison, we have also assessed the voting record on key ESG resolutions for 15 of the largest European managers. According to Morningstar Direct, these managers run close to USD 2 trillion of equity open-end and exchange-traded funds, with all but one in the global top 50. All 15 managers show average support for key ESG resolutions above 90%, both in 2023 alone and over the last three years. Among these, only Pictet displays a falling trend in support, but the firm still maintained a 91% level of support for key ESG resolutions in 2023.

The data also includes Norges Bank Investment Management, the Norwegian sovereign wealth fund manager. Although NBIM doesn’t manage any open-end funds or ETFs, it is the largest European shareholder of U.S. equities and frequently a top-10 shareholder at U.S. companies. This makes it an important contributor to overall voting outcomes on key ESG resolutions. NBIM supported 84% of key ESG resolutions over the last three years—high, but slightly lower than the European managers. However, because of a recent change in its policy, NBIM’s support for environmental key resolutions increased to 100% in 2023.

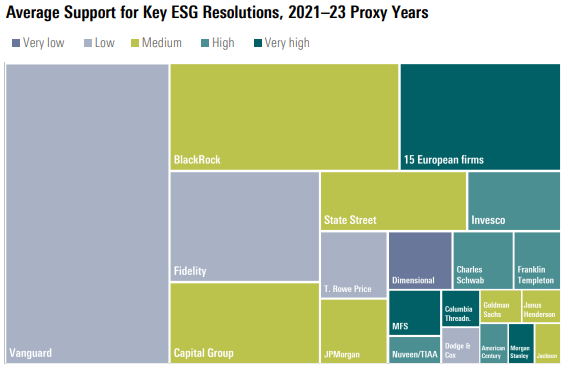

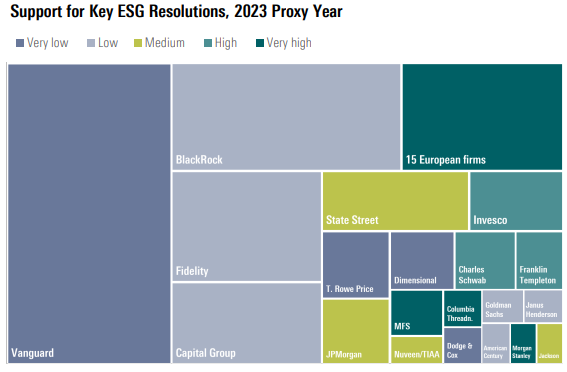

Vanguard, BlackRock, Capital Group, and T. Rowe Price Are the Largest U.S. Managers With Declining Support

The graphics below visually represent the changes in voting trends. The graphic on the left shows the 35 firms’ average support for key ESG resolutions over the last three years; the chart on the right shows the same data for the 2023 proxy year. The block sizes represent equity fund assets for each firm as of Nov. 30, 2023. A much higher proportion of the equity fund capital at the U.S. managers now shows Low (<40%) or Very Low (<20%) support for key resolutions— three-year view, rising to 78% on a one-year view. Vanguard, BlackRock, Capital Group, and T. Rowe Price are the largest firms with a clear decline in support in 2023. Vanguard and T. Rowe Price moved to Very Low from the Low support category. BlackRock and Capital fell to Low from Medium. The 15 European firms, grouped together on the chart, show constant, very high support.

Source: Morningstar Direct, Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Charts show voting decisions captured for proxy years ended June 30. Block sizes represent worldwide open-end and exchange-traded equity fund assets as of Nov. 30, 2023. See Appendixes 1, 3, and 4 for further information.

Source: Morningstar Direct, Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Charts show voting decisions captured for proxy years ended June 30. Block sizes represent worldwide open-end and exchange-traded equity fund assets as of Nov. 30, 2023. See Appendixes 1, 3, and 4 for further information.

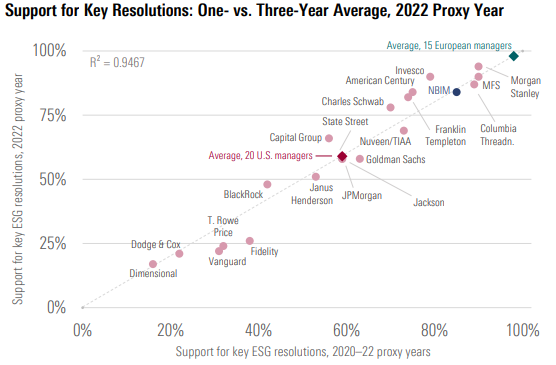

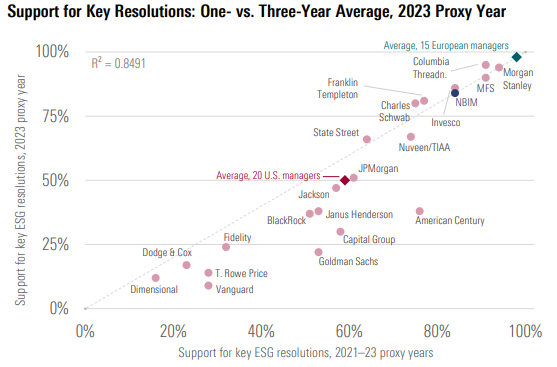

U.S. Managers’ Historic Voting Trends Became a Less Reliable Guide to More Recent Decisions

Plotting this information on a scatter chart shows that the U.S. firms’ ESG voting trends aren’t only diverging from European managers—they’re diverging from each other, too. The charts plot support for key ESG resolutions in the most recent proxy year (vertical axis) against the three-year average (horizontal axis), both in 2022 and 2023. Firms with a declining support trend appear below the dotted line (on which both values are equal).

American Century showed the steepest trend decline. Goldman Sachs, Capital Group, BlackRock, and Janus Henderson also showed significant falls. We see that voting patterns in 2023 are more dislocated compared with recent history and between different firms. (The steep fall in the R2 value illustrates this.) However, we think this is likely to be temporary, as the U.S. firms look set to maintain their current voting trends.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Charts show voting decisions captured for proxy years ended June 30. Support levels are calculated at fund level for U.S. managers and at firm level for European managers. See Appendix 1 for further information. The European firms’ average includes an estimate for the 2020 proxy year based on managers’ public disclosures.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Jan. 2, 2024. Note: Charts show voting decisions captured for proxy years ended June 30. Support levels are calculated at fund level for U.S. managers and at firm level for European managers. See Appendix 1 for further information. The European firms’ average includes an estimate for the 2020 proxy year based on managers’ public disclosures.

The full report is available to read here.

Print

Print