Heidi Welsh is the Executive Director at the Sustainable Investments Institute. This post is based on her recent Si2 memorandum.

Introduction

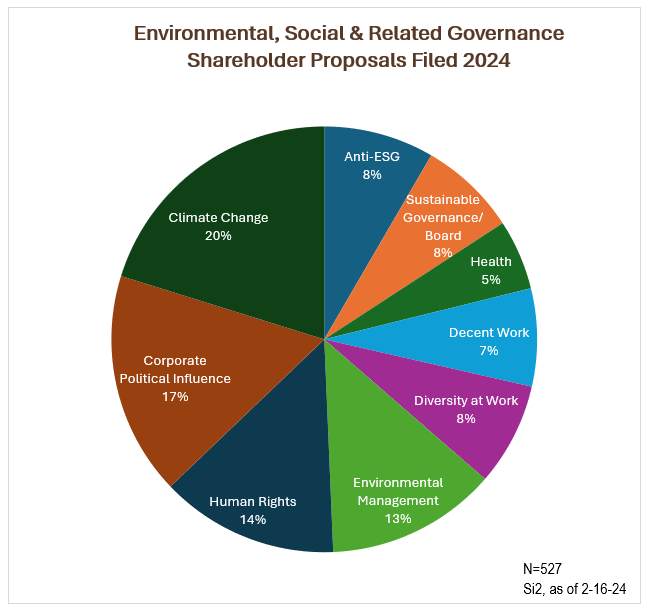

Proponents as of mid-Feburary 2024 had filed at least 527 shareholder resolutions on environmental, social and related sustainable governance issues for the 2024 proxy season. This is down by only a few from 536 last year at the same time. It still seems possible the total will reach the 630-year-end total of last year.

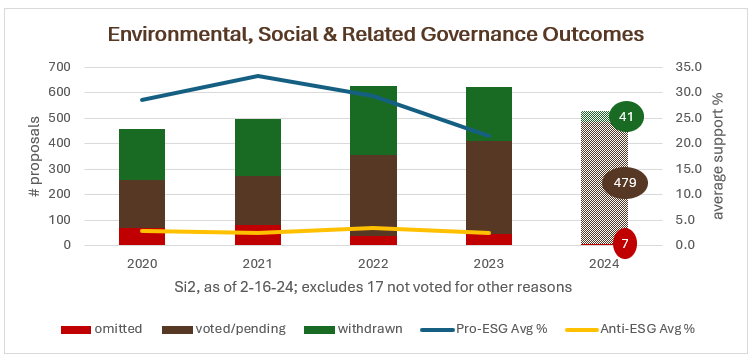

Support levels have fallen substantially on average in the last two years, largely because the biggest asset managers have stopped supporting as many proposals. Some of the chill clearly comes from attacks on the use of investment strategies that consider social and environmental matters in business, underscored by related litigation that is testing out novel legal theories that could upend shareholder rights and decades of investor engagement. Some also comes from the types of resolutions filed, as well as the context of a surging U.S. economy and fallout from global conflicts that has pushed energy prices higher. Proposals that favor changes that would strengthen corporate approaches to societal responsibility continued to drop are still earning far more than those that oppose such efforts by a wide margin, but the pro-ESG average did fall to 21.5 percent last year, down from an apex of 33.3 percent in 2021. The relatively small number of anti-ESG proposals still have gained no traction, though, and last year saw their already low average fall to only 2.5 percent.

The number and proportion of voted proposals rose in 2022-23, even as fewer were omitted given a policy shift at the Securities and Exchange Commission (SEC) in late 2021. Companies last year responded to the new SEC approach by lodging fewer challenges, but in 2024 their efforts to exclude proposals surged back to earlier levels. As of mid-February were just seven omissions and 94 challenges remained to be decided—compared with 12 omitted and 76 to which SEC staff had not responded in mid-February 2023.

Available information for 2024 suggests the shift to fewer withdrawals may continue. Further, this report counts about 70 proposals that are not described in detail, more than double the figure from 2023, as participants keep their engagements out of the public eye. As of mid-February, a total of 479 proposals on social and environmental issues were slated for votes, up from 450 at the same point last year. The final vote count will be lower as proponents withdraw and some are omitted.[1]

Key shifts for 2024: Some of the most notable new proposals ask companies about their use of artificial intelligence (AI), while a few also reference new recommendations to protect biodiversity and nature. Otherwise, the broad strokes of previous years are similar—with about one-third on environmental topics; about 30 percent about diversity, decent work and human rights; and 17 percent on corporate political influence. Anti-ESG proposals make up just under 10 percent of the total but this is likely to increase because these proponents do not share their proposals before voting begins in the spring. The health slice is smaller, since last year’s surge in proposals about reproductive rights has diminished (5 percent for all on health). A few more about sustainable investing practices address proxy voting this year (8 percent of the total).

The 2024 breakdown by topic appears on the pie chart below and a chart further down shows longer-trend trends over the decade.

Regulation: As of mid-February, the SEC was poised to release its long-awaited climate disclosure rule, which may reshape how companies report on greenhouse gas emissions and strategies, but breaking news on February 23 was that the new rule would exclude Scope 3 indirect emissions, in an apparent win for those opposed to more disclosure. Still stalled is a final rule on further amendments to SEC rules—proposed in 2022—about whether a shareholder proposal has been implemented, if it can be resubmitted and if it is duplicative.

Litigation: There has been no ruling on the lawsuit filed in 2021 by the Interfaith Center on Corporate Responsibility, As You Sow and James McRitchie; multiple postponements mean any decision will not affect this proxy season. Elsewhere, cases from right-wing groups that include the National Center for Public Policy Research, the dominant anti-ESG filer, are arguing that the entire shareholder proposal process is illegitimate and should be stopped. These cases also will not affect the current proxy season but may have some impact later on. In another novel move, Exxon Mobil sued investors who filed a climate change proposal. The proponents withdrew their resolution but Exxon is continuing its litigation in an effort to prevent future shareholder resolutions]. Whether the case continues remains in the hands of a judge in Texas.

Overview and New Issues in 2024

This section provides a look at the main issues raised for the topics in Proxy Preview 2024, with special attention to new developments. The analysis throughout the report is based on what is requested in the resolved clauses of resolutions, sometimes considering contextual information offered in the rest of a proposal. Additional proposals will be filed as the year progresses but the shape of the 2024 spring annual meeting season is now clear. Data are as of February 16, with a few updates near the end of February for meeting dates and SEC challenges.

Environmental Issues

Climate change remains the biggest single group of proposals—106 focus directly on corporate strategy and disclosure—plus 12 more on corporate political influence about climate policy and seven about related executive pay links and retirement plans. Another 68 proposals seek action and reports about more general environmental issues, a jump from only 38 last year the focus has shifted to include more about animal welfare. When taken together, a total of just over 190 proposals raise interrelated issues about corporate impacts on the environment, compared with about 160 last year and 180 in 2022.

Climate change: The volume of proposals specifically on climate change has fallen to 106, down from an all-time high of 122 at this point last year that ultimately reached 139 by year’s end 2023. The heavy focus on greenhouse gas emissions targets and reporting from last year remains. The biggest set is 42 concerned with climate transition planning and reporting, while 21 more are narrowly about emissions targets and reporting. Another 25 are more focused on climate change impacts and 17 concern carbon financing.

Transition planning and reporting—In about three dozen proposals proponents are mixing and matching requests to report on company responses to climate change, mentioning different GHG emission types and time-frames. An assessment new to this report in 2024 catalogs how often these elements come up, given the roiling controversy about how much companies can and should do. Few of the 33 now pending are resubmissions but four that are earned significant support last year (RTX, Constellation Brands, Lockheed Martin and Texas Roadhouse). So far proponents have withdrawn eight of these proposals.

Among the withdrawals is one from Arjuna Capital and its filing partner, Follow This, at Exxon Mobil. The two asked the company to accelerate efforts to curb all types of emissions but the company filed suit against them in a Texas federal court, using an untested theory holding they had no right to file proposals given Exxon’s belief that it was filed due to a supposed political agenda rather than financial impacts on shareholder value. While the proponents withdrew the proposal and have asked the judge to dismiss the case, the company is trying to keep it alive. Exxon on February 21 argued the case should proceed because the proponents still could file their proposal again. It also is asking for legal fees and wants to be granted access to documentation from all shareholder activists about any plans to file future proposals. Proponents are concerned about a possible precedent-setting decision and joined in a letter to Exxon’s board on February 7 saying the suit is “a serious threat to shareholder rights.”

Emissions targets—Twenty-one proposals ask only for adopting GHG reduction targets and reporting; all are still pending. A new angle among these comes from As You Sow, which wants a commitment from Valero to emission reduction targets that do not include “carbon offsets and avoided emission,” and SEC staff are still mulling a response to the company’s argument that its current policies make the resolution moot. Also new is a proposal at retailers Tractor Supply and Walmart from Green Century seeking data on emissions from the “Use of Sold Products,” broken down by product category; both companies are arguing the proposal is too specific and addresses issues outside their control.

Impact reports—New among the 22 proposals about particular kinds of corporate impacts related to climate change—regarding deforestation, water, a “just transition” and other issues—are some about biodiversity. Five companies face questions invoking September 2023 recommendations from the Task Force on Nature-Related Financial Disclosures and ask for a “biodiversity impact and dependency assessment.” Half of the impact proposals are at a mix of companies and about climate-related socio-economic changes, referencing the International Labor Organization’s “just transition” guidelines about layoffs, workers and communities. Eko, the former SumOfUs, has withdrawn a new proposal at United Airlines about the potential financial impact of fees that could be imposed on the aviation industry to mitigate developing nation climate impacts.

Climate finance—For the last few years, proponents have tried to get financial firms to pull back from financing the expensive long-term oil and gas infrastructure projects that are extracting the world’s last fossil fuel reserves, but with mixed results and little support for setting limits. The big new idea in shareholder resolutions on this front in 2024 comes from New York City Comptroller Brad Lander, who is proposing disclosure by five big banks about a “Clean Energy Supply Financing Ratio” that would unveil what proportion of total financing goes to low-carbon energy compared to that for fossil-fuel projects. A challenge at the SEC from JPMorgan Chase has yet to be decided. Another new resolution asks the big banks for reports on what portion of their net-zero sector-aligned portfolios have companies with “credible” targets. These sorts of resolutions last year earned north of 30 percent, despite their specificity.

Amalgamated Bank wants General Electric to report on the risks vs. opportunity of continued capital investment in carbon-intensive energy products, while As You Sow wants Chevron and ExxonMobil to report about divested high-carbon assets, reflecting concerns that these transactions could simply shift the problem to other owners, as the Glasgow Financial Alliance for Net Zero warns.

Environmental management: The number of environmental management proposals has reached an all-time high, with 68 resolutions—up from only 38 last year. Just over half address agricultural practices, including many new ones on farm animal welfare, while the rest are about waste and pollution with new iterations on hazardous materials as well as those from the past on plastics.

Agriculture—In 2023, animal rights groups started filing more proposals about farm animal welfare and there are even more in 2024. A new group called The Accountability Board has teamed up with the Humane Society of the United States (HSUS) with resolutions that ask a range of specific questions about how food animals are treated in restaurant and retailer supply chains. Some are specific to pigs and egg-laying chickens. One notable new proposal at Amazon.com is about enslaved monkeys used to harvest coconuts in Thailand but a vote is uncertain given a procedural challenge. But many of these resolutions may see votes. HSUS has reached a substantive agreement for changes in pig housing at Hormel Foods, though, and previous votes about farm animals have led to changes in corporate policies; this means more agreements and withdrawals may come this year.

Six proposals from the Physicians Committee for Responsible Medicine at three airlines and five health care companies do not seem likely to see votes since the SEC already has agreed that a request for offering plant-based meal options at two of the recipients is an ordinary business matter. The commission decided the same thing last year on a slightly different version of the proposal.

Antibiotics and pesticides—Investors face fewer of these proposals in 2024, with only three on antibiotics, including one about compliance with the World Health Organization’s guidelines that aim to address the burgeoning threat of microbial resistant diseases. Just two other proposals ask for reports on pesticides, down from years past. All are still pending.

Plastic—Proponents including As You Sow, Green Century and others have been pressing plastics producers and companies who use plastic packaging to cut back on this packaging to establish a “circular economy” where more is reusable and actually recyclable; a new investor statement illustrates growing urgency. They are back with the same requests this year at nineteen companies; to date there have been two withdrawals and seven are resubmissions, with four of them having earned more than 25 percent last year. Two newly ask about tobacco product waste and an individual proponent wants Kraft Heinz to report on its compliance with recycling labeling laws in California.

Hazardous materials and mining—After long absence, proponents have returned to the problems caused by mining, asking about risks connected to titanium extraction, in addition to the growing problem of deep-sea mining at five companies, including one that requests a moratorium from Tesla, as called for by nearly 50 companies. Three face challenges at the SEC.

New proposals also address worker health and safety and the environment, asking Align Technology about chemicals in medical equipment and Sempra about fallout from a major natural gas leak in California. One more dual-concern resolution is about the impact of a Utah quarrying project at Granite Construction.

Social Issues

Corporate political influence: Political influence proposals are still split roughly in three parts, with 30 about election contributions, 34 on lobbying and another 25 about inconsistencies between corporate policies and the viewpoints of politicians and groups who receive corporate money. Several proponents are underscoring their concern about political risks to democracy and it is far from clear that simply adopting board oversight and reporting on contributions is sufficient to deliver real accountability, which the Center for Political Accountability (CPA) considers in a report out last December called Corporate Underwiters and the Democracy Gap. A nascent SEC disclosure rule prompted a new Si2 report, also at the end of 2023, about The Corporate State Lobbying Black Hole, explaining the gap in mandatory reporting that is particularly acute at the state level.

Oversight and disclosure—About one-third of the lobbying proposals are resubmissions and 31 are pending as of mid-February, with two withdrawn; resubmissions earned for the most part high previous support. However, all but two of the CPA’s election spending proposals are at new targets who scored poorly on the group’s CPA-Zicklin Index; the resubmissions are at Caesars Entertainment (42 percent last year) and Stryker (36.8 percent).

Proposals last year began promoting adherence to CPA’s Model Code about disclosing third-party recipients of company money and what they spend have fared poorly in proxy season, with votes of 8 percent or less and this year there are just two. Undisclosed “dark money” spending by non-profit groups using corporate funds remains a core challenge to political accountability; few companies report.

Values congruency—Two dozen proposals are still asking companies to explain why their policies on climate change, reproductive health, voting rights and other matters clash with the policy goals of some recipients. Twelve are about climate change and 13 on other issues; new recipients make up about half of each group. Votes last year on these resolutions were mixed, but three of the resubmission are at companies where they were fairly strong—Boeing (36.8 percent), Walt Disney (36.3 percent) and Wells Fargo (32.3 percent).

Decent work: Fair pay and working conditions proposals continue to diminish, with only 41 this year and down from a high of 74 two years ago. Arjuna Capital, Proxy Impact and James McRitchie continue to ask about gender and racial pay disparities; eight of 14 resubmissions received support ranging up to 47 percent last year. New is the idea that employers and employees would benefit from a “living wage,” with proposals at six retailers. There is an increased focus on worker health and safety, with 11 resolutions asking for third-party audits on the subject, up from five last year. Four pending proposals about workplace bias raise specific concerns about past misconduct at Chipotle Mexican Grill, Goldman Sachs, Tesla and Wells Fargo.

Diversity in the workplace: Five of 22 pending proposals seeking more disclosure on diversity program metrics are resubmissions; the request is the same as last year, when it reached 57.3 percent at Expeditors International of Washington and is pending again. A few mostly unnamed companies have requests to release EEO-1 data, while NorthStar Asset Management is continuing its push for “fair chance hiring” of the formerly incarcerated at a few firms.

Once upon a time it appeared that equal rights for LGBTQ people had become safely enshrined in U.S. law. Now that right-wing politicians seek to erode these rights, a few shareholder proposals have cropped up to defend them. They seek reports or policies on queer-friendly corporate actions that including providing health benefits at International Paper, Lennar and J.B. Hunt Transport Services.

Ethical finance: Oxfam America has returned to energy companies asking them to adopt the Global Reporting Initiative’s (GRI) Tax Standard. The resubmission earned in the mid-teens last year at Chevron, ConocoPhillips and Exxon Mobil and new to Kosmos Energy.

Health: Resolutions again ask about reproductive health and drug pricing but add a new concern about non-sugar sweeteners.

Reproductive health and limits—Investors last year faced a large new array of proposals about health, many prompted by the June 2022 U.S. Supreme Court decision that struck down decades of federal abortion protections. But there are fewer resolutions this year and most have yet to be described publicly. Their content is similar to that in 2023, however, with many asking about risks to companies when employees do not have access to care, or how companies will cooperate with law enforcement agencies to implement new state bans and restrictions. A new proposal at Walgreens Boots Alliance asked about filling prescriptions for the abortion and miscarriage care drug mifepristone—whose fate will be determined anew by another Supreme Court decision later this year; it earned 7.8 percent in January. Other new proposals ask Coca-Cola and McDonald’s how growing health care legal restrictions in some of the states where they do business affected them—encompassing abortion and maternal health as well as transgender care.

Pharmaceuticals—ICCR members have resubmitted a specific proposal considered last year at six large drug companies, seeking a report on how the patent process affects access to care. All are pending and three of the votes at these companies were about 30 percent last year, at AbbVie, Merck and Pfizer.

Other health—A handful of new proposals seek no-smoking policies at three gaming companies, question the safety of non-sugar substitutes at Coca-Cola and PepsiCo and again raise concerns about adequate staffing at HCA Healthcare, which employs far fewer care workers than its peers.

Human rights: There are 20 fewer proposals about human rights in 2024, but a significant new issue is AI (19 proposals on this and the digital world). Just under two dozen ask about various human rights problems and risks, including some mention the ongoing wars in Ukraine and between Israel and Hamas. Far fewer (17, down from 32) address racial justice, well below the 50 filed in 2021. But trade union rights remain on the proxy season agenda, with 13 proposals. Common ground on human rights is hard to find and relatively few of these proposals tend to be withdrawn. Omissions also are fairly unusual.

Risky business—Amidst the well-trodden landscape of proposals seeking policies and reports on human rights risks, this year there are three proposals at big drug companies that put access to health care in a human rights frame, referencing the Pharmaceutical Supply Chain Initiative that promotes responsible supply chain practices for drug and health companies. The through-line for all these proposals is a request for more robust due diligence and risk assessment.

New proposals call out specific instances where companies are exposed to armed conflict or repression, in China, the Middle East, Russia, Ukraine and elsewhere—with slightly different requests at JPMorgan Chase, Marriott International, Mondelez International and TripAdvisor, as well as a resubmission at Texas Instruments regarding the use of its semiconductors in armed conflicts. The focus is on foreign military sales to Israel and Saudi Arabia at RTX, the former Raytheon. Foreign entanglement with repression through DNA testing of ethnic minorities in China prompted a resolution that was withdrawn at Thermo-Fisher Scientific, in a new proposal. The right-wing National Legal and Policy Center also will see early votes at Apple and Starbucks on its proposal about China and Russia, where it sees the companies’ policies being inconsistently applied.

Domestic child labor and the use of immigrant children to clean meat packing plants came up at Tyson Foods and the vote was 12.2 percent in February.

Racial justice—As noted, only 17 proposals ask companies about policies and practices to address racial justice; nine were pending as of mid-February and seven of these generated high votes before. They point to specific issues, such as support for police associations and racial profiling (AT&T and Walmart), but also reference discrimination against Black, Asian and female employees (Marriott).

Labor rights—Mostly led by trade unions are 13 proposals that locate company respect for international norms in a domestic context and seek related reporting—continuing an important new push started last year. As with many other proposals in 2024, the proponents cite specific cases of misconduct that sparked the proposals; all are pending. A new resolution from SOC Investment Group also asks Delta Air Lines about how much it has spent to oppose unionization drives but the company says the proposal is too vague; the SEC has yet to respond.

Digital content and AI—An entirely new issue for proxy season is raised in 13 proposals about AI. Mostly filed by the AFL-CIO, the main proposal asks primarily tech and media companies (the latter new to the conversation) about the ethical principles they are employing to guide the use of AI in their businesses. Four more mention AI in ongoing critiques of Alphabet and Meta Platforms about misinformation and human rights impacts. Both these companies again have proposals about child safety in the digital world. A question about global political risks that may be exacerbated by online content hosted by Meta is new. As You Sow also has a new proposal asking Meta to consider banning political ads in the runup to the U.S. general election in November to combat divisiveness and misinformation.

Sustainable Governance

In the face of a barrage of attacks about considering ESG factors in the investment process, twice as many resolutions this year ask for reports on the subject from investment firms, in a new surge—much of it about proxy voting. But shareholder proponents have lost much of their interest in resolutions about board committee composition and reporting, filing only 13 such resolutions—down from 21 last year and 57 five years ago. Many large investors continue to consider their votes in director elections as a key part of their ESG engagement strategies, with some notable campaigns about this promoted by Majority Action, although these are beyond the scope of this report.

Board structures: New this year are AFL-CIO resolutions at four railroads that ask for explicit board oversight of staffing and safety, in the wake of the ruinous February 2023 train derailment in Ohio. Trillium Asset Management also wants explicit board oversight of AI at Alphabet and Amazon.com.

Investment process: The main reason overall support for environmental and social proposals has fallen is because of voting shifts by the “Big Three” asset managers—BlackRock, Vanguard and State Street Global Advisors, although other factors also are in play. With the political winds from the right in the United States blowing hard—or at least noisily—against the idea that ESG considerations are legitimate business matters, the Big Three have reversed course from their brief foray into more support a few years ago. They have had to contend with federal and state legislative subpoenas, threats of legal action from state financial officers, and the potential loss of business from some customers. In response, shareholder proponents have filed new proposals.

New resolutions ask the biggest money managers to report on how their proxy voting practices may produce risks if they vote against the values and preferences of clients. Others ask specifically about how clashes between proxy votes and commitments elsewhere consider diversity and address climate risks. James McRitchie, who has long pursued corporate governance reforms, asks Bank of America and Citigroup about offering customized proxy voting for clients.

Executive pay links: State pension officials in New York and Illinois, as well as As You Sow, are asking five utilities to report on pay ties to climate change metrics; the proposal is pending at Cummins, FirstEnergy, General Electric, Southern and WEC Energy.

Metrics: Just three proposals asks companies to provide generalized reports on sustainability issues; one so far has earned 5.7 percent at the family-controlled company Ingles Markets. A vote still seems possible at Chemed, which recently settled a fraud case for $75 million with the U.S. Justice Department; Boston Trust Walden wants to know how the company addresses material ESG risks.

Anti-ESG

Organizations who argue that ESG considerations are irrelevant to business have been filing shareholder resolutions for many years. It is only in the last two that they have picked up substantial support from politicians who have been trying to use ESG opposition to their political advantage. There is little popular support for such naked partisanship, however, and certainly none in the investment world when these ideas are made explicit. As noted above, these groups and their allies have nevertheless cast a chill on proxy season. Average support for anti-ESG proposals dropped last year to an abysmal 2.5 percent despite a surge to 53 votes, up from only eight in 2021. The Anti-ESG section at the end of this report provides a listing of the resolutions and examines the main players and their dark-money funding, while noting new proponents in 2024. One of the new players, the American Family Association, is categorized by the Southern Poverty Law Center as a hate group given its work to undercut the rights of LGBTQ people.

There are three main types of proposals from the right. One set argues that corporate efforts to reduce discrimination has the opposite effect, while another suggests that companies and their board members are hostage to left-wing political ideologues in a way that produces economic harm to shareholders. The final group is about climate change; these question the scientific consensus and seek to end corporate action to mitigate climate impacts and risks, arguing such efforts are futile and/or too costly. Threaded through the diversity and political influence proposals this year is a new, strong animus against queer people in general and transgender folk in particular.

As of mid-February, 38 proposals were known to be pending, two had been omitted and four withdrawn after SEC challenges. The SEC has rejected challenges at four firms, regarding app removals at Apple; transgender health benefits at Johnson & Johnson and Walt Disney; and charitable contributions also at Walt Disney. Two votes to date were less than 2 percent. More proposals are likely but the proponents have declined to provide information about their proposals.

Proposal Trends

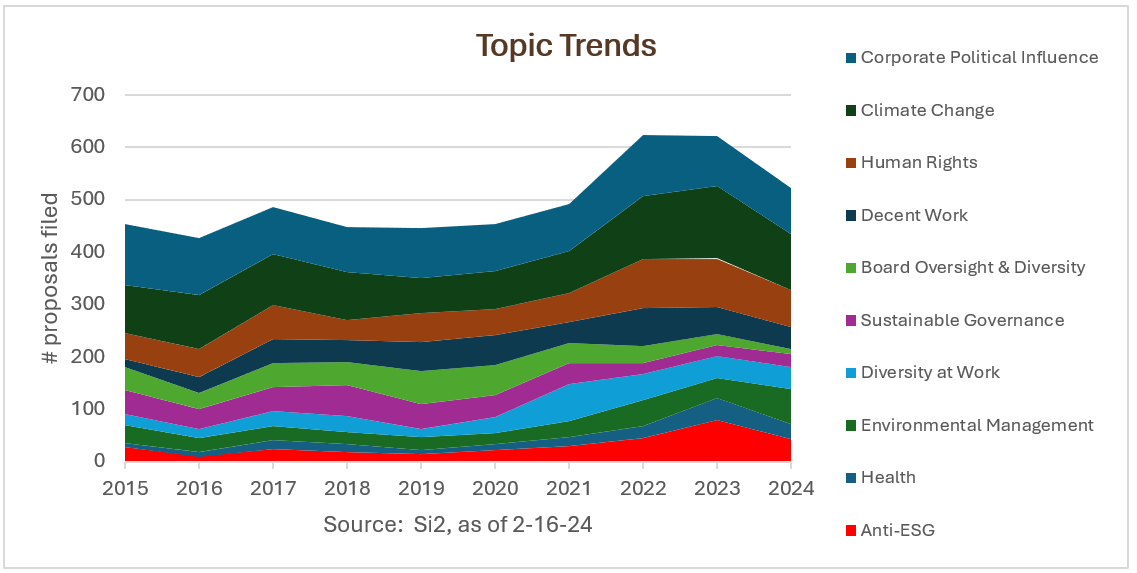

The charts below illustrate long-term trends for proposal filings. The first shows the dominance of political influence and climate change, a recent rise for human rights that now has fallen a bit, growth for decent work, a reduction in those about board diversity and oversight as well as fewer on sustainable governance, the persistence of diversity at work, an expansion for environmental management—and growth in anti-ESG proposals in the last few years.

The second illustrates shifts in the types of shareholder proponents who are lead proposal filers, with the most coming from socially responsible investing groups. (Because many faith-based investors of the Interfaith Center on Corporate Responsibility co-file with other proponents and may not be lead filers, the chart significantly undercounts their participation.) The foundation group is mainly As You Sow.

1Figures in this report exclude corporate governance topics not followed by Si2, which have receded in numbers for several years and generally get higher levels of support; anti-ESG groups also filed a small number of such proposals and earn slightly more for them than on environmental and social issues. Law firms tracking all proposals estimated last year there were about another 250 governance proposals filed beyond what Si2 tracks.(go back)

Print

Print