Subodh Mishra is Global Head of Communications at ISS STOXX. This post is based on an ISS-Corporate memorandum by Jacob McKeeman and Erica Chiorazzi.

The inaugural IFRS Sustainability Disclosure Standards were released by the International Sustainability Standards Board (ISSB) in mid-2023, designed to establish a global baseline for corporate disclosures. They are set to be adopted across several jurisdictions in the next few years. The new rules have garnered global support from 64 jurisdictions to date, with 19 national regulators already consulting on adoption of the recommendations under jurisdictional law.

The IFRS S2 Climate-related Disclosures rules are based on the architecture and recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). TCFD has defined climate reporting globally since the release of its recommendations in 2017. According to ISS data, 78% of companies on the S&P 500, 82% on the STOXX 600 and 98% on the FTSE 100 provide climate disclosures informed by TCFD. As an indication of its success, TCFD has now been disbanded, with the ISSB taking over the responsibility for monitoring the continued progress of climate-related disclosures.

Whilst based on TCFD, IFRS S2 significantly expands the scope and detail of disclosures required. To assess the concrete implications of this progression, ISS-Corporate performed a detailed cross-standard analysis, asking two key questions: What are the additional disclosures required under IFRS S2? And how well do exemplary climate reports align with IFRS S2?

Our analysis found that:

|

Transitioning from TCFD to IFRS S2: Raising the Bar

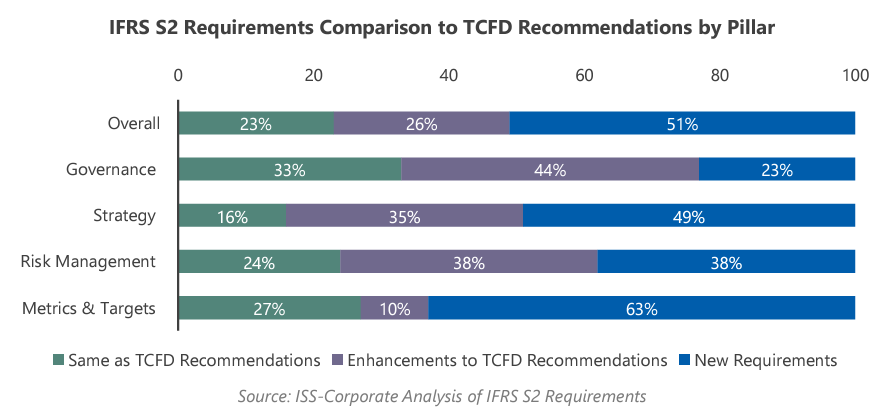

IFRS S2 is structured on the same four reporting pillars as TCFD: Governance, Strategy, Risk Management and Metrics & Targets. However, more than 50% of the (roughly 100) IFRS S2 cross-industry disclosure requirements are additional to TCFD, and another 26% are substantial advancements to the TCFD recommendations. Most of the new requirements are linked to information about Strategy and granular disclosure of climate Metrics & Targets.

The figure above depicts the key differences noted in ISS-Corporate’s analysis of the two standards, illustrating the substantial effort needed to align with IFRS S2’s climate-related disclosure rules. Companies can expect a considerable learning curve as they build enhanced disclosures to ensure compliance with the new climate reporting requirements.

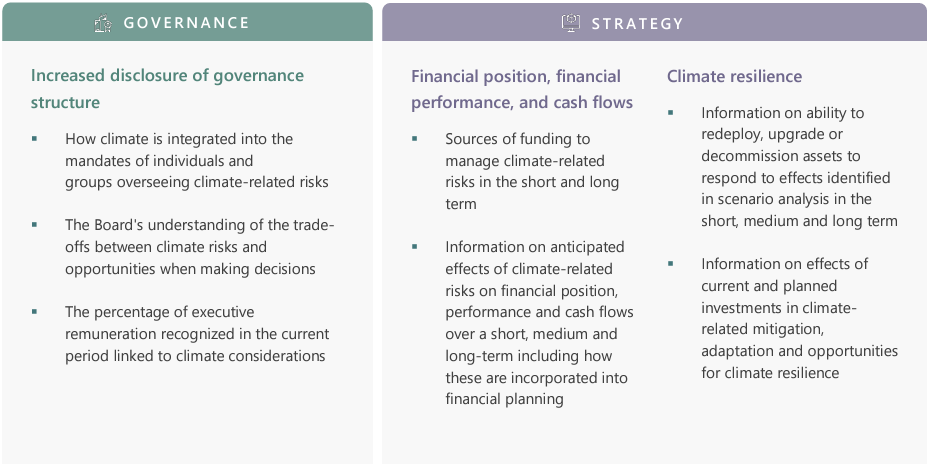

Examples of Advancements from TCFD to IFRS S2, by Pillar:

Despite being based on the same four reporting pillars as TCFD, IFRS S2 represents significant advancement in the scope and granularity of data points that need to be met by reporting companies. The four boxes below provide examples of the advanced disclosures required by each pillar.

Analysis of Two leading TCFD Disclosures against IFRS S2

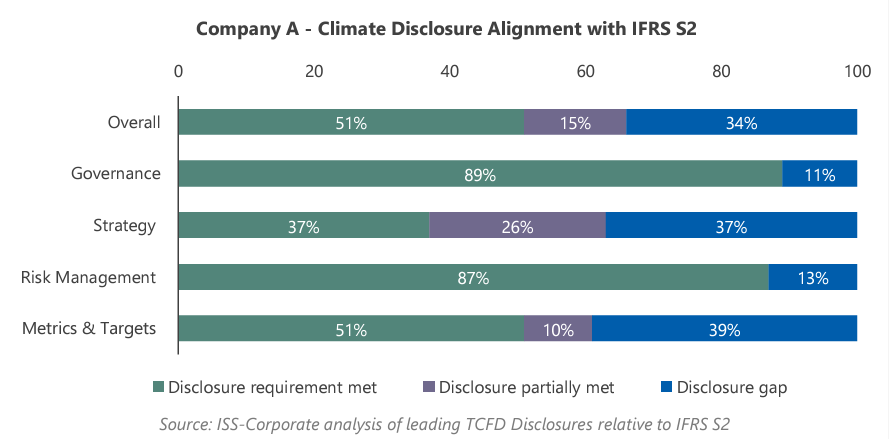

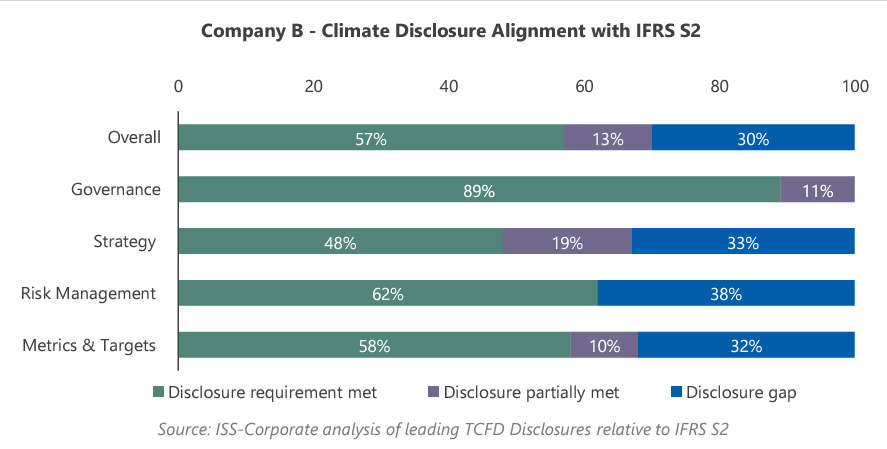

ISS-Corporate reviewed two industry-leading TCFD disclosures (FY 2022) and assessed them for alignment with IFRS S2. Both companies are large, listed multinational organizations that have been aligned to the TCFD recommendations for several years. Company A is in the pharmaceuticals sector, and Company B is in the fast-moving consumer goods (FMCG) sector. Our findings, summarized in the graphs below, are consistent with the cross-standard analysis discussed above.

Both TCFD disclosures displayed a reasonable level of alignment to the Governance and Risk Management pillars, with lower alignment against the Strategy and Metrics & Targets pillars. As discussed above when assessing the differences between TCFD and IFRS S2, the areas with the lowest alignment pertain to financial information, climate resilience, and additional metrics & targets.

Both leading climate disclosures were assessed as going beyond the requirements of TCFD, but this only resulted in an average of just over 50% alignment with IFRS S2. The results are set out below:

| This analysis reveals that achieving alignment with the IFRS S2 standard necessitates a substantial effort, rather than a fine-tuning of existing climate disclosures, even for companies already producing leading TCFD reports. |

Key Considerations for IFRS S2 Adoption

While IFRS S2 is aligned to TCFD in its structure and content, it represents a clear advancement in both scope and detail of disclosure requirements. Companies that currently align their climate disclosures to TCFD, and that expect to report under the IFRS Sustainability Disclosure Standards soon, should prioritize reviewing their existing disclosures to understand the additional effort required to transition from TCFD to IFRS S2.

The ISSB rules will be adopted by jurisdictions with differences in scope and timing. ISS-Corporate has produced a table (presented as an appendix to this publication) that summarizes the global adoption of the standards as of April 2024.

| Organizations awaiting the adoption of the rules in their region need to balance the opportunities for early adoption of the new standards with the operational considerations for achieving alignment, such as data availability, resources and strategic will. |

Organizations also need to consider the interoperability between other leading climate disclosure regulations such as CSRD, SEC Climate and the California Climate Bills, in what is a complex global environment. ISS-Corporate outlined the opportunities for early adoption and a discussion on regulatory interoperability in a recent article – “A Global Baseline? How to Navigate Interoperability Across Sustainability Reporting Rules.”

As part of that discussion, we outlined several opportunities for early adopters, including reputational benefits from increased transparency, differentiation from peers, attracting and diversifying investors, and attraction and retention of workforce. Several practical steps for companies that are transitioning from TCFD disclosures to the IFRS S2 standards would include:

- Performing an organizational mapping to understand when your organization is likely to be captured for ISSB reporting.

- Performing a mapping between your organization’s TCFD disclosure with the data points required in IFRS S2.

- Creating a strategy for data gathering to close any gaps that were identified.

- Considering the interoperability and efficiency across leading climate standards, e.g. CSRD, SEC Climate and the California Climate Bills, and avoiding duplication of effort.

- Communicating the new requirements throughout your organization and value chain, providing upskilling to key stakeholders and developing new processes to capture key data.

- Developing an implementation roadmap with milestones to deliver multiple reporting obligations efficiently.

Print

Print