Frederik Otto is Executive Director and Michael Reed is Director and Senior Advisor of the Institute for Sustainable Family Business at The Sustainability Board (TSB). This post is based on their TSB memorandum.

In 2019, when we began our reporting cycle, a mere 54 of the 100 largest global companies had clearly defined sustainability oversight, with 16% of directors being ESG-engaged. After seeing only modest gains in 2020, we wanted to understand how different ownership structures might affect sustainability preparedness of boards.

Our special report on publicly traded family business in 2020 revealed that sustainability oversight was lagging behind in comparison to our default sample of the Top 100 Forbes 2000 which contains mainly non-family businesses. However, directors on family boards were twice as likely to be engaged on sustainability than those in our default sample.

Fast forward to 2024 and we find three key themes that have evolved:

- Family businesses have raced to align their sustainability oversight, rising from 42% of boards with stipulated accountability in 2020 to 71% in 2024

- The sustainability engagement of family business directors is now level with our default sample at 43%, which points to a global engagement ceiling regardless of ownership structure

- Sustainability engagement of directors in family businesses is significantly more gender agnostic. In our default sample women are 64% more likely to be ESG-engaged, while on family boards it’s only 20%. Controlled on overall board and committee level, women are leading on the topic in both, but on family boards men are much more engaged.

These findings point to the continued leadership of family businesses in making sustainability core to their culture. The specific attributes of family businesses can help explain the reasons for their leadership. They can be nimbler, and keep decision making and execution on their vision, close.

The element of control can be distinguishing, particularly when considering long-term opportunities and risks. Many non-family businesses may have aspirational visions towards social and environmental issues but are constrained by unaffiliated shareholders seeking more immediate financial gain. Family businesses tend to think in generations.

In summary, non-family businesses can learn a lot from their family peers. Most obviously the courage to think long term.

Our 3 key findings

The world’s largest public family businesses’

- Have raced to align their boards for sustainability oversight

- Directors were engaged early in sustainability and have now reached an apparent engagement ceiling

- Individual board leadership in sustainability is significantly more gender equal than in non-family businesses

1. Sustainability governance has increased significantly

In 2020, only 42% of businesses had a board policy for sustainability oversight, now standing at 71%. Within the default sample[1], the percentage was 63%, reaching 88% by 2023.

This is a relative improvement of 40%, compared with 69% in family businesses (to Q1 2024).

Sustainability oversight is primarily measured by the presence of a board committee that addresses sustainability, or environmental, social, and governance (ESG) issues in its charter. We also source some of this information from proxy statements, corporate governance, and annual reports.

As with our default sample, we often see dramatic differences in disclosure between these documents. That means that a somewhat comprehensive approach to governance stipulated in the sustainability report might not translate into the relevant committee charter, or other documents, or vice versa.

Further, we see a significant increase in participation of the whole board in relevant committees.

Every fourth director is now a member of a relevant committee, compared to only 15% in 2020.

2. Individual directors’ early leadership in sustainability engagement is now slowing

Another important metric is the ESG-engagement of directors responsible for sustainability oversight. We define ‘ESG-engagement’ as either being ESG-conscious – that is having awareness and knowledge of issues, or being ESG-competent – the capacity to act on issues. This is assessed through a checklist – see methodology from page 20.

From 2020 to 2024, ESG-engagement of directors rose from 34% to 43%. This is now level with our default sample which saw a rise from 17% in 2020 to 43% in (Q3) 2023.

The data also suggests a possible stagnation of sustainability engagement, and future studies will determine if we are approaching an ‘engagement ceiling’ where fewer than half of directors engage in sustainability governance.

Family boards’ relevant committee chairs also have an almost level ESG-engagement at 47% compared to 46% in the default sample.

Committee chairs should arguably outperform committee members in sustainability engagement.

3. Women lead sustainability engagement, with men closing in

Sustainability engagement of directors in family businesses is significantly more gender equal than in our default sample. Women have led the leadership on sustainability governance for years, being 64% more ESG-engaged than their male peers in 2023.

This is only 20% in family businesses. The percentage is relative to all board directors. Controlled on committee level 44% of women are ESG-engaged compared to 42% of men. It’s 53% of women and 37% of men in the default sample.

This suggests, while women in family businesses may be less engaged in absolute terms compared to those in the default sample, they maintain a higher or similar level of engagement relative to men.

The overall board diversity has also risen from 24% in 2020 to 30% in 2024, which is close to the default sample at 32%.

Sustainability management experience is a key driver for ESG-engagement on family boards

The engagement of directors with sustainability criteria is evaluated using a checklist, which assesses them based on three distinct criteria (see page 25). A director is considered ESG-engaged if they meet at least one of these criteria.

120 of 282 directors tasked with oversight are ESG-engaged. 88% of them due to their corporate experience in sustainability strategy.

We also look at whether directors are members of a relevant non-profit organisation dedicated to industry material sustainability issues.

The share of directors who satisfy this criterion is significantly lower at 35% compared to the default sample’s 53%.

Like the default sample, the criterion with the least representation is ‘formal sustainability certifications or credentials’. However, it is slightly higher in family businesses, with 11% of directors meeting the criterion compared to 7%.

Within this category, we also include lecturers, professors, and other faculty members who teach sustainability topics.

Most family boards dedicate a committee to sustainability oversight

We assess the presence of board sustainability or ESG policy through the presence of a relevant board committee that stipulates such issues in its committee charter, proxy, corporate governance, or annual report.

So long as sustainability oversight is clearly stipulated in their policies these are referred to as ’relevant committees’.

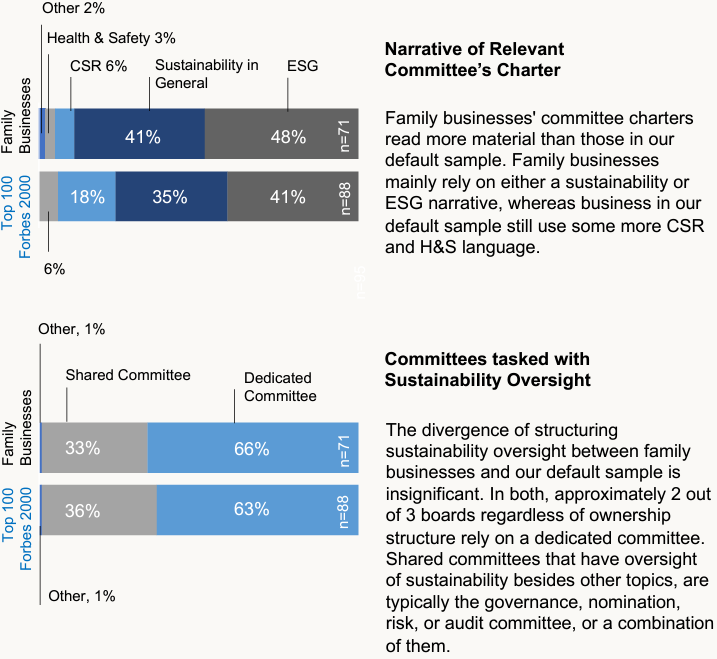

We then screen the policy (mostly committee charters) for narrative. There are four options: Health & Safety: Primarily focused on technical labour safety. CSR (Corporate Social Responsibility): Mainly focuses on employee well-being in a corporate setting. Sustainability in General: Does not exclusively detail ESG factors. ESG (Environmental, Social, Governance): Abbreviated or fully spelled out.

Endnote

1Constitutes our annual default sample, updated yearly to reflect the current Top 100. In 2023, this sample contained 10 family businesses that were also part of the sample in this report.(go back)

Print

Print